OUR ADAPT INVESTMENT STRATEGY

ADAPT Investment Strategy is what sets Caerus Private Wealth apart from the average investment strategy. ADAPT is an acronym for the five cornerstones that underpin our successful portfolio management in any market – Active, Disciplined, Asset Agnostic, Profitable, Trends. ADAPT is a data-based investment selection process which enhances returns while minimizing downside risk.

ACTIVE: As your Portfolio Managers, we are able to actively manage your investments. By law, portfolio managers have a fiduciary duty to act in the client’s best interest. This fiduciary duty is a standard that applies to lawyers and accountants, but does not apply to financial advisors.

As your fiduciary, we can quickly respond to unexpected market fluctuations and protect your assets in downturn markets. By delegating your active day-to-day investment decisions to your Caerus Private Wealth Portfolio Manager, you also give us the ability to take advantage of unforeseen investment opportunities for you.

DISCIPLINED: As your certified portfolio managers, we utilize our disciplined investment management strategy. We work in a very structured and strategic manner by researching, selecting, monitoring, and actively managing your investments. Our unique data-based investment strategy ensures we can maximize your future asset value while honouring your preferred risk tolerance.

ASSET AGNOSTIC: At Caerus Private Wealth, we are uncompromising – period. With our own personal investments at risk, we do not have a bias for asset allocation. We are what we refer to as “asset agnostic.” This gives us the ability to assess the risk-reward metrics for any asset class without bias in order to enhance the risk-adjusted return of our mandates. We are committed to undertaking fundamental and detailed asset analysis, which will enable strategic asset group alignment for our clients’ needs, goals and risk tolerance.

PROFITABLE: As we responsibly respond to market fluctuations, balancing your risk and rewards to yield financial gain is our central goal. We look for fundamental investment data pursuant to its ability to turn a sustainable profit on an ongoing basis. Investments that rise in price but don’t offer profitability are typically considered speculative in nature and come with greater risk. Our sound portfolio management focuses on a strong return on your investment, while mitigating your risk.

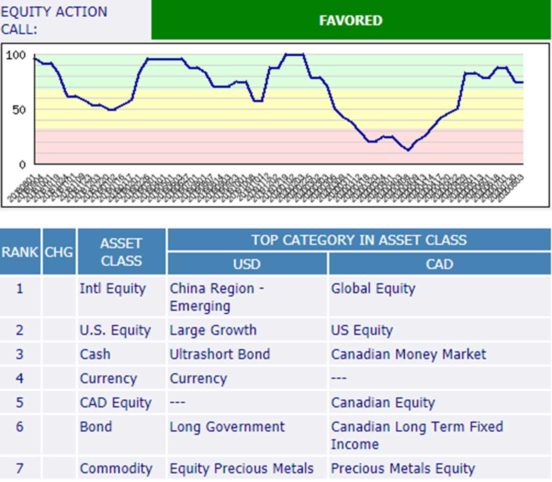

TRENDS: Using our unique “Caerus Strength Matrix” tool and trends charting, we are able to prudently seek data-based evidence of an investment’s strength relative to ther investments. Coupled with fundamental analysis, our the Caerus Strength Matrix looks at technical data supporting investment sentiment, price action and trends helpful in making informed transactions.

-

“Caerus Private Wealth provides me with total security and confidence that they are making investment choices on my behalf that will benefit me. With their unique investment strategy, I have seen excellent results year after year, even on years that have been tough worldwide. The Caerus team is constantly on top of the market trends and makes me feel my investments are safe. My financial goals are coming true as the Caerus team continues to strategically grow my financial future.”

Caerus Family Stories

-

Partner, Fellow Chartered Professional Accountant

Lohn Caulder LLP“Structuring a portfolio that is based on a momentum…if the market turns, then they’re out. And when they do invest the money back, they do much better.”

-

Co-President – ChimpKey Automation Ltd

“Decided to be with Caerus because they were more personalized, rather than set it and forget it...this is what Caerus does, they give personalized care…and I get immediate help.”

-

CEO of Cymax Group

EY Entrepreneur Of The Year – 2021 Pacific Winner“They are honest, committed, have knowledge of the industry and the market...I feel that sense of boutique, shop experience where they are still managing, maintaining, taking care of you at a very personal level.”

Comparing our ADAPT Investment Strategy to a typical “Buy/ Hold” Investment Strategy

What makes Caerus Private Wealth distinct and appealing to our Caerus family of clients is our unique, non-traditional, uncompromising ADAPT Investment Strategy. Sound data driven advice can have a monumental impact on your investment success.

“Buy/ Hold” Investment Strategy

- Passive investment management

- Investments held for long period of time without regard to market fluctuations

- Bull market needs to develop substantially enough to create positive returns

- “Set it and leave it” investment approach

- Mutual fund bias and advisor commission incentives

- Potential investment paralysis impacting financial goals

- Negates potential technological advancement and industry disruption impact on investments

- To realize positive returns and meet your goals it is imperative that you invest within the “right” time interval

- Poor investment experience watching your capital erode

- Lengthy recovery needed after major market downturn

ADAPT Investment Strategy

- Active investment management

- Investment success recognizes the paramount need to make changes

- Selection process designed to provide attractive returns for performing and fragile markets

- Values the growth and decline of businesses and seeks statistical evidence of growing or shrinking industries

- Informed investment decisions based on earning, investment sentiment, price movement and trends data

- Minimizes financial loss potential in a down market

- Investment decisions are independent and unbiased

- Disciplined fiduciary duty to act with care, honesty, and good faith, always in the best interest of our clients

- Defensive strategy for downside protection

- Prudent data-based investment selections that align with your risk tolerance

- Investment exit strategy ensures you stay clear of major market downturn

ADAPT Investment Strategy Tools

Strength Matrix

To make sound investment decisions, we utilize our Strength Matrix strategy tool to provide a systematic and sophisticated evaluation of potential equities and investment opportunities. This tool examines and evaluates the top 300 companies’ statistical profitability trend data to provide us with insight to act upon with accountability and confidence to minimize our clients’ exposure to potential financial loss in a volatile market.

Trend Charting & Analysis:

We perform technical analysis looking for trends when making our investment choices and finalizing our investment calls. We perform comprehensive analysis to ensure our clients investments are in the asset groups that are showing the most strength and that they are in alignment with our clients’ needs, goals, and risk tolerance.