Caerus Private Wealth, iA Private Wealth – September Commentary

The start of the fall season usually brings with it a series of renewed anxiety amongst people. Whether you’re a parent with children returning to school or an investor looking at past market performance for Sept, you are feeling some degree of angst. This fall season, for investors, there are plenty of reasons to feel nervous as there are several headlines that are playing a part in September’s lack-luster market performance.

- Prolonged Covid Crisis

- Supply Chain Woes and Inflation

- Fed Tapering

- US Debt Ceiling and a lurking Default

The one that will most likely continue to make headlines is the U.S. debt ceiling as deadline looms. The House on Wednesday passed a bill to suspend the U.S. debt ceiling as the US heads toward a first-ever default with no clear solution in sight. Republicans will most likely reject the plan in the Senate and will most likely put pressure on the Democrats to revisit their stance on investments in social programs and climate policy.

A Return to the 2011 Debt Ceiling Crisis?

In 2011, months of partisan brinkmanship over the debt ceiling prompted Standard & Poor’s Corp to downgrade the U.S. government credit rating for the first time in history. An unsettled stock market saw its worst week since the 2008 financial crisis and the cost of debt rose as investors fled the U.S. Treasury bond market. In the end, Congress agreed to raise what was then a $16 trillion debt limit hours before a deadline set by the Treasury. We believe that once the dust settles, a US default will be averted as it has over the last 80 years.

Is Inflation Transitory? Not According to The Supply Chain Woes

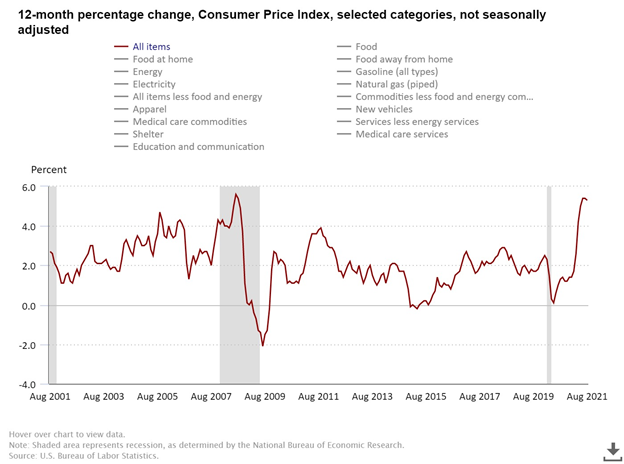

The inflation rate will directly impact how quickly central banks around the world will begin to lessen their accommodative policies. It has been argued that the rise in inflation is transitory or temporary while the world adjusts to a post-pandemic supply chain. However, that perspective may have to be adjusted as several different factors are pushing up prices for nearly all things including wages.

According to a report from Reuters, here are the five key elements in the inflation debate:

- Gasflation – European and US Gas prices have increased by 350% and 120% respectively this year. According to Morgan Stanley, these outages are a risk to end-users and suspect this to continue well into 2022.

- Chipflation – Chip prices have risen and continue to rise. Companies such as GM have had to cut car deliveries by 200,000 causing the prices of used cars to soar. As more cars become electric or rely heavily on electronic components, Intel’s CEO predicts that by 2030, chip costs will represent about 20% of a car’s cost of production.

- Foodflation – Global food prices rose 30% last year according to an index compiled by the UN Food and Agriculture Organization. This increase can be attributed to pandemic related issues surrounding logistics and transportation cost.

- Greenflation – Not often discussed, the stringent rules to transition to a greener future can often have short term economic setbacks resulting from shutting down factories, vehicles, ships, and mines. We see this continuing for the next decade as policy makers fight climate change.

- Wageflation – We are noticing a significant amount of labour shortage. This may have to do with stimulus cheques but in large workers seem to be demanding higher wages to offset higher costs of living. At some point, this wage gap needs to be filled.

Federal Reserve – Battle with Inflation

Last week, the Federal Reserve ended its two-day Federal Open Market Committee meeting, and as expected, there were no changes to current interest rate or bond purchasing policies. However, the Fed continues to prepare the market for a reduction (taper) of bond purchases. In the statement released shortly after the conclusion of the meeting, it was noted that a “moderation in the pace of asset purchases may soon be warranted”. Additionally, during the press conference, Chairman Jerome Powell mentioned that, “while no decision has been made, the Committee currently believes tapering would likely conclude around mid-2022”.

On Weds, the Fed chief said during a panel discussion hosted by the European Central Bank that he was “frustrated” and noted that the spread of the Covid delta variant “remains the most important economic policy that we have.” Furthermore, he went on to say “It’s also frustrating to see the bottlenecks and supply chain problems not getting better — in fact at the margins apparently getting a little bit worse,” he added. “We see that continuing into next year probably and holding up inflation longer than we had thought.”

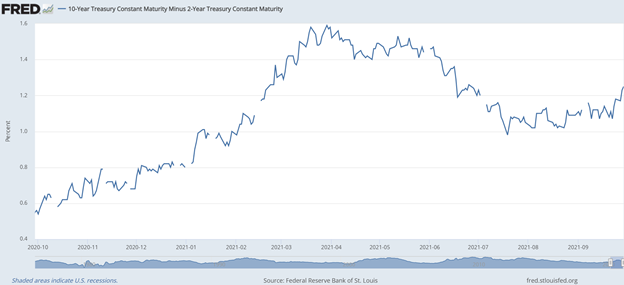

The 10-year Treasury yield started to level off in early August, and since then it has been heading higher as elevated inflation looks increasingly transitory in the near term, and markets start to anticipate central bankers slowly winding down extraordinarily accommodative monetary policy.

The Road to Recovery

As we digest the relentless amount of news surrounding the markets, we also keep a close eye on factors that are poised to help financial markets in the coming months. Let’s look at recent data cementing the road to recovery.

Labour Market Strengthening

Canada’s economy finished the summer by adding 90,200 jobs in August, the third consecutive monthly increase that brought the country as close as it has been to recouping historic employment losses last year. The unemployment rate fell to 7.1 per cent for the month, compared with 7.5 per cent in July, bringing the rate to the lowest level since the onset of the pandemic last year.

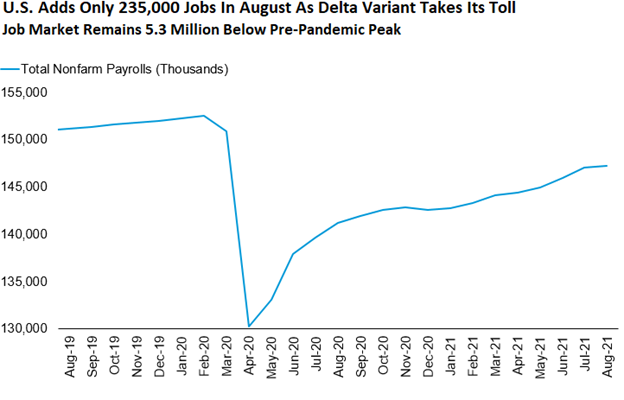

The U.S. Bureau of Labor Statistics released its August employment report early in September, revealing that the domestic economy added a disappointing 235,000 jobs during the month, falling well short of Bloomberg-surveyed economists’ median forecast for a gain of 733,000. This comes on the heels of a strong July during which payrolls climbed by an upwardly revised 1.053 million jobs. Although this was disappointing, the unemployment rate fell to 5.2% in August, in line with expectations. (Source: Bureau of Statistics)

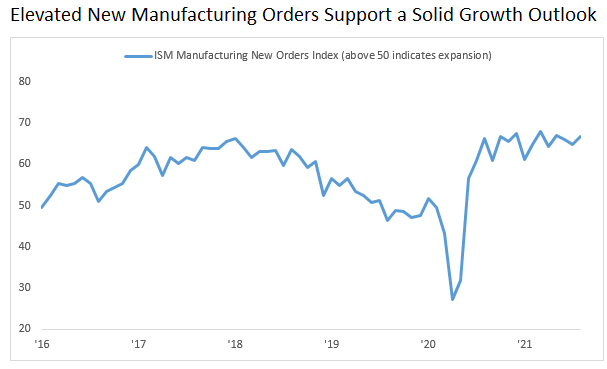

US ISM Manufacturing Heating Up

The Institute for Supply Management’s reading on US manufacturing surprisingly accelerated in August, coming in at 59.9 versus July’s 59.5 and economists’ consensus expectation of 58.5. This reading does show the resiliency of the US economy despite its challenges. Even if the rate of growth does slow down, we do still expect U.S. manufacturing activity to continue to expand overall. (Source: LPL Research). Today, the ISM said that its index of national factory activity increased to a reading of 61.1 last from the above 59.9 that came back in August. Important to note that a reading above 50 indicates an expansion in manufacturing. This is an important part of the recovery phase we believe we are currently part of.

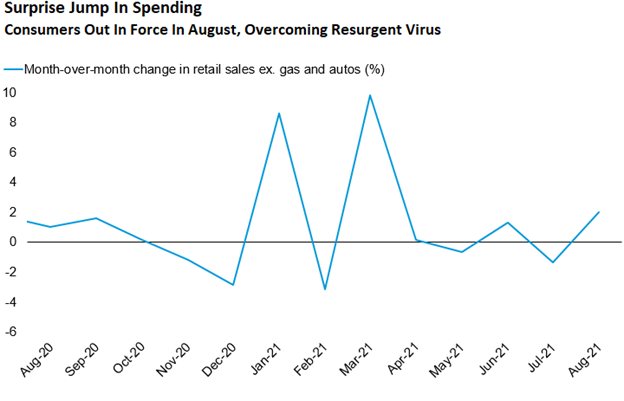

Retails Sales and Consumer Spending

US consumers surprised economists in August with their spending in the face of recent angst over the economic outlook. The US Census Bureau released August retail sales data showing overall retail sales grew 0.7% month-over-month vs. a consensus forecast for a 0.7% drop. The surprise in sales come after disappointing July data, which received additional negative revisions, taking a small bit of the shine off August’s numbers.

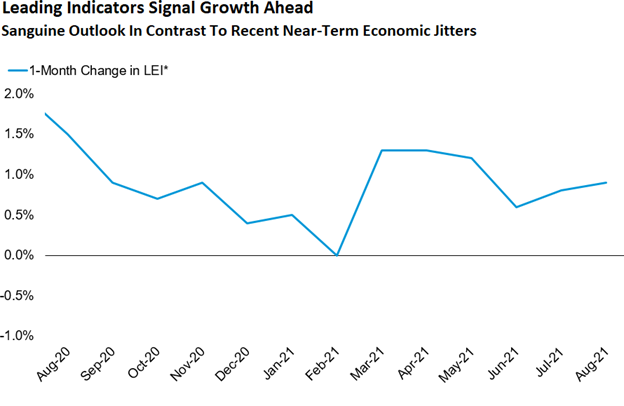

US Leading Indicators – A Contrast to Near-Term Economic Jitters

On Thursday, September 23, the Conference Board released its August 2021 report outlining the most recent reading for the Leading Economic Index (LEI), a composite of ten factors that tend to lead changes in economic activity. As most data points look backwards, investors pay special attention to the LEI, as it is forward-looking and spans across many segments of the economy. The index grew 0.9% month over month, the highest in three months and ahead of expectations for 0.7%. Eight of the ten components rose in August, while one fell, and one held steady. The lone negative contributor was average consumer expectations for business conditions, while average weekly manufacturing hours remained unchanged. Strong breadth among component indexes gives us increased confidence in the resilience of the economy. (Source: The Conference Board’s Leading Economic Index)

Caerus Wealth Portfolio

Despite the various factors pressuring markets in September, we continue to expect further recovery ahead. We expect that the Senate, as they have before, to come to an agreement to raise the US debt ceiling and avoid a default on Oct 18th. We expect to see inflationary pressure caused by disrupted supply chain and it’ll be interesting to see how the Federal Reserve plans on tackling this over the coming weeks and months. Tapering plans may rattle the markets if introduced prematurely or without a significant runway but it does appear that the Fed will be extremely careful in its rollout and implementation.

We have come a long way since the bear market low way back on March 23, 2020, and despite the general strength of the bull market we’ve seen two very different types of trades leading markets at different times. They include a “work-from-home” trade characterized by strength among growth-style oriented stocks. At other times, we’ve seen a “reopening trade,” where the cyclically oriented value-style stocks have led. The Caerus Private Wealth portfolios are diversified across several asset classes and service sectors presenting the best chance of success in a recovery stage of the business cycle. Our ADAPT Investment Strategy grants us the ability to remain objective and disciplined. Our research is focused on companies with increasing profitability and supporting trends. So far in 2021, we continue to benefit from allocating to cyclical stocks in sectors such as commodities, transports, and financials, as well as maintaining allocations to high-earning tech giants that continue to prove their resilience.

As your trusted Portfolio Managers, Terry and Kian, and the Caerus Private Wealth team is available to address any questions you may have. Stay safe!

Terry Fay, Director, Private Client Group, Portfolio Manager

Kian Ghanei, Director, Private Client Group, Portfolio Manager

Caerus Private Wealth – iA Private Wealth

700 – 609 Granville Street, Vancouver BC V7Y 1G5

T: 604.895.3316 | TF: 1800.665.2030 | F: 604.682.0529

terry@caeruswealth.ca | kian@caeruswealth.ca

iaprivatewealth.ca | caeruswealth.ca

This information has been prepared by Terry Fay & Kian Ghanei who are Portfolio Managers for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.