Caerus Private Wealth, iA Private Wealth – June Commentary

It is hard to believe that we are heading into the month of July. With the summer in full effect and loosening Covid-19 restrictions, we are seeing a surge in restaurant goers, packed malls, and an uptick in travelling outside of Canada for those fully vaccinated. We have come a long way and have waited for this moment for a long time. As we wait patiently to receive our second dose, if not already received, we are most likely doing some event planning that includes a gathering and/or a family vacation. All in all, there is a common sentiment felt everywhere that the worst may be behind us, and life as we knew it pre-pandemic, is coming back.

Amidst this Great Re-Opening and excitement, and from an investment point of view, there are some tailwinds and headwinds that are important to make note of and keep a watchful eye on.

KEY MARKET TAILWINDS

- Federal Reserves’ hawkish stance on inflation

Federal Reserve Chairman Jerome Powell acknowledged Tuesday that some inflation pressures are stronger and more persistent than he had anticipated, though still not on par with some of the worst episodes the U.S. has seen before. He stated, “I will say that these effects have been larger than we expected, and they may turn out to be more persistent than we have expected,” he added. “But the incoming data are very consistent with the view that these are factors that will wane over time, and inflation will then move down toward our goals, and we’ll be monitoring that carefully.” (Source: CNBC)

During last week’s meeting on Weds, the Federal Reserve held its key interest rate near zero and vowed to maintain its bond buying stimulus, but it’s now forecasting two rate hikes in 2023, up from none previously. This has created a longer than anticipated runway for the bull-market to continues its climb.

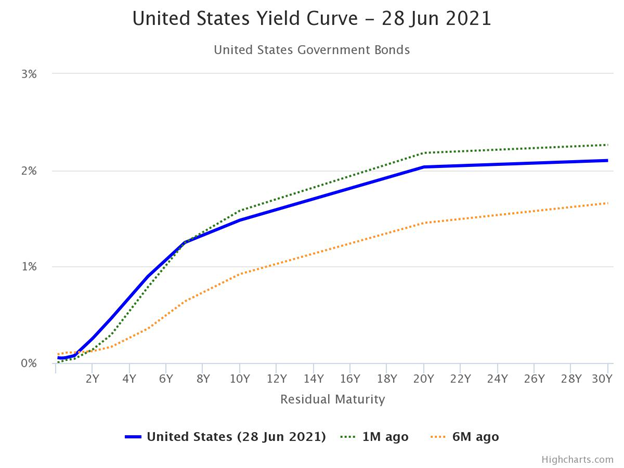

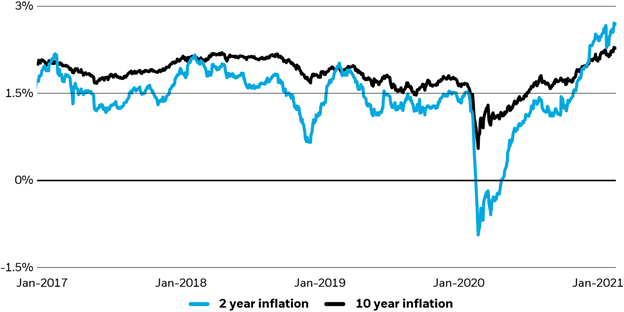

2. The Yield Curve as a Leading Indicator of Inflation

The yield curve which measures the various interest rates at different maturities (1 year through to 30-year treasury) can be leading indicator of inflation. The yield curve can shift at various time intervals to indicate if there will rising or declining interest rate in the future. If we take a look at the current US yield curve, we can clearly see that inflation seems to plateau past the 15 year mark and in the short term the expectation of interest rates have actually fallen somewhat as compared to a month ago. The longer the yield curve remains low and unchanged, the longer it takes for the cost of borrowing funds will remain low which further propelled spending and hence earnings. (Source: New York Federal Reserve and Highcharts)

3. Biden’s Infrastructure Plan

The bipartisan $1.2 Trillion infrastructure plan will be a well-timed economic growth strategy that will address some of the most concerning issues in the US. The Plan makes investments in clean transportation infrastructure, clean water infrastructure, universal broadband infrastructure, clean power infrastructure, remediation of legacy pollution, and resilience to the changing climate. We feel that this might be one of the most transformational economic plans set out by the US in years and it will most likely lead to a more competitive economic landscape.

4. Strong Expected Earnings

For Q2 2021, the estimated earnings growth rate for the S&P 500 is 61.0%. If 61.0% is the actual growth rate for the quarter, it will mark the highest year-over-year earnings growth rate reported by the index since Q4 2009. It’s difficult to be bearish when the vast majority of companies are showcasing strong earnings. Depending on where we are within the business cycle, we may see this trend continuing well into 2022 and beyond. (Source: Factset)

KEY MARKET HEADWINDS

Long-Term Inflation – Sustained?

Predicting long-term and sustained inflation can be a difficult task. There are a number of factors that play a part in inflation. Over the next several months we will have a showdown between those that believe that higher inflation will persist past 2021/2022 and those that believe that inflation is ‘transitory’, due to the reopening, and will likely be modest after 2022. Either way, inflation is an important factor (or risk) in investment management, and we must be mindful of its impact on our portfolio holdings. We don’t want to make any predictions, but we do think that if inflation was to remain persistent, it would be attributed to these following factors.

4 reasons inflation is poised for a sustained run:

- Monetary Policy. The Federal Reserve as well as other central banks have been explicitly exhibiting more tolerance to higher short-term inflation (and accommodative economic policy) to boost employment and make sure the economy remains stable. This is accomplished through a steady level of bond purchases (increasing the money supply) and maintaining low interest rate levels.

- Fiscal Policy. Governments have been quick to extend relief packages. The most recent Infrastructure bill in the US is an example of a number of packages aimed to help the economy while tackling some of it’s long-debated issues.

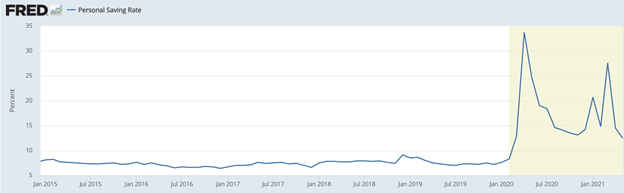

- Pent-up demand. Personal income has surged as a result of unemployment benefits since consumers haven’t been able to spend freely due to COVID-19 restrictions. In the US, the result is a jump in the U.S. personal savings rate from a low of 8% pre-pandemic to 12.4% in May.

4. Rising Production Costs. A rise in wages, commodities, and energy will lead to a direct increase in prices of goods that will be passed on to the end consumers.

Inflationary Counterpunch

As mentioned earlier, long-term inflation predictions are difficult. The difficulty lies with factors that often counter rising prices. In today’s environment, these factors can be summed up to the labour force and the effects of technology on the prices of goods. Traditionally, we would be taking into consideration the effects of globalization but given globalization is already a factor in existing prices, we will exclude this for the time being. It will be very interesting to see what happens over the next 12 months but for now, let’s take a closer look in how the labour force and technology play counter to a rising price environment.

- US Labour Force Participation Rate

Let’s look at the US labour force participation rate. Here we see a declining ratio of those either fully employed or seeking full employment which make up the labour force. Without getting into too much detail, this declining ratio means that less and less people are in the labour force and are sitting on the sidelines and classified as either too young, retired, or left the labour market completely. As you can see, the pandemic has played a part here too and the government is focused on getting the labour force participation rate back up to a point that would support and maintain a 2% inflation rate. Simply put, the less people in the labour force, the less income is earned, and fewer dollars are spent on good. (Source: The Balance)

2. Technology and Innovation

The second factor which can be the leading factor in price neutralization is technology adoption. As we know, technology and its adoption will increase productivity and in time lower the cost of production by automation, increasing computing power and implementation of efficient processes. These factors have played a huge part in inflationary pressures since the 90’s and will continue to play a part in both our labour force and production costs. For the reasons here, we don’t think we will have the same inflation issues experienced in the 70’s or the 80’s but we do want to be mindful of the immense impact inflation could have on our purchasing power, our daily lives and our portfolio valuations.

Headwind #2: The Delta Variant – All Eyes On The UK and Israel (Again)

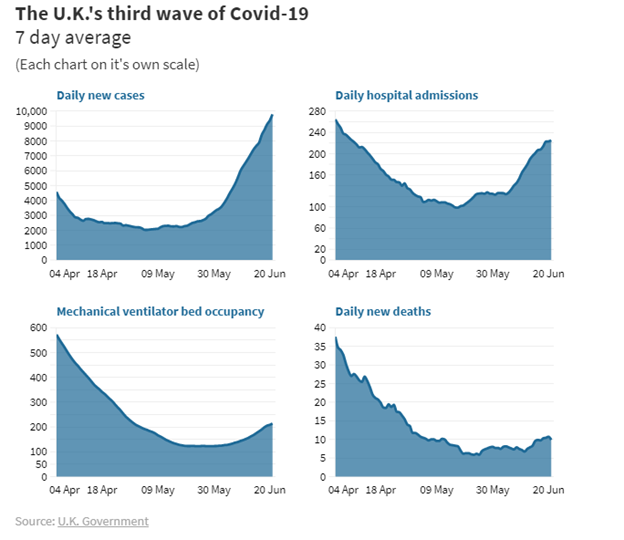

The UK has one of the highest Covid-19 vaccination rates in the world, yet it’s seeing a new surge in coronavirus cases largely attributed to the delta variant that first originated in India. Experts say that close attention is being paid to the latest data out of the UK as it could be a bellwether for others. And there is a fear that where the U.K. now treads, others like the US could follow.

Kallum Pickering, a senior economist and director at Berenberg Bank, said in a note Tuesday “With its high vaccination rate but a rising number of daily recorded infections, the UK has turned into the test case for whether mass vaccination against Covid-19 can bring an end to the repeated cycles of lockdowns”.

He also noted that medical data suggests that the UK’s high rate of vaccination has significantly weakened the link between recorded Covid infections and complications from the disease, supporting their view that “the UK can get through the new wave of infections without having to tighten restrictions and thus with only limited economic damage.”

Pickering said the data highlighted that this wave of infections was unlike previous ones with the number of recorded infections rising at a slower pace than during the previous wave, and that there had been no clear rise in deaths despite the rise in cases. He also noted that new hospital admissions had increased less than recorded infections — and by much less than during the winter wave.

Deutsche Bank Research Strategist Jim Reid noted on Wednesday that while there is “continued concern” about the spread of the delta variant, “the one good piece of news is that the latest wave has seen the age distribution of cases shift substantially lower relative to previous waves.”

Younger age groups are much less likely to be severely affected by the virus than older people. But still, the longer the young remain unvaccinated or partially vaccinated the virus can spread and potentially more variants can emerge.

So far, the vaccines have proved resilient to new variants, remaining largely effective in preventing serious Covid-19 for fully vaccinated people. An analysis from Public Health England released last Monday found two doses of Pfizer or the AstraZeneca Covid-19 vaccines were highly effective against hospitalization from the delta variant.

In the Middle East, Israel has reintroduced a requirement to wear masks indoors amid a rise in coronavirus cases, just days after it lifted the measure. Concern has grown after the country recorded more than 100 new daily cases in successive days after registering zero earlier this month. Most of the cases have been linked to the Delta variant from abroad. Israel has been one of the most successful countries in the world in tackling the pandemic. It implemented the fastest vaccination program, under which well over half the population of 9.3m has been partially or fully immunized.

It will be very telling over the next few weeks just how effective these vaccines are by closely monitoring the hospitalization and death rates.

Caerus Wealth Portfolio

We continue to expect additional modest gains for stocks in the second half of the year although those additional gains are likely to come with some volatility lead by news surrounding inflation and possibly the Delta variant. So far this year, we continue to see a significant rotation away from US based companies to Canadian based companies particularly in the energy, materials, and financials sectors. This rotation has served to provide some risk mitigation against a weakening US Dollar as well as a surge in short-term inflation. We expect global demand for these sectors to continue to drive earnings and share prices, but we remain mindful of some headwinds that could stall this expansion. We will continue to follow our ADAPT Investment Strategy in keeping up with an ever-changing economic landscape and will continue to walk away from challenged businesses.

The Caerus Private Wealth portfolios are diversified across several asset classes and service sectors presenting the best chance of success in a recovery stage of the business cycle. Our ADAPT Investment Strategy grants us the ability to remain objective and disciplined. Our research is focused on companies with increasing profitability and supporting trends. So far in 2021, we continue to benefit from allocating to cyclical stocks in sectors such as commodities, transports, and financials, as well as maintaining allocations to high-earning tech giants that continue to prove their resilience.

As your trusted Portfolio Managers, Terry and Kian, and the Caerus Private Wealth team is available to address any questions you may have. Stay safe!

Terry Fay, Director, Private Client Group, Portfolio Manager

Kian Ghanei, Director, Private Client Group, Portfolio Manager

Caerus Private Wealth – iA Private Wealth

700 – 609 Granville Street, Vancouver BC V7Y 1G5

T: 604.895.3316 | TF: 1800.665.2030 | F: 604.682.0529

terry@caeruswealth.ca | kian@caeruswealth.ca

iaprivatewealth.ca | caeruswealth.ca

This information has been prepared by Kian Ghanei who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.