Caerus Private Wealth, iA Private Wealth – April Commentary

There are lingering levels of frustration felt here in Canada and in other parts of the world with respect to vaccine supply shortages. There are growing concerns for certain regions in Asia and South America that are continuing to grapple with high levels of transmission and hospital capacity constraints. Here at home, we continue to hear unsettling stories about the rising cases in Alberta, the new variants across the globe, and devastation unfolding in India. These are terrible times, no doubt, but we have come a long way and we must continue to do our part knowing that there is light at the end of the tunnel.

The Leading Indicator – US

We often look at the US as a leading indicator of what we can expect here in Canada. This time is no different and perhaps this is one of the most important times in our history where we look to our neighbors for some reassurance on what we can expect to see here in Canada in the coming months. Politics aside, President Biden has done a great job at successfully rolling out an ambitious vaccine plan that has seen 220 Million doses of shots being administered to Americans in his first 100 days in the office. This is a great achievement specially since when he took office, he had promised 100 million doses to be administered in his first 100 days. Both mRNA vaccines (Pfizer-BioNTech and Moderna) authorized and recommended in the United States are proving to be highly effective. According to a new CDC assessment that finds fully vaccinated adults 65 years and older were 94% less likely to be hospitalized with COVID-19 than people of the same age who were not vaccinated. People 65 and older who were partially vaccinated were 64% less likely to be hospitalized with COVID-19 than people who were not vaccinated. People were considered “partially vaccinated” two weeks after their first dose of mRNA vaccine and “fully vaccinated” two weeks after their second dose. (Source: CDC)

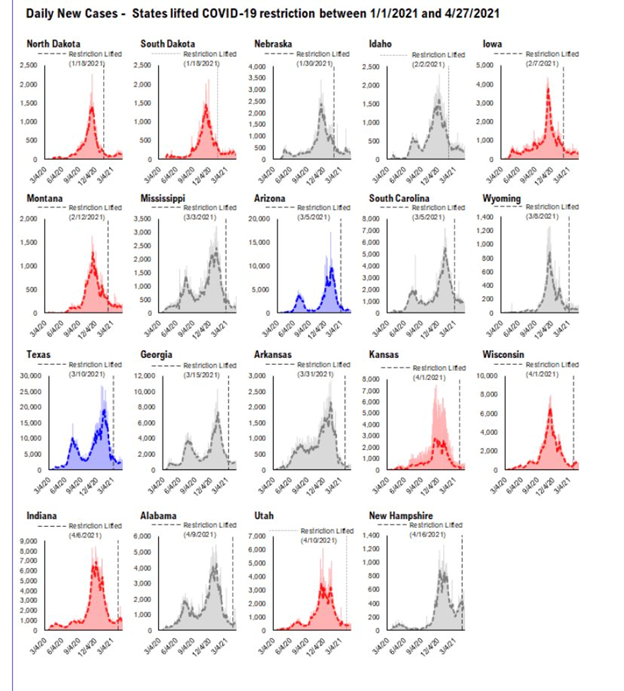

Let’s look at some of the states in the US and their trend in new COVID-19 cases:

There seems to be some easing in anxiety over covid-19 and renewed hope for a normal life in the months ahead. In fact, the US economic growth was accelerated in the first quarter, fueled by well-timed government aid to households and businesses, paving the way for what is expected to be a strong economy and GDP growth of 6.5% throughout 2021. (Source: SP Global)

During his first State of the Union speech, President Biden unveiled The American Families Plan, a large $1.8 Trillion package aimed to help families and bolster education throughout the US. Funded in part through tax increases on wealthy Americans, this new package along with an earlier infrastructure plan, sums up to approx. $4 Trillion in government spending which will most likely propel the markets higher over the next few quarters. The American Families Plan would raise $1.5 Trillion of taxes from those making over $400,000 per year and this includes a tax rate doubling of capital gains, which we believe will be something Canadians will face at some point in the future.

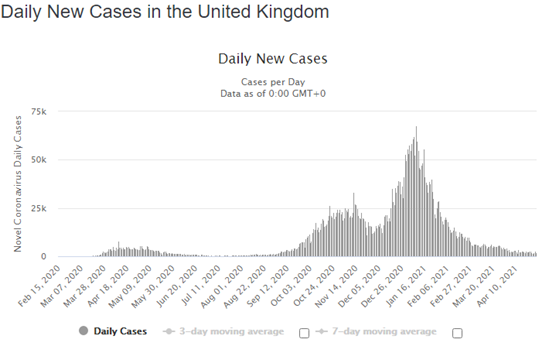

The UK and The Euro Zone

As mentioned in our March commentary, the UK has been also doing a superb job at lowering new cases nationally and this is very promising for the rest of the euro zone. The European Union’s statistics office Eurostat said GDP in the 19 countries sharing the euro contracted 0.6% quarter-on-quarter for a 1.8% year-on-year fall, putting the single currency area in a second technical recession in 12 months. Having said that, many believe that the euro zone is now firmly set on a recovery path as pandemic restrictions are lifted amid vaccination campaigns. (Source: Reuters)

Accommodative Inflationary Outlook

To top up the overall enthusiasm felt across the US, the Federal Reserve this week provided an optimistic view of the US economic recovery and reassured the public that they were going to stay accommodative to the economy by leaving interest rates unchanged and continuing their bond-buy back program. Furthermore, Fed Chair Jerome Powell reiterated their goal of focusing on full employment before they get too concerned about the lurking risk of persistent inflation.

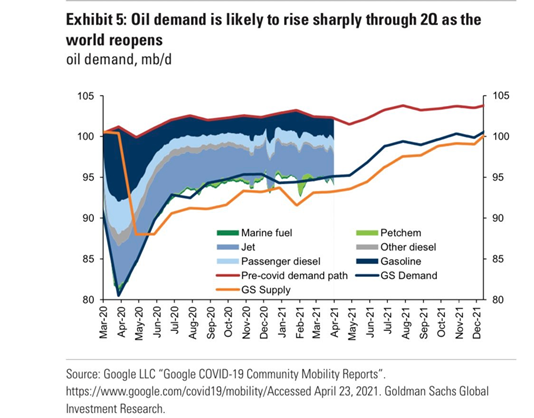

We view inflation as an ongoing theme over the next few quarters. As more and more people get vaccinated and the world continues to re-open, inflation will continue to make headlines. Commodities and energy continue to see prices surge and this will undoubtedly trickle down to the consumer. Goldman Sachs expects global oil demand to realize the biggest jump ever over the next six months fueled by the re-opening of the world, higher demand for travel and transport.

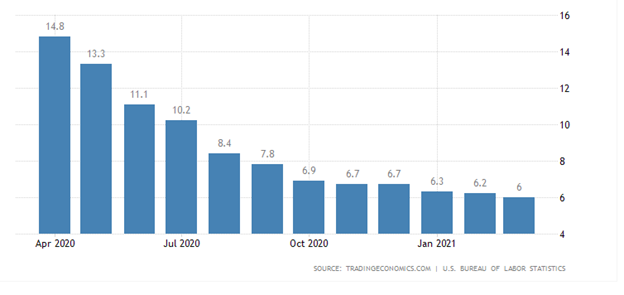

Employment Growth

In Canada, employment rose by 303,000 (+1.6%) in March. Combined with an increase of 259,000 (+1.4%) in February, this brought employment to within 1.5% (-296,000) of its February 2020 level. The unemployment rate fell 0.7 percentage points to 7.5%, the lowest level since February 2020. (Source Stat Can). Similarly in the US, they are experiencing a continued rise in employment which coincides with the recovery stage. We expect this to continue over the next 2 years.

Strong Earnings

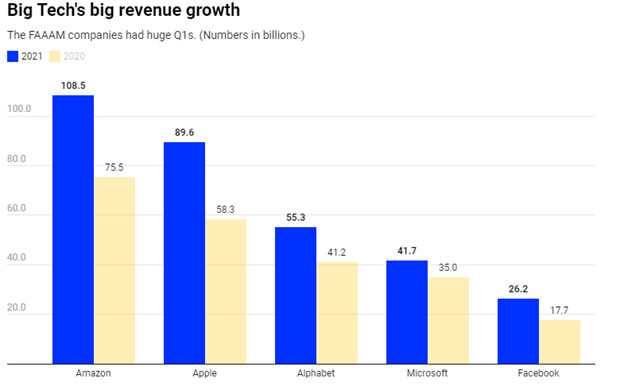

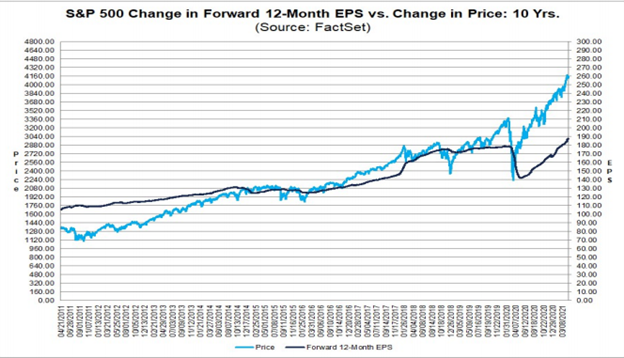

The earnings season is heating up and some very strong results have come in from some of the largest companies in the world. As of this week, companies comprising nearly half of the S&P 500’s market capitalization had reported earnings results with over 85% of them topping estimates by an average of a whopping 21.7%. These names included Amazon, Apple, Alphabet, Microsoft, and Facebook (FAAAM). (Disclosure: Caerus Private Wealth holds Amazon, Apple, Alphabet and Microsoft in its portfolio).

Important to mention, epicenter companies that felt the wrath of the virus last year are seeing an influx of consumer spending that should help them experience stronger numbers in the next two quarters. We anticipate a substantial rebound in travel, hospitality, and leisure in the coming months which would add to the breadth of the earnings of the S&P 500 companies. (Source: FactSet)

Caerus Wealth Portfolios

In April, we experienced an upbeat tone in the markets, demonstrated by healthy earnings and increasing prices in energy and material such as lumber and copper. Although the news has not been great across all spectrums, we continue to believe that significant directional improvements are being made in both Europe and North America. With the vaccine production in full force and ramping up, we expect a strong recovery led by the service, transport, and leisure sectors. From an investment standpoint, we have experienced great results from Canadian companies particularly in the financial markets and commodities and will continue to watch for developing opportunities.

The Caerus Private Wealth portfolios are diversified across several asset classes and service sectors presenting the best chance of success in a recovery stage of the business cycle. Our ADAPT Investment Strategy grants us the ability to remain objective and disciplined. Our research is focused on companies with increasing profitability and supporting trends. So far in 2021, we continue to benefit from allocating to cyclical stocks in sectors such as energy, transport, and base materials, as well as maintaining allocations to high-earning tech giants that continue to prove their resilience.

As your trusted Portfolio Managers, Terry and Kian, and the Caerus Private Wealth team is available to address any questions you may have. Stay safe!

Terry Fay, Director, Private Client Group, Portfolio Manager

Kian Ghanei, Director, Private Client Group, Portfolio Manager

Caerus Private Wealth – iA Private Wealth

700 – 609 Granville Street, Vancouver BC V7Y 1G5

T: 604.895.3316 | TF: 1800.665.2030 | F: 604.682.0529

terry@caeruswealth.ca | kian@caeruswealth.ca

iaprivatewealth.ca | caeruswealth.ca

This information has been prepared by Kian Ghanei who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.