Caerus Private Wealth, iA Private Wealth – March Commentary

We find ourselves once again inundated with Covid related news as we grapple with new lockdown measures not just at home but around the globe. As we countdown to Easter, we are reminded of the stubborn nature of the virus and its resilience. You can sense the frustration in everyone as we try so very hard to co-exist and function in the new normal. With that said and as discouraging as some of the news may be, there are some major breakthroughs around the globe that we need to focus on as we wait patiently for vaccines to do their part. Let us examine the current situation, the good and the bad, making news this past month as we head into a period of inoculation and increased hope.

EU’s Lockdown

Europe’s inoculation program has failed to deliver and are lagging significantly behind Israel, the UK, and the US, due mostly to poor negotiations surrounding vaccine contracts and supply chain delays. Here is a summary of the current lockdown measures across some of the nations in the EU. (Source: bbc.com)

GERMANY – Restrictions extended until April 18th.

FRANCE – New lockdowns placed on March 20th in Paris and other areas for four weeks.

ITALY – A total shutdown for shops, restaurants and schools are once again in place.

SPAIN – Curfew and other measures to continue.

BELGIUM – Lockdown continues and will most likely get extended.

NETHERLANDS – Lockdown and curfew to continue until April 26th.

All eyes on the U.S.

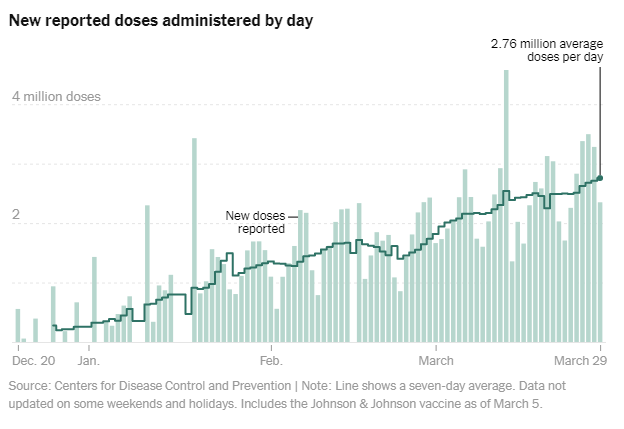

Given that the US is weeks if not months ahead of Canada in its vaccine rollout program, we should observe their progress as a precursor to what we can expect here in Canada. Despite the recent uptick in new cases, the US is undoubtedly doing a great job in its inoculation program as they are now averaging 2.76 million vaccinations per day as President Biden in on track to deliver on his promise to administer 100 million vaccines by his 100th day in the office. Overall, Covid cases have decreased for the past 10 weeks although lately we have seen an increase in the 7-day average of new cases. This will certainly be important to watch as more and more individuals get vaccinated in the coming weeks.(Source: cdc.gov)

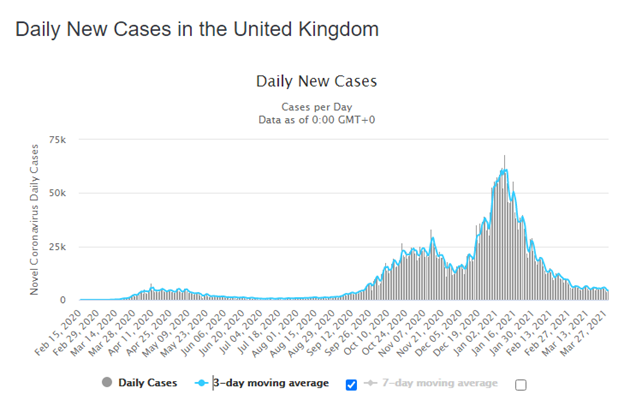

The UK Turnaround

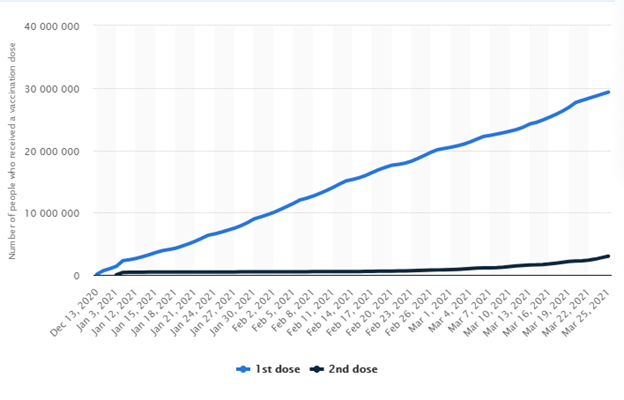

Despite the widespread lockdown measures amidst rising cases across Europe, the UK has been doing an excellent job at improving their situation since the start of the year due mostly to their rapid inoculation over the last several weeks. In the UK, more than 30 million people have received at least one done of a coronavirus vaccine. (Statista.com)

Although there are some common issues around vaccine delays as experienced across Europe, the UK has seen a steady decline of cases since the beginning of the year which gives us real hope that we can achieve an end to lockdowns in the coming months. (Source: BBC)

Israel’s Resolve

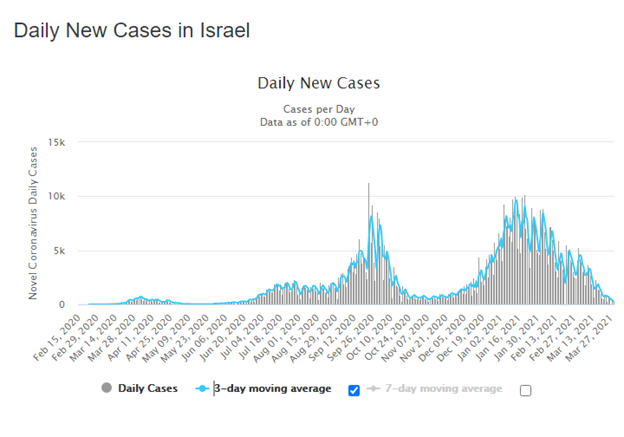

As more stories come from Israel regarding their remarkable achievement, we hear more about ‘herd immunity’ as it related to real data being extracted form that region. Figures published this week by the Israeli Health Ministry show that nearly 5 million people are fully vaccinated, and more than half of their population has received the second shot. Data suggests that through a successful and organized vaccine program, they have significantly lowered their R number (the number of people each person infects on average without protection) below 1 which has lead to a consistent decline in cases across the country. While it is believed that herd immunity is reached at 70-80% of vaccinated population, Israel has been able to achieve similar results with 40-50% of their population vaccinated. (Source: Haaretz.com)

Vaccines Proving Effective

According to data the US Centers for Disease Control and Prevention, the Pfizer and Moderna vaccines provide highly effective protection against preventing infections including those that had no symptoms. This is highly encouraging after some of the set-back of the AstraZeneca vaccines here in Canada and throughout Europe. In fact, the mRNA vaccine reduced infections by 80 percent two weeks or more after the first of two shots according to the data. (Source: cdc.gov) This is highly encouraging knowing that Johnson and Johnson are to also arrive at some point in the future.

Infrastructure Plan – The ‘Road’ to Recovery

With some momentum behind him from the recent Covid relief package, President Biden is due to unveil a massive infrastructure plan funded by tax hikes for the ultra wealthy and businesses. Most speculate that the $2 Trillion bill would focus on rebuilding roads and bridges, expand clean-energy investments, and create infrastructure for electric vehicles (EVs). (Source: CNN) The real question will be surrounding how this plan will be funded and the new proposed tax legislature that will surely create debate for weeks to come. At the very least, we see this as an opportunity to create more jobs during the US recovery stage which can lead the US economy to its pre-Covid levels and possibly to new heights.

Unemployment in Canada and GDP

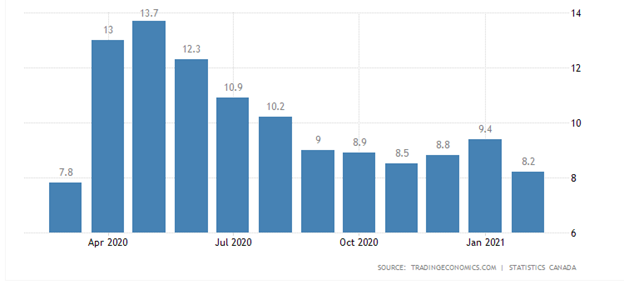

The unemployment rate in Canada fell to 8.2% in February of 2021, the lowest since March 2020. This is a good sign but this can slow down given the new rises in Covid cases and lockdown measures. With hat said, we still view this trend as positive as we get more vaccines delivered to Canada and begin vaccinating those over the age of 60. (Source: Trandingeconomics.com I Statistics Canada)

With respect to GDP, Canada’s economy grew for the 9th consecutive month, but it is still 3% short of the Feb 2020 level. The newest levels of restrictions and lockdowns will surely slow the growth but we anticipate the trend to continue in the coming months.

Unemployment in US

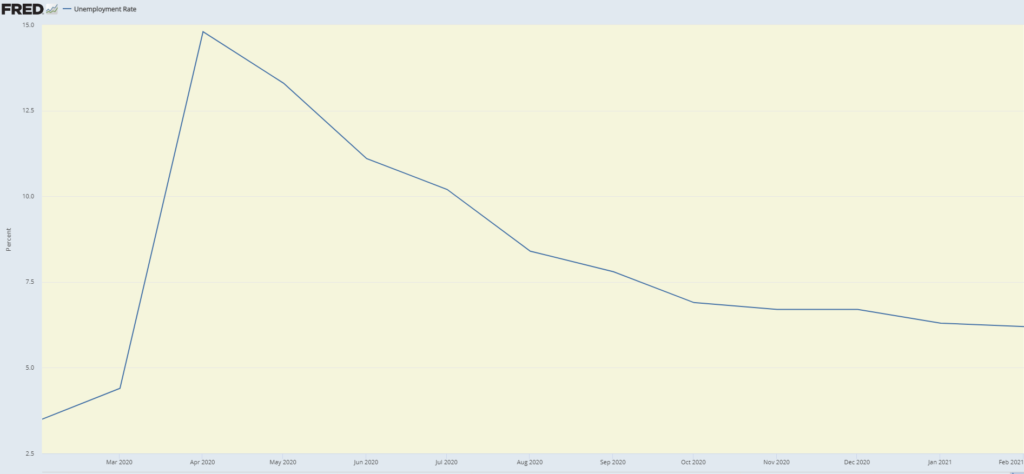

US unemployment added more jobs than forecasted in February and the unemployment rate declined to 6.2% suggesting the labor market is making progress after some lackluster numbers over the previous two months. We use some caution here as stricter measures are introduced due to the recent increase in Covid cases but we see this as a positive sign towards recovery and see unemployment numbers fall further in the coming months as inoculation across all states continue to ramp us and take effect. For instance, New York will make it possible this week for anyone over the age of 30 to get immunized. We believe this trend will continue in other states. (Source: Federal Reserve Bank of St. Louise – Bureau of Labor Statistics)

Earnings Growth – 2021

As an investors, growing earnings and earnings expectations are paramount. According to Factset, analysts and companies have been much more optimistic than normal in their estimate revisions and earnings outlooks for the first quarter to date. As a result, expected earnings for the S&P 500 for the first quarter are higher today compared to the start of the quarter. The index is now expected to report the highest year-over-year growth in earnings since Q3 2018 for Q1. Analysts expect double-digit earnings growth for all four quarters of 2021. In terms of estimate revisions for companies in the S&P 500, analysts have increased earnings estimates in aggregate for Q1 2021 to date. On a per-share basis, estimated earnings for the first quarter have increased by 5.8% since December 31.

Caerus Wealth Portfolios

In March, we experienced above average volatility driven by inflation, uncertainty around Covid, and new lockdown measures across Europe and other part of the world. Although the news has not been ‘rosy’ across all spectrums, we continue to believe that significant directional improvements are being made in countries like the UK and the US in what seems to be the greatest vaccine effort ever experienced by mankind. These countries are proving the effectiveness of the vaccines and are producing encouraging data that continues to shape our long-term projections. The Caerus Wealth portfolios are diversified across several asset classes and service sectors presenting the best chance of success in a recovery stage of the business cycle. With the rollout of the newest Covid relief stimulus in the US, we now shift the focus on the unveiling of the infrastructure plan this week as a huge catalyst in the recovery stage, falling unemployment, and higher expected corporate earnings.

Our ADAPT Investment Strategy grants us the ability to remain objective and disciplined. Our research is focused on companies with increasing profitability and supporting trends. So far in 2021, we are finding attractive opportunities away from some of our previous winners in technology and adding to cyclicals in sectors such as energy, transport, base materials, and the Bitcoin resiliency. Although we are still experiencing strength in the US, we are seeing a shift in Canadian names which is indirectly offering a currency hedge against a weakening US dollar. We will continue to monitor new data as we wrap up Q1 and will make the necessary changes as we head into April.

As your trusted Portfolio Managers, Terry and Kian, and the Caerus Private Wealth team is available to address any questions you may have. Stay safe!

Terry Fay, Director, Private Client Group, Portfolio Manager

Kian Ghanei, Director, Private Client Group, Portfolio Manager

Caerus Private Wealth – iA Private Wealth

700 – 609 Granville Street, Vancouver BC V7Y 1G5

T: 604.895.3316 | TF: 1800.665.2030 | F: 604.682.0529

terry@caeruswealth.ca | kian@caeruswealth.ca

iaprivatewealth.ca | caeruswealth.ca

This information has been prepared by Kian Ghanei who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.