Caerus Private Wealth, iA Private Wealth – February Commentary

The last week of February was choppy and it has investors feeling a little nervous. After all, we are in a stage of recovery and you can’t have a recovery without some corrections and readjustments. There are two trending themes playing out in the market right now: inflation and bond yields. However in our opinion, there are other factors that should be considered when assessing the trajectory of the economy and ultimately the markets. For now, let’s take a look at inflation and bond yields.

Rising Prices – Metals, Energy and Agriculture

Inflation is something that central banks are always concerned with and for good reason. Inflation can be detrimental to an economy as high levels of inflation will reduce the value of money and severely slow down a country’s global competitiveness. In the past two months we have seen a growing concern around inflation noted by a rise in the prices of metal, energy, and agriculture. These prices are driven up by high demand and a recovery in global activity. Surely this can’t be all bad, can it? After all, this is what you would expect during a period of recovery and a rising economic activity. So far this year, the TSX Composite Index has outperformed the S&P 500 by nearly 1.5% which again is indicative of the increase in prices of energy and material. (Source: Quote Stream)

Higher Yields

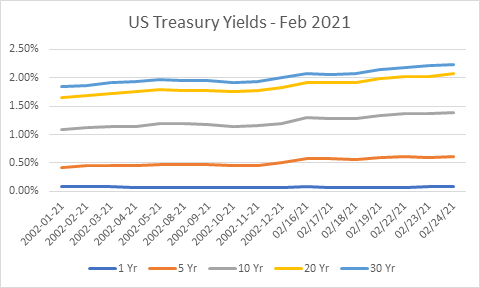

With higher prices, we tend to get an increase in interest rates. One of the most successful tools used by central banks during times of elevated inflation is to increase interest rates as a ‘cooling’ mechanism to slow down the economy from over-heating. Although there have not been any confirmed announcements of rising interest rates, the higher prices of goods and the likely potential of another round of stimulus has lead to higher rates in the longer-term (Treasury Yields as shown below). Here you’ll notice that over the last month, there has been a steepening of the yields across the 5, 10, 20 and 30 year T-Bills, which is a clear indicator that inflation is ramping up. (Source: Treasury.gov)

This is suggesting that some investors are starting to anticipate a tightening of policy sooner than anticipated, to accommodate an inflationary environment. Again, we ask, is this a bad thing? Surely excessive levels of inflation and interest rates can be crippling but we feel that these are simply a normal part of a recovery period. It appears that we are not alone in our assertion. Barclays Head of European Equity Strategy, Emmanuel Cau argues that the steepening yield curve is “typical at the early stages of the cycle”. That is as long as the vaccine rollouts are successful, growth continues ticking upward and central banks remaining cautious, reflationary moves across asset classes look “justified” and equities be able to withstand higher rates.

Reasons to remain optimistic

Covid-19 Update

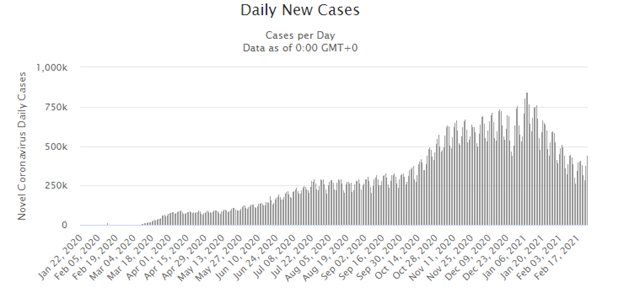

The news of the approval of the AstraZeneca vaccine by Canada is a sign of better things ahead. After all, global cases of CV-19 are coming down as stricter measures, including successful vaccine rollouts, continue to prove effective. Of course, we realize that we are not quite out of the woods yet, but the data is pointing to a better future for all of us. (Source: Worldometer)

Canada and US Unemployment

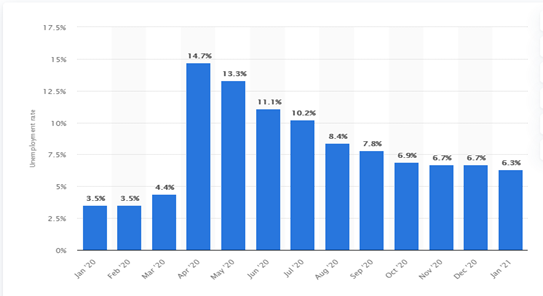

In Canada, stricter provincial measures counted for a increase in unemployment. Although these were entirely in part-time work, the unemployment rate in January increase by 0.6% to 9.4% nationally. We expect these numbers to improve as the CV-19 cases continue to fall and the vaccine rollout ramps up over the next several months.

In the US, much due to their early vaccine rollout programs, the unemployment rate fell to 6.3% and we anticipate this trend to continue over the next few months as economic activity increases. (Source: Statista)

A Jump in Retail

The numbers for January retail sales came out last week and the US saw a jump of 5.3% month-over-month, beating market forecasts by 1.1%. This may not seem like a lot but it is the strongest gain since June, perhaps linked to the new stimulus cheques to help boost spending. This is overall a good sign with more stimulus around the corner in the coming weeks. (Source: CNN Business)

More Stimulus Ahead

The $1.9 trillion stimulus legislation would provide billions of dollars in funding for unemployment benefits, schools, state and local governments and small businesses, as well as a round of $1,400 stimulus cheques, as part of a sweeping plan to help the economy continue to recover from the coronavirus pandemic.

Continued Rise in Expected Earnings

With a declining number of cases of CV-19, more stimulus and low interest rates, companies should become more profitable as consumer spending and capital expenditures rise. Here are some earnings projection data from Factset.

- Earning growth expectations for the US in 2021 is at 24%

- Earning are expected to grow at 30% for developed countries for 2021

- For Emerging markets, earnings growth estimates for 2021 are at 36%

Caerus Wealth Portfolios

The markets may remain volatile over the next few weeks, but we continue to believe that it is part of a normal recovery period. Inflation and rising interest rates are a normal part of this period and although it causes some concern, it can be a good gauge for a recovering economy. The Caerus Wealth portfolios are diversified across several asset classes and service sectors presenting the best chance of success in a recovery stage of the business cycle. We remain optimistic about the prospects of 2021 especially with regards to new stimulus measures, falling unemployment, and higher expected corporate earnings.

Our ADAPT Investment Strategy grants us the ability to remain objective and disciplined. Our research is focused on companies with increasing profitability and supporting trends. So far in 2021, we are finding attractive opportunities in areas of advanced medicine, base materials, ‘green’ trending companies and the cryptocurrency validation. We will continue to monitor new data as we wrap up Q1 and will make the necessary changes as we head into the spring.

As your trusted Portfolio Managers, Terry and Kian, and the Caerus Private Wealth team is available to address any questions you may have. Stay safe!

Terry Fay, Director, Private Client Group, Portfolio Manager

Kian Ghanei, Director, Private Client Group, Portfolio Manager

Caerus Private Wealth – iA Private Wealth

700 – 609 Granville Street, Vancouver BC V7Y 1G5

T: 604.895.3316 | TF: 1800.665.2030 | F: 604.682.0529

terry@caeruswealth.ca | kian@caeruswealth.ca

iaprivatewealth.ca | caeruswealth.ca

This information has been prepared by Kian Ghanei who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.