Caerus Wealth November Commentary

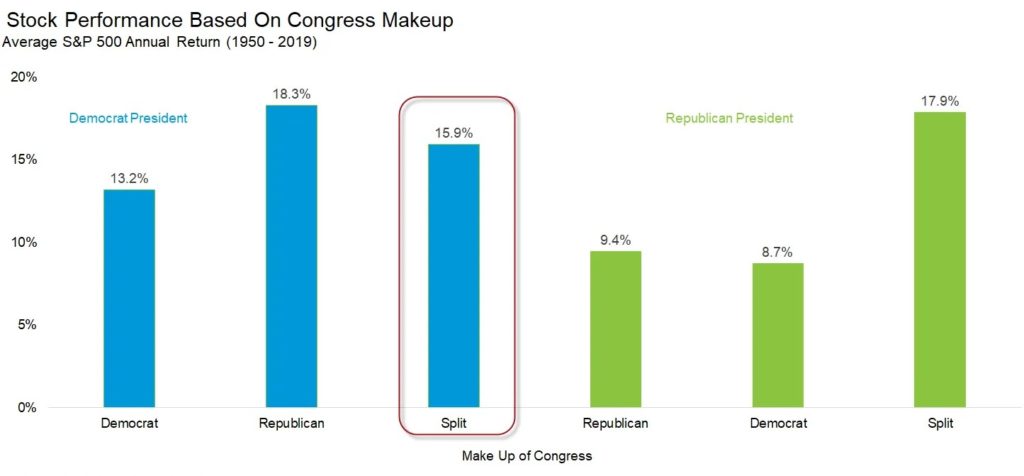

The US elections have come and gone, and for the most part, the results are clear. It was one of the most anticipated US elections in modern history with a record number of Americans casting their votes. Despite allegations of voter fraud, it is increasingly clear that Joe Biden will be the next US President and financial markets have embraced this change with one of the largest rallies since 1987. Aside from the Presidential race, the high probability of a split senate or gridlock in Washington have investors bullish on the outlook of the markets as they believe that this gridlock paves the way for more consistency in policy making over the next 4 years without major legislative changes to taxes, regulation and capital gains. The below chart shows that a split Congress tends to mean stronger stock returns and this scenario has historically produced an average return of 15.9% since 1950. (Source: Bloomberg and LPL Research)

Split Congress

(Source: Bloomberg and LPL Research)

Remaining Challenges

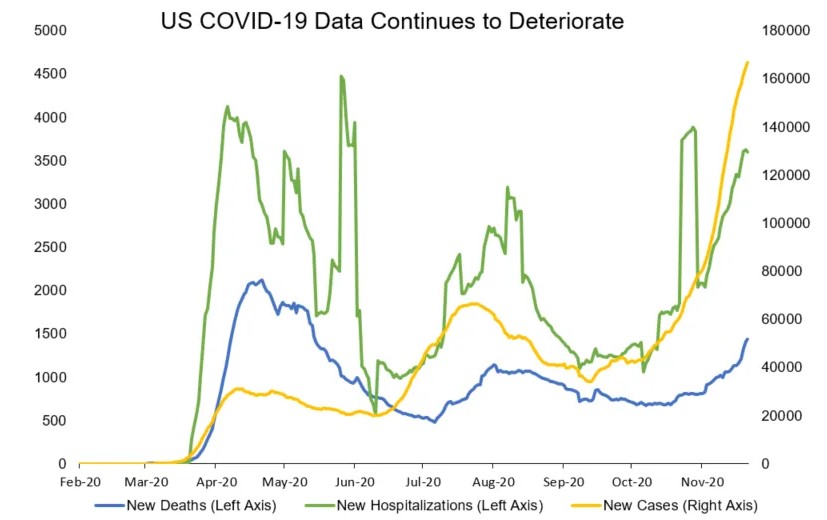

While investors continue to direct funds to stocks, Covid-19 cases have been rising in several regions around the world, prompting many countries to implement new restrictions to lessen the spread. While new restrictions are more targeted than the ones implemented in earlier this year, the recovery of certain economies are slowing down and could very well put some economies in a double-dip recession. The US has experienced worsening Covid-19 cases in the 4th quarter and with the weather getting colder, we see an elevated chance of further restrictions being enacted. New York and California have again placed curfew and closed some schools in an effort to curb the spread.

(Source: Covid Tracking Project)

Positive Trends and Vaccines

After a new record daily case count of 194,979 on Friday, US case growth slowed over the holiday weekend resulting in a 5.4% decline in the seven-day average over the prior week. Hospitalizations also had a decline of 4.3% in the seven-day average that we hope is a sign that people have come to their senses and are taking better precautions to limit the spread. (Source: Covid Tracking Project)

Furthermore, Pfizer and Moderna are now seeking rapid approvals from both the US and Britain where Britain is set to approve the vaccine developed by BioNTech and Pfizer by next week. Moderna Inc. said it would ask U.S. and European regulators to allow emergency use of its COVID-19 vaccine as new study results confirm the vaccine offers strong protection — ramping up the race to begin limited vaccinations as the coronavirus rampage worsens.

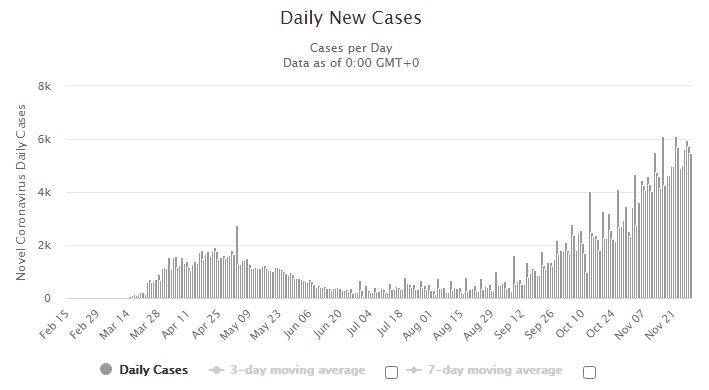

Cases in Canada

Here in Canada, we have surpassed 12000 death as of Sunday with infections on the rise. Alberta announced 1608 new cases which now is the highest daily increase amongst Canadian provinces.

(Source: Worldometers)

There have been some criticism of the government’s procurement plan from the Conservative opposition, but Moderna has confirmed that because Canada was among the first countries to make a pre-order with Moderna, the country is guaranteed to receive a certain portion of the company’s initial batch of doses as long as the vaccine proves safe and effective and is given regulatory approval. The federal government secured an agreement on Aug. 5 with Moderna for 20 million doses of its vaccine, with the option to procure an additional 36 million doses.

Another round of stimulus

Despite the rises in Covid-19 cases, all major US indexes closed at all-time highs as investors welcome a successful vaccine, mainstream politics and the potential of another round of stimulus. Congress comes back to Washington this week to discuss two major issues. One, they require to pass a spending bill before Dec 11th to avoid a shutdown. Two, they must get back to negotiating on whether they will move forward with another round of coronavirus relief bill as twenty-one states recorded records of hospitalizations over the US Thanksgiving weekend. An expansion of unemployment benefits, moratorium on federal student loan payments and some protections from eviction will expire at the end of the year. Millions of Americans are already struggling to cover costs. (Source CNBC)

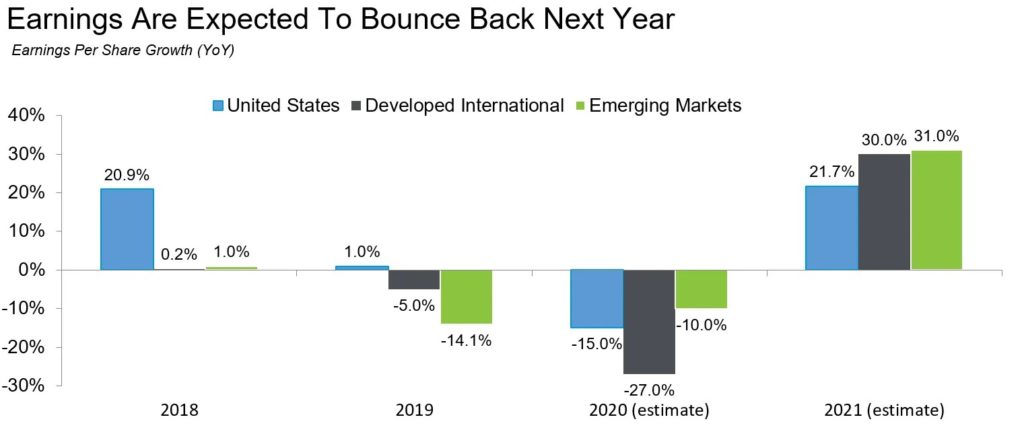

2021 Expected Earnings

With a successful distribution of a safe vaccine, we can also expect earnings to bounce back in 2021 in the US and Europe with the strongest bounce expected to occur in China and the Emerging Markets. Over the weekend, China reported an official purchasing managers’ index (PMI) for manufacturing expanding for the ninth straight month. As recoveries for the US and Europe are temporary muted, China’s growth continues to stand out globally. (Source: Reuters)

Caerus Wealth Portfolios

The Caerus Wealth portfolios are diversified across several asset classes and service sectors presenting the best chance of success in a fragile environment. Although we are very hopeful of the vaccine outlook and its economic implications, we are mindful of its challenges around safety, timing and distribution. Our ADAPT Investment Strategy grants us the ability to remain objective and disciplined as we continue to navigate through this challenging year. Our research is focused on companies with increasing profitability and supporting trends and we continue to see a great deal of upside broadly in technology and healthcare. With that said, we are becoming increasingly interested in the emerging markets and we will carefully review these opportunities. We will continue to monitor new data as we wrap up Q4 and will make the necessary changes as we head into the holiday shopping season.

As your trusted Portfolio Managers, Caerus Private Wealth and its team are available to address any questions you may have.

Stay safe!

Terry Fay, Director, Private Client Group, Portfolio Manager

Kian Ghanei, Director, Private Client Group, Portfolio Manager

Caerus Private Wealth – HollisWealth, a division of Industrial Alliance Securities Inc.

700 – 609 Granville Street, Vancouver BC V7Y 1G5

T: 604.895.3316 | TF: 1800.665.2030 | F: 604.682.0529

terry@caeruswealth.ca | kian@caeruswealth.ca

holliswealth.com | caeruswealth.ca

This information has been prepared by Terry Fay and Kian Ghanei who are Portfolio Managers for HollisWealth® and does not necessarily reflect the opinion of HollisWealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. Terry Fay and Kian Ghanei can open accounts only in provinces in which they are registered. HollisWealth® is a division of Industrial Alliance Securities Inc., a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada.