Caerus Wealth October Commentary

For many of us the fall season can be calming after the busy summer months. This year, however, we might begin to feel more anxiety than calm as we try to unravel and cope with this prolonged pandemic environment. Although we are trying to look past these clouds in search of a ray of sunshine, we know that the current situation is, sadly, not so bright. As investors, we must remain calm and objective while examining both the good and the bad with an outlook that looks into the future. Even in these times, there have been some better-than-expected data around employment, GDP growth and corporate earnings. Let’s take a look.

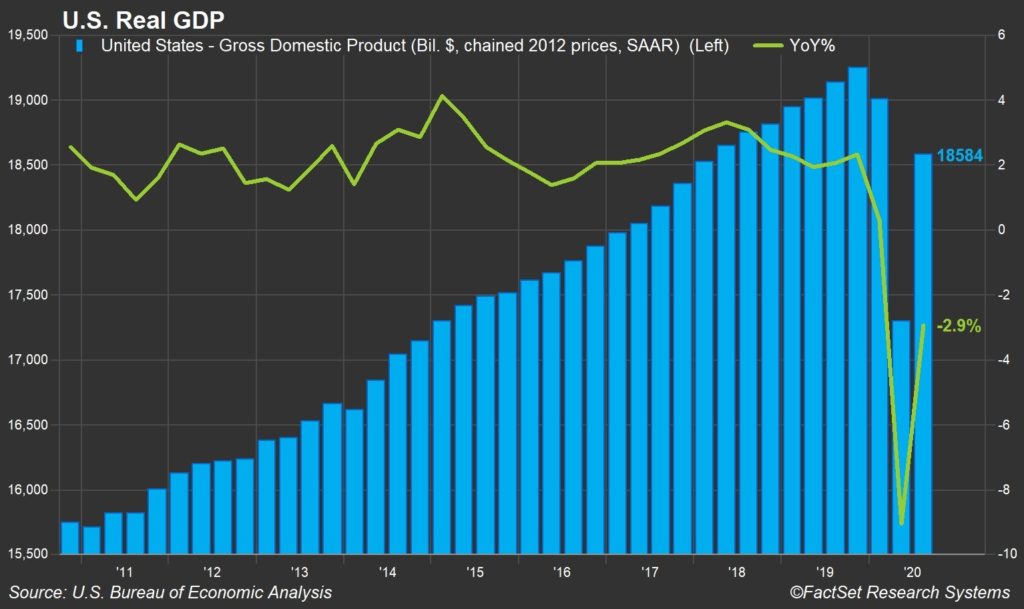

US GDP

The US economy grew at a historic pace in the third quarter surging at a rate of 7.4% in Q3. Now we realize that the GDP is still 3.5% below pre-covid levels but the trend certainly is viewed positively.

(Source: US Bureau of Economic Analysis)

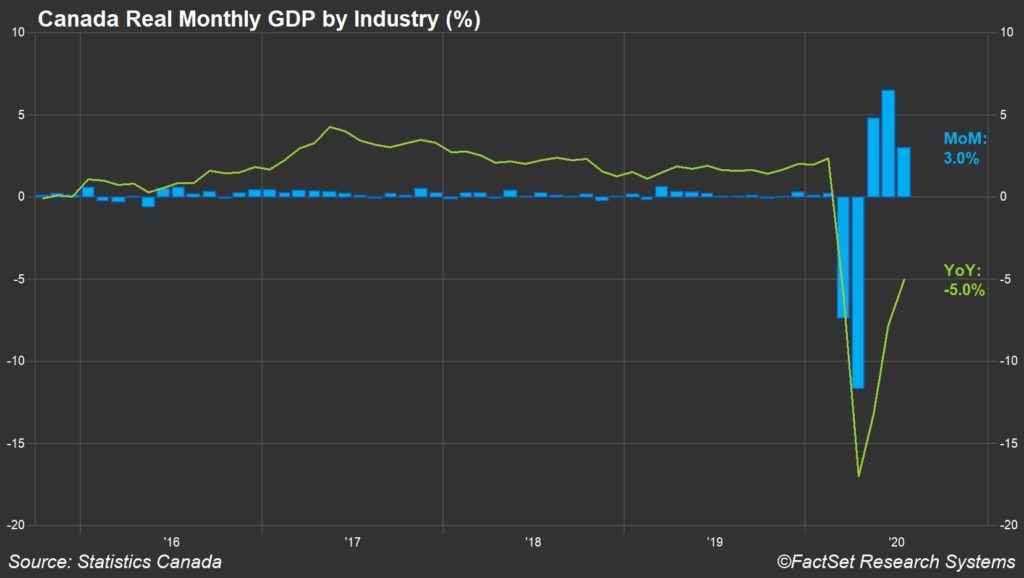

Canada GDP

Monthly GDP figures in Canada show signs of a recovery also for Q3 but at a slowing pace. On the year-over-year basis, the economy was down 5% since last July.

(Source: Statistics Canada)

Positive Earnings Per Share (EPS) Surprises

According to FactSet, 64% of the companies in the S&P 500 have reported actual results for Q3 2020 to date. Of these companies, 86% have reported actual EPS above estimates, which is well above the five-year average of 73%. If 86% is the final percentage for the quarter, it will mark the highest percentage of S&P 500 companies reporting a positive EPS surprise since 2008.

Fall in Jobless Claims in the US

In the US, in a sign that the labor market is slowly continuing to improve, 751,000 Americans filed for first-time unemployment benefits last week, the Department of Labor said Thursday in its last report before the presidential election. That’s down 40,000 from the prior week, which was revised slightly higher.

Acceleration of Hiring in Canada

Canada’s economy added 378,000 new jobs in September, Statistics Canada says, almost all of which were full-time positions. September’s job gains mean that the job market is now within 720,000 positions of where it was in February, before the advent of COVID-19 in Canada.

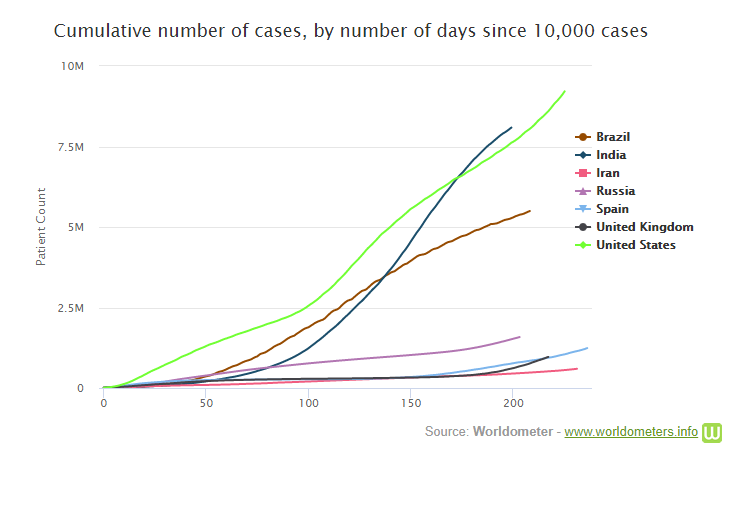

Despite some of the positive data coming from both sides of the border, there are still two major themes globally that continue to drive the markets. The US elections and the second wave of the pandemic. Although the outcome of the elections will be a moral victory for some, the real fight will continue to be the pandemic and its unwavering impact on the global economy. We can all agree that the path and direction of new cases have changed for the worse and important measures must be re-implemented globally to combat the lurking health care crisis. Numbers across the globe are heading in the wrong direction in both North America and Europe resulting in fresh lockdowns in Europe.

Here is a summary of the major changes in Europe recently including new lockdowns and restrictions. (Source Worldometer)

Germany:

Angela Merkel, the Chancellor of Germany, has announced a four-week shutdown of restaurants, bars, gyms, pools, theatres and cinemas, beginning on November 2. Germany’s new shut down rules also restrict all hotel stays that are for leisure, making it virtually impossible to be a tourist within Germany’s borders for the next month.

France:

Starting tomorrow on October 30th, France will enter another nationwide lockdown, as announced by President Emmanuel Macron. France has seen an out of control flood of cases over the past few weeks, reporting as high as 50,000 new cases per day, provoking further restrictions and regulations to be put into place.

Spain:

Spain has initiated a state of emergency that is set to last until May 2021, which gives local authorities the power in their own regions to restrict travel and/or impose curfews, depending on case levels.

Italy:

Italy is seeing many of the same new restrictions as the rest of Europe, but not quite as strict as France or Germany. Prime Minister Giuseppe Conte announced on October 26 that bars and restaurants can still remain open for the time being, but they must close early, by 6pm. Facilities like gyms, pools, cinemas and other related businesses will be forced to close down for at least the next month.

United Kingdom:

Most surprising, The UK has seen the highest death rate in all the EU countries, but has yet to impose any stricter border controls, essentially allowing passengers from high-risk countries to enter with just a promise they will quarantine for 14 days.

Red Versus Blue: The most anticipated US Presidential Elections in US history!

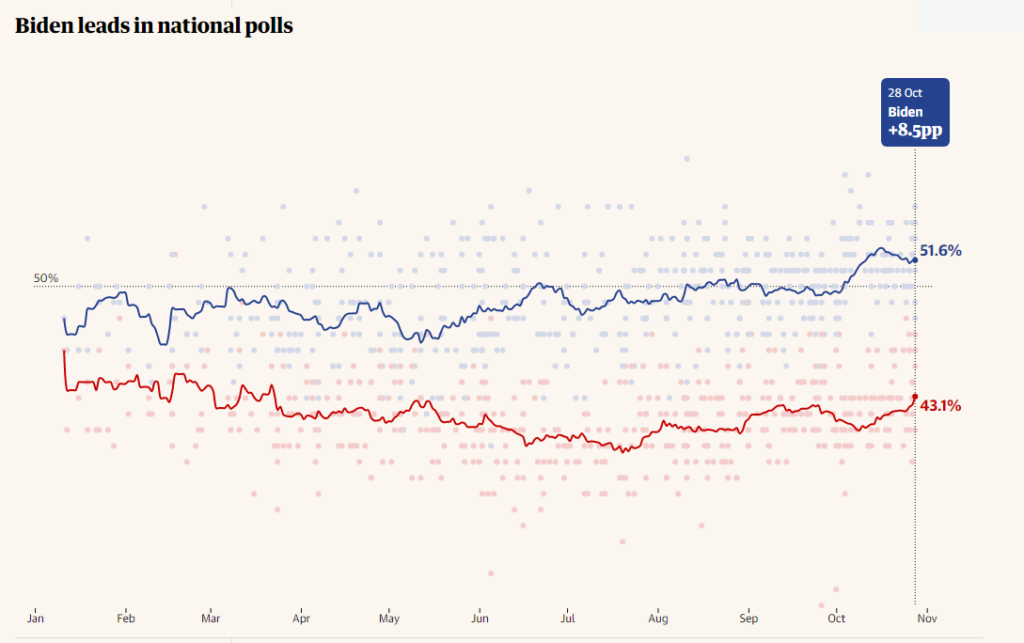

On Tuesday November 3rd, Americans will vote for their next president. With 4 days remaining, we have seen an incredible rise in early voting never seen before in the history of the US elections. American are divided and are making sure their voices are heard early and counted in time before the elections are over. We are often asked about our opinion on how the elections will impact the markets and it has become clear to us that biggest challenge for any financial market is uncertainty. Not having a clear path to making financial projections is the most challenging thing for the markets and with that said, we look forward to moving past the elections. Surely there will be people upset at the outcome and there will be industries that may be negatively impacted but at least we can move forward with some normalcy without political campaigning and distractions.

As for our prediction, we think that it is too close to call and although the national polls are favoring Biden’s camp presently, polls can be misleading as they were back in 2016 (Source: The Guardian)

Caerus Wealth Portfolios

The Caerus Wealth portfolios are diversified across several asset classes and service sectors presenting the best chance of success in a prolonged COVID-19 environment. Our unique internal process grants us the ability to remain objective and disciplined as we continue to navigate through a challenging year. Our research is focused on companies with increasing profitability and supporting trends and at the present time continue to see a great deal of upside broadly in technology and healthcare. We will continue to monitor new data as we head into Q4 and will make the necessary changes as we head into the election season.

As your trusted Portfolio Managers, Caerus Private Wealth and its team are available to address any questions you may have.

Stay safe!

Terry Fay, Director, Private Client Group, Portfolio Manager

Kian Ghanei, Director, Private Client Group, Portfolio Manager

Caerus Private Wealth – HollisWealth, a division of Industrial Alliance Securities Inc.

700 – 609 Granville Street, Vancouver BC V7Y 1G5

T: 604.895.3316 | TF: 1800.665.2030 | F: 604.682.0529

terry@caeruswealth.ca | kian@caeruswealth.ca

holliswealth.com | caeruswealth.ca

This information has been prepared by Terry Fay and Kian Ghanei who are Portfolio Managers for HollisWealth® and does not necessarily reflect the opinion of HollisWealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. Terry Fay and Kian Ghanei can open accounts only in provinces in which they are registered. HollisWealth® is a division of Industrial Alliance Securities Inc., a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada.