Caerus Wealth September Commentary

The upcoming US elections took center stage this week with its’ first Presidential debate. With less than 30 days to the US elections, we are prepared to filter through the noise and propaganda and focus on the relative data impacting the markets and the economy. With the third quarter wrapping up yesterday, we welcomed some positive data at the end of a volatile September for equities and commodities.

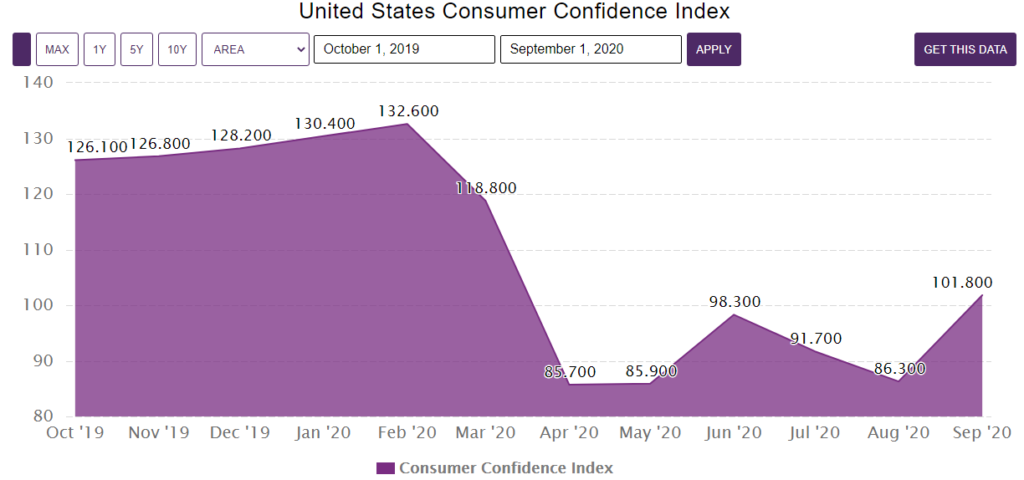

Consumer Confidence Index

Six months into the pandemic, Americans are beginning to feel much better about the economic recovery. Consumer confidence soared to its highest level since Covid-19 swept across the country, according to the Conference Board. The Conference Board Consumer Confidence Index® increased in September after declining in August. The Index now stands at 101.8 (1985=100), up from 86.3 in August. In contrast, Global Consumer ConfidenceIndicators seem to be lagging. (Source: www.Ceicdata.com I Conference Board)

The Stimulus Package and CV-19 Relief

House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin are trying one final time to ease a bitter standoff on Capitol Hill over a pre-Election Day package to provide relief to millions of Americans reeling from the damaging economic crisis. Equities seem to anticipate a deal which will now seem to range between $1.6 Trillion and $2.2 Trillion depending on which side you are on. The latest counteroffer that came from the White House is working itself closer to a deal, although they still need to convince the Senate Republicans. This will be an important catalyst for equities kickstarting in the fourth quarter.

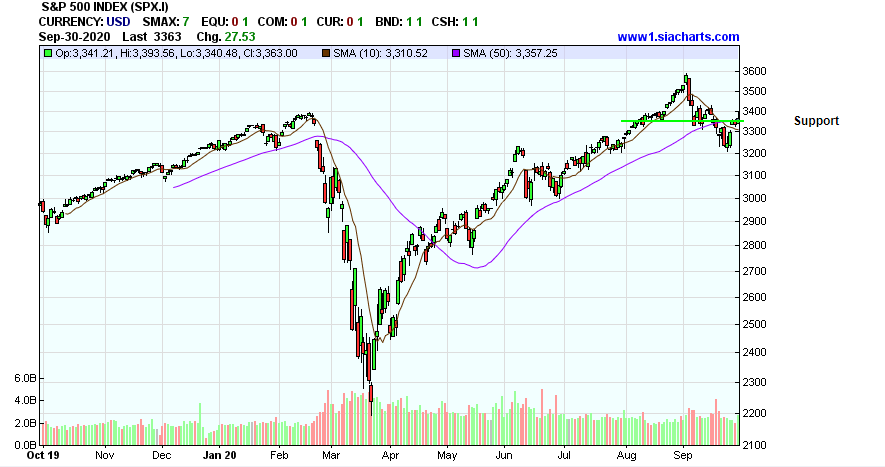

Technical Update

Over the last three weeks, equities saw a sell-off that trimmed off approx. 10% of the broad market indexes. The technical support of these indexes was challenged where we saw a breach of the 50-day moving average of the S&P 500 which for most observers indicates the emergence of a potential bear market that has been marked at the 3355 mark. Over the last week, however, we saw a reversal of this decline and have broken above the 50-day moving average which is a strong technical indicator for money managers and investors.

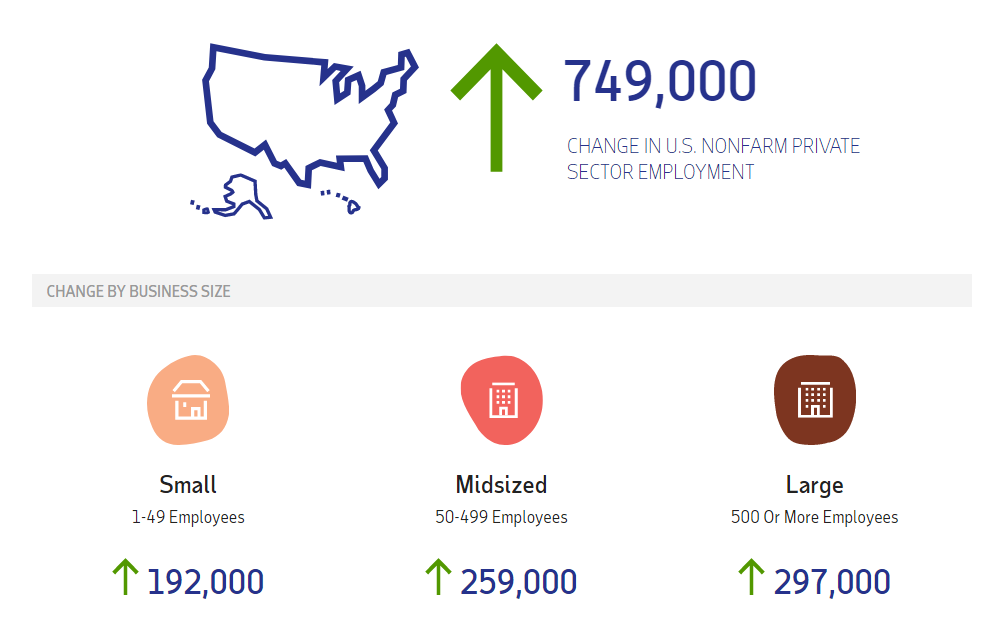

ADP Private Jobs Report

US Companies added jobs at a faster-than-expected pace in September due in good part to a surge in manufacturing hires, according to a report Wednesday from ADP. The firm’s monthly private-sector job count showed growth of 749,000, ahead of the 600,000 expected from a Dow Jones economist survey.

The report, done in conjunction with Moody’s Analytics, comes two days ahead of the more closely watched Labor Department count of nonfarm payroll growth. That report is expected to show an addition of 800,000 after August’s 1.37 million, with the unemployment rate projected to fall two-tenths of a point to 8.2%. However, this news came at a time where major layoffs from the likes of Disney and Air Lines have surfaced.

Employment and Job creation will continue to be challenged in the next 6 months to 1 year before the pandemic is under control. In Canada, The ADP job report for September will be released on Oct 15th.

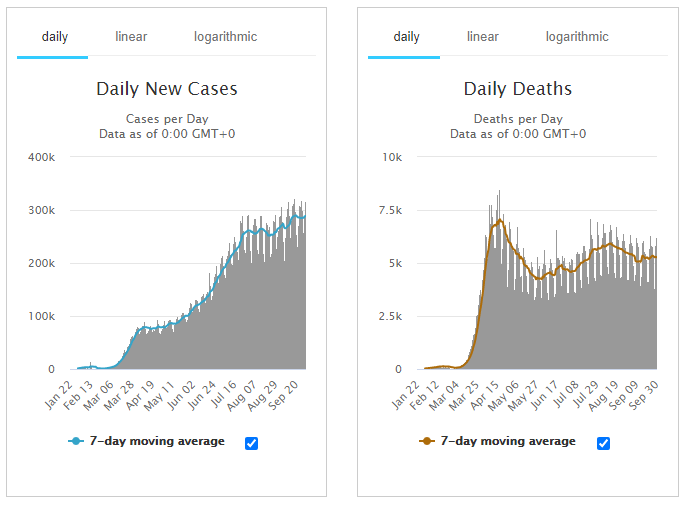

CV-19 News

With the school season upon us, and as expected, we are seeing an increase in the number of cases on both sides of the border. The pandemic continues to be the single biggest driver of uncertainty across the globe. With the flu season here, we expect cases to continue across the globe heading into the holiday season. The below charts show the global daily cases and the global daily deaths which tells us that the pandemic is still running rampant. We hope with the summer months behind us, we can revert to taking precautionary measures that will control the spread while waiting for an effective and safe vaccine to get distributed by the Summer of 2021. (Source: Bloomberg)

Caerus Wealth Portfolios

The Caerus Wealth portfolios are diversified across several asset classes and service sectors presenting the best chance of success in a prolonged COVID-19 environment. Our unique internal process grants us the ability to remain objective and disciplined as we continue to navigate through a challenging year. Our research is focused on companies with increasing profitability and supporting trends and at the present time continue to see a great deal of upside broadly in technology and healthcare. We will continue to monitor new data as we head into Q4 and will make the necessary changes as we head into the election season.

As your trusted Portfolio Managers, Caerus Private Wealth and its team are available to address any questions you may have.

Stay safe!

Terry Fay, Director, Private Client Group, Portfolio Manager

Kian Ghanei, Director, Private Client Group, Portfolio Manager

Caerus Private Wealth – HollisWealth, a division of Industrial Alliance Securities Inc.

700 – 609 Granville Street, Vancouver BC V7Y 1G5

T: 604.895.3316 | TF: 1800.665.2030 | F: 604.682.0529

terry@caeruswealth.ca | kian@caeruswealth.ca

holliswealth.com | caeruswealth.ca

This information has been prepared by Terry Fay and Kian Ghanei who are Portfolio Managers for HollisWealth® and does not necessarily reflect the opinion of HollisWealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. Terry Fay and Kian Ghanei can open accounts only in provinces in which they are registered. HollisWealth® is a division of Industrial Alliance Securities Inc., a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada.