January 2025 Commentary

Canadians generally view Donald Trump unfavorably, seeing him as a divisive and controversial figure. His policies, rhetoric, and leadership style have often clashed with Canadian values, particularly regarding issues like immigration, climate change, and international diplomacy. Many Canadians were frustrated by his approach to trade, especially during NAFTA (USMCA) renegotiations, which led to tensions between the U.S. and Canada. Additionally, some Canadians feared that Trump’s ‘America First’ approach treated Canada as a subordinate rather than an equal ally, with jokes and concerns surfacing about Canada becoming the “51st state” under U.S. influence. But perhaps the most reprehensible of all must be the blanket tariffs imposed not just on China, but on America’s most long-lasting trading partners and allies, Canada and Mexico.

As of February 1, 2025, President Donald Trump has implemented a 25% tariff on all imports from Canada (10% on Canadian Energy). This decision is part of a broader strategy that also includes similar tariffs on Mexican imports and a 10% tariff on goods from China.

Given the current climate, we understand that many are concerned about the prospects of Canada and markets overall. Making decision that are emotionally charged are often met with unfavorable outcomes. As your portfolio managers, we share some of your concerns and we are always considering all options on the table. We form our opinions and decisions about the markets based on the available data, and although this opinion may change quickly, and we are currently not making any considerable changes to the portfolios. Here are some of the things that we think are shaping today’s market including some of our thoughts surrounding the tariffs.

The Fed and Fiscal Policy

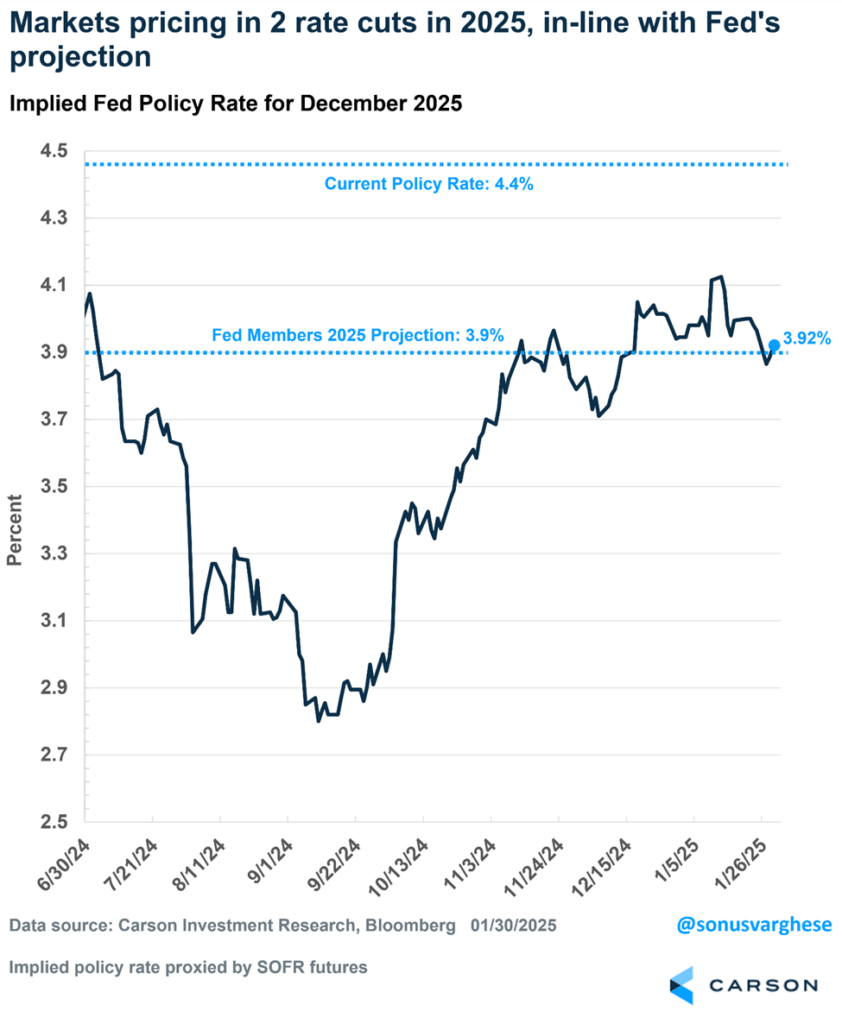

The Federal Reserve’s January 2025 meeting held no major surprises, as they maintained interest rates between 4.25-4.50% and continued reducing their bond holdings. However, their statement did acknowledge that inflation remains somewhat elevated, suggesting that rate cuts may not come anytime soon. Fed Chair Jerome Powell reinforced this by stating they are not in a hurry to adjust policy and will need to see more data before making any changes. Current market expectations indicate two rate cuts in 2025, with the first one likely coming no earlier than June, reflecting stronger-than-expected economic data that has reduced recession fears.

Despite the Fed’s cautious stance, Powell expressed optimism about inflation, suggesting that recent strong inflation data was a temporary factor and that year-over-year inflation readings should improve in early 2025 due to favorable base effects. He also emphasized that inflation expectations remain in check, both among consumers and businesses. However, Powell also noted that the Fed’s policy rate remains restrictive, meaning it could slow the economy if left too high for too long. Any further weakening in the labour market could prompt the Fed to cut rates sooner than expected to prevent economic harm.

One of the key reasons for the Fed’s pause is rising uncertainty around U.S. policies, particularly regarding tariffs, immigration, fiscal deficits, and regulatory changes under the Trump administration. Powell acknowledged that they need more clarity on these policies before adjusting rates. However, keeping rates high for an extended period is not a neutral stance, as it puts pressure on housing, business investment, and U.S. exports by keeping the dollar strong. The latest economic data suggests that while GDP growth remains solid, investment spending is slowing, particularly in equipment and manufacturing. If this trend continues, it could slow overall economic growth, reinforcing the Fed’s need to balance inflation concerns with economic stability.

The US Economy – Still Steaming!

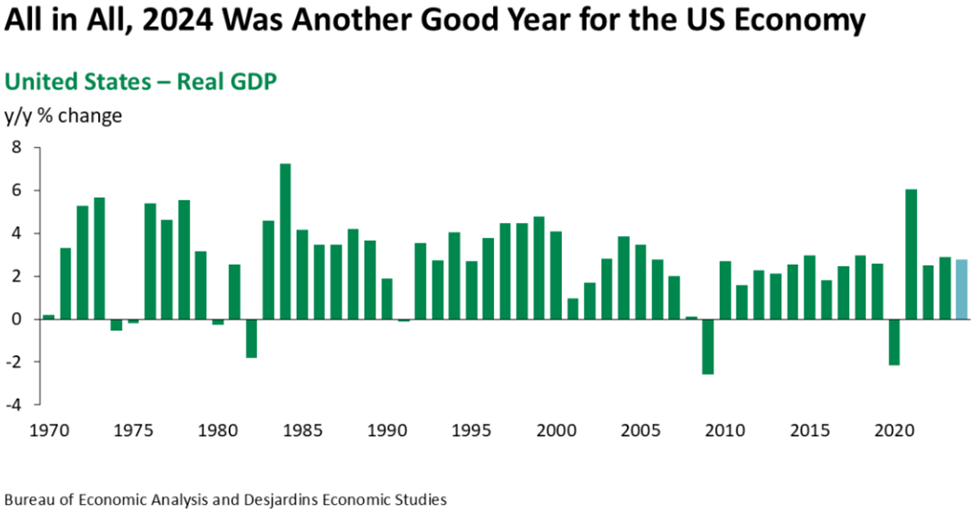

Things played out largely as we expected in 2024, as we continued to fade the numerous recessions calls and maintained an overweight recommendation to stocks that has been in place since late 2022. But what lies ahead?

The fourth quarter of 2024 marked the slowest U.S. economic growth since the first quarter of the year, but an annualized gain of 2.3% still reflects a solid performance. Final domestic demand, which measures the total spending within the economy, rose 3.1%, following a strong 3.7% increase in the previous quarter. This indicates that despite economic headwinds, domestic activity remained robust.

A key driver of this growth was real consumer spending, which surged 4.2% annualized, the highest rate since early 2023. Given that consumer spending accounts for over 70% of GDP, this strong performance underscores the resilience of households amid high interest rates and election-related uncertainty. The labour market’s strength and rising incomes played a crucial role, with real disposable income growing at a 2.8% annualized rate in the fourth quarter, supporting continued spending.

The Canadian Economy – A bit fragile!

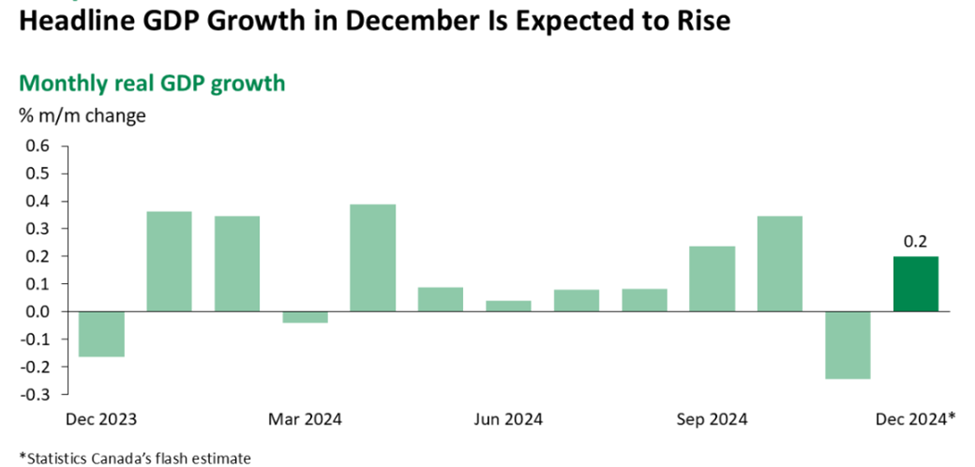

In 2023, Canada’s economy experienced a 1.5% growth in gross domestic product (GDP), a deceleration from the 4.2% increase in 2022 and the 6.0% growth in 2021. This slowdown was primarily attributed to a decline in exports and a moderation in household spending. (Source: Statcan.gc.ca)

Throughout 2024, the economy exhibited modest growth. The first quarter saw a 0.4% expansion, followed by a 0.5% increase in the second quarter, and a 0.3% rise in the third quarter. These gains were driven by higher household and government spending, though tempered by slower non-farm inventory accumulation, reduced business capital investment, and lower exports. (Source: Tradingeconomics.com)

In November 2024, GDP contracted by 0.2%, mainly due to significant declines in sectors such as mining, quarrying, oil sands extraction, and transportation. However, preliminary estimates suggest a 0.2% rebound in December, led by retail trade, manufacturing, and construction. Overall, while Canada’s economy continued to grow in 2024, the pace was slower compared to the previous year, reflecting ongoing challenges in various sectors. (Source: Statistics Canada)

It’s not all that bad for Canada. The Canadian GDP could benefit from a low CAD Dollar in terms of exports, and an easing monetary policy will have a positive impact on both personal consumption and business investments and activity.

US Labour Market

As of December 2024, the U.S. labour market demonstrated resilience, adding 256,000 nonfarm payroll jobs, bringing the total employment growth for the year to approximately 2.2 million jobs, or a 1.4% increase. Significant gains were observed in sectors such as healthcare (+46,100 jobs), government (+33,000), and social assistance (+23,400). The unemployment rate slightly decreased to 4.1% in December 2024, down from 4.2% in November. Throughout 2024, the unemployment rate fluctuated between 4.1% and 4.2%, indicating a stable labour market. (Source: BLS.gov)

In comparison to the previous year, the unemployment rate has risen modestly. In December 2023, the unemployment rate was 3.8%, which means there has been a 0.3 percentage point increase over the past year. Despite this uptick, the current rate remains relatively low by historical standards, suggesting that while some individuals may experience longer job searches, widespread unemployment has not been a significant issue.

Canada’s Labour Market

As of December 2024, Canada’s labour market exhibited notable strength, adding approximately 90,900 jobs, primarily in full-time positions. This increase led to a slight decrease in the unemployment rate, bringing it down to 6.7% from 6.8% in November. The labour force participation rate remained steady at 65.1%. (Source: statcan.gc.ca)

When compared to the previous year, there has been a discernible rise in the unemployment rate. In December 2023, the unemployment rate stood at 5.8%, indicating a 0.9 percentage point increase over the past year. This upward trend suggests that while employment has grown, it has not kept pace with the expanding labour force.

Earnings

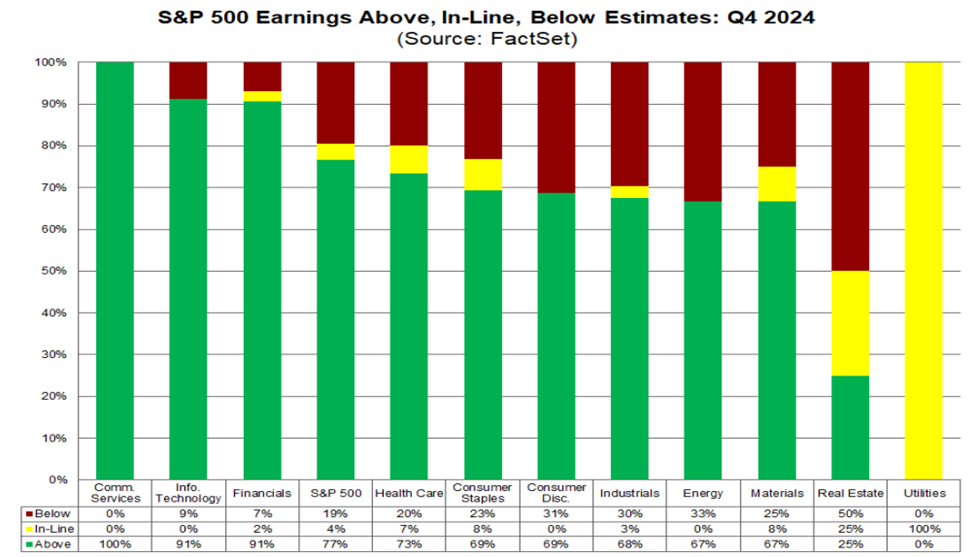

As the fourth-quarter earnings season progresses, S&P 500 companies are delivering mixed results relative to expectations. While a higher-than-average percentage of companies are reporting positive earnings surprises, the magnitude of those surprises is lower than the 10-year average. Despite this, the index has shown improving earnings growth compared to both the previous week and the end of the quarter. Notably, the year-over-year earnings growth rate for Q4 2024 is the highest in three years, indicating overall resilience in corporate performance.

So far, 36% of S&P 500 companies have reported actual earnings results, with 77% surpassing earnings per share (EPS) estimates—matching the five-year average and exceeding the 10-year average of 75%. However, the average earnings beat stands at 5.0%, below the five-year average of 8.5% and the 10-year average of 6.7%. Sector-wise, positive surprises in Communication Services and Information Technology have driven earnings growth in recent weeks, though weak results from Industrials have partially offset these gains. Since the start of the quarter, Financials and Communication Services have been key contributors to the rise in overall earnings growth, while Industrials have been a drag.

Tariffs

While the proposed tariffs aim to protect U.S. industries and address trade imbalances, research indicates they could have significant negative effects on both the Canadian and U.S. economies, including reduced GDP, higher consumer prices, and disrupted supply chains.

Top 10 Canadian Exports to the US and Canada

Based on the latest available data, Canada’s top ten exports to the United States are:

- Crude Petroleum: Approximately $128.51 billion USD.

- Vehicles (excluding railway or tramway): Around $58.21 billion USD.

- Machinery (including nuclear reactors and boilers): About $33.75 billion USD.

- Commodities not specified according to kind: Valued at $20.46 billion USD.

- Plastics: Approximately $14.05 billion USD.

- Precious Stones, Metals, and Coins: Around $12.43 billion USD.

- Electrical and Electronic Equipment: About $11.87 billion USD.

- Wood and Articles of Wood, Wood Charcoal: Valued at $11.53 billion USD.

- Aluminum: Approximately $11.36 billion USD.

- Mineral Fuels, Oils, and Distillation Products: Around $128.51 billion USD.

There is no doubt that tariff have some negative implications on both sides of the border. In Canada, the most impacted sector will be the crude petroleum industry which based on the most recent figures exports $128.5 Billion USD per year. On Saturday, Trump announced a 10% tariff on energy exports from Canada which is substantially better than the 25% stated earlier. Even with a ‘reduced’ tariff on Canadian energy, there will be some consequences for the Canadian sector that is by far the largest item on our list of exports to the US.

Trump’s latest policy around domestic oil production is ‘drill baby drill’ but how quickly can they bridge the gap on their petroleum dependency from Canada? The United States is significantly dependent on Canada’s crude petroleum. In 2023, Canada supplied approximately 60% of U.S. crude oil imports, a substantial increase from 33% in 2013. This growth underscores Canada’s role as the largest foreign supplier of crude oil to the U.S. In terms of volume, the U.S. imported nearly 3.9 million barrels of crude oil per day from Canada in 2023, marking the highest level recorded to date. (Source: EIA.gov)

The truth of the matter is that Canada needs to fix its dependence on petroleum exports to the US. Although this topic is beyond the scope of this commentary and there are many issues to overcome on our dependency on US petroleum imports, our new government leaders will have to invest in a long-term solution to keep us protected and less reliant on external postering.

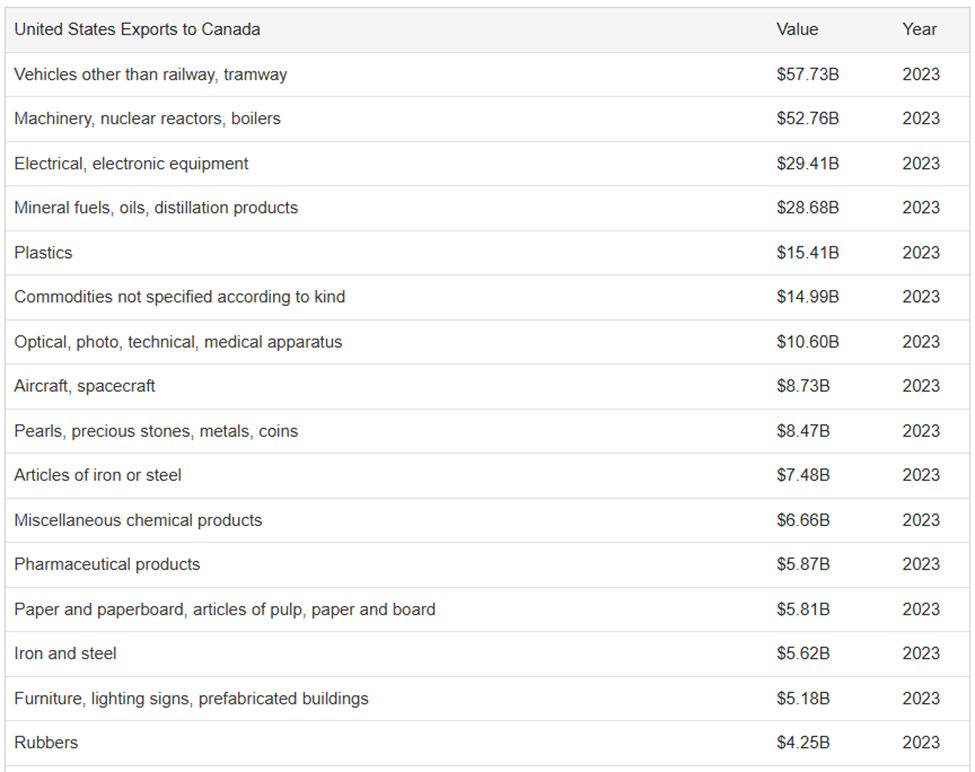

On the flipside, here are the top US exports to Canada:

Canada’s Response:

Canadian Prime Minister Justin Trudeau condemned the U.S. tariffs as “totally unacceptable” and declared that Canada would implement retaliatory tariffs on American goods. Starting Tuesday, Canada will impose a 25% tariff on various U.S. products worth $20 billion, with further tariffs on additional goods expected. Trudeau emphasized that these measures are designed to protect Canadian interests and urged citizens to support domestic products. Some provincial authorities have also planned to remove American liquor brands from store shelves. (Source: CBC)

Mexico’s Response:

Mexican President Claudia Sheinbaum announced that Mexico would impose retaliatory tariffs on U.S. goods, though specific details were not immediately provided. Sheinbaum rejected allegations linking the Mexican government to criminal organizations and called for diplomatic dialogue to address issues like drug trafficking. She emphasized that problems are not resolved by imposing tariffs and proposed establishing a task force with the U.S. to address these concerns.

It appears that she has been able to defer tariffs for 30 days to address the border issues. Could this be the start of some negotiations that’ll avoid an all-out tariff war amongst the North American allies? We hope so!

Renewal of the USMCA Agreement

The North American Free Trade Agreement (NAFTA) was replaced by the United States-Mexico-Canada Agreement (USMCA) on July 1, 2020. NAFTA itself does not have an expiration date, but it effectively ceased to be in force when USMCA came into effect. What will happen to their agreement and why is it relevant?

With the imposition of tariffs and counter tariffs, this agreement will most likely have little significant even if those trade terms and conditions are breached (which they clearly have). But the agreement, which is set to expire in 2036, has a review process or renewal process every 6 years which coincides with 2026. Some think that the latest Trump tactics are simply a way to start the renegotiations early and have things resolved by 2026. There is no proof of this in any shape or form, but one can hope there is some rhyme or reason to his deliberate escalation of tensions.

In Summary

Looking back at January, the broader indexes on both sides of the border have seen increases of approx. 2.5-3%. This is all coming off a very strong year in the markets. Some wonder how this can be possible with a backdrop of tariffs and policy uncertainty but the financial markets, particularly the stock market, tend to see past the noise. We tend to agree with how the market views and analyzes financial news. However, we also understand that these are unlike any other time before. Emotions are running high and there is a sense of divisiveness and fear that’s not only blatantly apparent in the US but also across Canada.

It’s times like this that we strictly and objectively adhere to our ADAPT Investment Process to guide us and help us see through the noise. We will continue to monitor the markets and will take a defensive stance if necessary but for now, we remain optimistic and continue to benefit from this rising market.

We thank you for your continued trust and we welcome you to reach out to us with any questions you may have.

This information has been prepared by Kian Ghanei and Terry Fay who are Portfolio Managers for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The [Investment Advisor/Portfolio Manager] can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.