July 2024 Commentary

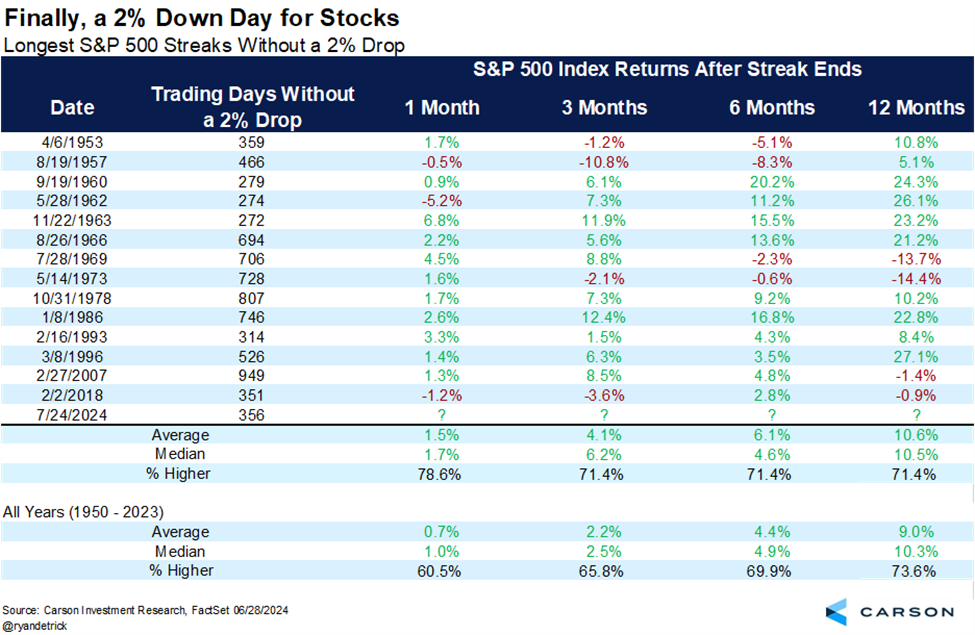

Recently in July, the S&P 500 experienced a 2% drop, ending a 356-day streak without such a decline, but this is not a sign of an end to the current bull market. Although the dip was triggered by underwhelming earnings reports from major companies like Tesla and Alphabet, historical data indicates that such fluctuations are typical within long-term upward trends. As seen in this chart, there have been many years in the past where strong market performance have included multiple 2% declines, indicating that these dips are a normal part of market dynamics and do not necessarily signal a downturn. (Source: Carson Research)

In the U.S., the economic environment remains strong, supported by solid consumer spending, healthy income growth, and a resilient labor market. Analysts predict continued earnings growth, supported by historical trends that show markets often rebound and continue to grow after temporary setbacks. This positive outlook is underpinned by strong economic fundamentals and corporate earnings growth, suggesting that the recent drop is a routine correction rather than a sign of an impending bear market.

Canada’s GDP – Slow But Steady!

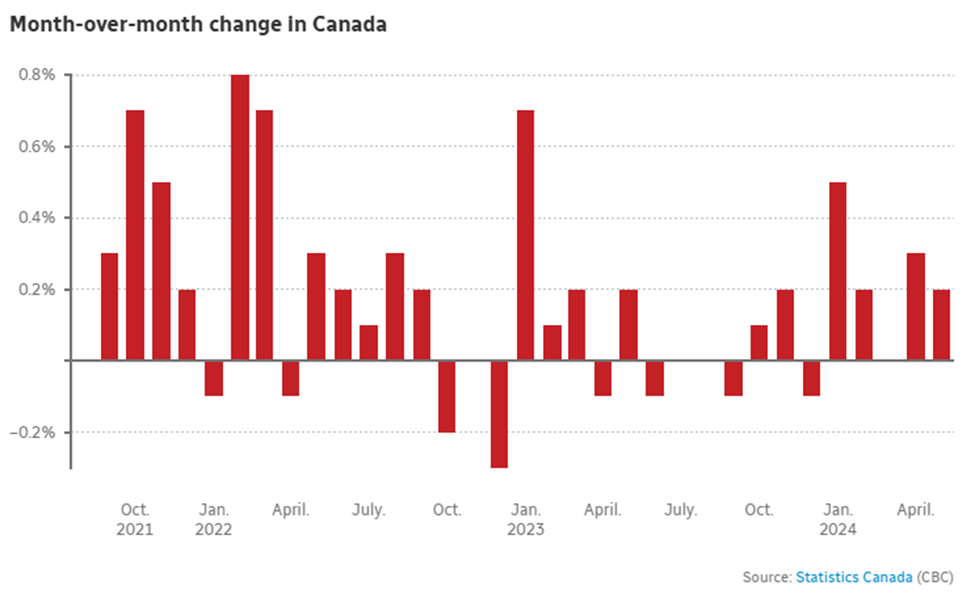

In Canada, many are open to the idea of slower economic growth if it means continued monetary easing and lower interest rates. Canada’s GDP grew by 0.2% in May 2024, following a slight economic contraction in previous months, indicating a steady yet cautious recovery. Key contributors to this growth included real estate, rental and leasing, and finance and insurance.

However, retail trade was a significant detractor, contracting by 0.9% and offsetting the previous month’s gains. Most subsectors experienced declines, with food and beverage stores down by 2.3%, health and personal care stores by 1.4%, and general merchandise stores also by 1.4%. This downturn was somewhat mitigated by a 0.8% increase in motor vehicle and parts dealer activity, reflecting higher sales at new and used car dealerships. Economists suggest that this modest growth, combined with other economic indicators, might prompt the central bank to reconsider its monetary policies. The Bank of Canada has signaled a willingness to make further interest rate cuts if necessary to support the economy, as the overall economic outlook remains cautious, with close monitoring of inflation and employment data to guide future policy decisions. (Source: Stat Canada)

Canada’s Inflation Trending Lower

Canada’s annual inflation rate eased to 2.7% in June 2024, down from 2.9% in the previous month, defying market expectations that it would remain at 2.9%, which was the three-year low reached in April. This decrease continues the disinflation trend in Canadian consumer prices and aligns broadly with the Bank of Canada’s forecasts, which anticipated CPI inflation to hover near 3% in the first half of the year. (Source: Trading Economics)

Notably, inflation dropped significantly for transportation (2% compared to 3.5% in May), driven by a sharp slowdown in gasoline costs (0.4% versus 5.6%). This change coincides with OPEC’s decision to gradually phase out production cuts.

While inflation for shelter remained high, it did decrease slightly (6.4% versus 6.2%) as rate cuts by the Bank of Canada and lower bond yields helped to ease mortgage rates and reduce competition in the rental market. However, food prices saw an acceleration (2.8% versus 2.4%), reflecting higher grocery costs. The significant impact of gasoline prices on overall disinflation kept the trimmed mean core inflation rate steady at 2.9%.

Canada’s Labor Market Dynamics

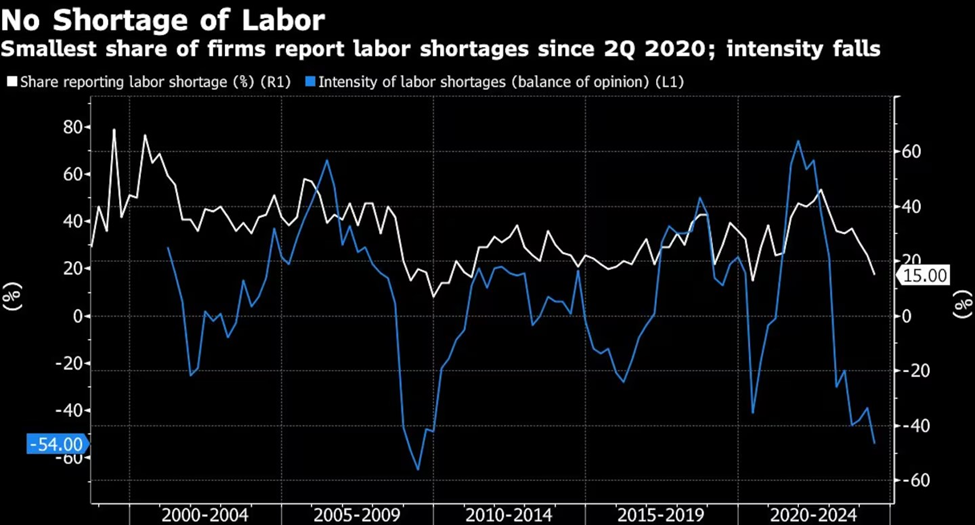

Canada’s labor force survey for June 2024 shows the economy added 60,000 jobs, yet the unemployment rate increased to 6.4%. This paradoxical rise in unemployment is attributed to more individuals entering the labor market, indicating growing confidence among job seekers. Despite the higher unemployment rate, the job additions signal a strengthening economy, with the private sector being the primary driver of employment growth. (Source: Bloomberg Canada)

The increase in employment was predominantly seen in full-time positions, with significant gains in the construction and professional services industries. This trend suggests that businesses in these sectors are expanding and investing in long-term projects, contributing to economic stability. However, while full-time jobs saw a notable increase, the overall participation rate remained unchanged, highlighting a steady but cautious approach among workers re-entering the job market.

US Corporate Earnings

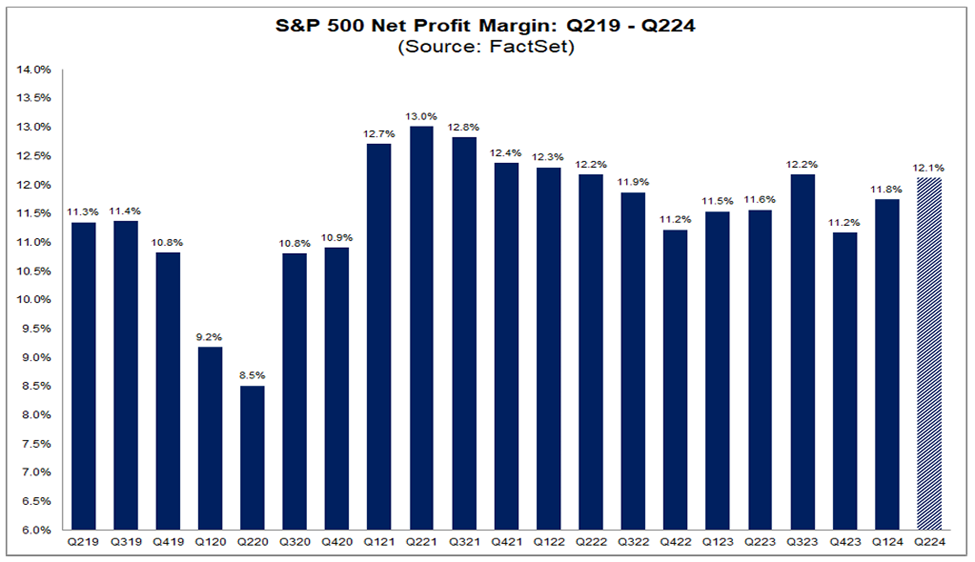

The S&P 500 has reported a net profit margin of 12.1% for Q2 2024, marking only the second instance of exceeding 12% since Q2 2022. This figure is higher than the 11.6% net profit margin from the same quarter last year, the five-year average of 11.5%, and the 11.8% from the previous quarter. At the sector level, six sectors, including Financials Information Technology and Communication Services, reported year-over-year increases in their net profit margins. Conversely, five sectors, led by Real Estate experienced a decline compared to Q2 2023.

Additionally, six sectors reported net profit margins above their five-year averages, with Industrials (10.7% vs. 8.2%) and Consumer Discretionary (8.7% vs. 6.6%) leading the way. Bottom line, analysts project that the net profit margins for the S&P 500 will remain above 12.0% for the rest of 2024, with estimates of 12.4% for both Q3 and Q4. (Source: FactSet)

Powell and the Fed

The Federal Reserve’s Open Market Committee concluded its meeting on Wednesday by leaving target interest rates unchanged, maintaining the levels set a year ago. In their statement and press conference, the committee noted signs of moderation in the labor market and an increase in the unemployment rate. Chair Powell hinted at potential rate cuts in September but stopped short of confirming them. Following these remarks, futures markets quickly assigned a 98% probability to a 0.25% rate cut in September.

Waiting until the next meeting allows the Federal Reserve to review two more non-farm payroll reports and the inflation data for both July and August. This additional data will provide a clearer picture of the economic landscape by mid-September. The extra time will enable the Fed to make a more informed decision regarding rate cuts based on the latest economic indicators. In the meantime, there will likely be strong calls for the Fed to cut interest rates sooner to avoid falling behind, especially if economic or inflation data show signs of weakness. Over the next month and a half, there will be considerable attention and debate over the Fed’s decisions as market participants closely watch economic developments.

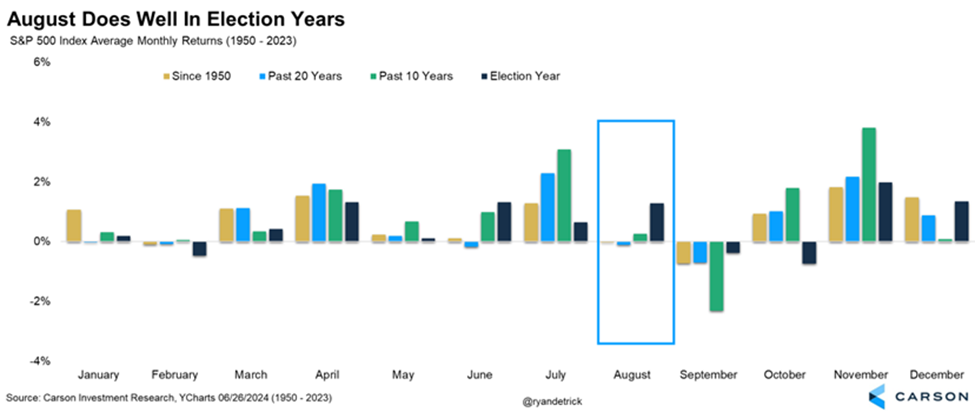

The August Effect… In Election Year!?

August has typically been a difficult month for the stock market, with the S&P 500 often underperforming, similar to February and September. However, in election years, August frequently brings positive returns as optimism and potential policy changes associated with elections drive market performance. The anticipation of these changes often results in strong gains in June, July, and August during election years, offering unique opportunities for investors despite the usual volatility. Market fluctuations in August, especially during election years, can present advantageous buying opportunities for investors who focus on long-term strategies. (Source: Carson Research)

In Summary

Despite recent fluctuations, the financial markets maintain an optimistic outlook. The 2% drop in the S&P 500 is viewed as a routine correction rather than a sign of a downturn, with the U.S. economy still buoyed by strong consumer spending and income growth. Analysts predict continued earnings growth, reinforcing confidence in the resilience of the markets and the current bull market trend.

In Canada, while GDP growth is modest, inflation has eased, creating a more favorable economic environment. The labor market is expanding, with job additions indicating strength despite a rise in unemployment due to higher labor force participation. With the potential for monetary easing in Canada and anticipated rate cuts in the U.S., both markets present opportunities for growth. Historical election year trends further suggest that the markets could perform well, especially as election-driven optimism and potential policy changes are factored into economic forecasts. While we anticipate continued upward movement in equities, volatility remains a factor. Our ADAPT Investment Strategy enables us to adeptly navigate opportunities and risks, facilitating necessary adjustments across asset classes and sectors as we enter the summer months amidst a pivotal U.S. election year.

We thank you for your continued trust and we welcome you to reach out to us with any questions you may have.

This information has been prepared by Kian Ghanei and Terry Fay who are Portfolio Managers for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The [Investment Advisor/Portfolio Manager] can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.