June 2024 Commentary

Happy Canada Day!

We hope everyone had an enjoyable Canada Day long weekend spent with family and friends. It’s in times like these that we get to reflect on just how lucky we are to live in Canada and enjoy its countless opportunities, especially when our friends down South are facing a rather bizarre period in their political arena and the overall outlook of their renowned democracy.

Considering the recent presidential debate, many Democrats are feeling let down and perhaps slightly nervous as the US election inches closer. Still, some hope that a newly energized Biden comes out onto the stage during the second presidential debate with guns blazing and steers America away from the edge of the cliff or another period of autocratic American leadership. We suppose only time will tell.

From an objective point of view, the financial markets haven’t provided any signals indicating a decisive winner. Since the debate, the financial markets have remained steady and were initially boosted higher with a rising probability of a Trump victory. Politics aside, there is more data pointing to a stronger second half of the year than there are signs of trouble. For this, we need to once again look at the simple data available to us versus headline doomsday rhetoric that might have some remaining on the sidelines. Let’s have a look at the drivers in both the US and Canada

Inflation and Economic Updates

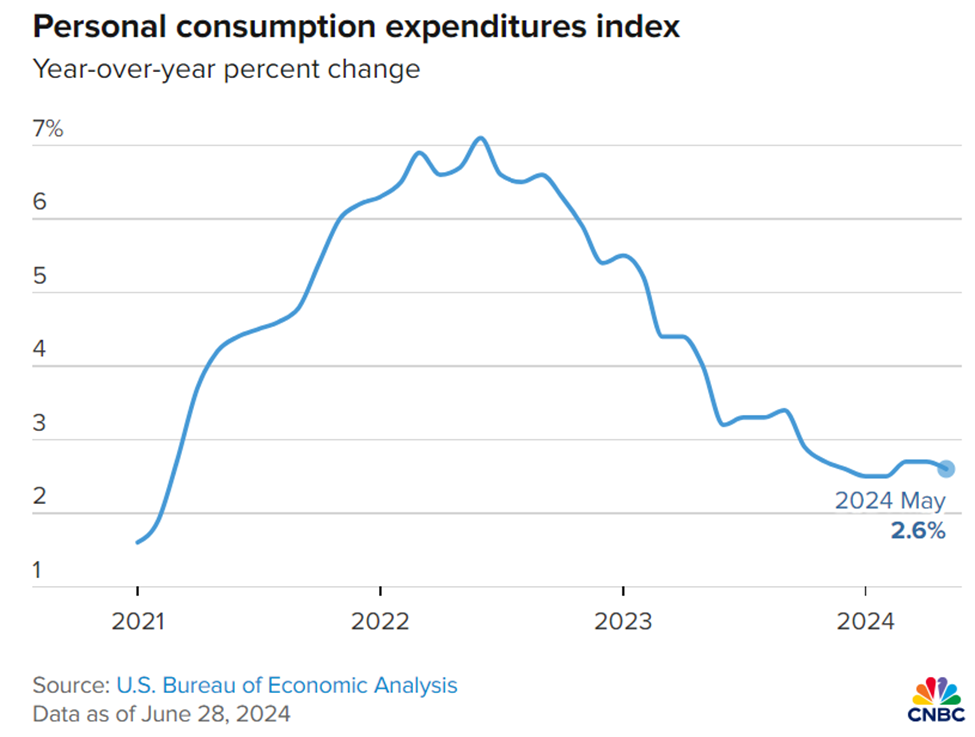

In May 2024, U.S. monthly inflation remained unchanged as a modest increase in service costs was offset by the largest drop in goods prices in six months. This development brings the Federal Reserve closer to potentially cutting interest rates later in the year. The Commerce Department’s report indicated a marginal rise in consumer spending and the slowest pace of underlying price increases in six months, raising optimism for a “soft landing” where inflation cools without causing a recession and a significant rise in unemployment. The personal consumption expenditures (PCE) price index remained flat in May, following a 0.3% gain in April, marking the first time in six months without an increase. Goods prices fell by 0.4%, with significant declines in recreational goods, vehicles, and durable household equipment, while services costs increased by 0.2%, driven by higher housing, utilities, and healthcare prices. On an annual basis, the PCE price index rose 2.6%, slightly down from 2.7% in April, aligning with economists’ expectations. Despite the slowdown, inflation remains above the Federal Reserve’s 2% target. (Source: US Bureau of Economic Analysis)

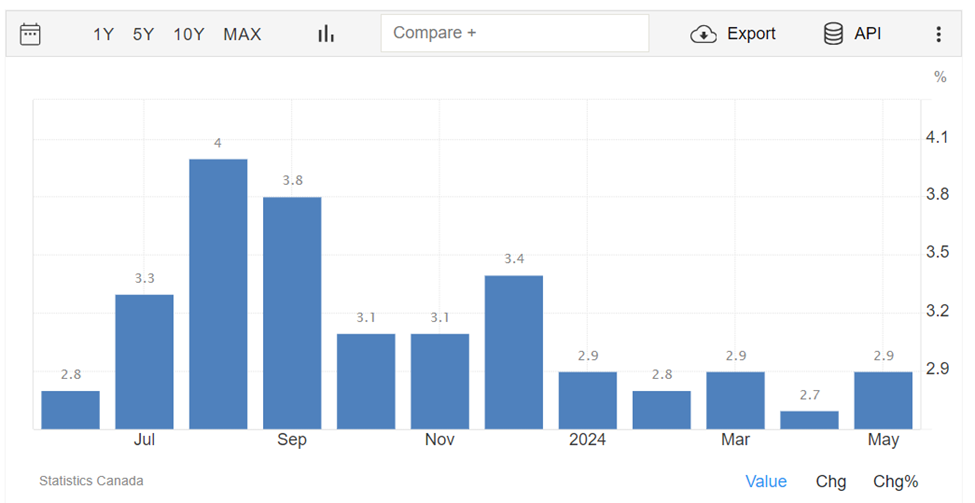

Canada’s inflation rat saw an unexpected rise in May, climbing to 2.9% from 2.7% in April, driven by increased costs in services and groceries. According to Statistics Canada, the rise in prices for rent, cell services, travel, and air transportation, particularly for trips to the United States, significantly contributed to this uptick. Grocery prices experienced a notable month-to-month increase, the largest since January 2023, driven by higher costs for fresh produce, meat, and non-alcoholic beverages. Despite these rises, some analysts suggest that these elements of the consumer price index are volatile and may not sustain the same upward momentum, particularly in travel costs. Persistent inflationary pressures in housing, with shelter inflation steady at 6.4% annually and rent costs rising from 8.2% in April to 8.9% in May, continue to impact Canadians significantly. These factors, along with increased core inflation metrics, are likely to influence the Bank of Canada’s decisions on interest rates. Despite a recent 25-basis-point rate cut, faster-than-expected price pressures have cast doubt on the possibility of another rate decrease in July. The central bank will closely monitor upcoming economic data, including the June employment report, to inform its next steps.(Source: Tradingeconomics)

US GDP Growth and Forecasts

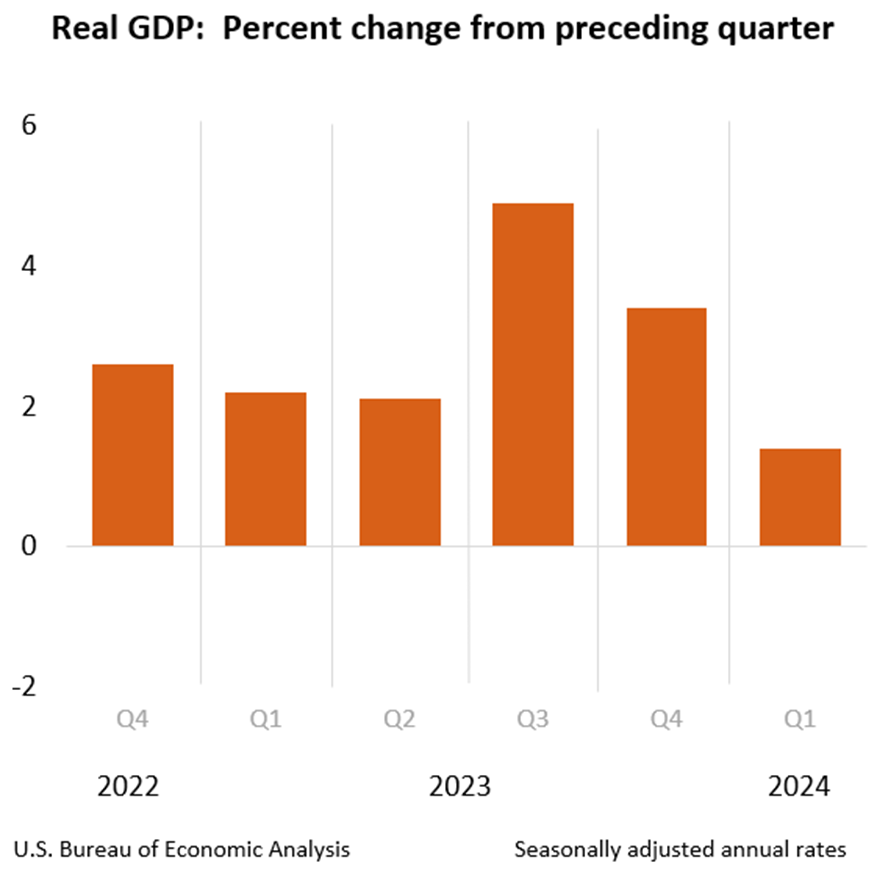

In light of falling inflation and reduced GDP growth, the likelihood of a rate cut by the Federal Reserve in the United States has increased compared to earlier in June 2024. The annual core consumer price inflation rate has eased to its lowest point in over three years, and real GDP growth slowed significantly to 1.4 percent in the first quarter of 2024 from 3.4 percent in the previous quarter. These developments suggest that the Federal Reserve may be more inclined to reduce interest rates to stimulate economic activity and counteract the slowing growth. Consequently, market expectations for a rate cut have risen, reflecting increased investor confidence in potential monetary policy easing. The importance of this is in the fact that up to a week ago, the probability of a Fed rate cute was very low which ultimately doesn’t fair well for interest sensitive assets classes and overall asset valuations including stocks. As such, this development is favorable for the financial markets. (Source: US Bureau of Economics)

S&P 500 Earnings Growth Projections for 2024 and 2025

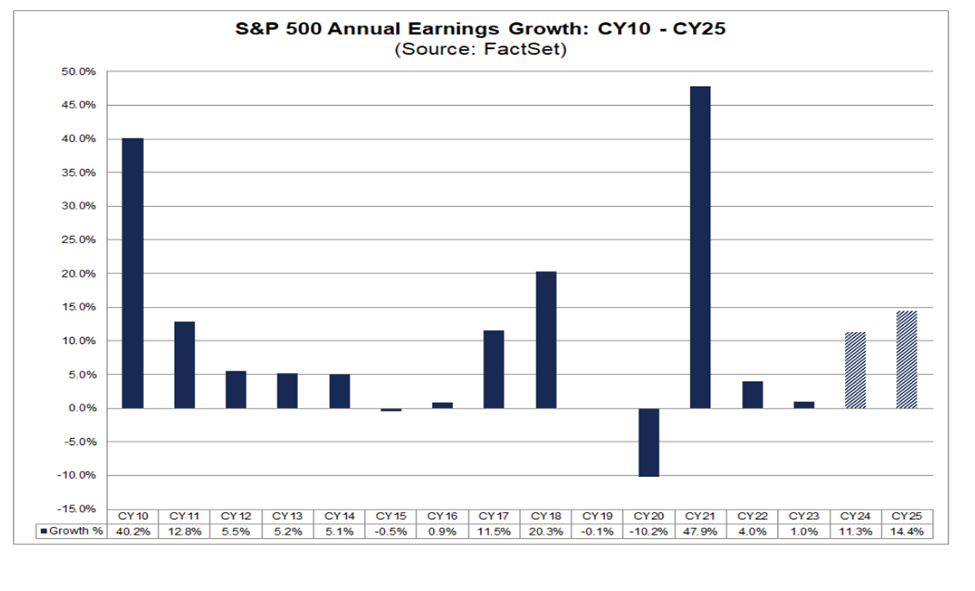

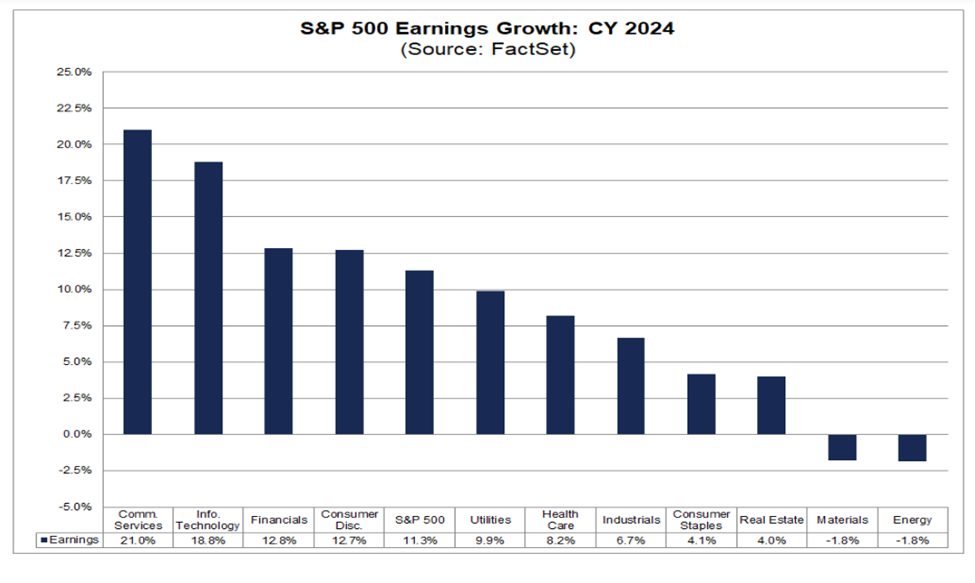

Continuing the ‘bull’ train, analysts forecast significant earnings growth for the S&P 500 in the upcoming years. After a modest 1% year-over-year earnings growth in 2023, industry analysts predict the S&P 500 will see an 11.3% increase in 2024 and a 14.4% rise in 2025. If realized, this would be the third instance in the past 15 years of consecutive double-digit earnings growth for the index. The last periods of such growth occurred in 2017-2018 and 2010-2011. (Source: Factset)

At the sector level, broad-based growth is expected. For 2024, nine out of eleven sectors are projected to report year-over-year earnings growth, with Communication Services (21.0%) and Information Technology (18.8%) leading the charge. In 2025, all eleven sectors are anticipated to show earnings growth, with eight sectors expected to achieve double-digit increases. The Information Technology sector is predicted to grow by 19.5%, while the Health Care sector is forecasted to see an 18.5% increase.

Notably, these projections have been revised upwards over the past six months. At the end of December, the estimated earnings growth rates for the S&P 500 were 11.2% for 2024 and 12.7% for 2025. The current estimates reflect a more optimistic outlook, underscoring analysts’ increased confidence in the market’s earnings potential over the next two years.

Historical Trends and Future Outlook

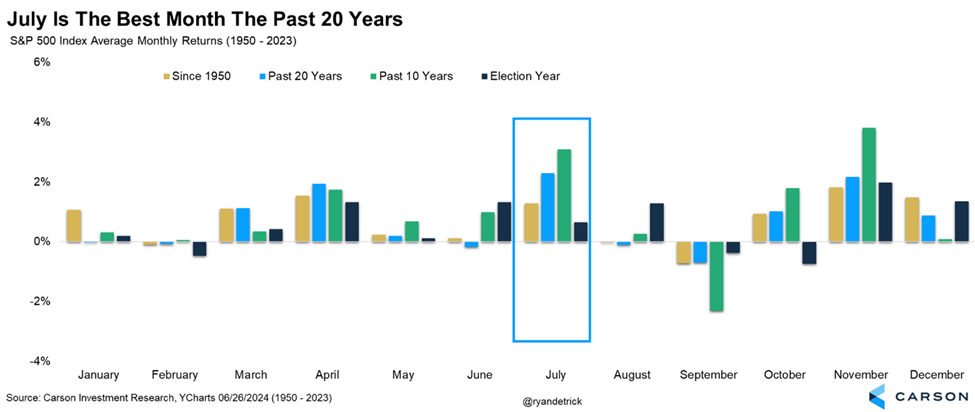

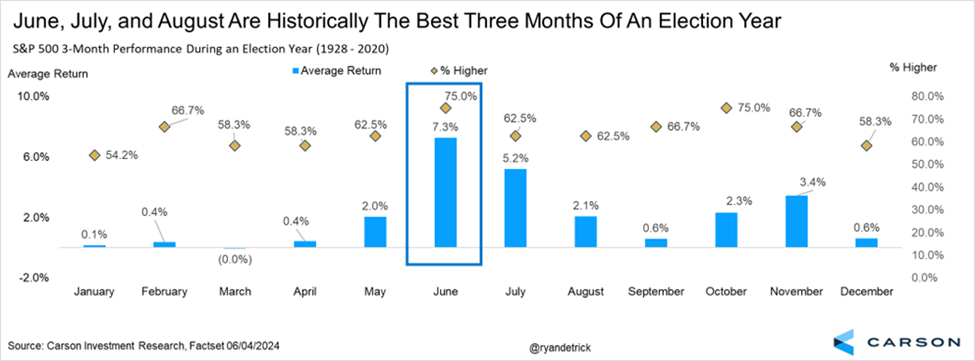

Historically, July has been the best month for the S&P 500 over the past 20 years. This trend continued in 2024, with the S&P 500 experiencing substantial gains in June, a month that is usually weaker for the index. Despite the general anticipation of a rough summer, the S&P 500 saw minimal declines, with the worst daily drop being only 0.31%. Remarkably, the index hasn’t faced a daily decline of 2% or more since February 2023, indicating a prolonged period of low volatility and stability. The historical performance of July reveals consistent strength, with the S&P 500 rising for nine consecutive years and 11 of the past 12 years. This trend aligns with long winning streaks observed in the mid-20th century. One explanation for this consistent strength is the robust second-quarter earnings season, which often dispels recession fears and boosts stock prices. (Source: Carson Research)

Moreover, election years tend to see summer rallies, with the S&P 500 gaining more than 7% on average in June, July, and August. This historical data suggests that July’s strong performance is not merely random but may be driven by underlying economic factors.

In Summary

Looking ahead, July 2024 could continue this trend of strong performance. The combination of solid earnings reports and potential improvements in inflation may contribute to another positive month for stocks. Despite initial fears and negative economic forecasts, strong earnings often reveal a more optimistic economic outlook, leading to rising stock prices. This year, the anticipated improvement in inflation, alongside robust earnings, could sustain the momentum, making July another green month for the S&P 500. As we navigate through these dynamic political and economic landscapes, there is reason to remain optimistic about the future and the potential for continued growth and stability in the markets. This positive trend highlights the resilience and adaptability of the market, suggesting that higher gains in 2024 are well within reach. Our ADAPT Investment Strategy enables us to adeptly navigate opportunities and risks, facilitating necessary adjustments across asset classes and sectors as we enter the summer months amidst a pivotal U.S. election year.

We thank you for your continued trust and we welcome you to reach out to us with any questions you may have.

This information has been prepared by Kian Ghanei and Terry Fay who are Portfolio Managers for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The [Investment Advisor/Portfolio Manager] can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.