It took over two years, but on Friday, the S&P 500 reached a new all-time high, surpassing the previous record set on January 3, 2022. This achievement follows a challenging period marked by a sharp 25% decline and a bear market triggered by the war in Ukraine, supply chain disruptions, a significant surge in inflation, China implementing lockdown measures, and the Federal Reserve adopting its most assertive stance in four decades. The bear market eventually concluded in October 2022. Since then, stocks have defied numerous experts who consistently (and incorrectly) predicted a weakening economy, a saturated consumer base, and various other reasons to doubt the emergence of a new bull market. Fortunately, our perspective has consistently stood in contrast to the prevailing strategist consensus, as we firmly maintained our belief that stocks would surpass expectations, and the economy would exhibit resilience.

Embrace market highs without fear!

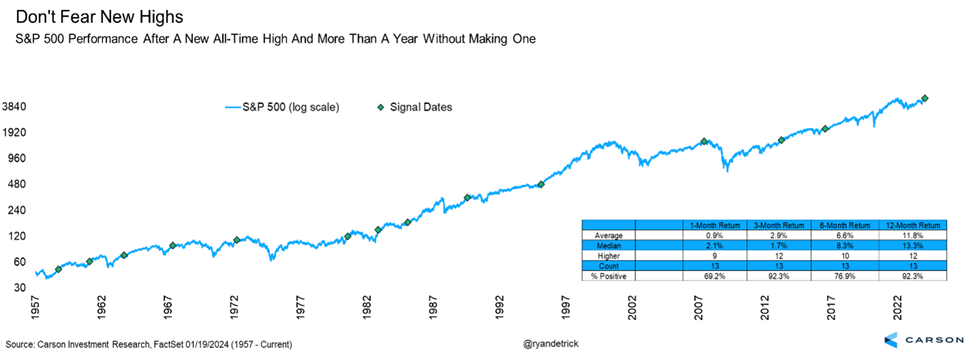

While historical instances like the bear markets of 1987, 2000, 2007, and 2020 saw new highs before downturns, it’s crucial to recognize that the market has also delivered remarkable gains post-new highs. Generally, these record-breaking moments have not acted as warning signals.

When there’s been a considerable gap since the last record high, as was the case before Friday, historical trends show a positive outlook. The S&P 500 has experienced periods without setting new highs on 13 occasions. Following the establishment of a new high, returns were consistently above average, with one-year gains surpassing 11% on average and an even more impressive median return of 13%. (Source: Factset, Carson Research)

The US Economy Surprising Everyone!

The performance of the U.S. economy has been a pleasant surprise for many. Last Thursday brought a robust GDP report, revealing a remarkable expansion at an annual rate of 3.3%, surpassing the anticipated 1.8%. Once again, the economy has defied expectations, a theme we’ve previously explored here. Initially, predictions pointed towards an impending recession, coupled with rising unemployment, triggered by the Federal Reserve’s assertive move from near-zero interest rates to over 5%. Many market participants foresaw a scenario where inflation would persist unless the unemployment rate stayed above 5% for an extended period, even evoking the specter of “stagflation” reminiscent of the 1970s.

Contrary to these forecasts, the reality unfolded differently:

> In 2023, the economy experienced acceleration, with GDP growth reaching 3.1%, well beyond the 2010-2019 trend of 2.4% and the 2017-2019 pace of 2.8%.

> Over the past six quarters, coinciding with a period of surging interest rates, real GDP expanded at an annual rate of 2.9%.

> The unemployment rate dropped to 3.7%, not far from lows unseen in over 50 years.

> Inflation receded to 2.6% in 2023 and further plummeted to 1.5% in the fourth quarter.

(Sources: CNBC, Reuters)

A similar narrative unfolds in Canada – perhaps even more astonishing!

The Canadian economy experienced a notable rebound in the last quarter of 2023, propelled by increased production and shipments of goods, coupled with heightened demand from the United States. According to preliminary estimates from Statistics Canada in Ottawa, gross domestic product (GDP) saw a growth of 0.3% in December, surpassing expectations after a 0.2% expansion in the previous month, which had already exceeded the forecasted 0.1% in a Bloomberg economist survey.

Looking at industry-based data, the indications point towards a 1.2% annualized growth in the final quarter of the previous year, reversing the contraction observed in the third quarter. These numbers suggest that Canada’s economy benefited from robust consumer spending in the U.S., concluding 2023 with a faster expansion rate than anticipated by the Bank of Canada. The central bank had forecasted flat growth for the fourth quarter.

Top of Form

Anticipated Rate Cuts in the Future, Yet Timing Remains Uncertain

A prominent theme in 2024 is expected to revolve around the Federal Reserve. In 2022, the central question was the extent to which the Fed would raise interest rates, while 2023 brought speculation about whether the Fed would implement rate cuts.

There is a reasonable certainty that the Fed is poised to cut rates, but investors optimism of a March rate cut was crushed yesterday by Fed Chair Powell press conference following their decision to hold rates. “Based on the meeting today, I would tell you that I don’t think it’s likely that the committee will reach a level of confidence by the time of the March meeting to identify March as the time to do that, but that’s to be seen.” Powell said.

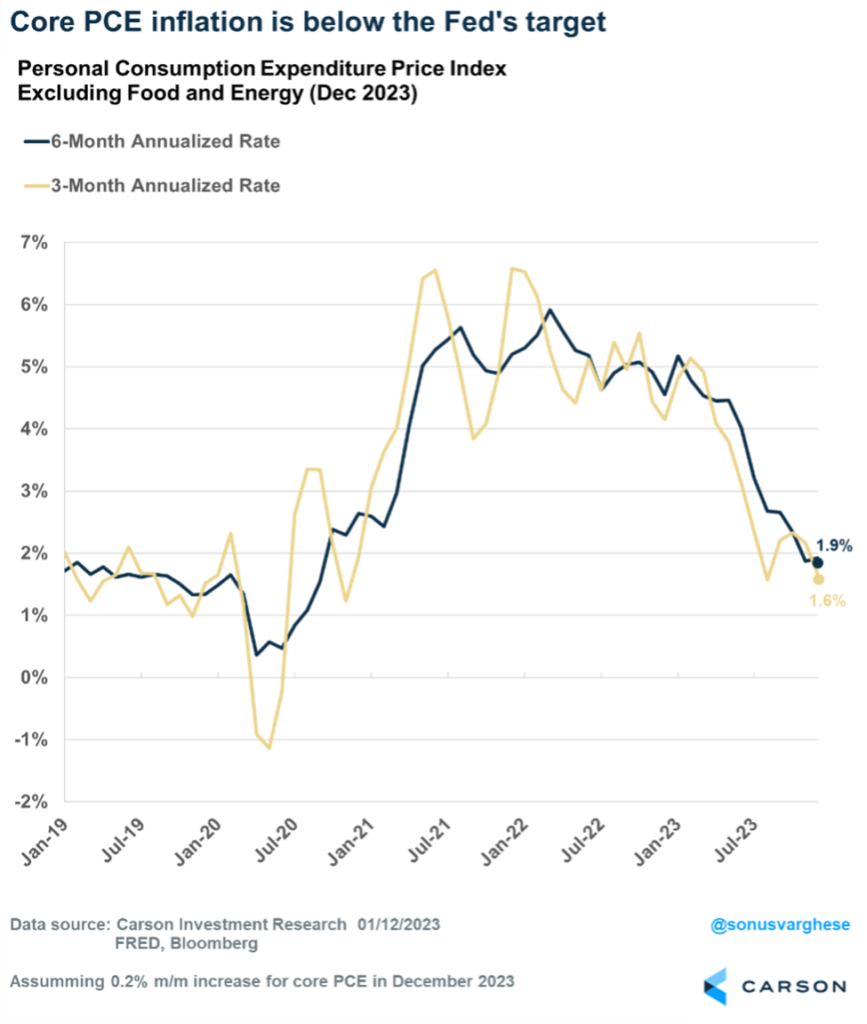

Despite the Fed Chair’s comments yesterday, the prospect of rate cuts has emerged due to the alleviation of inflation, returning to the Fed’s target. Notably, during their December meeting, Federal Reserve members indicated a projection of three cuts (each amounting to 0.25%) in 2024.

According to Carson Research, the inflation target has already been met when you analyze the most recent 3 month and 6 month core inflation rate. December inflation data for the consumer price index and the producer price index suggest that core PCE is likely to experience an increase of less than 0.2% month over month in December. This translates to an annualized rate of 1.9% over the last six months and 1.6% over the last three months. The takeaway here is that although the Fed may not cut rates in March, May is looking like a sure thing.

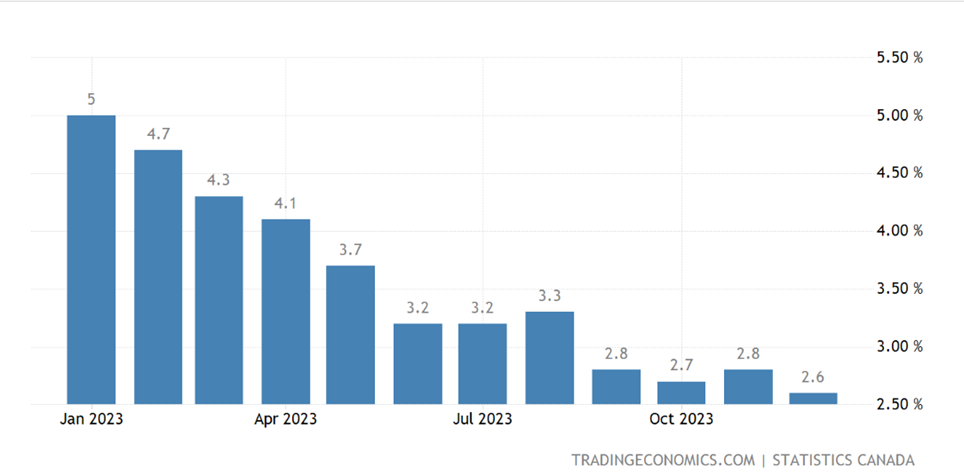

In December 2023, Canada’s annual inflation rate increased to 3.4%, up from the previous month’s 3.1%, aligning with market expectations but also disappointing for many Canadians. This aligns with the Bank of Canada’s forecast that headline inflation will persist at around 3.5% through the middle of the next year, signaling the potential need for another rate hike to counter unsustainable price growth. The rise in consumer prices was influenced by a rebound in gasoline costs (1.4% compared to -7.7% in November), leading to a recovery in transportation costs (3.2% compared to -0.1%). Additionally, inflation accelerated for shelter (6% compared to 5.9%) due to higher mortgage rates hindering home ownership and lifting rent prices (7.7% compared to 7.4%). (Source: Trading Economics)

Examining Core Inflation in Canada tells a different story about the underlying core prices. The annual core inflation rate, which excludes volatile components like food, energy, and mortgage interest costs, eased to 2.6% in December 2023, down from 2.8% in the previous month, marking the lowest rate since April 2021. This has many questioning how a higher rate environment is conducive to some of the fundamental issues surrounding the shortage of housing and rental units as well as higher costs associated with higher mortgage payments.

In Summary

In both 2022 and 2023, positive economic indicators often triggered stock market sell-offs, while weak data led to market rallies. This pattern stemmed from concerns that robust data might prompt the Federal Reserve to raise rates, and vice versa. The market is now returning to more conventional behavior, where strong economic growth and positive data are viewed favorably as signs that the economy is avoiding a recession. As a result, we maintain a fully invested position in equities, aligning with our strategic asset allocation and actively acquiring strong-performing equities to build on the momentum from 2023.

Federal Reserve Chair Jerome Powell has emphasized a balanced approach to economic risks, acknowledging the similarity in risks between lowering rates and fueling inflation and the dangers of maintaining a tight stance for an extended period and negatively impacting the labor market. Powell also highlighted that inflation doesn’t necessarily have to revert entirely to 2% for rate cuts; it just needs to be on a sustainable path toward that target. Given the current trajectory, with inflation likely to decline further in 2024, rate cuts are anticipated in the first half of the year, possibly in May and June, providing a reassuring prospect for investors and an additional boost to the economy.

We thank you for your continued trust and we welcome you to reach out to us with any questions you may have.

This information has been prepared by Kian Ghanei and Terry Fay who are Portfolio Managers for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The [Investment Advisor/Portfolio Manager] can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.