As November wraps up, global markets find themselves navigating through a complex interplay of economic factors, geopolitical developments, and shifting investor sentiments. In this dynamic landscape, inflation seems to be a dominate factor in the shift in sentiment felt in November. Canada witnesses a significant deceleration in prices, removing any speculation about the central bank’s next move. Simultaneously, the United States too experienced a decline in prices, with notable shifts in energy and consumer sectors.

The Canadian GDP stumbled, while its U.S. counterpart surged, showcasing the divergent paths at the moment that might prove short-lived. Amidst this backdrop, corporate profits paint a brighter picture, influencing investor confidence. With all that considered, it’s no surprise that the technical trade signals a return to equities with an optimistic outlook toward the traditional Santa Claus Rally and a rebound year in 2024.

Let’s review the data that has led to this recent optimism and why we have made a decision to re-enter the equity market.

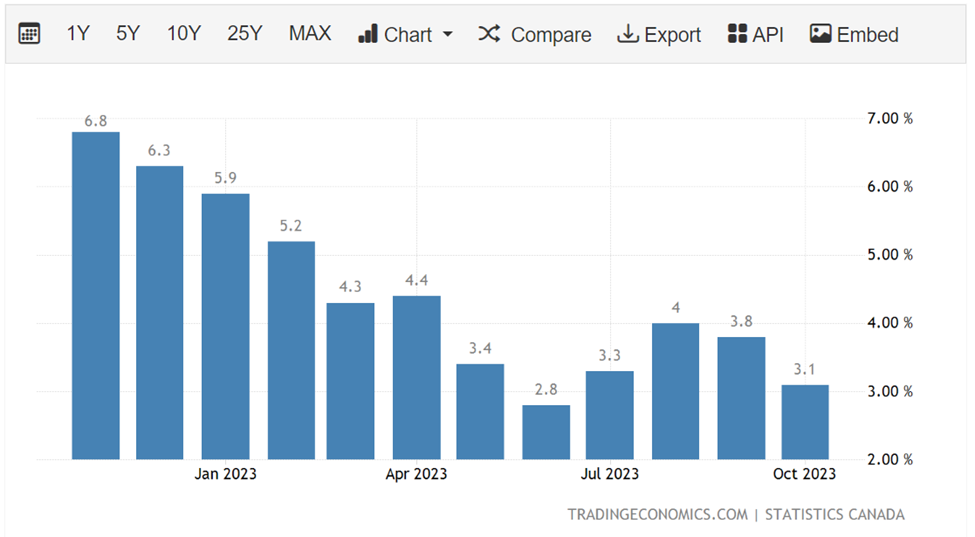

Canada Inflation Update: Moderate Adjustments in October 2023

In Canada, the annual inflation rate eased to 3.1% in October 2023 from the previous month’s 3.8%, slightly below the expected 3.2%. This modest decline has led to speculation that the Bank of Canada may not pursue another rate hike, aligning with their forecast of inflation remaining close to 3.5% until mid-next year. (Source: Tradingeconomics)

Key sectors experienced subtle shifts. Transportation prices decreased by 0.4%, primarily due to a 7.8% drop in gasoline prices. Inflation also slowed for food (5.6% vs. 5.9%) and health and personal care (4.9% vs. 5.6%). Conversely, shelter costs accelerated to 6.1%, attributed to a rise in mortgage costs fueled by increased bond yields. Core inflation slipped to 2.7%, and the trimmed-mean core rate dropped to 3.5%, slightly below expectations of 3.7%.

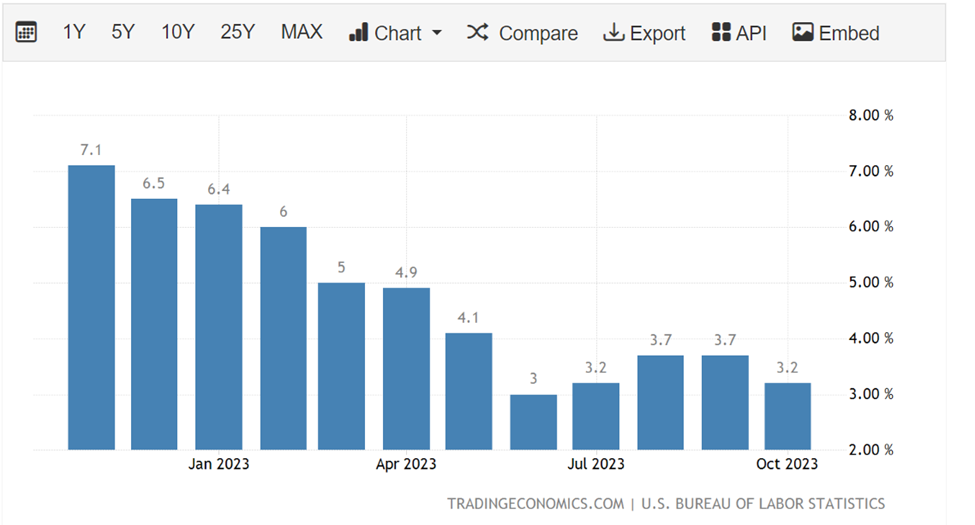

US Inflation Trends: A Calm October 2023

In the United States, the annual inflation rate eased to 3.2% in October 2023, down from 3.7% in both September and August, falling slightly below market forecasts of 3.3%. Energy costs saw a notable 4.5% decrease, driven by declines in gasoline, utility gas service, and fuel oil. (Source: Tradingeconomics)

The economic landscape exhibited softness in various sectors. Food, shelter, and new vehicles experienced slower price increases, while used cars and trucks continued their decline. Some sectors, such as apparel, medical care commodities, and transportation services, witnessed a modest uptick in prices. The overall Consumer Price Index (CPI) remained unchanged, marking the quietest month in fifteen months.

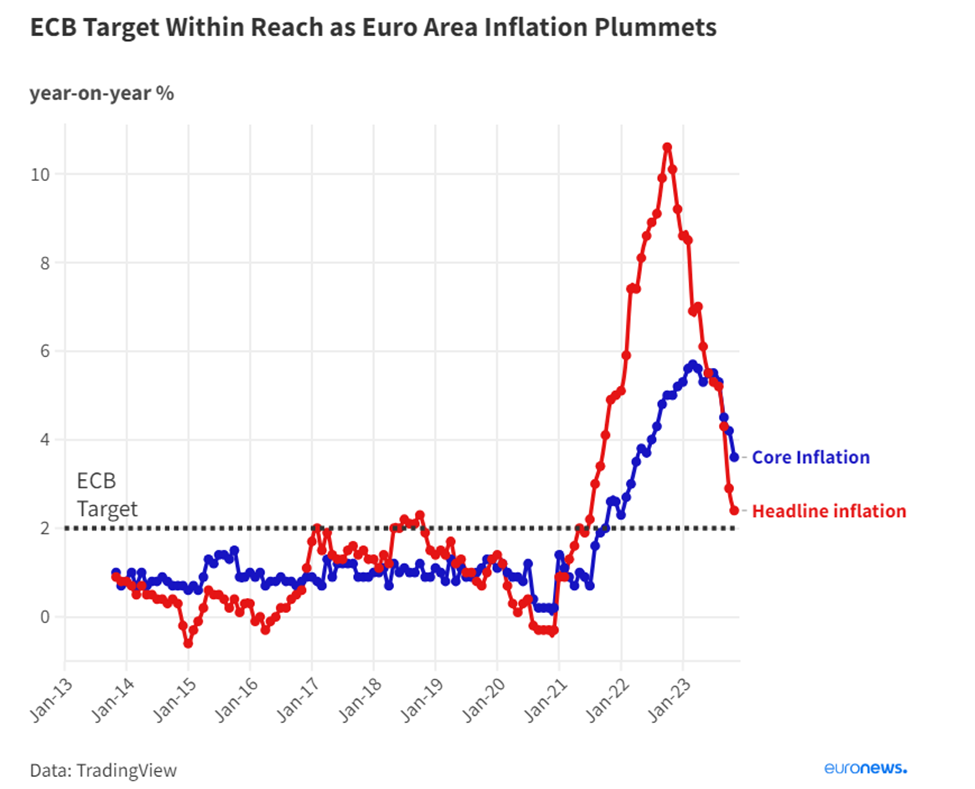

German and Euro Inflation:

In Germany, inflation eased more than expected in November, dropping to 2.3%, lower than the anticipated 2.6%. This decline was attributed to lower energy prices.

Inflation within the euro area has experienced a notable downturn, marking its lowest point in over two years. According to the most recent data provided by Eurostat, the inflation rate in the eurozone decreased to 2.4% year-on-year (y/y) in November 2023, a decline from the 2.9% annual rate reported in October 2023. (Source: Eurostat)

This deceleration in inflation draws attention to the European Central Bank (ECB)’s 2% inflation target, bringing it sharply back into focus for the first time since the summer of 2021. This development potentially hints at an impending adjustment in monetary policy as policymakers have been grappling with a tough economic landscape.

Geopolitical Landscape:

Tensions and emotions ran high on the geopolitical stage, sparking concerns about a potential multinational war. However, there was no material escalation from external interference, leading to a temporary ceasefire and a momentary easing of geopolitical risks. The de-escalation is welcoming news and although tensions may be running high, we might see little to no change in the overall global financial markets. Of course, we don’t want to make light of the situation in the Middle East and the loss of lives on both sides tragic at. From a financial standpoint, an escalation of this conflict could mean disruptions that echo through the globe and may be create heightened volatility ahead.

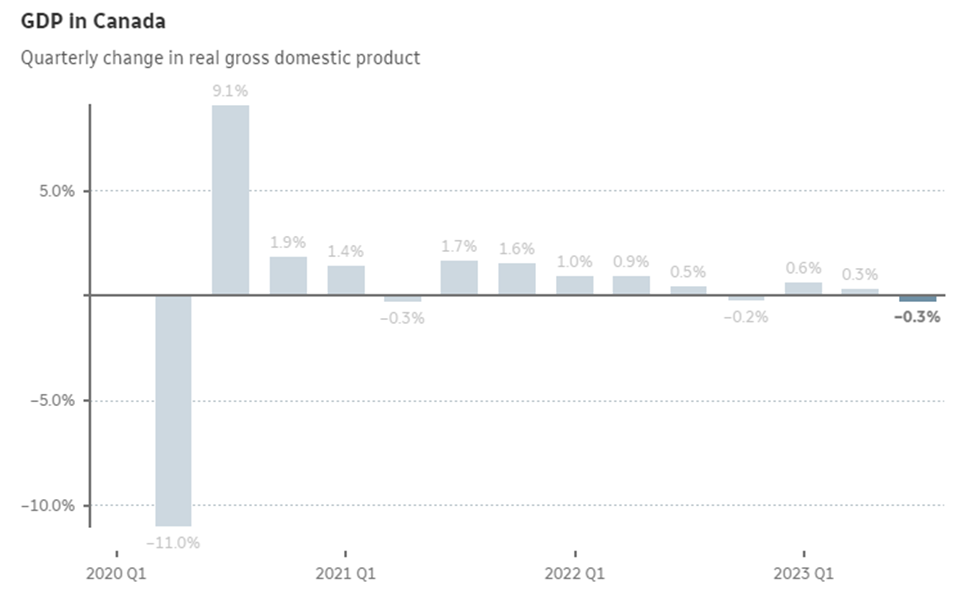

Canada GDP: Unexpected Contraction in Q3 2023

The Canadian economy unexpectedly contracted at an annualized rate of 1.1% in the third quarter, below the forecasted 0.2% GDP increase. While this avoids a recession, it signals a stumble in growth ahead of the upcoming interest-rate decision. We have said before that in a backdrop of high interest rates, bad news is good news, and it appears that some are already calling for a rate reduction in the first half of 2024 here in Canada. (Source: CBC)

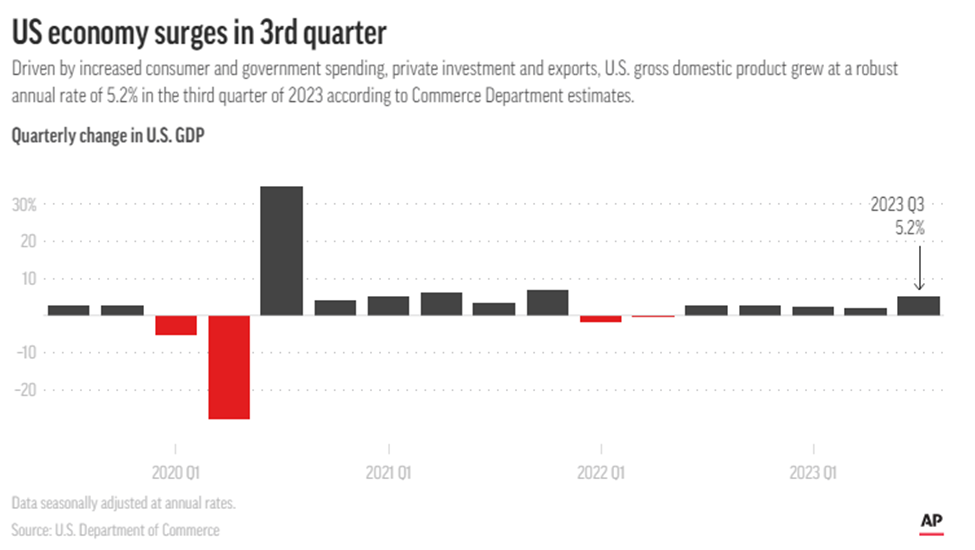

US GDP and Consumer Spending Fatigue

The US Gross Domestic Product (GDP) accelerated at a 5.2% annualized pace in the third quarter, surpassing initial estimates and economist forecasts. (Source: Associated Press)

However, consumer spending saw a slight downward revision to 3.6% from the initial estimate of 4%. The latter is important as the US consumers contribute to the lion share of the US GDP growth and if that number is showing signs of fatigue, not only will interest rates begin to come down but we could experience a sharp rally in the next 12-24 months.

Corporate Profits and Market Analysis

The most significant reason stocks go up in value is their profitability. Recently, corporate profits experienced a notable uptick, accelerating by 4.3% during the period, a significant improvement from the previous quarter’s gain of 0.8%. The S&P 500 reported higher earnings for Q3 2023, with a substantial percentage of companies reporting positive earnings surprises. This marks a positive shift, signaling growth in earnings for the first time since Q3 2022. Given the backdrop of high interest rates, it’s impressive to see the earnings resilience demonstrated by companies on the S&P 500.

Equity Markets: Technical Trade Reassessment

Given recent inflation data, corporate earnings, and a relative isolation in geopolitical tensions, investors have regained confidence in the equity markets. All 11 sectors have witnessed an increase in value, prompting a strategic reallocation back into stocks, a process expected to conclude by the end of the coming week. As the economic year nears its end, the prospect of the traditional Santa Claus Rally adds a note of optimism.

In Summary

A lot can happen in a month. It seems that investor sentiment has once again picked up as we head into the new year. This was not the case in October as we took some risk out of our portfolio models by selling equities while holding onto our private debt securities as well as our structured notes, also knows as bank notes. Our goal was to get back into the market as soon as the risk-reward metrics tilted the scale back in favor of equities. With the recent shift in sentiment described above, we have begun the transition to move back into equities as we anticipate a strong year-end followed by an aggregate rebound in asset prices in 2024.

We thank you for your continued trust and we welcome you to reach out to us with any questions you may have.

This information has been prepared by Kian Ghanei and Terry Fay who are Portfolio Managers for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The [Investment Advisor/Portfolio Manager] can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.