Unlike some of the temperatures experienced around the globe this summer, inflation is cooling . In July, as many had anticipated, the Federal Reserve raised the federal funds rate by another 0.25% taking rates to the highest in 22 years. Some argue that this rate hike was completely unnecessary in the face of a declining inflation rate but when you consider the economic data such as GDP and unemployment, the US central banks is taking no chances and is determined to continue its fight against inflation.

The stock market is also showing continued strength and what’s most interesting is that we are seeing support in the overall breadth of the market which should provide a tailwind for the remainder of the year. Overall, it appears that sentiment has shifted positive for the time being and with no recession in sight. Here are key takeaways from July.

Inflation and CPI – US

The annual inflation rate in the US slowed to 3% in June of 2023, the lowest since March of 2021 and compared to 4% in May and expectations of 3.1%. The slowdown is partly due to a high base effect from last year when a surge in energy and food prices pushed the headline inflation rate to 1981-highs of 9.1%. Energy cost slumped 16.7% (vs -11.7% in May), with prices falling 36.6% for fuel oil, 26.5% for gasoline, and 18.6% for utility gas service.

Also, inflation slowed for food (5.7% vs 6.7% in May) and shelter (7.8% vs 8%). Smaller price increases were also recorded for new vehicles (4.1% vs 4.7%), apparel (3.1% vs 3.5%), and transportation services (8.2% vs 10.2%). (Source: US Bureau of Labor Statistics)

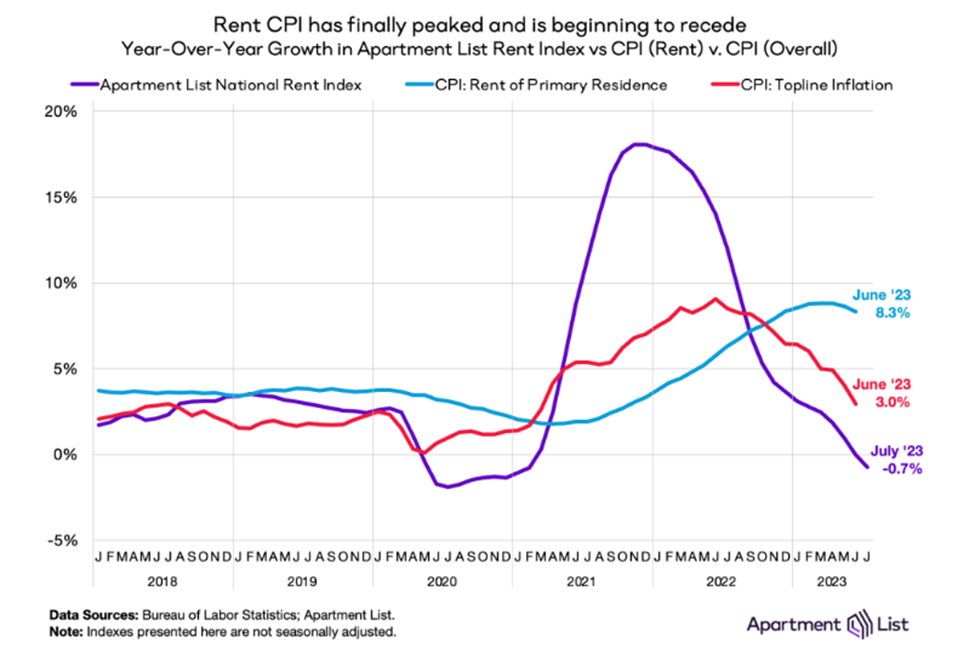

Core inflation rate dropped to 4.8%, the lowest since October of 2021. Although this figure is still relatively high, we believe that it’s well on a path to decline over the next few quarters. One of the biggest contributors of core inflation, which makes up 40% of core CPI inflation is ‘housing’ inflation, which is running at a 5-6% annualized pace right now. That’s down from 8-10% earlier this year, but still above the 3-4% rate we experienced pre-pandemic.

Private rental data indicate more deceleration is coming. In fact, the Apartment List data for July indicates rental prices fell 0.7% year-over-year. Add to this the fact that multi-family construction is at a record high. This means more rental units will come online as we near the end of 2023 and into 2024, putting more downward pressure on rents. (Source: Apartment List data for July)

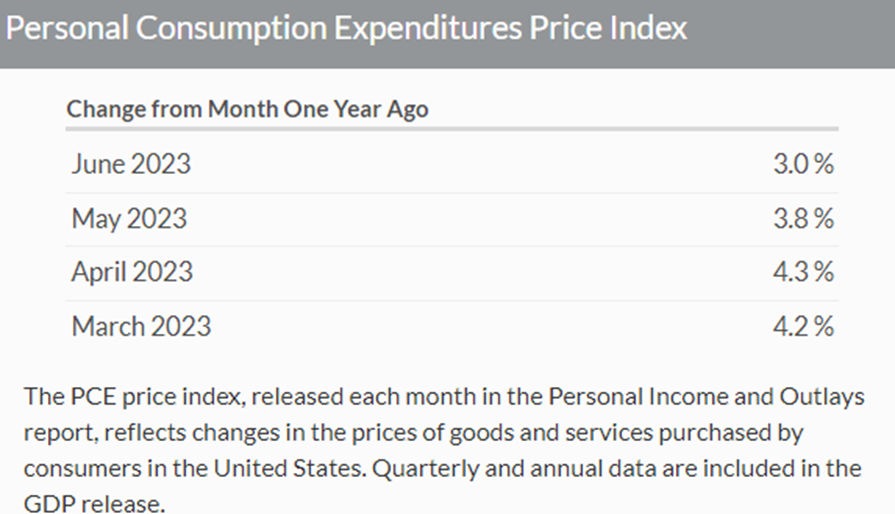

Personal Consumption Expenditures Price Index – PCE Price Index

The PCE is a measure of the prices that people living in the United States, or those buying on their behalf, pay for goods and services. The PCE price index is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior. This, too, also points to a decline in prices for Americans which will influence the Fed’s decision in September. (Source: Bureau of Economic Analysis)

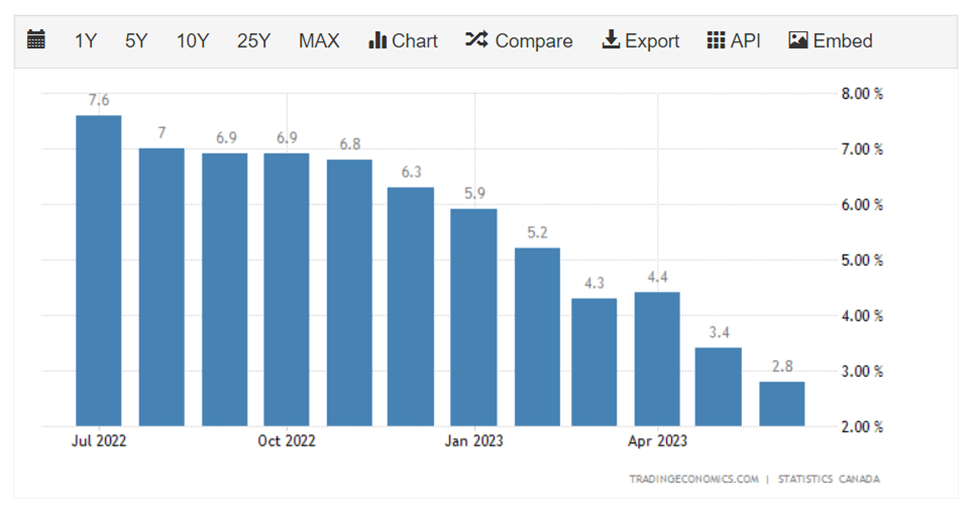

CPI – Canada

The annual inflation rate in Canada fell to 2.8% in June of 2023, the lowest since March of 2021 from 3.4% in the previous month and below market expectations of 3%, as gasoline prices declined further. Keep in mind that these numbers have a lag and so far in July, gasoline and crude prices have risen by approx. 15% as a result of OPEC’s production cuts. Transportation costs fell by 3.4%, extending the 2.4% decline in the previous month amid a 21.6% slide in the price of gasoline. On the other hand, food inflation remained steady at 8.3%, lifted by a 9.1% increase in the cost of groceries.

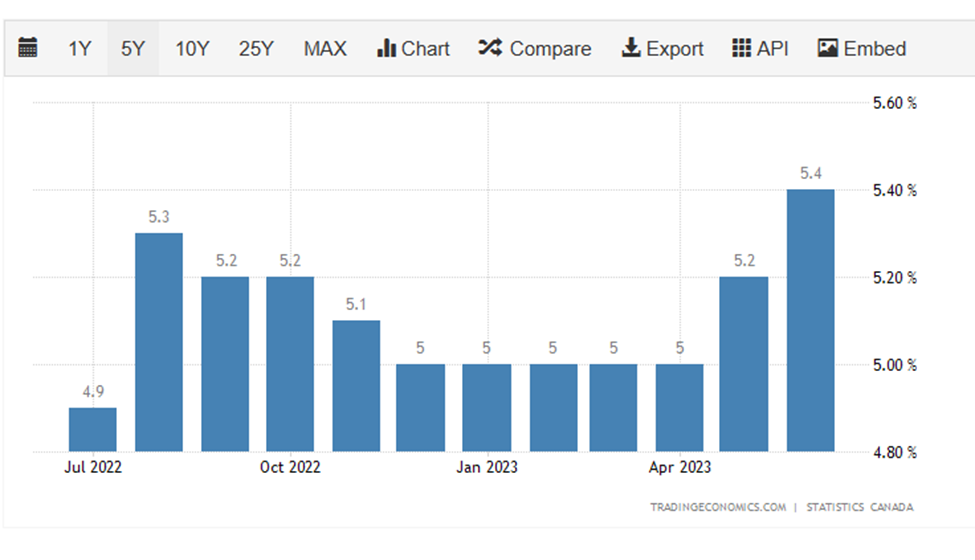

A surprise to many, the Bank of Canada’s July hike followed another quarter-percentage-point increase to the policy rate in June. The Canadian central bank governing council’s consensus in July was that leaving the key policy rate unchanged at 4.75 per cent would risk stalling the progress it had made in tamping down price increases, which has so far seen annual inflation cool to a low of 2.8 per cent from highs of 8.1 per cent last year.

A Double-Edged Sword

The rate hike in July took many by surprise. Although we understand the concerns of the Bank of Canada in easing off the breaks prematurely, the rate hikes in a face of a declining inflation rate seems to be adding more fire to the calculated inflation rate as mortgage payments and housing costs continue to weight heavy on the inflation calculation and in-fact lifted shelter inflation to 4.8%. Shelter costs are a big component of household budgets and overall costs which makes up approximately 30% of the CPI calculation.

Recession? More like expansion.

The U.S. economy grew faster than expected in the second quarter as a resilient labour market supported consumer spending, while businesses boosted investment in equipment and built more factories, potentially keeping a much-feared recession at bay.

The US Commerce Department reported that there is broad-based acceleration in and that the gross domestic product growth in the United States accelerated to 2.60 percent year-over-year in the second quarter of 2023 from 1.8% in the first quarter. This is part of the reason why we saw yet another rate hike in July by the Fed.

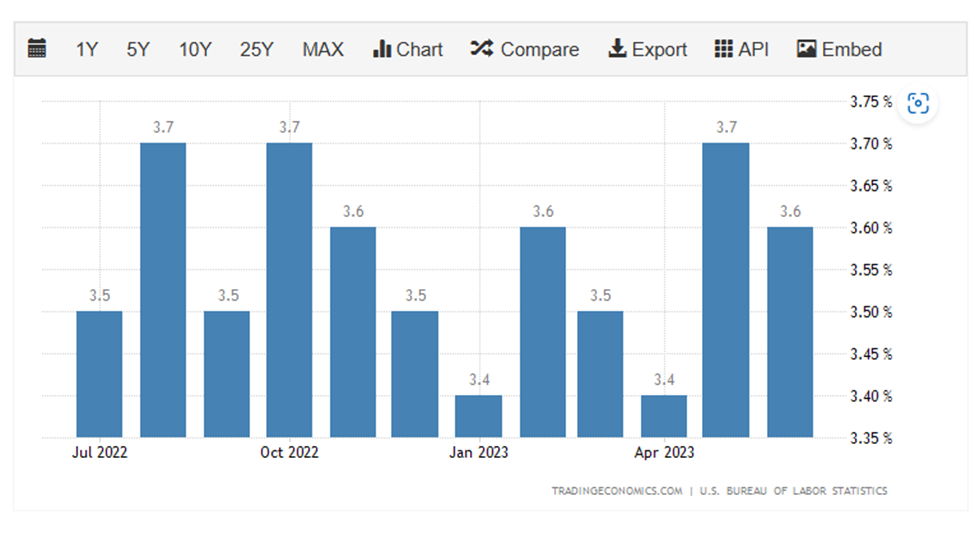

A Very Tight Labour Market – US

The unemployment rate in the US decreased slightly to 3.6 percent in June 2023, which is lower than May’s seven-month high of 3.7 percent. The jobless rate has fluctuated between 3.4 percent and 3.7 percent since March 2022, indicating a consistently tight labor market, and again, allowing the Federal Reserve the flexibility to continue raising interest rates to combat inflation.

In Canada, the unemployment rate in Canada rose to 5.4% in June of 2023 from 5.2% in the previous month, the highest since February of 2022 and slightly above market estimates of 5.3%. Still, it was only the second monthly increase since August of 2022 and the jobless rate remained firmly below averages from prior to the pandemic-induced crash of 2020, underscoring tightness in the labor market.

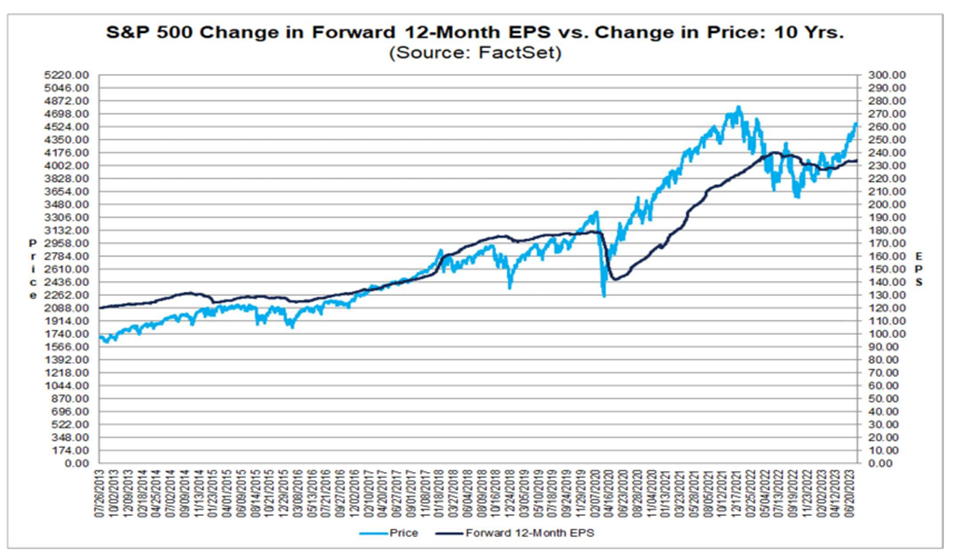

Revenues and Earnings – S&P 500

A rising rate environment hasn’t been overly friendly to company earnings and revenues. Having said that, the negative impact hasn’t been as punishing as some had expected. Looking at the S&P 500, the percentage of companies beating revenue estimates is below 5-Year average. In terms of revenues, 64% of companies have reported actual revenues above estimated revenues and 36% have reported actual revenues below estimated revenues. The percentage of companies reporting revenues above estimates is below the 1-year average (71%) and below the 5-year average (69%), but above the 10-year average (63%). At the sector level, the Information Technology (81%), Health Care (75%), and Financials (73%) sectors have the highest percentages of companies reporting revenues above estimates, while the Utilities (25%), Materials (33%), and Communication Services (33%) sectors have the lowest percentages of companies reporting revenues above estimates. Keep in mind, this is all in the face of a tightening environment that has seen rates reach their 22-year highs. (Source: Factset)

Summary

The Federal Reserve has raised rates 11 times over the past 17 months (starting March 2022). This was the most aggressive rate hike cycle in 40 years. Many people predicted a recession to occur by now which hasn’t really been the case. Many investors sold the equity market betting that the stock market would test their lows of 2022 but that also didn’t pan out.

Important takeaways:

- The US economy created 5.2 million jobs since they started raising rates, and 1.7 million jobs just over the first six months of this year.

- The US unemployment rate was unchanged at 3.6% between March 2022 and June 2023 and the Canadian unemployment rate is below it’s pre-pandemic level.

- The US economy has grown 2.6% over the past 4 quarters, which is faster than the growth rate we experienced prior to the pandemic.

- Meanwhile, headline US inflation has pulled back from 9% to 3% and headline Canadian inflation has pulled back from 8% to 2.8%.

- Additionally, the TSX is up 6.41%, and the S&P 500 index is up 19.52% since the beginning of 2023.

As a result, we continue to see an uptrend in the equity markets. There is compelling data indicating that this trend will most likely continue to the end of 2023 and possibly into 2024. The labour market in both Canada and the US remain strong. This is a big indicator of a strong economy on both sides of the border. Canada may pause rate indefinitely in September and likewise the US may have seen their last rate hike for this current economic cycle.

The big tech names continue to perform well since the beginning of the year and contributing to most of the run up in the S&P 500 index. As mentioned last month, we expected other sectors to show some resilience in the coming months and play some catch up and they have.

The Proshares S&P 500 Ex-Technology ETF, (which excludes the big tech names) has gained in the months of June and July to nearly keep pace with big tech names which means that the stock market is finding a strong footing and getting some breadth. This is encouraging as more and more sidelined cash is making its way back into the equity markets.

We thank you for your continued trust and we welcome you to reach out to us with any questions you may have.

This information has been prepared by Kian Ghanei who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The [Investment Advisor/Portfolio Manager] can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.