We hope you and your family had an enjoyable Canada Day long weekend. Also, Happy 4th of July to those celebrating the holidays in the US today. With so much happening around the world, it’s nice to take a few days to appreciate our beautiful home and the wonderful opportunities it rewards us with.

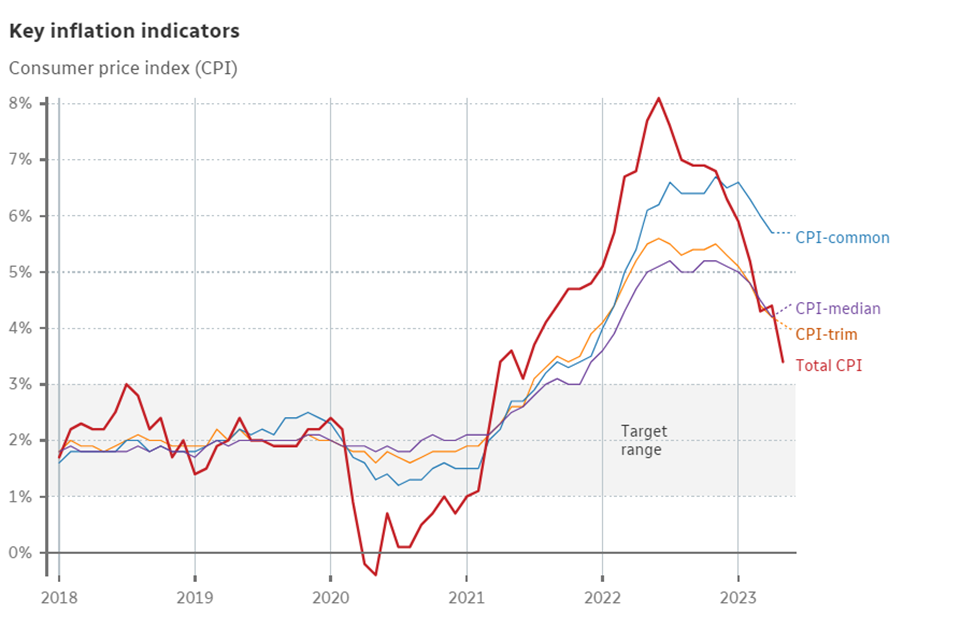

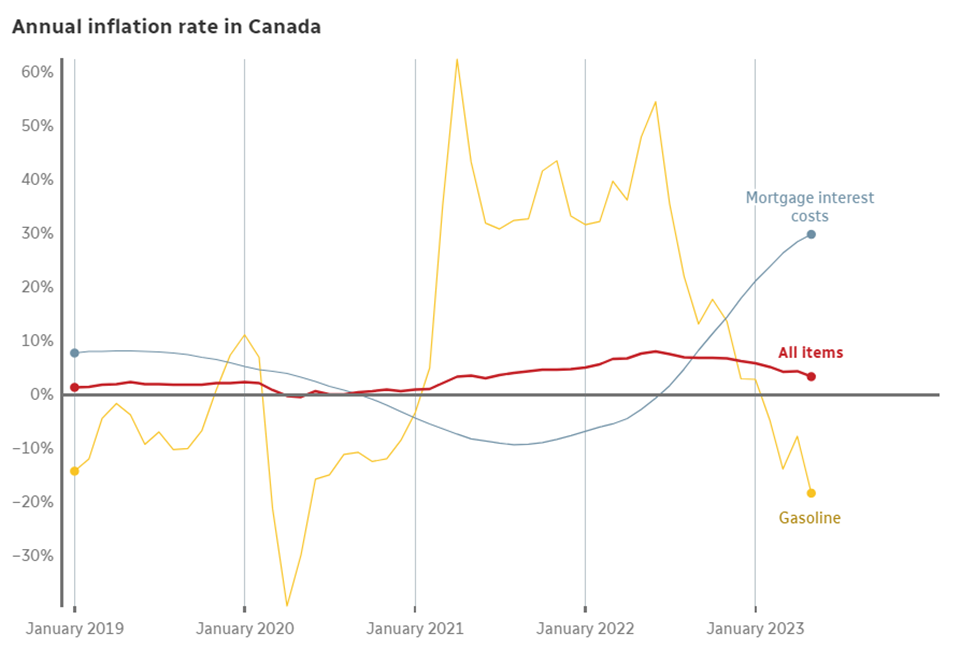

Another month has come and gone and the focus in June has been placed back on inflation and the central banks. Last month, the bank of Canada surprised most with a 0.25% increase in interest rates which came after a minor uptick in April’s CPI numbers. Fast forward a month, Canada’s inflation rate decelerated to 3.4 per cent in the year up to May led by lower gasoline prices. Although the decline is attributed to lower energy costs, inflation hit a 2-year low which is a step in the right direction. (Source: Statistics Canada)

Most price increases in Canada are being attributed to food and housing. Food prices remain high and continue to move higher at a 9% annual rate. Proportionately, housing prices seem to be a much bigger detriment to those renting and those borrowers that have variable debt and mortgage payments. This is going to be a concern for policy makers as the Bank of Canada contemplate another rate hike on July 12th in the face of a significant risk to consumers and their ability to keep above water.

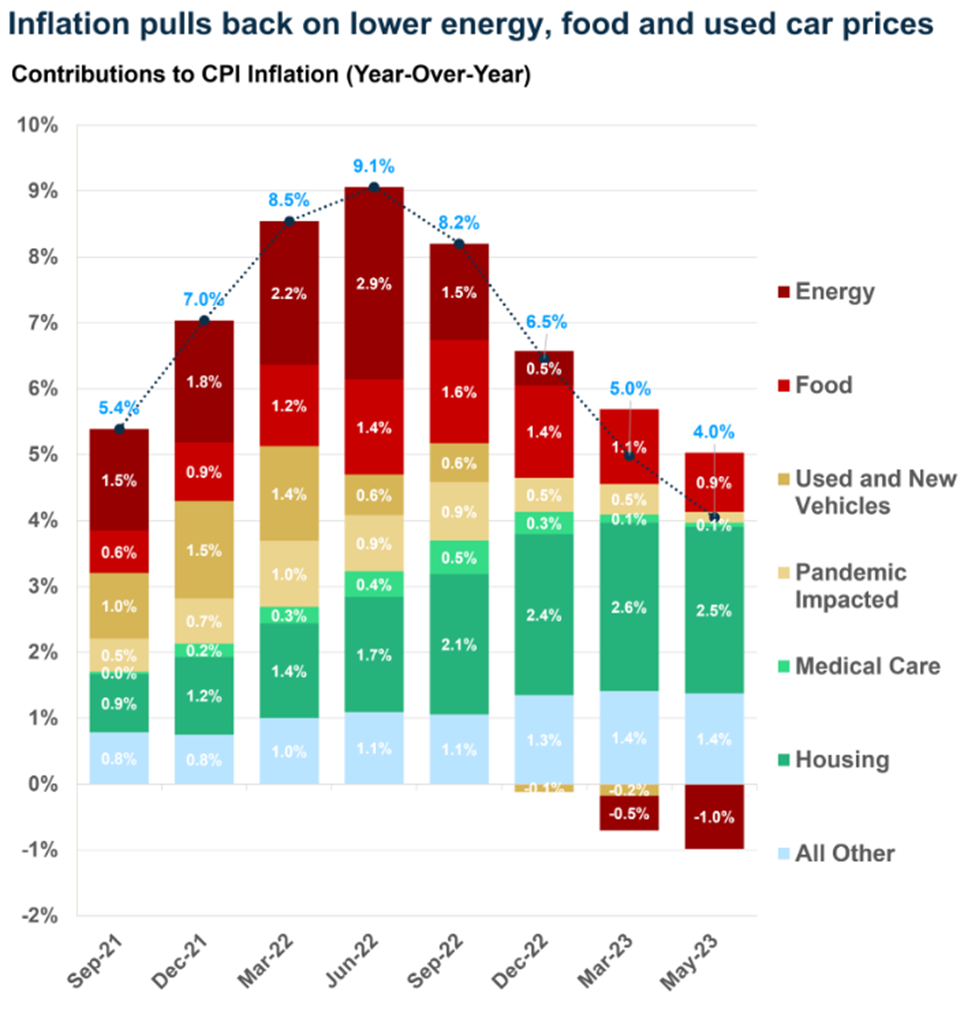

In US, Headline CPI inflation has decelerated from a peak of 9.1% year-over-year in June 2022 to 4% in May. Over the past three months, inflation is running at a 2.2% annualized pace, the slowest 3-month pace since two and a half years ago. Like Canada, the big driver of the pullback has been energy, but more recently, food prices have also started falling which is encouraging news for Canadians. Vehicle prices, which boosted inflation last year, are also moving lower – used car prices rose over the last two months. (Source: Bloomberg)

The Federal Reserve didn’t raise rates in June and left the Federal Funds rate in the 5-5.25% range marking the first pause going back to March 2022. They, however, left a hawkish tone in their messaging indicating that the rates would be 0.5% higher than thought earlier in March and its members updated their projection for rates to hit 5.6% before the end of the year. The fact is that there is no certainty with what they’ll do this month or in the months to come. The ‘hawkish’ tone may be a way for them to persuade the market and cool it down further. This is quite common in economics as central bankers use this type of persuasion or ‘moral suasion’ to influence sentiment and sometimes that’s enough to get the needle moving in their favor.

In the days following the Fed’s comments, the market began to show some volatility as assets were being repriced considering the new rate projections but that didn’t hold long. In the last few days of June, the S&P 500 reached a 1-year high and the market seemed to find its way back to the path of growth.

Is there a new bull cycle in the works currently?

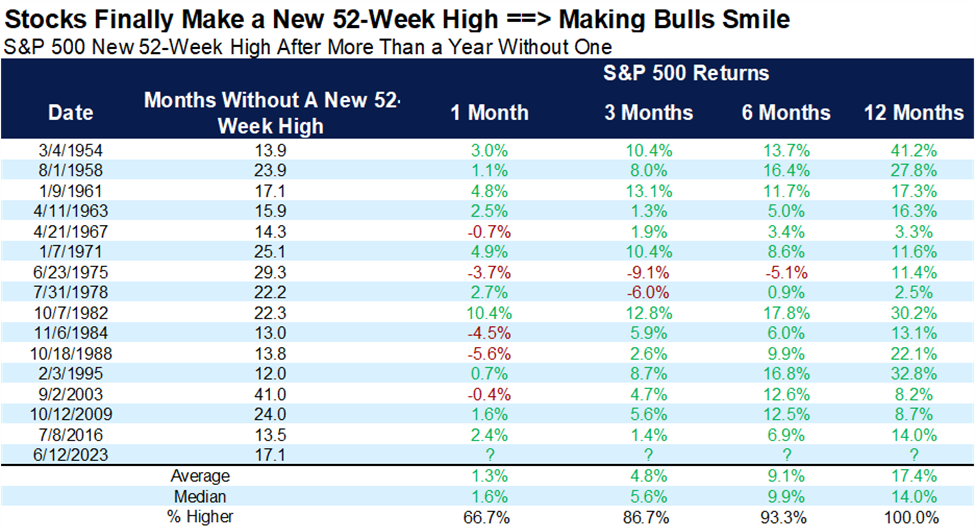

Technically yes! The S&P 500 is now up more than 20% from it’s October lows which technically is an indication of a bull market. Although there are some issues in the underbelly of the markets, this is an important historical data which can be compared to past occurrences.

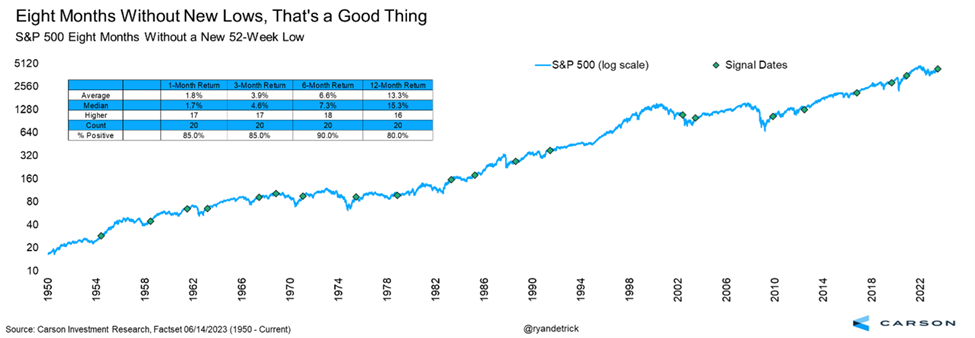

Below is a chart that looks at the S&P 500 since 1950 and summarizes all the times stocks went at least one year without a new 52-week high and the good news is more strength is quite likely. A year later stocks have been higher an incredible 15 out of 15 times and up more than 17% on average. Adding that to the numbers in the first table and the next year could continue to surprise to the upside. (Source: Carson Research)

At Caerus Private Wealth, we began to move back into equities as early as Nov 11th, 2022, and we continued to add equities into December and January where we rebalanced back into our respective strategic equity percent allocation. We have now gone 8 months without a new 52-week low in the markets which add more conviction for us in the coming months.

Why is this important? It would be extremely rare for stocks to roll over and make new lows from here. In addition, three months later the S&P 500 was up 85% of the time, six months later 90% of the time, and a year later 80% of the time higher. The bottom line, once you get to eight months without a new 52-week low, the upward trajectory likely stays in place.

Strong Labor Markets

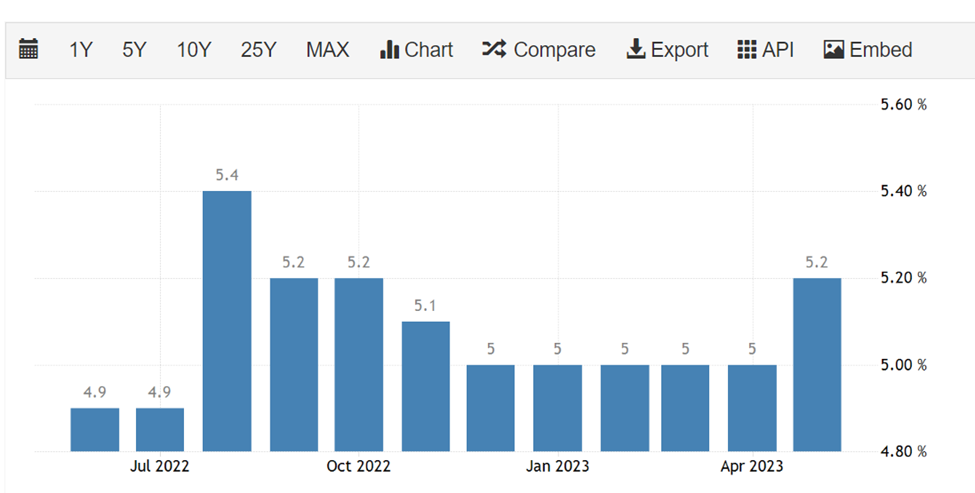

The unemployment rate in Canada rose to 5.2% in May of 2023 after remaining at 5% for the five previous months, above market estimates of 5.1%, to mark the first monthly increase in the unemployment rate since August 2022. The data suggested that the Canadian labor market is starting to give in to higher interest rate from the Bank of Canada after remaining stubbornly tight for a long period. This will be something that will be considered for Bank of Canada as they consider another hike later in two weeks. (Source: TradingEconomics)

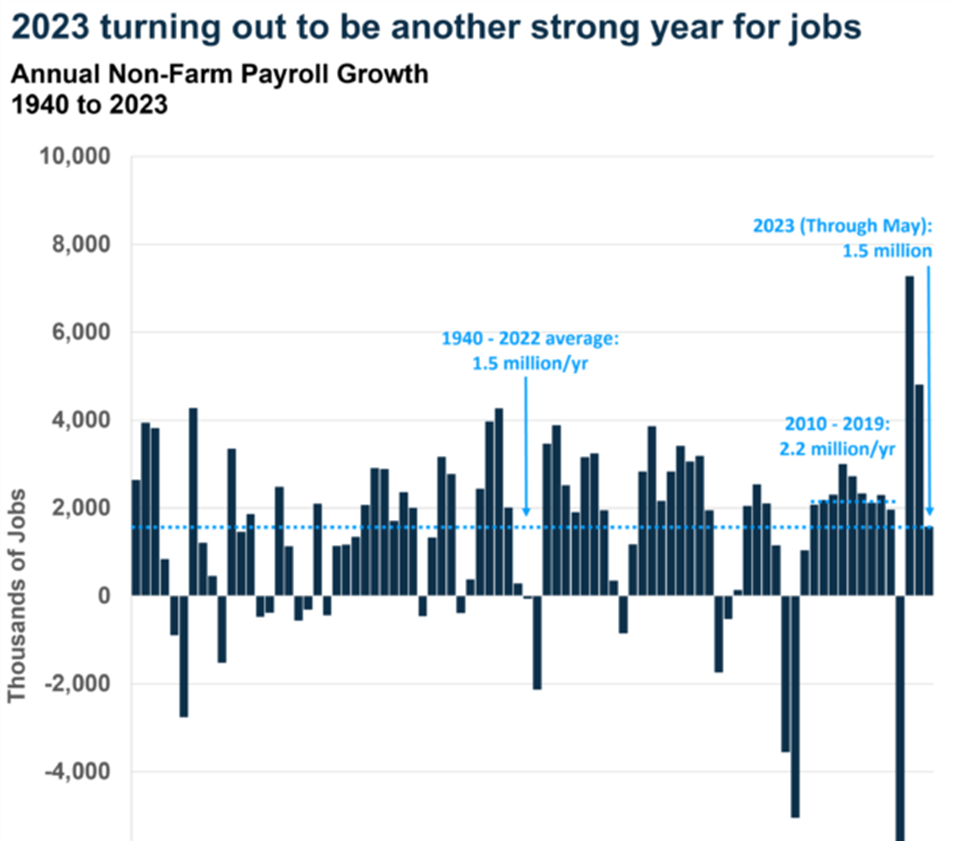

In the US, the unemployment rate rose from a historic low of 3.3% to 3.7% but the jobs report came is hot. Many are asking how could the unemployment rate rise while the jobs report came in above estimates? The answer lies in the source of its data. The US unemployment rate is derived from asking 60,000+ respondents about their current employment status. It appears that an influx of self-employed people put themselves in the unemployed category in May.

On the other hand, the US jobs report is obtained by gathering information about recent hiring activity from over 120,000 businesses. Many put more emphasis on the latter statistic versus the former. Looking at the jobs report, he US economy added 339,000 jobs in May, nearly double the expectations. In addition, payroll growth in March and April were revised higher by a total of 93,000 where March payrolls were revised up by 52,000, from 165,000 to 217,000 and April payroll were revised up by 41,000, from 253,000 to 294,000. (Source: Bureau of Labor Statistics)

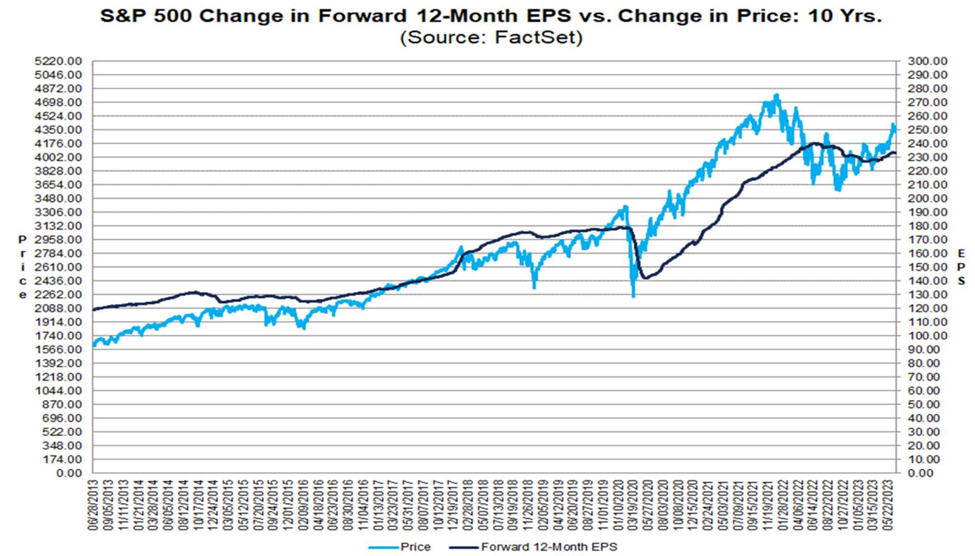

Earnings

With the second quarter earnings season for the S&P 500 starting in a few weeks, investors wonder if many analysts have lowered EPS estimates for S&P 500 companies for the second quarter and the answer is no. During the second quarter, analysts lowered EPS estimates for the quarter by a smaller margin than average. The Q2 bottom-up EPS estimate (which is an aggregation of the median EPS estimates for Q2 for all the companies in the index) decreased by 2.9% (to $52.80 from $54.38) from March 31 to June 29.

In a typical quarter, analysts usually reduce earnings estimates during the quarter. During the past five years (20 quarters), the average decline in the bottom-up EPS estimate during the quarter has been 3.4%. During the past ten years, (40 quarters), the average decline in the bottom-up EPS estimate during the quarter has also been 3.4%. During the past fifteen years, (60 quarters), the average decline in the bottom-up EPS estimate during the quarter has been 4.5%. During the past 20 years (80 quarters), the average decline in the bottom-up EPS estimate during quarter has been 3.8%. (Source: Factset)

Summary

We continue to see an uptrend in the equity markets. There is compelling data indicating that this trend will most likely continue to the end of 2023 and into 2024. The labour market in both Canada and the US remain strong. This is a big indicator of a strong economy on both sides of the border. There are some concerns around the stickiness of inflation when it comes to shelter and food, but the US is seeing food prices come down and maybe that’ll be the case for Canada as well. Cost of housing isn’t helping the underlying inflation numbers and this may prove more long-term in Canada as we battle an aggregate housing shortfall. The good news is that overall inflation is coming down in both Canada and the US and perhaps the Bank of Canada and the Federal Reserve will view this as a reason to pause future rate hikes.

The big tech names continue to perform well since the beginning of the year and contributing to most of the run up in the S&P 500 index. Moreover, we think other sectors will do some catching up when there is more certainty around inflation and future interest rates. Afterall, a large amount of capital remains on the sideline and those will need to make a shift to other asset classes if inflation continues to fall leading to a declining rate environment.

We thank you for your continued trust and we welcome you to reach out to us with any questions you may have.

This information has been prepared by Kian Ghanei who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The [Investment Advisor/Portfolio Manager] can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.