In May, the focus shifted away from Jerome Powell and was focused primarily on the debt ceiling as McConnell and President Biden rallied their sides to vote in favour of a deal that was passed by the House on Weds. Now it’s up to the Senate and Senate Leader, Chuck Schumer, to get this bill passed back to White House. The idea of a failed deal will be quite detrimental for the global financial markets, but if history repeats itself, we’ll find a deal reached by as early as today. But what is the debt ceiling and why is it important to the markets?

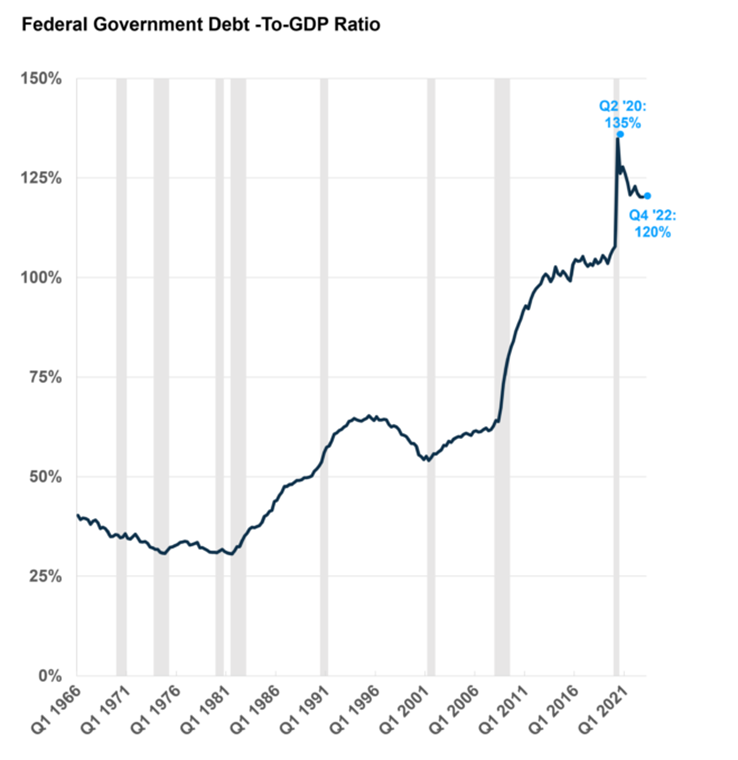

Also known as the debt limit, this is a law that limits the total amount of money the government can borrow to pay its bills. This includes paying for federal employees, the military, Social Security and Medicare, as well as interest on the national debt and tax refunds. Every so often, US Congress votes to raise or suspend the ceiling so it can borrow more. In recent years, The US has seen their debt burden rise at an uneasy pace and this has many politicians on both sides less reluctant to continue this volume of borrowing. Naturally, both sides have their own agenda in what they should budget for and what they should cut.

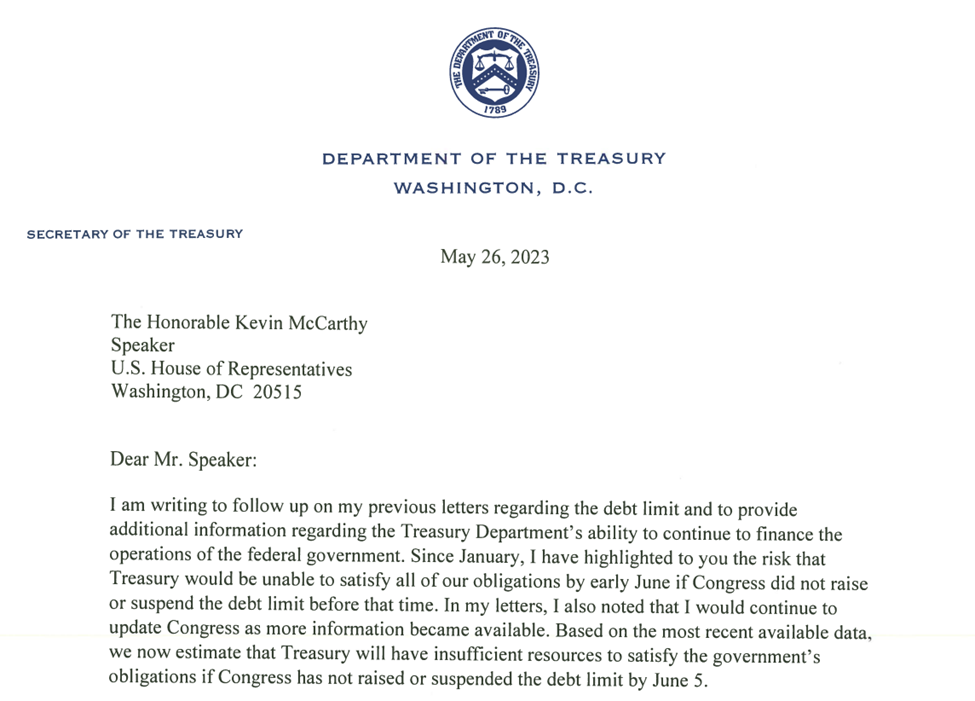

In a letter written by Treasury Secretary, Janet Yellen to the House Speaker, Kevin McCarthy, she expresses the need for funding to be able to finance the obligations of the federal government. The troubling part is that it explicitly mentions that without further funding, there will be payments that would be missed as early as early June. This is a significance of reaching a deal to either raise the debt ceiling or to suspend it. The first paragraph of this letter reads:

What are they deciding on?

The issue is that this is a partisan problem that requires a bipartisan solution. There are issues surrounding spending and initiatives that each side prioritizes, and often struggle to come to an agreement. Here are some of those examples being discussed and debated now. (Source: BBC/CNN)

Caps on spending, but not defense

Both sides claim victory here. The White House says these cuts are not significant. The defense spending rise is what President Biden wanted but it’s below the rate of inflation and doesn’t meet the demands of the more hawkish Republicans.

Unspent Covid funds returned

A win for Republicans. Many Democrats were concerned public health initiatives would be impacted by this, but it was easier for Biden to give up than other Republican priorities like Medicaid work requirements.

Welfare tinkered with, but no overhaul

The White House will be happy it gained exceptions to the food stamp requirements for veterans and people who are homeless but stricter work requirements overall are a win for Republicans. It will be a hard sell for progressive Democratic lawmakers.

Funds to enforce tax rules on wealthy Americans

The Republicans wanted to dump the $100 billion in IRS funding, claiming it would be used to hire an army of agents to audit Americans – the agency said it would also be used to modernize the system. Instead – in showcasing his deal-making skills – Biden agreed to cut $20 billion but divert that cash to other non-defense spending.

Easier to get energy project permits

A win and a loss for the White House. Both parties agree it takes far too long for new energy infrastructure to be built but disagree on what projects should be prioritised. Republicans want more gas pipelines and fossil fuel projects; Democrats want more clean energy. This could be another red line for progressive Democrats.

Things not in the deal

- Student loan relief – Republicans had wanted the Biden plan to forgive student debt to be rescinded but it survived. The Biden administration’s student debt case will be ultimately decided by the Supreme Court. But the bill does require the Biden administration to follow through with a plan to end the current pause – which has been in effect since the start of the pandemic – on student loan repayments by the end of summer.

- Tax hikes – Democrats had targeted wealthy Americans for new tax hikes but there are no new taxes here. House Democrats will be fuming about this. They were already critical that the White House did not make taxes on the rich and powerful the centrepiece of their talks.

- Clean energy – Republicans had wanted to repeal key provisions of the Inflation Reduction Act’s clean energy and climate provisions but it was unscathed. A win for both – certainly as far as environmentalists are concerned. The US renewable energy industry group the American Clean Power Association said it “applauds President Joe Biden and Speaker Kevin McCarthy for prioritising national interests over partisan politics”.

Moving on from the debt ceiling

We continue to see a resilient North American economy with a rebound in stocks over the last 6 months. The market is far from perfect and there remains a lot of uncertainty about the future of the financial markets but there are also several positive indications that we may be at the start of the next bull market as the S&P 500 has risen 9% since the start of the year and is posed to continue its trajectory. Below are some data points that are shaping today’s market behavior.

US Inflation

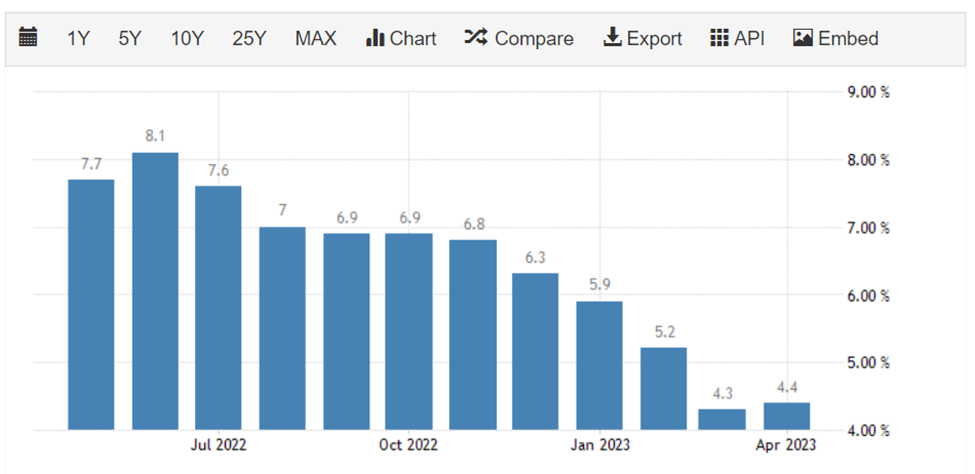

The annual US inflation rate in the US fell to 4.9% in April 2023, the lowest since April 2021, and below market forecasts of 5%. Food prices grew at a slower rate (7.7% vs 8.5% in March) while energy costs fell further (-5.1% vs -6.4%) including gasoline (-12.2%) and fuel oil (-20.2%). Also, shelter cost which accounts for over 30% of the total CPI basket, slowed for the first time in two years (8.1% vs 8.2%) and prices for used cars and trucks declined once again (-6.6% vs -11.6%). Compared to the previous month, the CPI rose 0.4%, much higher than 0.1% in March but matching market expectations. The shelter was the largest contributor to the monthly all-items increase, followed by used cars and trucks and gasoline. (Source: U.S. Bureau of Labor Statistics)

Canada Inflation – On the other hand, the annual inflation rate in Canada rose to 4.4% in April of 2023 from the 19-month low of 4.3% in the previous month, well above market expectations of 4.1% to reignite fears of a hawkish Bank of Canada. Consumer prices soared as the central bank’s tightening path lifted mortgage rate costs (28.5% vs 26.4%) and rent prices (6.1% vs 5.3%). The CPI also accelerated for transportation (1.3% vs 0.3%), as OPEC’s crude oil output cut pinned energy costs at stubbornly high levels. Like the US, inflation fell for food (8.3% vs 8.9%) amid eased pressure from fresh vegetables, coffee, and tea. (Source: Statistics Canada)

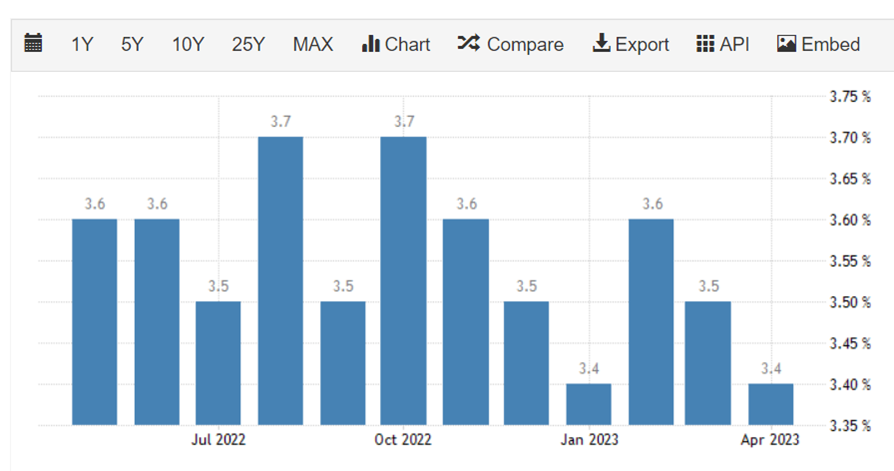

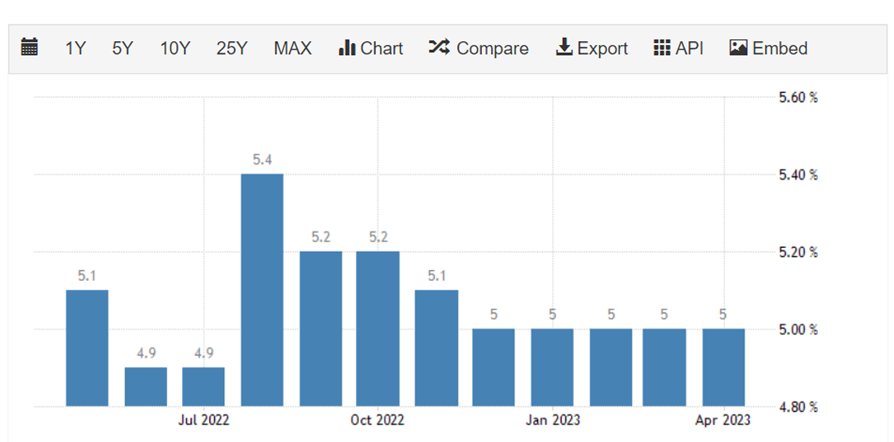

Historically Low Unemployment Rate on both sides

Policy makers are scratching their heads as employment continues to be tight on both sides of the border propelling consumer spending on good and services. This isn’t boding too well for inflation battle, and many are now beginning to price in more future rate hikes. Below are the Unemployment rates over the last 12 months in the US and Canada respectively. (Source: Trading Economics)

US Unemployment Rate

Canada Unemployment Rate

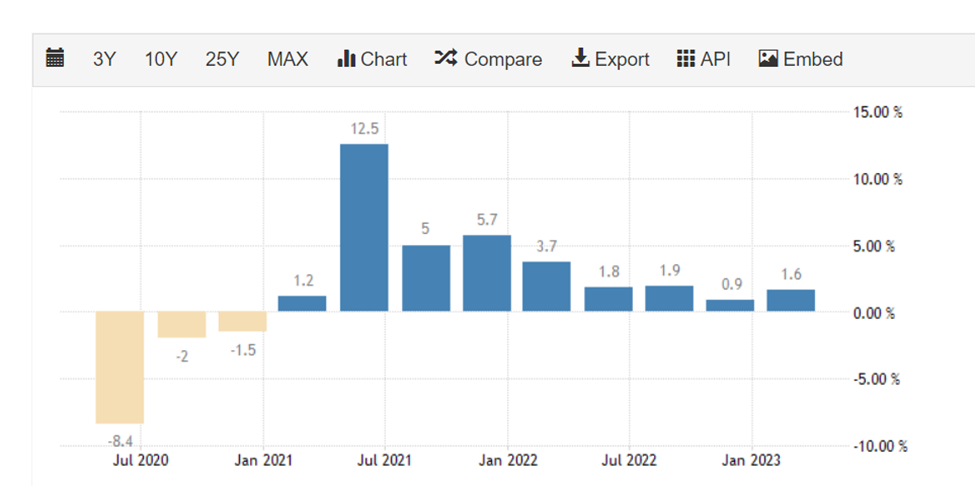

Canada’s GDP

Statistics Canada reported on Wednesday that the country’s economy grew at an annualized rate of 3.1% in the first quarter of 2023, beating StatsCan’s own 2.5 per cent forecast. The figures show continued resilience in the economy as the Bank of Canada fights to bring down high inflation, and it might encourage the central bank to break from its pause in its interest rate tightening cycle earlier than many expected.

In the US, the annual GDP is also gaining some momentum over the last 2 months. The probability of rate hikes in the US in June and July have risen but still undetermined. This is just another sign that both economies are moving forward with resilience despite many predicting a recession sooner than later.

Corporate Earnings

This past earnings season was good relative to expectations. Approximately 95% of S&P 500 companies have reported first-quarter earnings and a very impressive 78% beat expectations. Earnings are set to come in down 2.2% versus the first quarter last year, but this is much better than the 6.6% drop that was expected this time seven weeks ago. Also, all 11 sectors came in better than expected, with tech really impressing. Lastly, the average company beat earnings by 6.5%, one of the best beats in years, while the average small cap stock beat by an even wider margin. (Source: FactSet)

Furthermore, the better-than-expected earnings coupled with a slow and gradual decline in inflation has made the S&P 500’s 200-day moving average turned higher. This is a longer-term trendline and it tends to catch significant trends. Some previous times the 200-day turned higher after trending lower for an extended period were July 2016, August 2009, June 2003, and March 1991. For those who remember their stock market history, all those times indeed took place after significant lows were already formed and continued strong gains occurred. According to Carson Research, this has happened 10 times this turned higher and all 10 were nice times to own stocks.

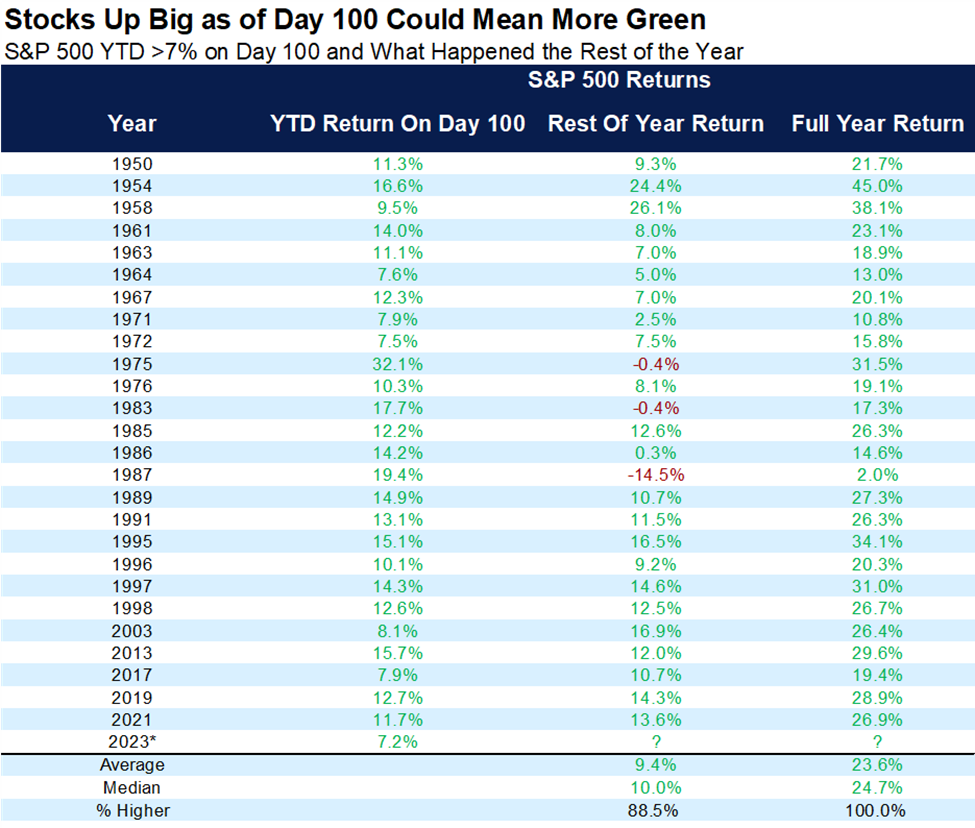

First 100 Days

Looking at all the years to gain at least 7% by Day 100 showed that the rest of the year was higher by 9.4% on average and up 88.5% of the time. Lastly, the full year has never closed the year lower when up more than 7% on Day 100. Yes, 1987 is in here, so we know that stocks can indeed go lower from here, but to have a red year in 2023 would truly be rare. (Source: Carson Research)

Summary

There are compelling reasons as to why equities have risen since the beginning of the year. It hasn’t been a straight line and in fact many sectors are still struggling to find a footing. Having said that, and despite a backdrop of a worrisome regional banking mismanagement and the debt ceiling worries, the S&P 500 is up over 9% year-to-date as equities are poised to rebound from their lows of last October.

The big tech names have had a monstrous run since the beginning of the year and contributing to most of the run up in the S&P 500 index. In fact, if it wasn’t for these names, the S&P500 would be marginally up for the year in tune of 1.75% compared to 9%. These can be determined by looking at a chart for the S&P 500 excluding the technology such as SPXT (S&P 500 excluding technology ETF) which is up 1.5% year-to-date.

Six stocks including Apple, Nvidia, Microsoft, Alphabet, Amazon, and Meta Platforms, now have a combined valuation of around $10 trillion and make up over a quarter of the S&P 500’s total market capitalization. It’s historically rare for a handful of stocks from the same sector to make up such a large part of the S&P 500.

With so much money being held on the sideline defensively, we feel that this rally will continue, and at some point, when it begins to make its way back into stocks, it’ll give life to some other sectors that have been held back over the last several quarters.

On a cautionary note, the stickiness of inflation is frustrating for sure and may derail this momentum should the central banks kickstart their tightening. Given the new GDP numbers and continued tight labour market, the probability of rate hikes has increased in both the US and Canada, and it’ll be interesting to see how that plays out.

We thank you for your continued trust and we welcome you to reach out to us with any questions you may have.

As your trusted Portfolio Managers, Terry and Kian, and the Caerus Private Wealth team is available to address any questions you may have.

This information has been prepared by Kian Ghanei who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The [Investment Advisor/Portfolio Manager] can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.