From bank failures to indictments, March was nothing short of a rollercoaster ride. We get a sense that 2023 will continue to keep us on our heels as we look at several factors making things uneasy for investors across the globe. As it may be, there is also compelling data that is fueling a more optimist tone amongst investors and given that the S&P 500 has risen in each of the last two quarters, it points to a start of a bull market rally that may continue through to the end of the year. Afterall, spring is finally here and with April being one of the strongest months of the year, we remain eagerly optimistic.

Let us have a look at some of events that occurred earlier in March.

SVB and Other Bank Failures

Friday, March 10 — The US government’s Federal Deposit Insurance Corporation (FDIC) took control of SVB. It was the biggest banking collapse in America since Washington Mutual in 2008. The wheels started to come off 48 hours earlier when the bank took a multibillion-dollar loss cashing out US government bonds to raise money to pay depositors. It tried — unsuccessfully — to sell shares to shore up its finances. That triggered the panic that led to its downfall. According to LPL Research, SVB Financial Group had far more marketable securities relative to total assets of 55.4% compared to the average bank having 22.2% which means that SVB was running a business far more prone to changes in market prices (ie, interest rates) and therefore exposed to price pressures that led to its demise.

Sunday, March 12 — The FDIC shut down Signature Bank after a run on its deposits by customers who were spooked by the implosion of SVB. Both banks had an unusually high ratio of uninsured deposits to fund their businesses.

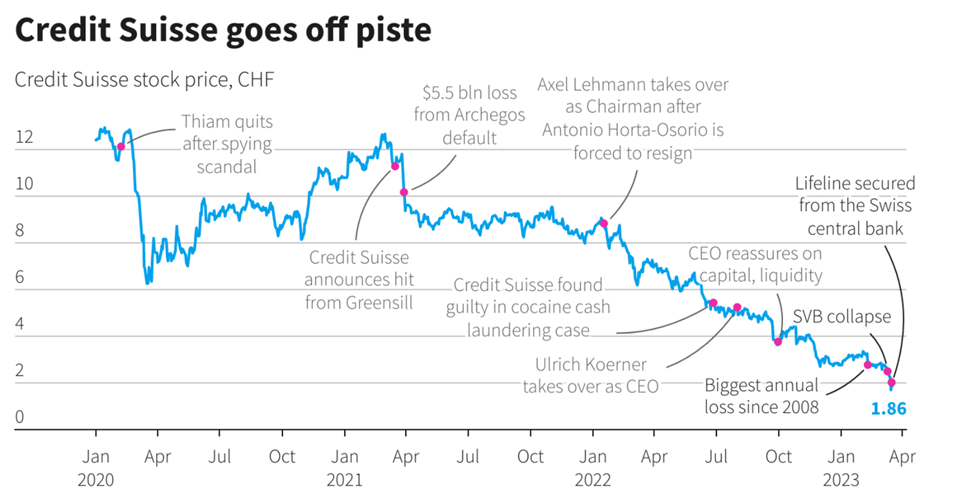

Wednesday, March 15 — After watching shares in Credit Suisse collapse by as much as 30%, Swiss authorities announced a backstop for the country’s second-biggest bank. It calmed the immediate market panic, but the global player wasn’t out of the woods yet.

Thursday, March 16 — First Republic Bank was teetering on the brink as customers withdrew their deposits. In a meeting in Washington, US Treasury Secretary Janet Yellen and Jamie Dimon, the CEO of America’s biggest bank, drew up plans for a private sector rescue. The result was an agreement with a group of American lenders to deposit tens of billions of dollars of cash into First Republic to staunch the bleeding.

Sunday, March 19 — Switzerland’s biggest bank, UBS, agreed to buy its ailing rival Credit Suisse in an emergency rescue deal aimed at stemming financial market panic. Credit Suisse’s demise or takeover was just a matter of time. The old and prestigious Swiss private bank has had its name dragged through spy scandals, cocaine cash laundering, and investment losses for over 5 years now and shares holders have seen their share prices cut by over 95% over that stretch. (Source: Bloomberg)

Is this 2008 all over again?

We don’t think so. Although the banking sector has experienced a large scale selloff, the issues surrounding the two events are different. In 2008, during the subprime crisis, we dealt with collateralized debt obligations (CDO) that eventually turned out to be toxic and worthless. Today, we are dealing with highly quality assets such as AAA rated Treasuries and Agency mortgage-backed securities. The issue here lies in the fact that although these securities will ultimately mature at their original value, in the midterm their values are interest rate sensitive and prone to price fluctuation in the secondary market if they are forced to be sold prior to maturity. SVB and some other lenders tied up too much of their assets in these longer-term securities without considering the consequences of higher interest rates and faster customer withdrawal demands which ultimately led them to take substantial losses to meet withdrawal demands.

While it was too late for SVB, the Fed introduced a new facility called the Bank Term Funding Program hat will act as an additional source of liquidity for high-quality securities eliminating institutions need to quickly sell securities under stress. In return, it can use those securities as collateral for a loan that can address any potential large withdrawal events.

How will the Fed react to the latest banking vows?

While the job market has remained strong and inflation has been trending somewhat lower over recent months, the failure of Silicon Valley Bank and the eruption of a sudden banking crisis posed a dilemma for the Fed: Keep raising rates to sustain the fight against high inflation or hit pause to give markets space to cope with fallout from the banking crack-up.

The members of the FOMC opted to remain focused against inflation, which is not surprising given recent rhetoric from key Fed officials—especially Fed Chair Jerome Powell. “The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated,” Powell told Congress earlier this month.

“The U.S. banking system is sound and resilient,” wrote the FOMC in its post-decision statement. “Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation. The extent of these effects is uncertain. The Committee remains highly attentive to inflation risks.”

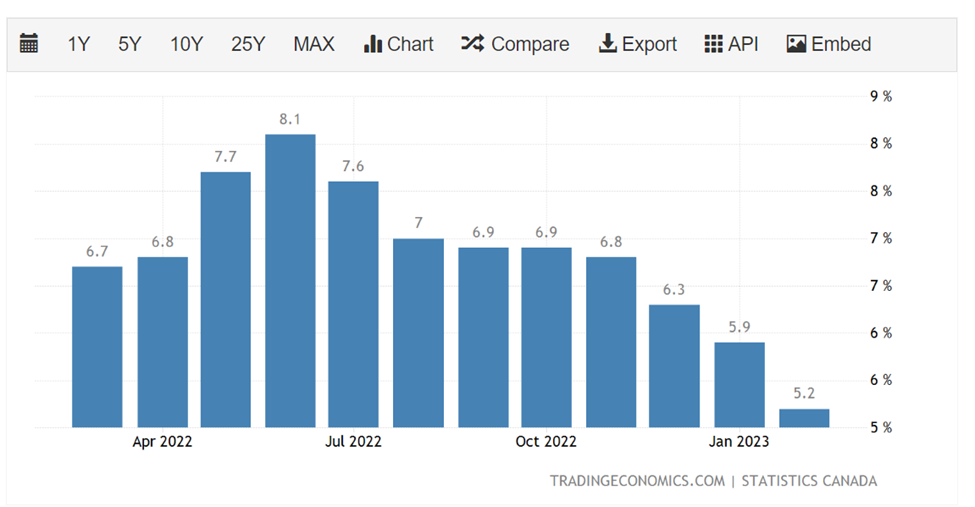

Earlier this month, the Labor Department reported that the consumer price index (CPI) rose 6% in the 12 months to February. This was the lowest CPI number since Sept 2021. That was down from the 6.4% annual gain in January and down from peak inflation of 9.1% in June 2022. (Source: Trading Economics)

Furthermore, the U.S. labor market has remained healthy, but that is making the Fed’s inflation battle harder. The Labor Department reported the U.S. economy added 311,000 jobs in February, beating expectations. Wages were up 4.6% and the unemployment rate was 3.5%, higher but still very low by historical standards.

What does this mean?

The Federal Reserve and policy makers view the banking sector as sound but if the crisis continues, the Fed will most likely refrain from raising rates again this year, and similarly if things continue without a deeper contagion, we’ll most likely see at least one more rate hike in the coming months. The end of rate hikes will create some optimism for hit-hard assets and will most likely result in some gains in the coming months.

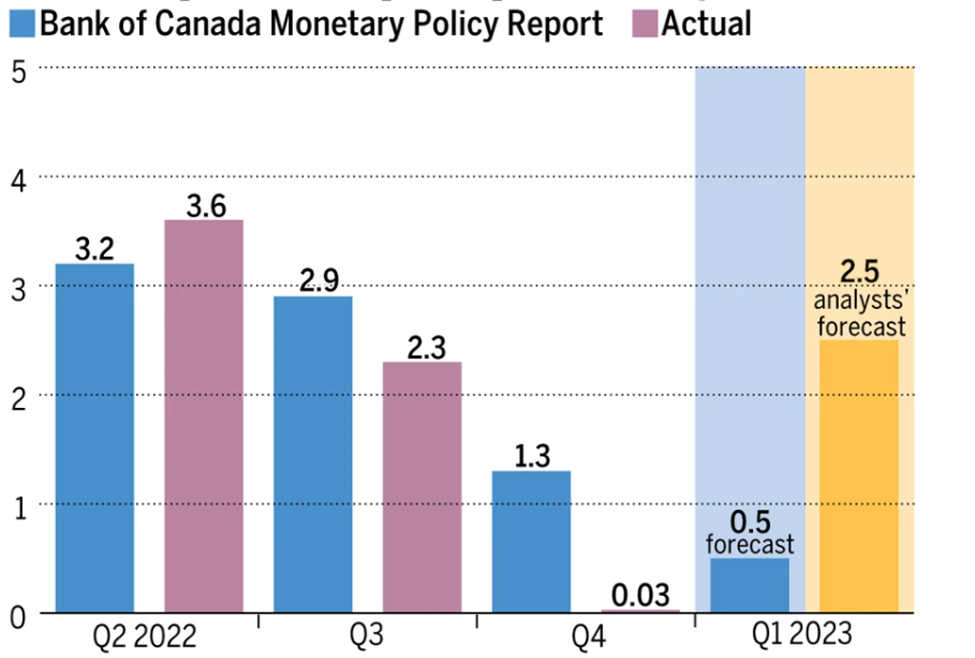

Canada Rebounds

The latest flash GDP numbers in Canada were surprisingly good at 0.5% for Q1 of 2023. This is also lead by wage growth in Canada which is boosting consumer confidence and spending. This is slightly worrisome for those that are hoping to put a stop to rate hikes in Canada. The Bank of Canada will have some thinking to do later this month as they review the data that has increased the probabilities of yet another potential rate hike in Canada.

Considering the recent US Regional Banks concerns, the Bank of Canada will likely consider the implications of a raising interest rates and what that could mean to many consumers and businesses. If inflation keeps its downward trend, it will grant them more time to weigh out their options. Perhaps, they might be able to avoid a recession completely. (Source: Statistics Canada and Trading Economics)

Spring brings optimism!

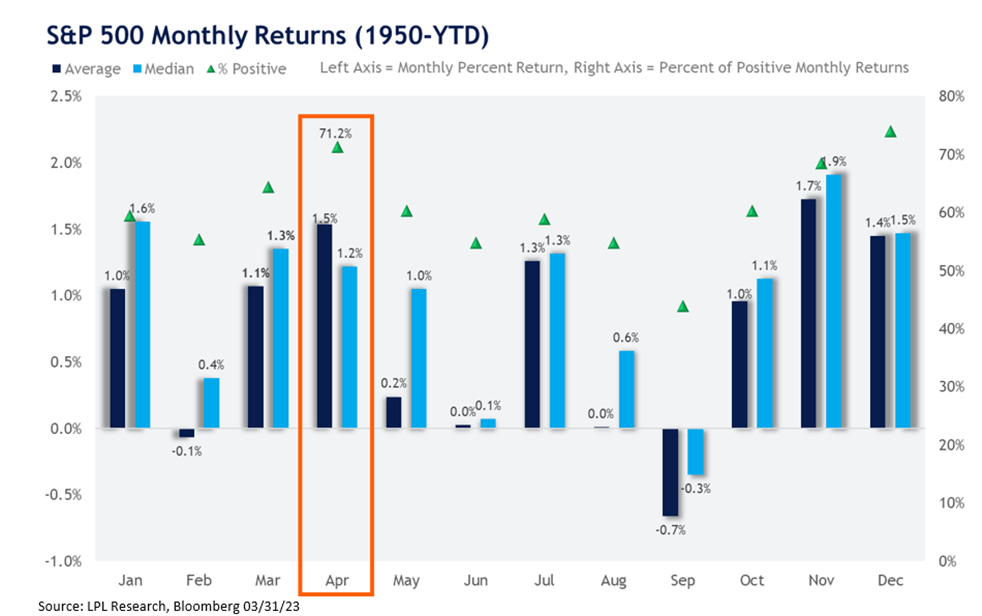

It might seem a little irrational, but April does fair well for equities when looking at the data. It might be the warmer weather, the longer days, or perhaps the end of the first quarter but spring bodes well for equities.

The S&P 500 finished March with nearly a 2% gain. Despite the issues surrounding the banking sector and another rate hike in the US, April seasonality trends suggest buying pressure could continue in April. Since 1950, the S&P 500 has posted average and median returns of 1.5% and 1.2% respectively. The index has also finished in the green 71% of the time, making it the second most positive month for stocks in the calendar. (Source: LPL Research)

What are fund managers doing of late?

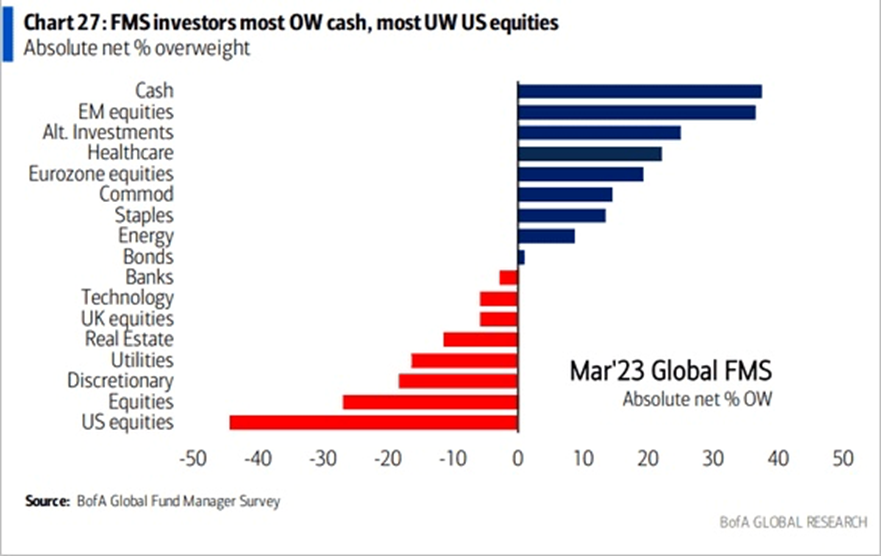

The Bank of America conducts a monthly survey of over 300 institutions and money managers worldwide. Like many fund managers, we remained largely defensive through the second half of 2022. The newest survey in March of 2023 shows the ranking of asset classes used by fund managers in the US. This latest survey shows that the highest growing assets class is in Money Market securities or Cash instruments while the least favored asset class is in US equities. At first glance, this report seems very pessimistic for investors but after careful consideration, and from a contrarian lens, it’s painting a different picture. In our view, the S&P 500 has gained momentum over the last 2 quarters, and technically it has made a support level while moving higher creating higher highs and lower lows. Although we can’t predict the future, this is a type of price action we’re looking for in the rebound stage of the equity markets. The latest survey from Bank of America looks like an opportunity for considerable shift back into equities as conditions improve.

Summary

Last month, we were convinced that the Federal Reserve would continue raising rates throughout 2023. Only four weeks later, and thanks in part to some terrible banking decisions in the regional banking sector, the landscape for higher rates has somewhat changed. At least for now.

The latest CPI numbers, although still relatively high, have receded to their level dating back to Sept 2021. With the recent banking vows, and a tighter credit environment, we expect inflation to continue to come down over the next 12 months. With the recent climb in the S&P 500 over the last two quarters, we maintain a positive outlook for equities in the face of a normalizing rate environment.

The Golden Cross of the S&P 500 that occurred in February still holds true with the 50 day-moving-average holding above its 200 day-moving-average, and we now are looking at this as a level of support heading into April. Despite the recent volatility in March, the S&P 500 remains resilient is continues to make higher lows as its determined to make up some of the losses of 2022. We might be looking through rose-colored lenses as we remain optimistic. After all, winter is gone, and spring is here!

We thank you for your continued trust and we welcome you to reach out to us with any questions you may have.

As your trusted Portfolio Managers, Terry and Kian, and the Caerus Private Wealth team is available to address any questions you may have.

This information has been prepared by Kian Ghanei who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The [Investment Advisor/Portfolio Manager] can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.