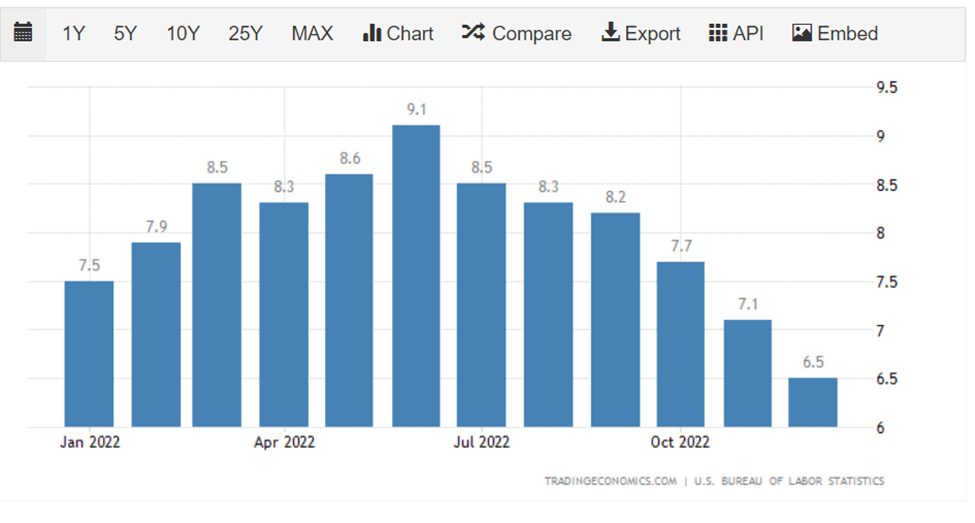

There is no doubt that the interest rate hikes are having a cooling down effect in several key economic areas such as consumer spending, inflation, and corporate earnings. But is that enough for the central banks to hint at a pause on their rate hike policy and are they convinced that long-term inflation targets will be met? We will get a better sense of their intentions today as they wrap up the FOMC meeting that began yesterday.

Earlier in January, the Bank of Canada seemed convinced that their most recent 0.25% rate hike would be enough to moderate inflation in the coming months. The Federal Reserve, which is widely expected to announce its eighth consecutive rate hike today by another 0.25%, will have a tough time balancing inflation expectation without crippling the US consumers and business. After all, even with the significant decline in CPI over the last 12 months, it remains above their long-term target of 2%.

One of the more stubborn metrics has been the very tight labor market, and although unemployment remains historically low at 3.5%, other factors such as consumer spending, real estate sales, and higher debt coverage costs are pushing overall prices downward and trending downwards. Even with unemployment’s stickiness, the Employment Cost Index (ECI) in Q4 was up 1% versus the 1.1% expected which marks the third quarter in a row where it has dropped. That’s the first time that’s happened since 2004!

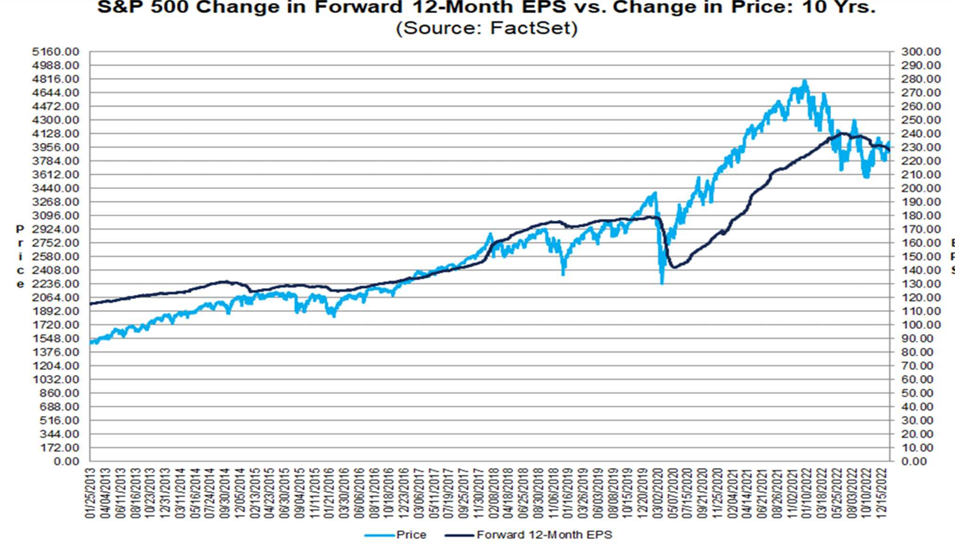

Corporate earnings are also being dampened. According to FactSet, the percentage of Companies beating EPS Estimates (69%) is Below 5-Year Average. In fact, out of 19 companies on the S&P500 that have issued guidance so far this year, 90% have issued a negative EPS (Earnings Per Share) guidance. If this is the case with large publicly traded companies, it must also resemble the underbelly of the average US business which will directly impact growth and employment. This overall earnings squeeze will also trickle down on consumer spending and capital expenditures.

Despite the recent market rally and a consensus of a normalizing rate hike environment, some investors feel that there is some more downside pressure on stocks in the coming months as they contemplate a recession to be a likely outcome at some point in 2023. According to research collected from CNBC, since the World War II, the market has never bottomed before the start of a recession. Given that we’re not (yet) in a recession, some suggest that there is more room to the downside before we bottom. There are certainly areas that would suggest that we are at or near a recession given the trends in many of the indicators already mentioned. Afterall, just because the central banks may be done raising interest rates, it doesn’t mean that consumer feel any sort of relief from their debt obligations, job security, and shrinking balance sheets.

Non-Traditional Investments – Thinking Outside the Box!

Bottom line, the market remains largely uncertain. The is uncertainty around monetary policy, around a looming recession in both Canada and the US, around forward earnings guidance, or around geopolitical risks that could trump all other potential risks. However, there is a silver-lining here. The recent uncertainly and volatility surrounding the markets over the last 12 months has created some compelling investment opportunities in some non-traditional investment, particularly in structured products (aka Structured Notes). The terms embedded in this investment category are highly attractive in an environment where investors are seeking growth in a market where risk management should be of utmost priority. For this reason, we would like to share with you some of our recent strategic allocations in this investment category and before we do so, it would be helpful to gain a basic understanding of structured notes (bank notes) and their contractual terms.

Understanding Structured Notes (aka Bank Notes) – In today’s economic landscape, investors are increasingly looking for ways to generate returns while preserving their capital. With higher interest rates, the prospects of GICs or Term Deposits are becoming more and more attractive but not without their limitation. After all, there is a premium associated with locking-in funds for a period of one year or longer, and for many, the GIC route may not be the best long-term approach.

On the other hand, traditional bonds have historically provided a relatively decent and steady rate of return pattern, but the aggressive rate hike policies of 2022 took the wind out of those sails and resulted in bonds having their worse performances in modern history. (Source: CNBC & Edward McQuarrie, an investment historian, and professor emeritus at Santa Clara University)

Structured Notes offer a compelling offering for investors during periods of uncertainty. Structured Notes are constructed using derivatives to create binary outcomes and payouts for an underlying basket of investments. The underlying basket of investments will be the determining factor in the eventual return or loss associated with the Structured Note. Structured Notes can be principle guaranteed or principle at-risk and according to which you choose, they will provide a different set of outcomes for investors. For the Caerus portfolios, we have chosen several at-risk bank notes and we will outline those for you here.

Structured Notes – The Basics!

- Maturity – In most cases, structured notes have maturities ranging between 2 to 7 years.

- Underlying Asset – The performance of a structured note generally tracks the performance of an underlying asset. That could be an index, stock, basket of stocks, commodities, or currencies.

- Type and amount of protection – The amount an investor is protected against depends on the terms of the note. For principle protected notes, the principle is guaranteed if held until maturity. For at-risk notes, the protection is negotiated and outlined in the terms of the note. This protection typically ranges between 20% to 40% in the event of the underlying asset’s price reduction. This protection will not protect investors if the underlying assets price fall below the protection threshold and remains there at maturity.

- Payoff Formula – This is the amount the investor receives over the term of the note if certain market conditions are met. There are 2 basic types of payoffs: income and growth. Income payoff provides investors with a maximum return level limited to the aggregate of the coupon payments, and growth payoffs gives investors a level of upside participation on the underlying asset.

As mentioned earlier, our team at Caerus has been working closely with BMO and Scotia to design and construct several at-risk bank notes that qualify according to parameters important to us:

- Secure underlying asset (Canadian Large Banks)

- Enhanced Protection (20-40% protection at maturity)

- High Level of Income (8.5% to 9% of annual income)

- High Probability of Growth (11 to 17% annual growth)

- Liquidity (daily liquidity)

The bank notes that we have designed and implemented across all client accounts, fall into three categories:

- Coupon Notes

- Booster Notes (Long-Term Growth)

- Auto-Callable Notes (Growth)

Our Notes at Caerus! New** and Older Bank Notes implemented across Caerus Models:

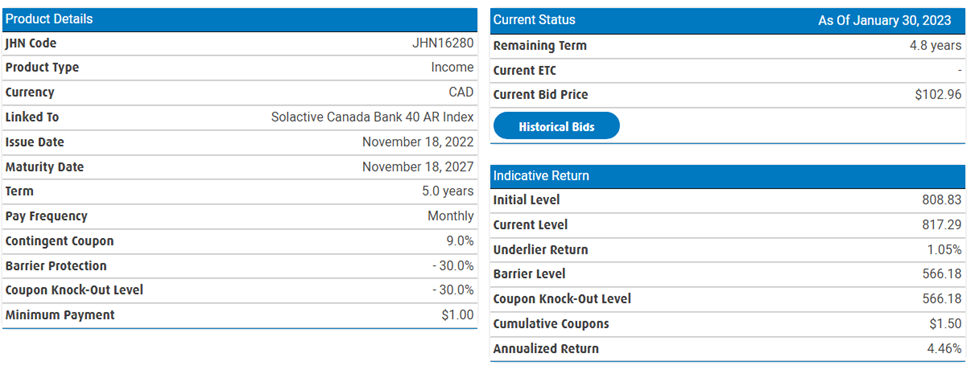

BMO JHN16280 – Coupon Note – New**

- Term – 5 years

- Underlying Investment – Canadian Banks

- Benefit – Coupons of 9% per year if the note trades above 70% of original purchase price of $100.

- Protection – 30%, original capital will be repaid in full if the note ends above 70% of original price.

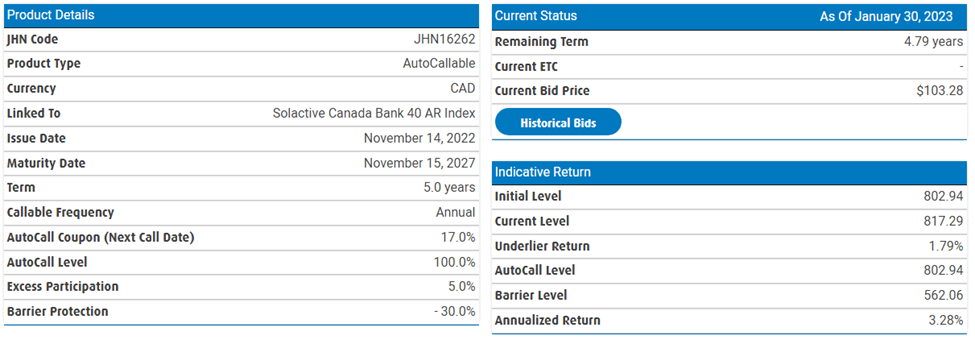

BMO JHN16262 – Auto-callable Note – New**

- Term – 5 years

- Underlying Investment – Canadian Banks

- Benefit – Potential for a 17% rate of return for each year held if the underlying investment trades above the original price on each annual observation date.

- Protection – 30%, original capital will be repaid in full if the note ends above 70% of original price.

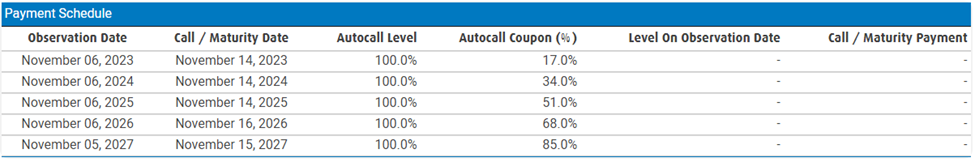

Scotia SSP3863 – Booster Note – New**

- Term – 5 years

- Underlying Investment – Canadian Banks

- Benefit – Growth of 86%, uncompounded rate of return of 17.2% per year, over the 5-year term if note remains at or above its original purchase price of $100.

- Protection – 20% – 100% of principle repaid if note remains below original price and above 80% of original price.

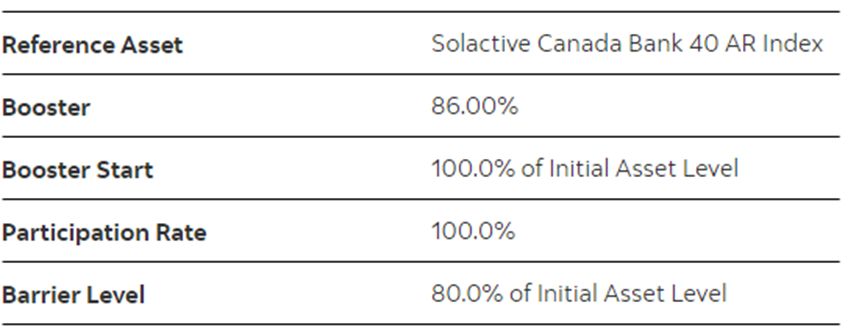

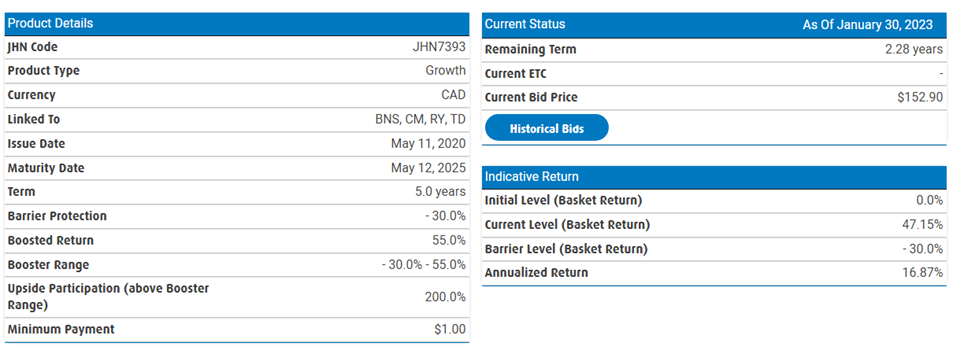

BMO JHN7393 – Booster Note – Existing

- Term – 5 years

- Underlying Investment – Canadian Banks

- Benefit – Growth of at least 55%, uncompounded rate of return of 11% per year, over the 5 year term if note remains above 70% of original purchase price of $100.

- Protection – 30%

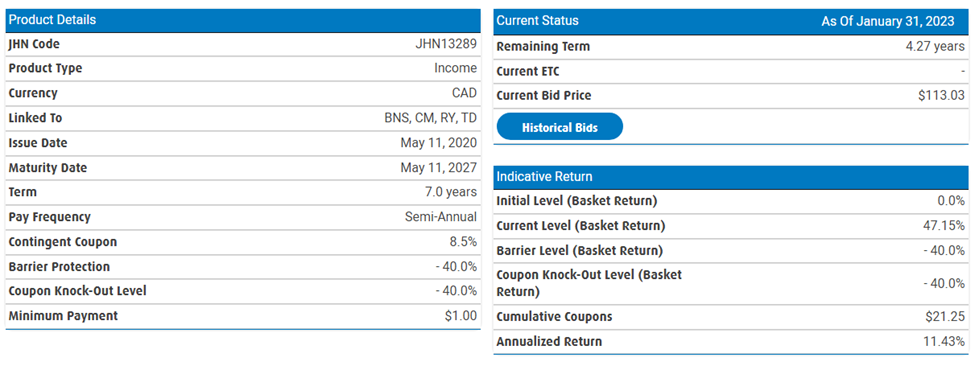

BMO JHN13289 – Coupon Note – Existing

- Term – 7 years

- Underlying Investment – Canadian Banks

- Benefit – Coupons of 8.5% Annualized if the note trades above 60% of original purchase price of $100.

- Protection – 40%, original capital will be repaid if the note ends above 60% of original price.

A Measured Approach for Equities

Early in January, we noticed a small rally in the markets and some technical data suggesting that we may be at the start of the new rally into 2023. Inflation and interest rate policy is key is determining where the stock market goes from this point on. Although many remain skeptical of any significant surge this year, the price-action of equities is finding some momentum and slowly breaking out. By strictly adhering to technical data relating to price action of equities, early in 2023 we implemented a 3-tiered equity re-entry strategy to participate in a market rebound without exposing ourselves to potential ‘bear-traps’.

Given the volatility surrounding many individual stocks, we have chosen to use the S&P 100 index which holds 100 of the largest US equities with a bias towards some discounted tech giants. Once we decided on this vehicle, we set forth 3 price ranges where we would enter the market with subsequent exit price points should the market reverse on us. The exit price points do not have a long leash and we will be quick to exit swiftly and decisively if a reversal occurs at our sell price points.

So far, we have executed our first two entry price tiers and are waiting on confirmation before allocating the third and final tier back in the equity markets. So far this year, the momentum favors being invested in stocks with a crucial technical confirmation (aka Golden Cross) that should play a big part for the remainder of the year.

=> Why might this be important? January Effect and The Golden Cross!

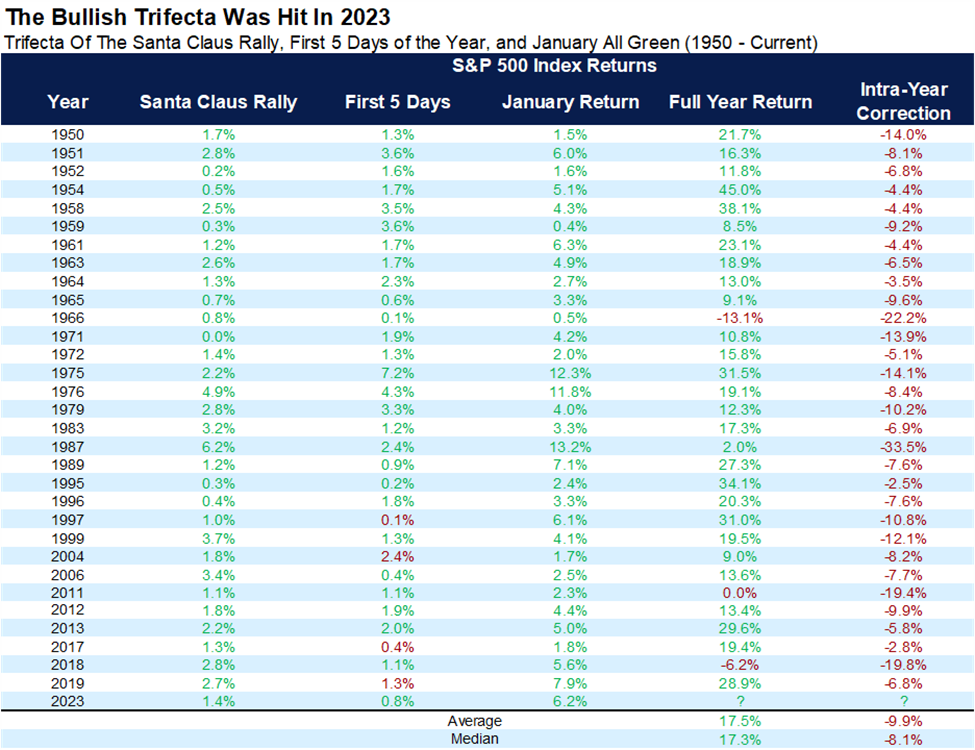

January’s stock market gains may be a good sign for the rest of the year. According to data dating back to World War II, “if the market is up in January, it has continued to rise in the remaining 11 months of the year more than 85% of the time and with an average gain of 11.5%” says Sam Stovall, chief market strategist at CFRA. In fact, if you look back at the times since 1950 where the Santa Claus Rally was positive along with a January that was positive, the full calendar years where 90% of times in the green with the average rate of return for the year being 17.5%. (Source: Carson Investment Research and Factset)

In addition to the positive sentiment of late, we are inching closer to a Golden Cross which is when the 50 day-moving-average (Blue Line) crossed upwards through the 200 day-moving average (Red Line). The S&P 500 is now very close at making this cross which historically has happened 36 times since 1950 and the median return over a 12-month period is 12.7% and higher 78% of times. You can see from the chart below that since 2012, whenever there has been a golden cross, the markets have generally performed very well in subsequent years.

Summary

We continue to see some encouraging sings around inflation and expectations are easing around aggressive rate hikes. There is a lot riding on the Fed meeting which wraps up today and we will see how the market reacts. January has been a good month so far and with the S&P 500 potentially breaking through its 200 day-moving-average, we are looking at being fully reallocated to the broad stock markets in the coming days. We will maintain our entry price point and be prepared to make another full stop should things unravel out of favor for stocks. So far, we have executed on two entry points in the S&P 100 with one more confirmation to go. We’ll see if we get there this week or the next.

To conclude, we have loosened our defensive stance since the month of November and have allocated upwards of 40% of portfolio values back into the markets using measured investment tools such as bank notes (to maintain our vigilance while providing with a superior rate of return) and a tiered entry point into the broad market. In the coming days, and if we get price confirmation on our third and last tier, we will be adding additional funds to the stock market which will put us nearly at our long-term strategic asset allocation.

We thank you for your continued trust and we welcome you to reach out to us with any questions you may have.

As your trusted Portfolio Managers, Terry and Kian, and the Caerus Private Wealth team is available to address any questions you may have.

This information has been prepared by Kian Ghanei who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The [Investment Advisor/Portfolio Manager] can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.