The holiday season is upon us, and we can hardly wait for some quality family downtime. The financial markets may be sharing the same level of excitement brought by the holiday season. After all, broad equity markets are up from their October lows, and so has the beaten-up bond markets. Much of this exuberance is brought upon by the consensus that the central banks may be changing their views around their hawkish stance and their declining appetite for larger rate hikes. The data in our own research shows that we are at or near a period of market entry and stock allocation within our portfolios. In anticipation of the tides changing, during the last few weeks we looked at some creative ways to add value to the portfolios.

In November, we designed and implemented two equity-linked investments in our models across all discretionary models. These two investments are structured as bank notes that offer superior risk/reward for our clients. This allocation brings us a step closer to our strategic asset allocation and away from our tactical defensive stance. Having said that, we are not yet fully invested in the stock market, but we feel that we are getting close in the coming days. After all, these are complex times and there are tremendous amounts of data that we need to consider and analyze to confirm a full re-entry back in the equity markets.

Powell’s Remarks

In yesterday’s remarks, Fed Chair Powell confirmed that the central bank will need to extend higher rates and that they still have some work left before getting inflation back under control. He mentioned that there are areas that are showing a cooling off in prices and that was encouraging. Investors were encouraged by his tone and the markets rallied to a point where the S&P 500 broke through its 200 day moving average.

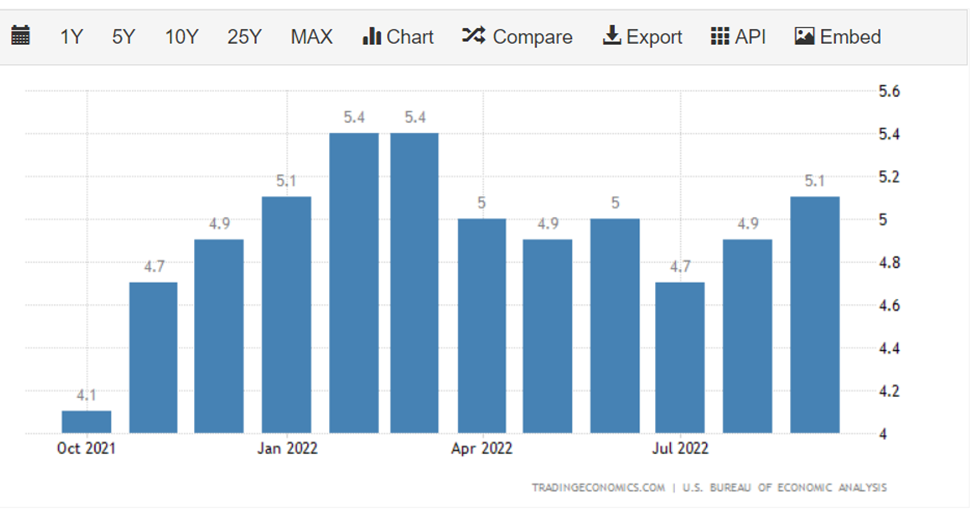

Focus On Core PCE Inflation – Minus Energy and Food

Powell downplayed the significance of the October CPI report, noting hotter-than-expected readings the prior two months. “It will take substantially more evidence to give comfort that inflation is actually declining.” Powell focused attention on the core personal consumption expenditures price index, which he said provides the best signal of where inflation is headed. At 5%, core PCE inflation, has moved up then down a bit, but has essentially shown no progress since December. (Source: tradingeconomics.com)

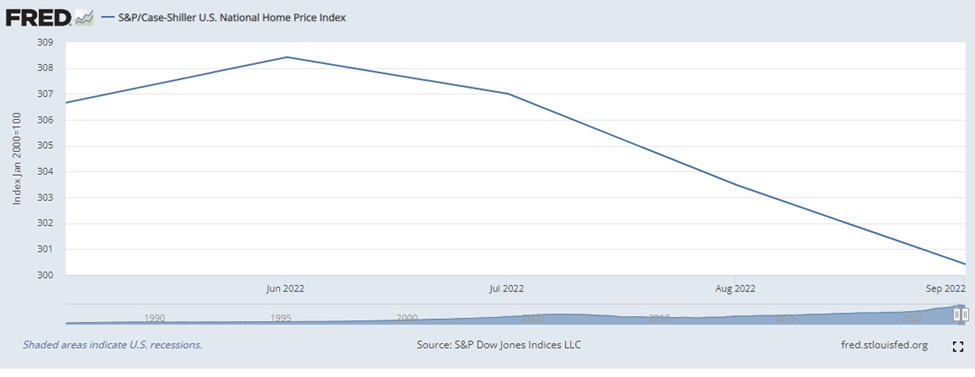

Powell said that the inflation rate for new lease prices for renters has “fallen sharply.” Once the bulk of leases are up for renewal, measures of housing inflation should begin to fall in 2023, he said.

Much of the data around new leases won’t be available until next year but the Case-Shiller index which was updated on Nov 29th indicated that the US Real Estate prices has fallen for the third straight month. Although real estate prices aren’t included in the CPI numbers, they do provide a glimpse into how higher rates are trickling down on overall demand and consumer behaviors.

Powell highlighted another area of concern for policymakers: core services inflation excluding housing. That accounts for more than 50% of the core PCE price index, including categories such as health care, education, and hospitality.

“This may be the most important category for understanding the future evolution of core inflation,” Powell said, because price changes are closely tied to wage growth. “The labor market holds the key” to inflation in this category, he said. We agree that labor market is an important key to tempering inflation along with consumer spending. (Source: CNBC)

The Labour Market & Consumer Spending

As mentioned above, the labour market strength and wage increases are a big factor in how the central banks view inflation. Since the beginning of the pandemic, the labour participation rate has fallen across the globe which means that there were several million voluntary and involuntary retirements/exits propelled by the pandemic and closures. A decline in the number of people in the labor market has resulted in more job openings and higher wages across the spectrum. This has been an important factor in consumer spending and consumption which accounts for nearly 70% of the GDP (unadjusted) in both Canada and the US. (Source: fred.stlouisfed.org)

In October, the US personal spending rose 0.8% from the prior month. The personal-consumption expenditures price index rose by 6% in October compared with the same month a year ago, which surprisingly marks an easing from 6.3% in September. (Source: US Commerce Department)

There is no doubt that the labour market is an important indicator for the central banks in determining the right policy going forward. There are some new developments around this that may be viewed optimistically by central banks, but more work needs to be done before the balance is met to normalize job openings and wage growth. Let’s look at the data around unemployment rate and job openings.

ADP Report – Lesser Job Openings

The ADP report published on yesterday, showed that Private hiring slowed in November signalling that perhaps the labor market is losing some strength. US companies added just 127,000 positions for the month which was a steep reduction from the 239,000 reported in October.

“Turning points can be hard to capture in the labor market, but our data suggest that Federal Reserve tightening is having an impact on job creation and pay gains,” said ADP’s chief economist, Nela Richardson. “In addition, companies are no longer in hyper-replacement mode. Fewer people are quitting, and the post-pandemic recovery is stabilizing.” (Source: Bloomberg)

In Canada, we’ve seen the unemployment rise from its June and July lows, but the Bank of Canada will more than likely increase its benchmark by another 0.50% in December.

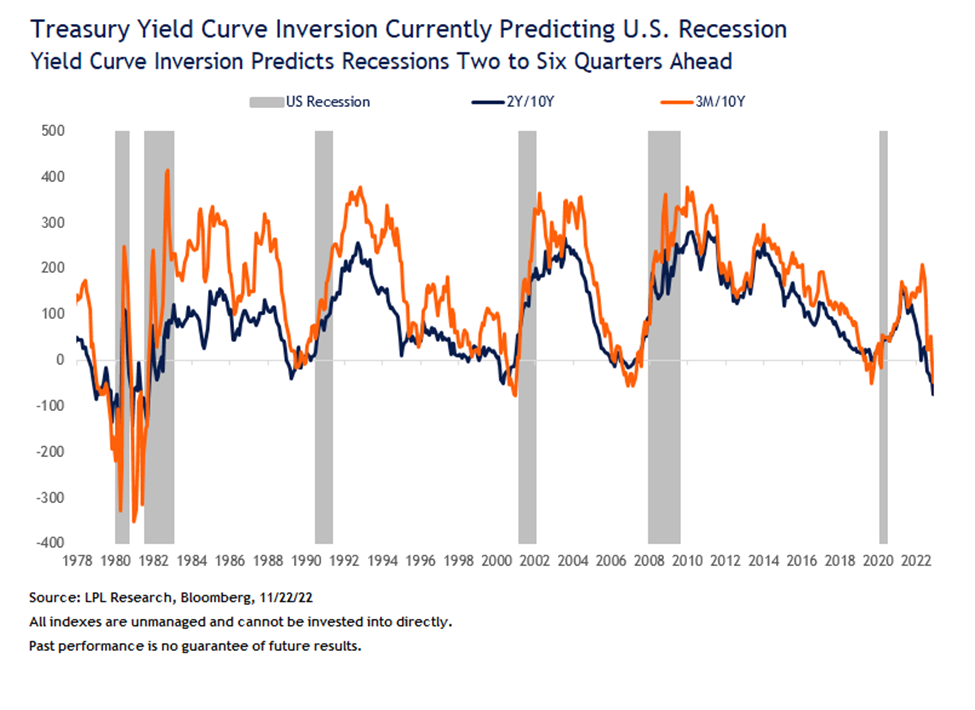

10 Year Yields on a decline – A Steeper Inversion

The shape of the US Treasury yield curve is used as a barometer for investors to determine economic growth. As mentioned in previous commentaries, in so-called normal times, the series of yields associated with the extension of time is often upward sloping. However, in times of high inflation, such as today, the yield curve will invert which often is a signal for a looming recession.

The yield curve is a powerful tool for many investors. For instance, when the yield curve is inverted, most headline will quickly call for an upcoming recession. In fact, to this day, there has never been a recession where the yield curve had not inverted. Having said that, a recession or an economic slowdown in today’s inflationary environment is welcomed by policy makers and investors. The reason for this is that it also signals a period in the future when interest rates must reverse course and come down to provide support to a period of economic slowdown.

The below graph is a great way to visualize what typically leads and lags a recession and its clearly shown here that an inversion of the 3 Month to 10 Year Treasury yield is viewed as a leading indicator of what’s in store down the road. Again, this may be counter intuitive for many investors but in a period of high inflation and high growth, an economic slowdown is welcomed and depending on its degree, may be bullish for the equity markets.

ISM Report

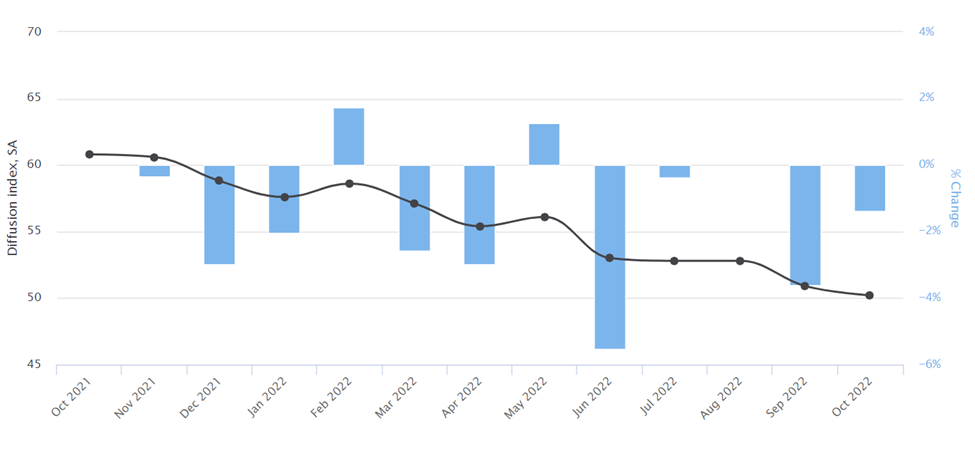

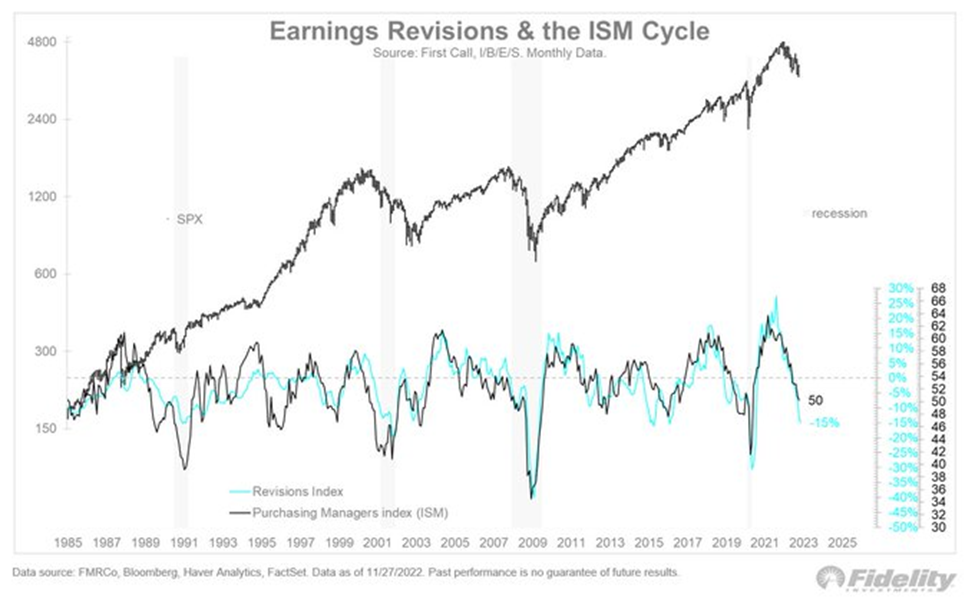

The ISM Report on Business is composed of data from over 400 purchasing executives in the manufacturing sector, representing 20 industries, corresponding to their contribution to the Gross Domestic Product (GDP) in all 50 states. A major feature of the report is the composite index, the Purchasing Managers’ Index (PMI).

The PMI is a composite index used only in the Manufacturing Report on Business. A PMI index over 50 represents growth or expansion within the manufacturing sector of the economy compared with the prior month. A reading under 50 represents contraction, and a reading at 50 indicates an equal balance between manufacturers reporting advances and declines in their business.

Since the start of the year, and the start of the tightening policy phase, the PMI index has been steadily declining and near contraction. This is a good measure of assessing the overall health of the business sector as they too will help slow down an overheating economy. (Source: Economy.com)

According to the chart below, if the PMI Index continues to shrink, not only will that most likely coincide with a recession, but it’ll also impact business earnings during those periods. Corporate earnings will be an important part of the eventual rebound and success of the stock market. Therefore, earnings will need to remain relatively strong during periods of a looser policy regime for the stock markets to rebound and elevate to new highs. (Source: Fidelity Investments & FactSet)

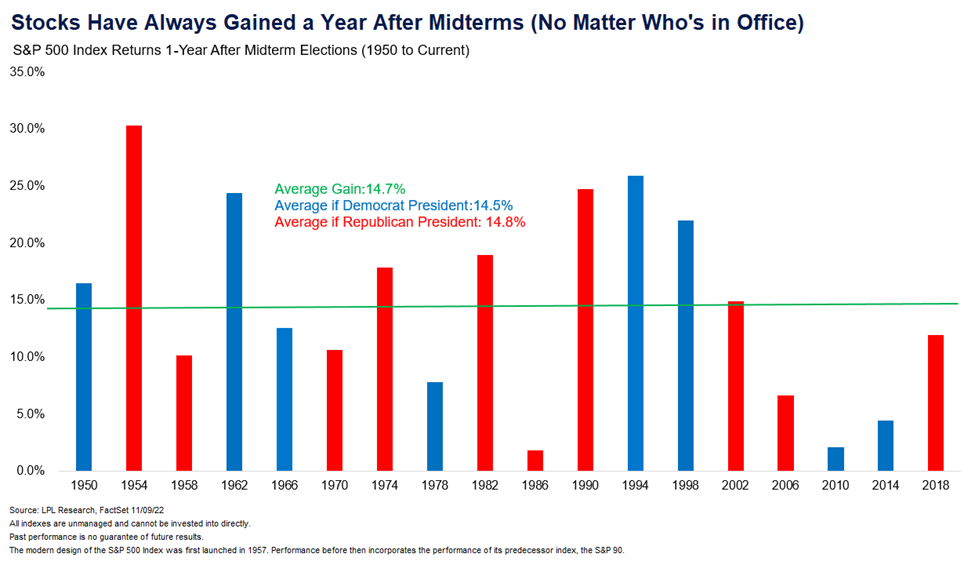

Post Mid-Term Elections – Supportive of stocks

The US midterms were interesting to watch. Generally, investors view a mixed government outcome as a market friendly event. Investors value certainty when it comes to the governing policies impacting the financial markets. As a result, a gridlock is normally viewed favorably because one party can’t unilaterally set policies. With the Democrats retaining control of the Senate and the Republicans taking a majority in the House, we can now shift our focus to past market trends relating to a post-midterm era and how that impacted the markets.

Since 1950, the markets have historically performed well in the year after the midterms. In fact, they have been higher 18 out of 18 times. Of course, there is no guarantee that this will repeat itself, but this does provide an interesting data point for us to consider. (Source: LPL Research)

In addition to the above, we are also entering a stage in the US presidential term that has historically been favorable for the stock market. The third year of this term has produced nearly 17% returns and has been positive 89% of the times since 1950, more than any other year of the presidential 4-year term. (Source: LPL Research)

Summary

We are beginning to see some encouraging signs around inflation. Although inflation remains above normal levels, the momentum is shifting downwards in important areas. We are seeing a decline in energy prices, a decline in business activity measured through the PMI Index, a decline in job openings, and personal consumption. Although things aren’t perfect, the momentum is encouraging and hard to ignore. The risk/reward opportunity for stocks is looking compelling, specially given the seasonality of stocks during the month of December as well as the fact that we’re heading into the third presidential year which historically has been very accommodative for the equity markets. With the S&P 500 breaking through its 200 day-moving-average, we are looking at reallocating to the broad stock markets in the coming days. We will maintain our entry price point and be prepared to make another full stop should things unravel out of favor for stocks.

In November, we loosened our defensive stance and have allocated upwards of 20% of portfolio values back into the markets using measured investment tools such as bank notes to maintain our vigilance while providing with an above-average r rate of return. In the coming days, we will be adding additional funds to the stock market to bring you closer to our long-term strategic asset allocation.

We thank you for your continued trust and we welcome you to reach out to us with any questions you may have.

As your trusted Portfolio Managers, Terry and Kian, and the Caerus Private Wealth team is available to address any questions you may have.

This information has been prepared by Kian Ghanei who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The [Investment Advisor/Portfolio Manager] can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.