It’s only fitting that Halloween falls on the Monday before the highly anticipated Federal Reserves meeting. All eyes will be on the Fed Reserve Chairman Jerome Powell as he will most likely announce a new rate hike of 0.75% followed by the Feds take on the current state of the US economy and an explanation of their plans in the coming months. It’s the latter that most people will attempt to decipher to gauge the extend of rate hikes down the line looking for any signs of a pivot in interest rate policy.

The stock market rose in the latter half of October. The markets seemed to implicitly call a ‘sooner-than-later’ pivot and a bottom in the stock market. The S&P 500 rose approx. 7.5% in the month of October with the TSX rising approx. 6.5%. These gains, as impressive as they are, came on the back of a lack luster earnings season that saw nearly double-digit losses amongst technology giant stocks such as Microsoft, Amazon, TSLA, and Meta. This surge is indicative of just how important interest rate policy will be in the coming weeks and months. Afterall, the stock market is looking into the future and it’s signaling a potential top in inflation and a pause in rate hikes heading into 2023. This may be true, but we need to look at the data that has been leading the tightening for validation of this assertion.

Alternatively, the above predictions may be too early, and we could see an extended rate environment causing volatility in asset prices across the globe as we’ve experienced in the number of months. We refrain from making prediction at this point. There are too many unknowns, and it would be sensible for us to maintain a watchful eye on certain economic indicators confirming a market direction before we jump in the deep end.

Let’s look at some key inflation metrics.

US Inflation Rate (including energy and food prices)

The annual inflation rate in the US slowed for the third month running to 8.2% in September of 2022, the lowest in seven months, compared to 8.3% in August but above market forecasts of 8.1%. The energy index increased 19.8%, below 23.8% in August, due to gasoline (18.2% vs 25.6%), fuel oil (58.1% vs 68.8%) and electricity (15.5% vs 15.8% which was the highest since 1981). A small slowdown was also seen in the cost of food (11.2% vs 11.4% which was the highest since 1979) and used cars and trucks (7.2% vs 7.8%). (Source: US Bureau of Labor Statistics)

The US Inflation Rate (including energy and food prices)

The decrease in the inflation rate is positive sign but is it acceptable by the Federal Reserve in making a potential pivot any time soon? Let’s have a look at the US Core Inflation:

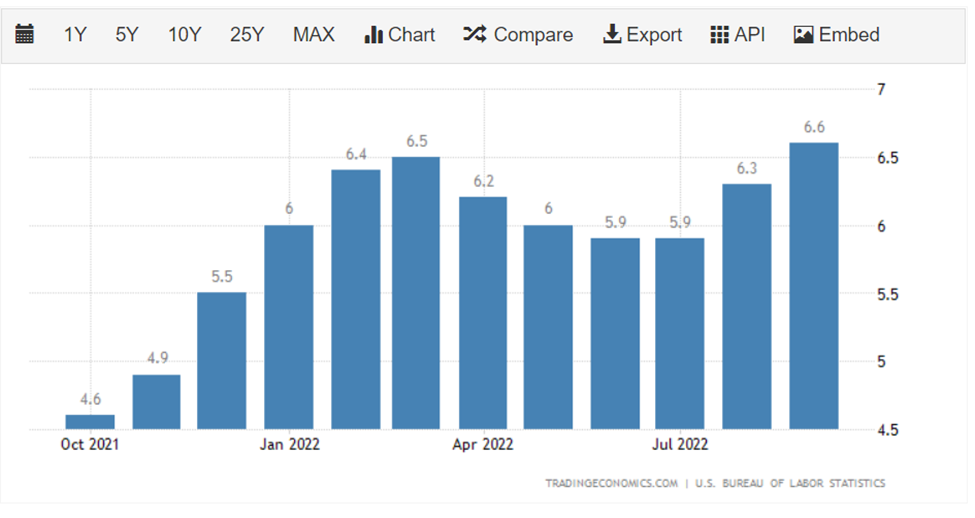

US Core Inflation Rate: (excluding energy and food prices)

The annual core inflation rate in the US accelerated to 6.6% in September of 2022, the highest since 1982 from 6.3% in the previous month and above market forecasts of 6.5%. On a monthly basis, underlying prices excluding energy and food prices rose 0.6%, the same as in the previous month, and above market expectations of a 0.5% rise. The indexes for shelter, medical care, motor vehicle insurance, new vehicles, household furnishings and operations, and education were among those that increased over the month. (Source: US Bureau of Labor Statistics)

The above September figures for inflation and core inflation aren’t encouraging. We realize that there is a lag here in reporting this pivotal number but simply don’t know just how ‘sticky’ this inflation is. This is a real challenge for central bans and its only gets more problematic when we consider other important indicators such as the tight labor market and the unrelenting consumer spending on both sides of the border.

Bank of Canada

The Bank of Canada surprised many by increasing interest rates by 0.5% versus the expected 0.75% from a month earlier. Those that are calling for a bottom in the stock market and a rally into the new year were quick to make the conclusion that the Fed Reserve may follow a similar path sooner than later. However, the situation in Canada is different than the situation in the US. We often refer to US data for a better gauge into the financial markets in Canada but that doesn’t hold most often when reversed.

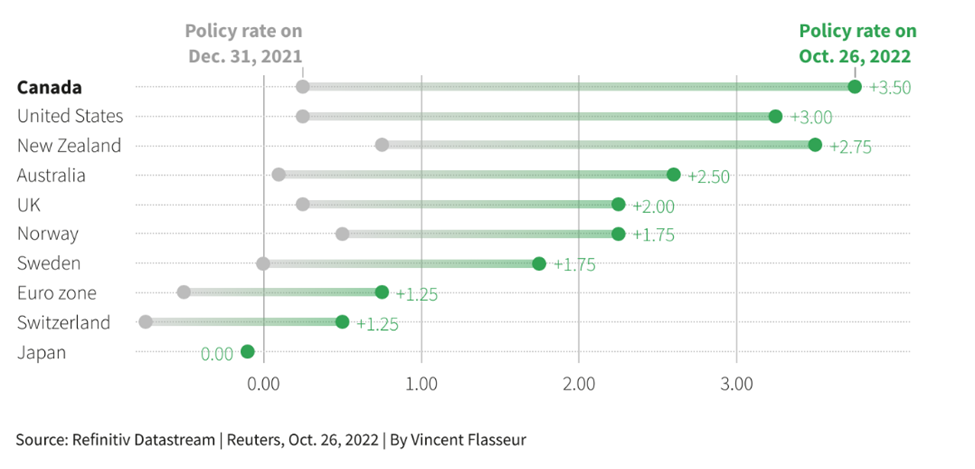

For instance, inflation in Canada hasn’t been as high as inflation in the US. Inflation in Canada was recorded to be 6.9% for Sept versus the 8.2% in the US while Core inflation came in at 6% versus 6.6% in the US in September. Furthermore, Canada so far this year, has increased interest rates by 3.5% high is higher than other countries including US, UK, New Zealand, Australia, Norway, Sweden, Switzerland, and Japan.

Furthermore, just over two months ago, Canada decided it was going to take a more decisive stance a few months ago when it raised rates by an unprecedented 1%. Globally, this remains to be the highest one-time rate increase amongst developed countries so far in 2022. (Source: Bank of Canada)

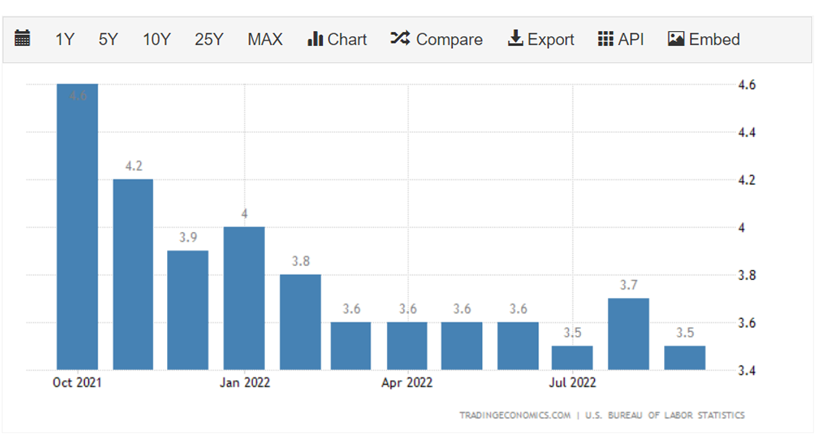

Unemployment Rate and the Labour Market

During September’s press conference, Jerome Powell said that “despite the slowdown in growth, the labour market has remained extremely tight, with the unemployment rate near a 50-year low, job vacancies near historical highs, and wage growth elevated.” He further went on to say that “FOMC participants expect supply and demand conditions in the labour market to come into better balance over time, easing the upward pressure on wages and prices.” Of course, this is an important part of inflationary pressures as a tighter employment market will typically push up wages and create an inflationary environment.

Unfortunately, the Sept unemployment rate of 3.5%, a 50-year low, did not showcase a slow down in the labor market as seen in August. The strength of the labor market is undoubtedly causing some headwinds for the central bank to control inflation and subsequently lessen future rate hikes.

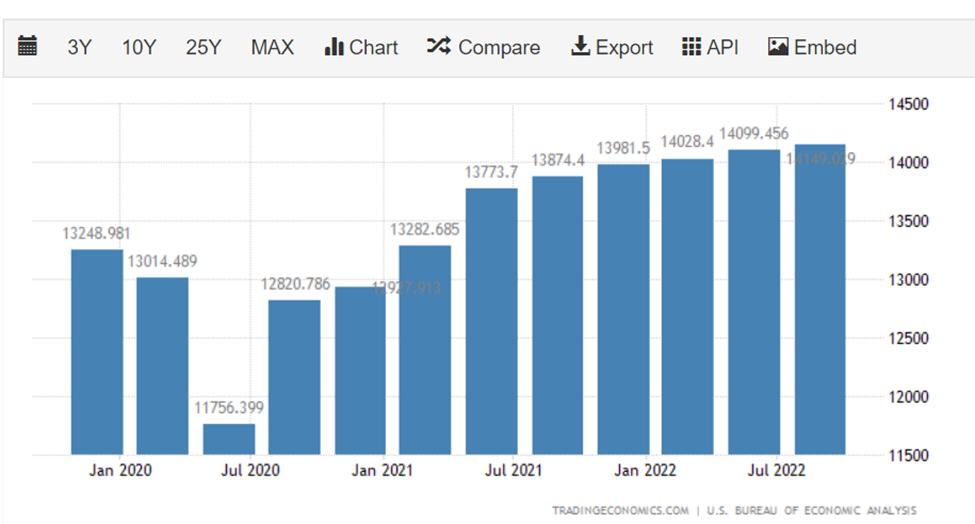

GDP and Consumer Spending

In our last month’s commentary, we mentioned that for the Fed and other central banks, bad news is good news. We are referring to the impact of the tightening environment and the effectiveness of central bank policy. According to the data, the central banks have yet to take a strong hold of the economy and more tightening will likely be required. Key metrics remain inflationary and not indicative of their inflation objectives. More evidence of this can be found in Gross Domestic Product (GDP) growth and number surrounding consumer spending which account for nearly 68% of the US GDP.

US Consumer Spending

US consumer spending has not slowed as much as policy makers had hoped. Many of these figures are delayed but the Q3 US Consumer Spending numbers came in higher than expected posing yet another challenge for policy makers.

Consumer Spending is a large part of the US economic engine. Naturally, this is the core of the problem, and the Fed is doing what it can to ‘cool’ this down by raising interest rates. As noted earlier, consumer spending accounts for nearly two-thirds of the US GDP so this is a big part of inflation and whether the US enters a period of GDP contraction or a recession.

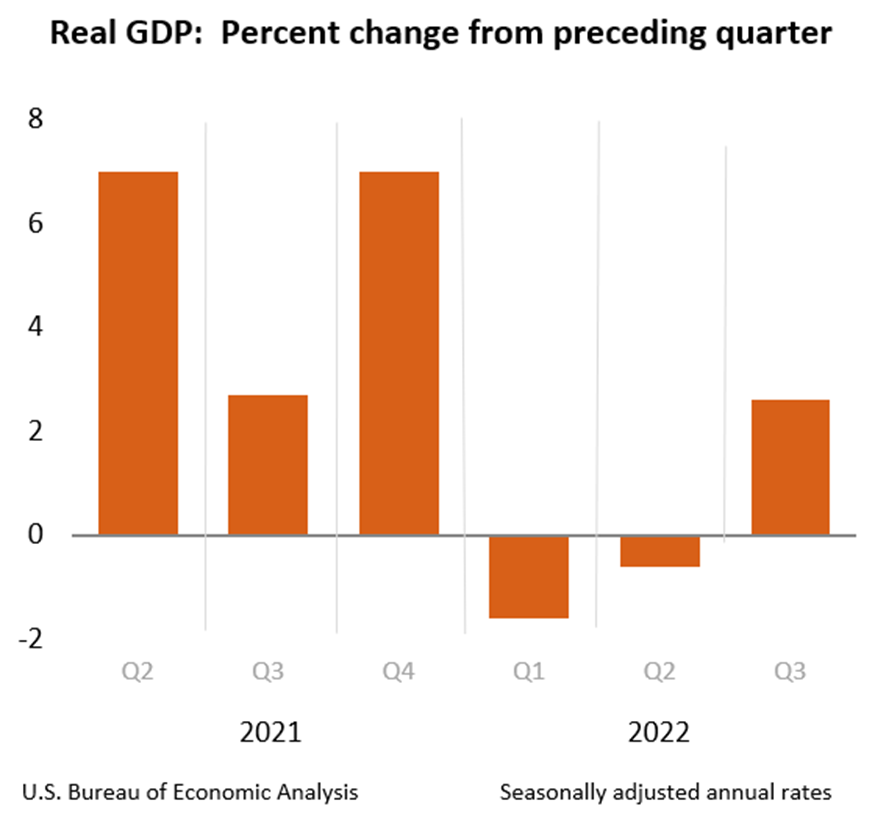

Recession rumor’s were put to rest, at least for the time being, when the US Real GDP numbers for Q3 came in higher than expected. Not only is the US economy not cooling, but in fact its now showing signs of expanding in the face of an aggressive fed rate hike policy. This is a problem that the Fed is facing when deciding on the next rate hike. For now, its anyone’s guess and the likelihood of higher and longer rate environment remains a possibility.

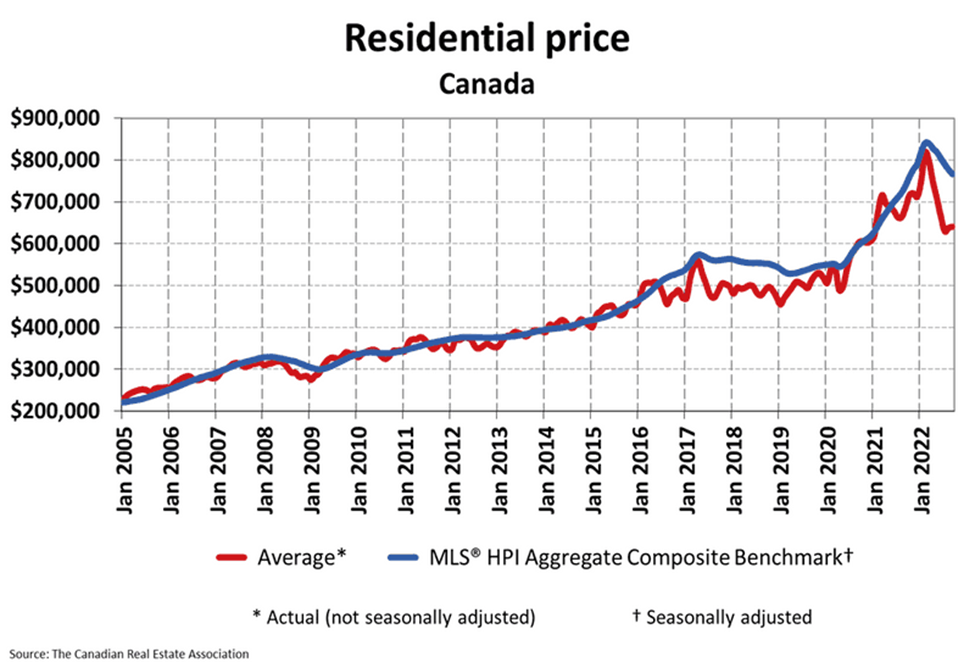

Real Estate and Housing – A look at Canada

The sector seeing the most headwinds is real estate. In October, statistics released by the Canadian Real Estate Association (CREA) show national home sales were down in September 2022. In our view, its normal for real estate to be impacted adversely in the face of an aggressive rate hike environment. Having said that, a prolonged rate hike policy could badly hurt the average US or Canadian consumer and cause a major deflationary environment down the road. Since the start of rate hikes, the ratio of debt to income for Canadians has been on the rise. Simply put, more of their income is going towards debt servicing than to discretionary spending.

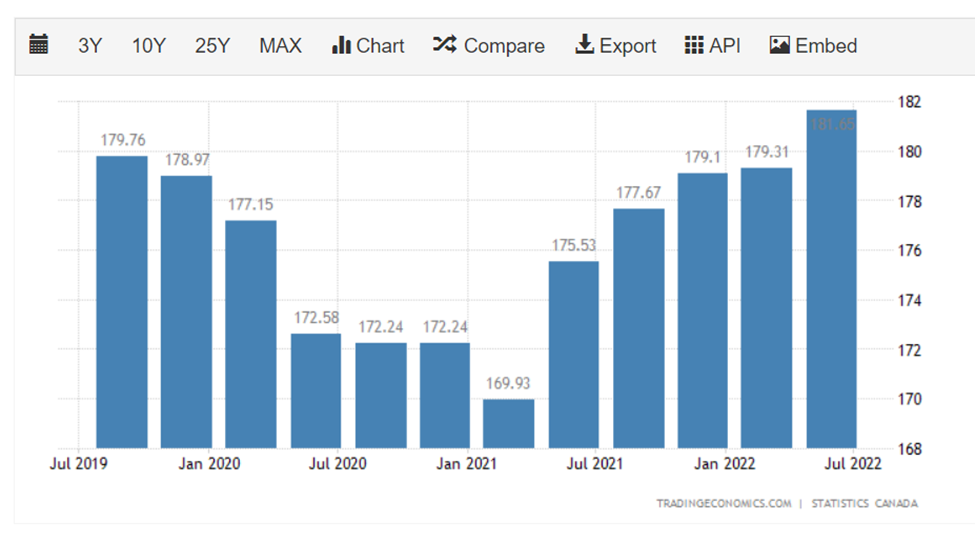

Canada Households Credit Market Debt to Disposable Income

Although not surprising, this should cause some concern if this pattern continues. Perhaps, the Bank of Canada sees a sizable crunch in disposable income which prompted them to increase rates by 0.5% this time around. High mortgage rates and stress tests have already sidelined many potential buyers and with inventory steadily increasing, we are seeing a decrease in real estate prices across the country.

Summary

To conclude, we’ll maintain our defensive stance and keep risk off until the time we see a clear runway and risk/reward balance tips in our favor. Although the rise in the equity indexes over the last two week is encouraging, we do not want to falsely conclude that there may be a shift in the Federal Reserves interest rate policy. In the upcoming FOMC meeting starting today, the Fed members will be discussing the US economy as well as deciding on the next rate hike which will be announced tomorrow on Weds Nov 2nd. We will tune in closely and listen to the language used for an indication of their intend in the coming months. As it stands, Chairman Powell has been very deliberate and explicit in describing the Feds sole objective of creating price stability and controlling inflation, and we’d be surprised if he changes his tone. Unless there is a change in overall objectives, we believe that the Fed should continue their hawkish stance and increase rates at the expected rate of 75 basis points. We will be listening for their views on consumer spending, the labor market, and core inflation. These factors as well as the tone used in his speech, will be a good sign for what we can expect heading into the new year.

As your portfolio managers, we thank you for your continued trust and we welcome you to reach out to us with any questions you may have.

This information has been prepared by Kian Ghanei and Terry Fay who are Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The [Investment Advisor/Portfolio Manager] can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.