The Dilemma…

When it comes to investing, there are times when it pays to be defensive. Last month, we stated that September is the most volatile month of the year for the financial markets. This time, things weren’t different. The current state of global financial markets seems to be in a severe disarray and there are competing issues and challenges that are posing unprecedented challenges for Central bankers and policy makers around the globe.

The dilemma faced by central bankers globally is difficult to overcome and with serious consequences. On one hand, they’d like to suppress inflationary pressures via rate hikes and reduced liquidity, but on the other hand, they would like to avoid a deep and painful recession. On the surface, they claim that their primary goal is price stability, but at the core, they understand the implications of aggressive rate hikes and the impact that may have on equity markets, bond markets, and currency markets. The contractionary policies have consequences, and as such, we are noticing signs of fragility and extreme volatility felt around the globe.

We’ll begin with the Bond Markets…

It shouldn’t come as a surprise to know that the bond markets have had an unusual level of volatility this year. Afterall, rates have steadily risen over the last several months which have put downward pressure on existing bond prices for many investors holding bond securities in their portfolio. 2022 has proven to be a textbook example of what happens to an traditional fixed income portfolio during a rising rate environment. In a normal rate increase environment, bonds tend to be less volatile, but the last several months hasn’t been normal. The velocity and degree of rate hikes this year has caused double digit losses for many investors. In fact, year-to-date, the US Aggregate Bond Index (Source: SP Global) is down nearly 13%.

This is far from what bond investors come to expect from their fixed income portfolios, and in the UK, it has prompted the UK Central Bank to step in to prevent further losses in this segment of the market. The iShares Global Aggregate Bond Fund is down nearly 20% in the last year which speaks volumes to what some pension funds in the UK and other parts of the world are feeling.

The Currency Markets

The US Dollar’s recent surge against other currencies has sparked a series of concerns also. The US Dollar historically has been perceived as a safe haven and used as a flight-to-safety strategy during times of global uncertainty. In other words, the US Dollar and US Treasuries are preferred over risky assets during periods of economic fragility. Furthermore, the Federal Reserve has been very deliberate and aggressive in its rate hike policy whereby making its Treasuries more attractive to investors in comparison to some of its counterparts at the European Central Bank or the Bank of Japan. This pattern is similar and resembles other periods of uncertainly such as the one experienced at the onset of the pandemic and during the global financial crisis of 2007-2008.

The surge in the US Dollar is creating an untenable situation for the US stock market. Michael Wilson, the chief equity strategist at Morgan Stanley, said on Monday that based on his calculations, a 1% rise in the US Dollar Index has a negative 0.5% impact on S&P500 earnings as a stronger US dollar will make foreign earnings less profitable. Similarly, he stated that a strong US dollar will reduce earnings growth in the fourth quarter of 2022.

The S&P 500 is in a bear market territory which means it has declined by more than 20% from its peak. The Nasdaq has been in bear market territory for a few months now and has lost over 31% of its value from its peak. The fact is that an accelerated rising rate environment is not only damaging to bonds but all assets including equities, real estate, precious metals, and crypto currencies.

Real Estate

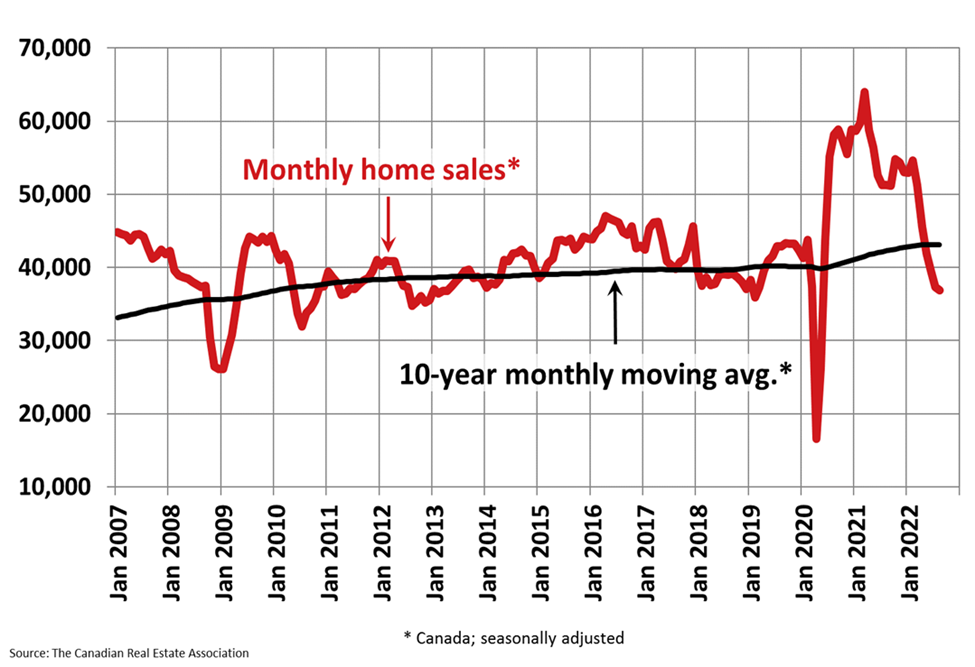

In Canada, Canada’s national housing agency has forecasted that Canadian real estate will see a drop of 15% over the next year as mortgage rates continue to climb. This shouldn’t surprise anyone as total ownership costs, including mortgage payments, are now up to 60% of a typical household income. With that in mind, things may worsen in October as the Bank of Canada revisits another likely rate hike. (Source: CMHC)

The actual number of transactions in August 2022 came in 24.7% below the same month last year. While still a large decline, it was smaller than the 29.4% year-over-year drop recorded in July. (Source: Canadian Real Estate Association)

The Pandemic housing boom saw U.S. home prices soar 42%. Heading forward, some of those gains will get erased. On Tuesday, the price reduction finally showed up in the Case-Shiller US National Price Index as the reading for July came in 0.24% below its June reading. That marks the first month-over-month decline in home prices since 2012.

While this is a small numerical drop in the Case-Shiller Index, it’s still a clear indication of a trajectory shift. The decline is also bigger than it first appears, because the Case-Shiller Index is a lagged three-month average. That means the price drop in July was sharp enough to wipe out all gains in May and June. (Source: John Burns Real Estate Consulting)

The ‘R’ Word Getting Louder

In a survey released by the Switzerland-based World Economic Forum on Wednesday, seven out of 10 respondents in a sample of 22 leading private and public sector economists said they believed a global recession was at least somewhat likely in 2023. (Source: Weforum.org)

Meanwhile, Ned Davis Research, a Florida-based research firm known for its Global Recession Probability Model, raised the likelihood of a global recession next year to 98.1 percent, the highest since the COVID-19 pandemic-related downturn of 2020 and the global financial crisis of 2008-2009.

Many believe that we are currently living through a recession and its not a matter of if but a matter of when. They are pointing the blame on central banks such as the Federal Reserve Chair, Jerome Powell, for miscalculating the problem of inflation and waiting for too long to attempt to cool it. Wharton Business School professor Jeremy Siegel criticized the Federal Reserve and its chairman, Jerome Powell, on Monday, saying the U.S. central bank is moving too aggressively to fight inflation and will hurt American workers in the process. He went on further to say that Jerome Powell “owes the American people an apology”. (Source: CNBC)

Outside of North America

Outside of the US, economic headwinds offer little cause for optimism. Germany, Italy and the United Kingdom, three of Europe’s largest economies, are expected to undergo lengthy recessions next year, largely due to the energy supply issues caused by Russia’s invasion of Ukraine, the Organisation for Economic Co-operation and Development (OECD) said earlier this week.

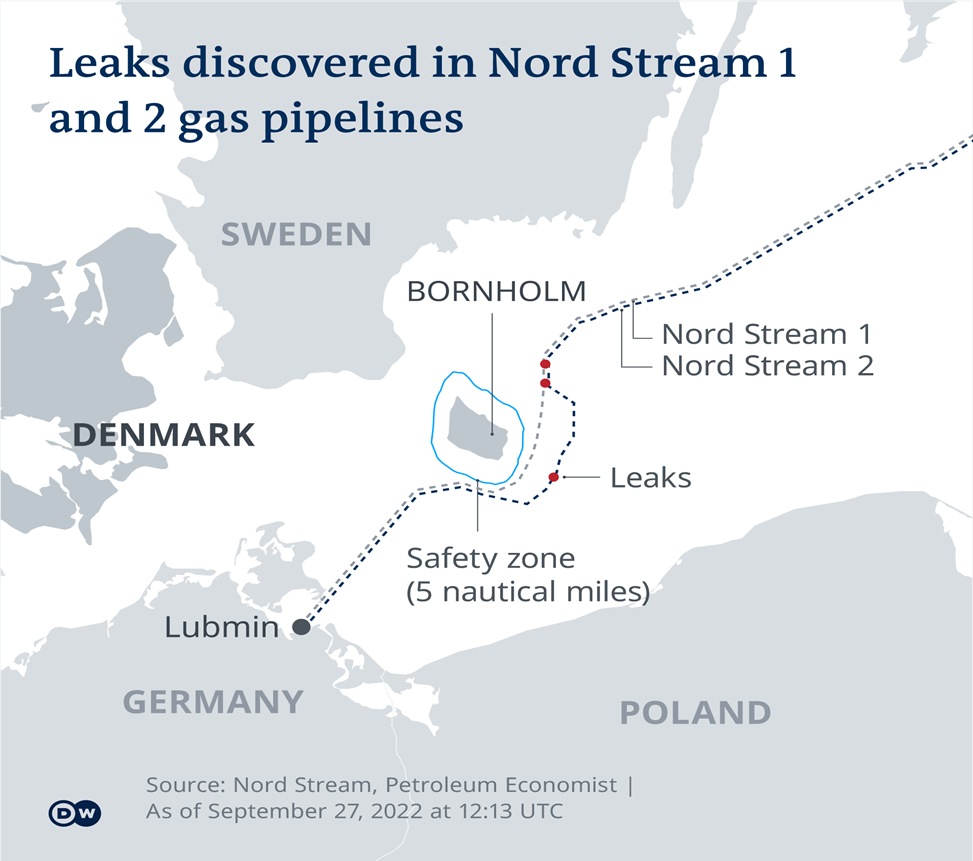

In light of the recent explosion and the suspected sabotage of Nord Stream pipelines, European companies are trying hard to find some answers. Before the pipeline leaks discovered Tuesday, natural gas prices in Europe had dropped from their all-time peak in late August because countries have filled storage facilities to 87 per cent of capacity ahead of winter, when demand for the fuel soars to heat homes and generate electricity. But Europe’s natural gas prices have spiked about 14 per cent since the pipeline ruptures rattled nerves about energy security. (Source: CBC)

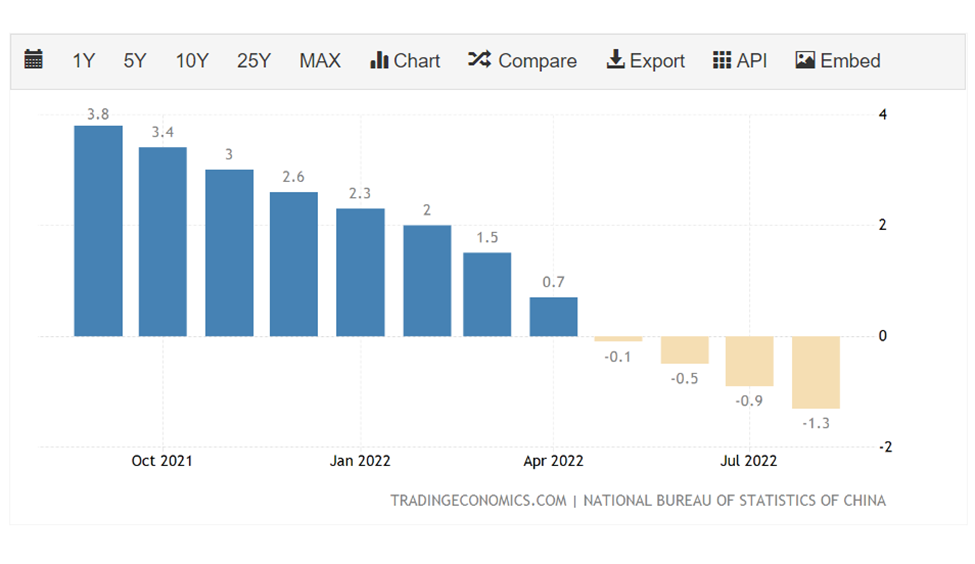

In addition to the above risks, the looming Chinese real estate crisis could cause a ripple across many global economies. Investors are underestimating the potential risk of a collapse in China’s struggling real-estate market, famed short-seller Jim Chanos has warned. The hedge fund manager said Wednesday that while they focus on Russia’s war on Ukraine and the Federal Reserve’s interest rate hikes, they’re missing a massive story happening in China. Chanos described Chinese apartments as the second-most important asset class in the world, after US Treasurys. Overseas investors have over looked the struggles in China’s real-estate sector, despite its importance. (Source: Bloomberg) Below, is the price change of new home sales in China.

Summary

The financial markets around the globe are reacting to a tightening environment in the face of global inflation. This has created some severe shocks throughout the world and has prompted many to seek safe-haven securities such as US Treasuries. The ripple effect is felt through the currency markets and has led to a price correction in both bond markets and equity market around the globe. Policy makers and central banks may be closer to pivot their tightening policy regime, but we think some more pain is still ahead until we have a steady reduction in inflationary pressures in areas of consumer spending and loosening of the labor market. Sadly, this may take some more time.

In conclusion, we will remain defensive in our models. We continue to view that the current environment as not suited for risk-on assets such as stocks and bonds and we foresee more tightening from central banks in North America and around the globe. As Fed Powell said, there might be some short-term pain and we’d like to remain on the sideline until things become clearer from a policy standpoint and continue to look for better opportunities as they make themselves available. As a reminder, periods of extreme volatility are typically followed by a period tremendous growth and we believe we are well positioned to take part in that phase when the time is right.

As your portfolio managers, we thank you for your continued trust and we welcome you to reach out to us with any questions you may have.

This information has been prepared by Kian Ghanei and Terry Fay who are Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The [Investment Advisor/Portfolio Manager] can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.