IMPORTANT NOTICE: Apples 4-1 stock split took effect on Aug 24, 2020. The increased number of shares is not reflected in your August end statement so the account value will be misrepresented, but will be adjusted accordingly when the new issues are released to us later in September 2020.

Caerus Wealth August Commentary

Over the last 5 months, we have witnessed an incredible stock market rally propelled by the technology, internet and communications sectors. In fact, the S&P 500 had its strongest performance in the month of August in over 36 years. Given all that, are we due for a breather? Or are the markets poised for setting new all-time highs? Let’s examine a few drivers that may pose opportunities or risks in the coming months.

Potential Stock Market Risks

- COVID-19 continues to cast a shadow on economic activity and on our everyday lives. With the start of the school year, we may encounter an uptick in its spread. Only time will tell.

- COVID-19 vaccine trials may prove ineffective or take much longer to successfully distribute.

- Permanent unemployment will be important to keep an eye on. We will watch to see if the economic recovery will help those that have lost jobs to regain employment again.

- Political turmoil and unrest caused by the polarizing upcoming elections. Aside from the markets, this upcoming election seems to be the most important election in the history of the United States. With so much riding on it, we can expect the unexpected.

- Failed stimulus negotiations. Although there is some progress being made here, things could turn for the worst if the two sides do not find a way to compromise.

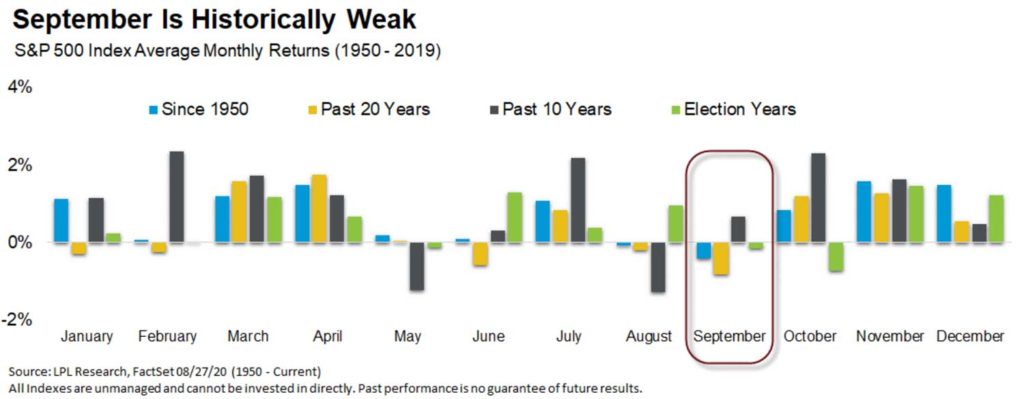

- On average, September is the weakest month of the S&P 500 dating back to 1950. Back to school months have never been overly joyful for the stock market. We will see if this time will be different.

Potential Stock Market Opportunities

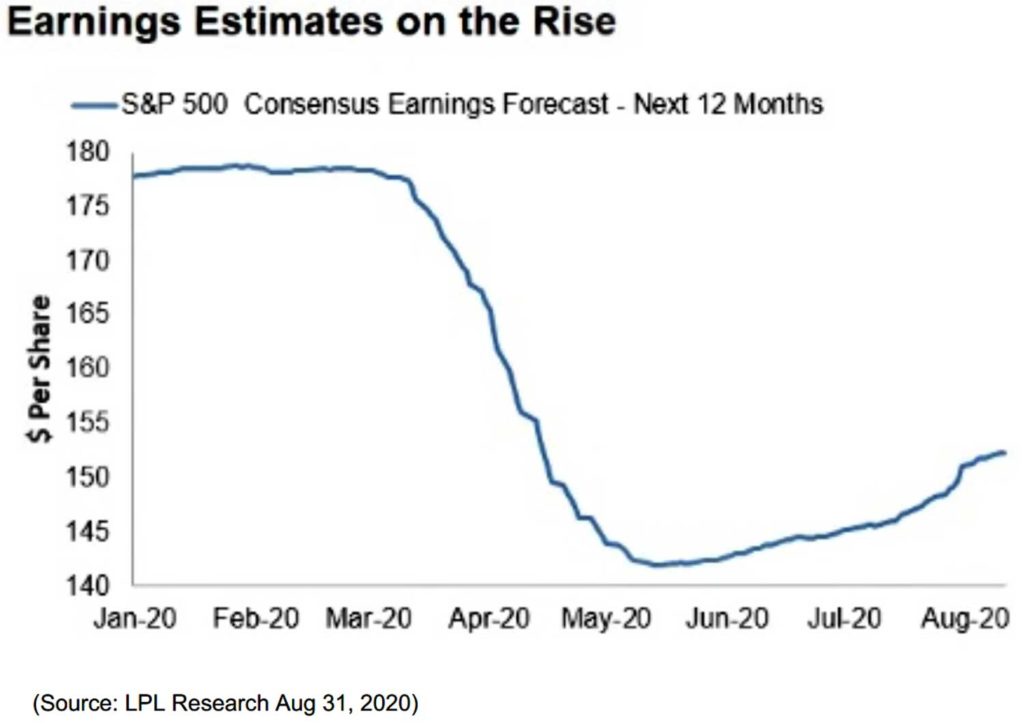

Earnings have been better than expected so far: Earnings continue to be better than expected on both sides of the border and the trend is indicative of an economic recovery. If this trend continues, we could see stocks rally to new all-time highs. Goldman Sachs just recently increased its 2021 earnings to $170 per share which will bring corporate earnings back to the pre-COVID-19 levels (Source: Market Insider).

The Feds new stance on Inflation

The Federal Reserve Bank Chair Jerome Powell announced a major policy change in the target inflation rate. Although we do not know what this target has been raised to, there is speculation that the target could be raised to as high as2.5% opening the door to an increase in future stimulus and monetary easing (Source: CNBC).

Progress surrounding the stimulus negotiations

It appears that House Democrats and the White House are $500 billion away from passing the next stimulus package. Although it is not clear how a potential deal could impact US citizens and the overall US economy, it is a positive step in the right direction and reassuring that something will be agreed upon soon. This will mark another $2 trillion in stimulus that will be used in the recovery of the US economy.

Investor sentiment

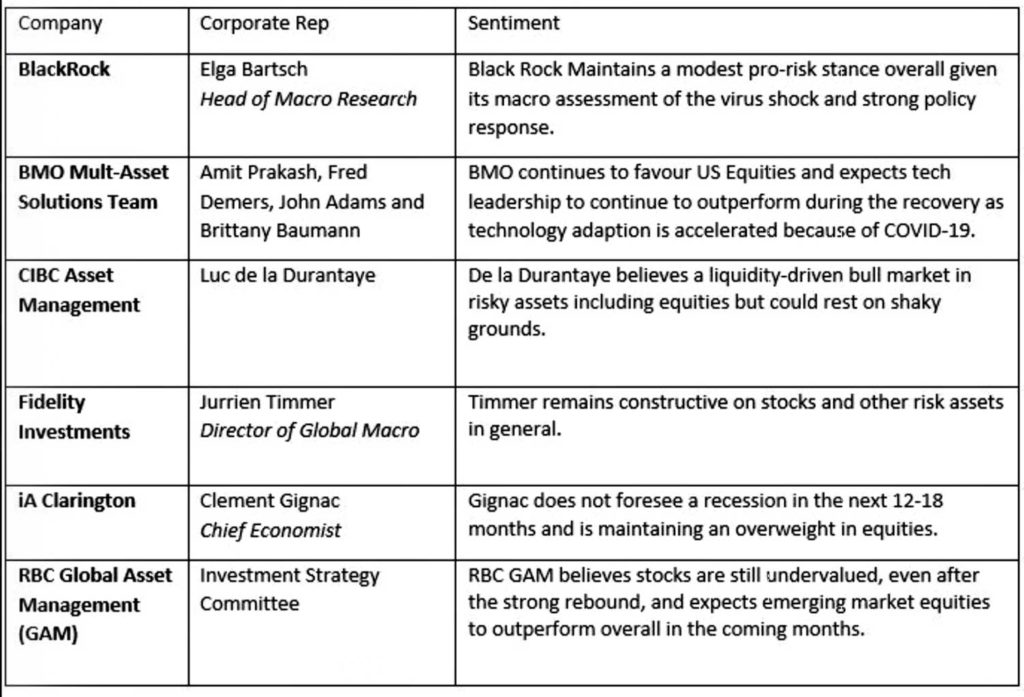

With investor sentiment on the rise, we could see more injection of capital in the stock market within the next few months. This follows an overall sentiment of large investment institutions and a large pile-up of cash in check-able accounts in the US. iA Wealth collected and compiled market outlook sentiments from large investment institutions in both the USA and Canada and the results are overwhelmingly bullish. Here are some notable examples from the overall report:

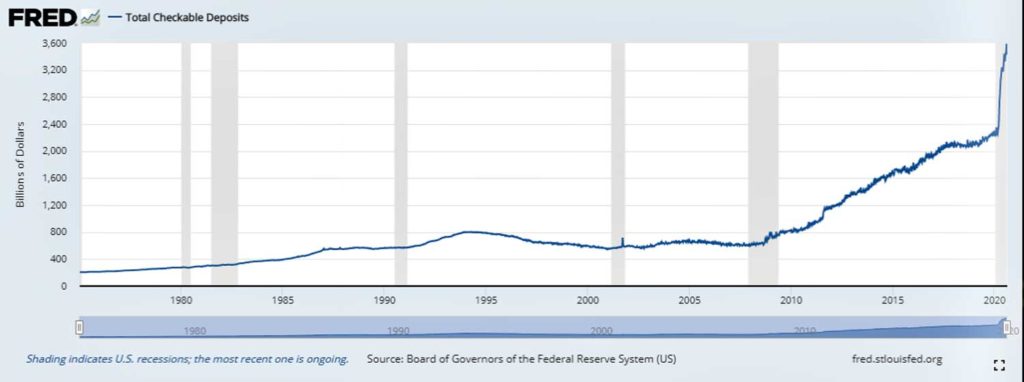

From a contrarian standpoint, there seems to be an increasing accumulation of checkable deposits in American bank accounts as measured by the Board of Governors of the FederalReserve System. In fact, the Total Checkable Deposits accumulated in the banking accounts of Americans now balloons to over $3.5 trillion which investors feel will help asset prices when they are eventually used to purchase investments that offer a better opportunity than the zero percent offered by deposit accounts as interest rates remain at historically low levels (Source: Fred St. Louise Federal Reserve).

Caerus Wealth Portfolios

The Caerus Wealth portfolios are diversified across several asset classes and service sectors presenting the best chance of success in a prolonged COVID-19 environment. Our unique internal process grants us the ability to remain objective and disciplined as we continue to navigate through a challenging year. Our research is focused on companies with increasing profitability and supporting trends and at the present time continue to see a great deal of upside broadly in technology and healthcare. We will continue to monitor new data as we head into Q3 and will make the necessary changes as we head into the election season.

As your trusted Portfolio Managers, Caerus Private Wealth and its team are available to address any questions you may have. Stay safe!

Terry Fay, Director, Private Client Group, Portfolio Manager

Kian Ghanei, Director, Private Client Group, Portfolio Manager

Caerus Private Wealth – HollisWealth, a division of Industrial Alliance Securities Inc.

700 – 609 Granville Street, Vancouver BC V7Y 1G5

T: 604.895.3316 | TF: 1800.665.2030 | F: 604.682.0529

terry@caeruswealth.ca | kian@caeruswealth.ca

holliswealth.com | caeruswealth.ca

This information has been prepared by Terry Fay and Kian Ghanei who are Portfolio Managers for HollisWealth® and does not necessarily reflect the opinion of HollisWealth. The information contained in this newsletter comes from sources we believe reliable,

but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or

sell any of the securities mentioned. The information contained herein may not apply to all types of investors. Terry Fay and Kian Ghanei can open accounts only in provinces in which they are registered. HollisWealth® is a division of Industrial Alliance Securities

Inc., a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada.