Over the last month, we have seen some improved conditions in both the economy and the financial markets. While some are calling for a rebound in the stock markets from their lows a few weeks ago, the landscape remains fragile and uncertain. As before, inflation will be key in determining the path of future policies and subsequently the trajectory of the markets. As it stands currently, the inflation heat is still on and its difficult to assess the current effectiveness of the steadfast contractionary policy on both sides of the border.

Inflation Data

In the United States, unadjusted Consumer Price Index is based on the prices of a market basket of food (14 percent of total weight), energy (9.3 percent), commodities less food and energy commodities (19.4 percent) and services less energy services (57.3 percent). The last category is divided by shelter (32.1 percent), medical care services (5.8 percent) and transportation services (5.5 percent). The June inflation number came out at 9.1% which marked the highest inflation rate in the US since 1981. Core CPI which excludes food and energy increased 5.9%, slightly below 6% in May, but above forecasts of 5.7%. (Source: US Bureau of Labor Statistics)

Canada’s inflation rate rose to 8.1% last month, Statistics Canada says, the fastest annual increase in the cost of living in decades. The data agency said gasoline was the biggest single contributor to the overall rate going up, as pump prices were up by 54.6 per cent compared to the same month a year ago. If gasoline is stripped out, the inflation rate would be 6.5 per cent. Another major source of inflation this year has been food prices, which rose by 8.8 per cent in the past year. (Source: Stat Canada)

It’s not surprising that the Bank of Canada rose short term rates by 1% in June. The Federal Reserve similarly continued the tightening policy with a 0.75% rate increase to the feds fund rate which now sits at 2.5% which is considered to be their neutral target range whereby their monetary policy is neither contractionary nor expansionary. The rate hike didn’t come as a surprise but what came as a surprise during the 2-day FOMC meeting was that the Fed did not give any indication of additional rate hikes and instead suggested an ad hoc approach in the coming months to assess the data surrounding inflation. The financial market reacted favorably to this and began to price in a possibly pivot or shift in policy should inflation slow and begin a downward trend. After all, the Fed is remaining its focus to manage ongoing inflation without having to create a deliberate recession which might be very difficult given the technical recession they are currently in.

Technical Recession

A technical recession is defined by two back-to-back quarters of shrinking GDP. With the second quarter GDP numbers out in the US, the US economy is technically in a recession. This narrative is being played aggressively by GOP politicians since we are in a mid-term election year. Many, however, argue that the US is not in a recession.

Treasury Secretary Janet Yellen said in a statement “we do see a significant slowdown in growth but a true recession is a broad-based weakening of the economy, and that is not what we’re seeing right now.” She also flagged that the official arbiter of recessions in the US is the National Bureau of Economic Research. James Poterba, the NBER President and Chief Executive Officer, said Thursday that the recession-dating committee doesn’t believe in “the two-quarter-declining GDP rule.”

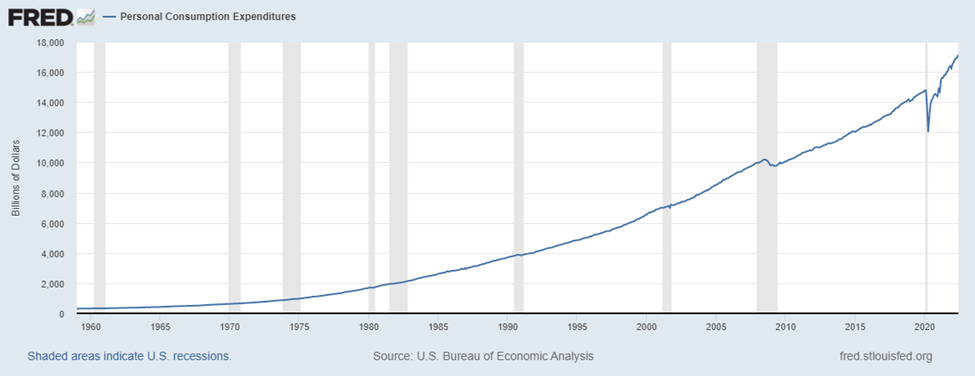

There are several factors that play a part in the ‘broad-based’ definition of a recession, but the two most important ones tend to be consumer spending and unemployment. In the US, consumer spending, although slowing down, remain elevated and has yet to show a significant slowing down.

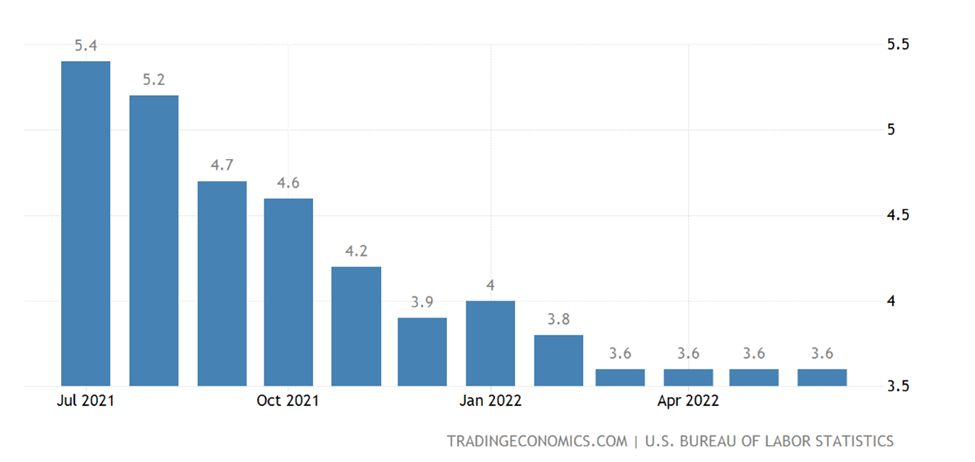

The Unemployment rate in the US for June remained at 3.6%. This level has held for 3 consecutive months. Considering the latest consumer spending figures as well as the unemployment rate holding firmly at 3.6%, its hard to say that the US is in a recession at the current moment. This assessment, however, does not mean that the economy won’t slow down in the coming months. Rate hikes often take several weeks and months to combat spending and capital expenditures. If these factors don’t slow down substantially, its difficult to see an ease in inflationary pressures and therefore a pivot in rate policy in the fall.

Canada’s Economy

The Canadian economy grew at an annualized rate of 4.6% in the second quarter, boosting market expectations of another big interest rate hike in September. The result outpaced the central bank’s July 13 forecast for 4.0% annualized growth in the second quarter, up from 3.1% in the first. Although we may see a slowing down in GDP growth due to the aggressive tightening rate policy, we anticipate further rate hikes in the fall to combat inflation and rising prices. At this point, strong economic data should be viewed as indication of much higher rates and a rising probability of a broad-based recession in the months ahead.

SMI Reports

The SMI Reports are a great indicator of what manufacturers in the US are experiencing within their operations and industries. The Services PMI and Manufacturers PMI survey reports are conducted by surveying 300 businesses across various sectors. Let’s look at the most recent surveys for June and assess the current economic activity as it relates to various services and manufacturers. A Manufacturing or Services PMI reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally declining. (Source: ISMWorld.Org)

Services PMI Survey

Economic activity in the services sector grew in June for the 25th month in a row — with the Services PMI registering 55.3 percent, say the nation’s purchasing and supply executives in the latest Services ISM Report. This survey overall is pointing to higher activity and elevated prices in service-related industries. The highlights of the report are summarized below and although there are some signs of a slowdown in demand, the supply side remains the challenge and is most likely adding pressure higher prices. The report for July may be a better indication but not yet released. (Source: ISMWorld.Org)

- Supply chain and supplier reliability continues to improve for most of our key food and packaging needs. Equipment still (experiencing) typical long delays. Staffing employment challenges have resurfaced, and costs have dramatically increased on core needs, led by soybean oil products. Rise in diesel fuel affecting almost everything. – Accommodation & Food Services

- Interest rate increases have slowed sales but have not helped with supply challenges yet. – Construction

- The shutdowns in China due to the zero-COVID policy have adversely impacted our supply chain. – Health Care & Social Assistance

- Demand has softened across consumer product lines, channels and brands over the last year, to levels below those forecast earlier this year. Adjusting all outlooks down for the rest of year. The (Shanghai) omicron slowdown had an impact, but activity is slowly coming back. Information

- Energy services sector demand and activity remains strong. – Mining

- Consumers are shifting purchases away from our discretionary products to essentials. Inflation is definitely taking a bite from our sales, and mall traffic is far below the norm, potentially due to inflation, a need for more disposable income on essentials and less willingness to drive to malls. E-commerce sales will be going up again. – Retail Trade

- Despite higher inflation and energy costs, demand and business activity continue to be at record highs, with little sign of a slowdown. – Utilities

- Business continues to stay steady amid rising interest rates, a lack of labor, inflation, transportation problems and high gas/diesel prices. Outlook is measured due to economic headwinds. – Wholesale Trade

Manufacturing PMI Survey

Manufacturing grew in June, as the Manufacturing PMIregistered 53 percent, 3.1 percentage points lower than the May reading of 56.1 percent. The Manufacturing PMI continued to indicate sector expansion and U.S. economic growth in June. All of the six biggest manufacturing industries registered moderate-to-strong growth in June, in this order: Computer & Electronic Products; Machinery; Transportation Equipment; Petroleum & Coal Products; Food, Beverage & Tobacco Products; and Chemical Products. Here is a summary of the report. (Source: ISMWorld.Org)

- New Orders and Employment Contracting

- Production and Backlogs Growing

- Supplier Deliveries Slowing at a Slower Rate

- Raw Materials Inventories Growing; Customers’ Inventories Too Low

- Prices Increasing at a Slower Rate; Exports and Imports Growing

- Record-Long Lead Times for Capital Expenditures and Production Materials

Q2 Earnings Season

The number of S&P 500 companies reporting positive earnings surprises continued to rise over the past week. As a result, the earnings growth rate for the second quarter is higher today compared to the end of last week and compared to the end of the quarter. However, both the number and magnitude of positive earnings surprises are still below their five-year averages. On a year-over-year basis, the S&P 500 is reporting its lowest earnings growth since Q4 2020. The lower earnings growth rate for Q2 2022 relative to recent quarters can be attributed to both a difficult comparison to unusually high earnings growth in Q2 2021 and continuing macroeconomic headwinds. During the upcoming week, 152 S&P 500 companies (including two Dow 30 components) are scheduled to report results for the second quarter. (Source: Factset)

The Lag of Rate Hikes and Inflation

The current monetary policy is geared to combat inflation in an expeditious fashion. This ‘front-load’ approach of larger increases within a shorter period will help combat inflation from a demand standpoint but like other contractionary periods, there is a lag between rate hikes and the cooling down of inflation. Unfortunately, we won’t have the inflation data for the month of July for another two weeks or so, but July’s number could be a great indication as to the effectiveness of the aggressive policies adopted by both Canada and the US. Looking at the past periods of rate hikes, it may take inflation anywhere from 9 months to 2 years before it cools off. We don’t suspect that will be the case this time around but its important to be realistic about the possibility of a prolonged inflationary environment and the path for future rate hikes. Again, the next two months will be very telling as we head into two of the most challenging months of the year for the stock market, August and September. (Source: Bloomberg)

Summary

We remain our defensive stance. Although there are signs of improved inflationary conditions, such as lower energy prices, we maintain cautious in the face of a prolonged inflationary environment paving the way for future rate hikes. Although the US is in a technical recession, many broad factors are not indicative of a recessionary environment. Factors such as employment and consumer consumption remain elevated, and with continuous challenges surrounding the global supply chain, we are not crossing out the possibility of further rate hikes and an actual broad range recession. The next several weeks will be very telling and we believe will provide us with the confirmation and opportunity to redeploy our cash assets into suitable investments. As your portfolio managers, we thank you for your continued trust and we welcome you to reach out to us with any questions you may have.

This information has been prepared by Kian Ghanei and Terry Fay who are Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The [Investment Advisor/Portfolio Manager] can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.