Lately there has been a considerable amount of pessimism surrounding the outlook of the economy and stock markets. As a result, we have seen one of the most volatile trading months in a long time. The American Association of Individual Investors, which conducts weekly surveys amongst individual investors to assess their overall bullishness or bearishness of the market over the next six months, showed a sharp increase in the percentage of individual investors who are bearish about short term market expectations (Source: AAII Sentiment Survey). This serves as the second most bears in 10 years and highest level since early April 2013. (Source: AAII Sentiment Survey). There are several factors playing into this pessimistic narrative, and it is important to assess what this means for us today and in the months ahead. However, it is also important to note that many investors take these extreme bearish sentiments as signs of a rebound of the markets and this too cannot be ignored. Let’s have a look at some of the market drivers making an impact today and in the coming months.

Inflation

Inflation spiked in 2021 due to pandemic-induced supply constraints, soaring energy costs, labour shortages, increasing demand and a low base effect from 2020. Many believe, and for the right reasons, that Inflationary pressures are likely to last well into mid 2022.

In Canada, the Consumer Price Index (CPI) rose 4.8% on a year-over-year basis in December, up from a 4.7% gain in November. Excluding gasoline, the CPI rose 4.0% year over year. We continue to feel the impact of rising prices for groceries in December, as unfavourable weather conditions during the growing season and supply chain disruptions put upward pressure on prices. Supply chain disruptions also led to higher prices for durable goods, including passenger vehicles and household appliances, while higher construction costs and the increased frequency and severity of weather events contributed to rising home and mortgage insurance costs (Source: Statistics Canada).

In the US, the annual inflation rate accelerated to 7% in the last month of 2021, a fresh high since June of 1982, compared to 6.8% in November. Energy was the biggest contributor to the gain, but the rise was smaller than in November with gasoline prices surging 49.6% vs 58.1% (Source: US Bureau of Labor Statistics).

Why is inflation running so high lately?

The answer lies in three factors, however, these all lead back to one culprit: pandemic. The recent run up on prices can be attributed to historically low interest rates, historic government spending, and a disruption in the supply chain. It ultimately comes down to the good old supply and demand paradigm. The pandemic created an environment where governments and central banks needed to intervene and do what was required to keep the economy from collapsing. They implemented measures to assist business owners and consumers by lowering barriers and costs to access capital, and injected trillions of dollars into the system. Furthermore, closures and restrictions directly impacted trade and logistics which further pressured rising prices of goods. Simply put, more money is chasing fewer goods which will ultimately put upward pressure on prices until one or more of the inflation-causing factors ease. For that to happen, a repricing must occur in the market to account for a higher interest rate and less spending. This is what we have witnessed in the month of January.

A Valuation Reset (a.k.a a healthy correction)

Despite the volatility we saw this past month, we remain optimistic about the future of the economy and the markets. Ever since the central banks have been hinting at a more restrictive or hawkish stance on policy, we have experienced valuations (Price to Earnings Ratio) of the S&P500 trickle downwards from their peak in the first quarter of 2021 where they climbed to 23.4 to being down by approx. 3 points at the end of January 2022. A higher P/E ratio is indicative of an over-valued market which can explain the environment since the start of the pandemic where lower interest rates inflated prices (as calculated by the discounted cash flow model) which was further amplified by investors pouring money into the stock market (Source: Fidelity Investments).

The tide is now turning as it needs to. As central banks discuss some definitive interest rate hikes in the coming months, the discounted cash flow models that are used to evaluate stock prices are recalibrating and causing a reset of prices knowing that we are most likely going to see higher and higher interest rates in the coming months and years. This really shouldn’t surprise investors, and for most long-term investors, this should be viewed as a healthy part of a growing and recovering economy.

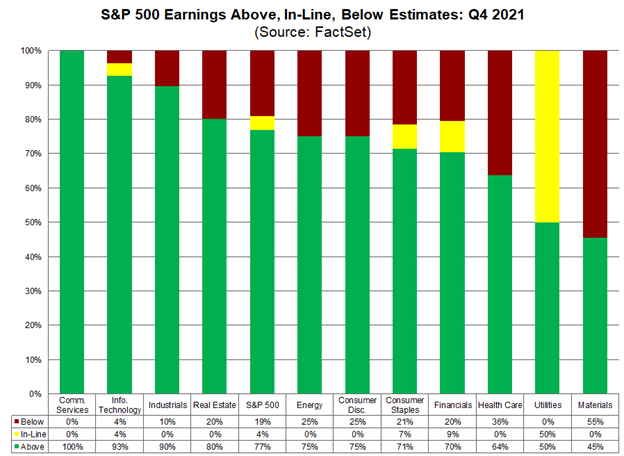

S&P 500 Earnings

For the markets to maintain their resilience, corporate earnings must remain healthy and strong. We are currently in the early innings of Q4 earnings season but with over 33% of S&P 500 companies reporting their earnings, we are noticing a healthy earnings theme so far. Of the ones that have reported so far, 77% have reported actual Earnings above estimates, which is above the five-year average of 76%. In terms of revenues, 75% of S&P 500 companies have reported actual revenues above estimates, which is above the five-year average of 68%. In aggregate, companies are reporting revenues that are 2.5% above the estimates, which is also above the five-year average of 1.5%.

COVID Update

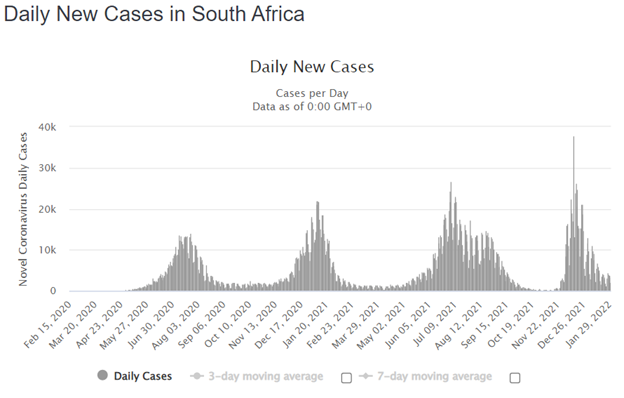

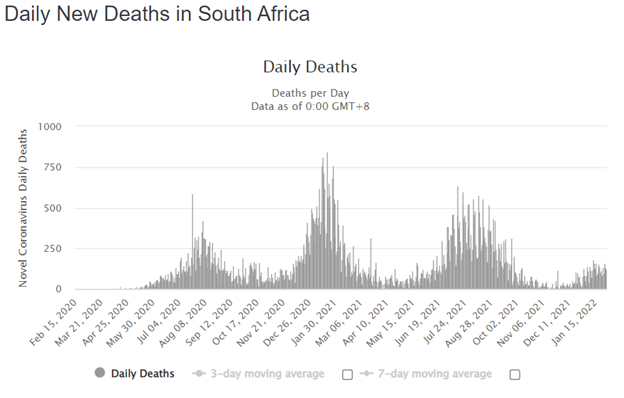

Covid has proved to be illusive and disruptive and for this reason, we try not to predict how the current pandemic will playout. Having said that, the Africa Health Research Institute released a study showing promising data as more and more people fall ill to Omicron. These studies suggest that Omicron appears to cause less severe illness. A laboratory study conducted in South Africa found that while those who previously caught the Delta variant could contract Omicron, those who get Omicron couldn’t be infected by Delta which has health experts hopeful that this could very well turn into a more manageable endemic. While Omicron is significantly more infectious than Delta, hospital and mortality data in countries including South Africa appears to show that it causes less severe disease.

William Hanage, an epidemiologist as the Harvard T.H. Chan School of Public Health, pointed out that labelling the virus an endemic doesn’t mean it is harmless as it is still an issue for those with underlying health conditions or those that haven’t had any vaccination. Having said that, he said “I think we should be optimistic about where we are, because we have learned a lot about vaccines…we have new drugs that are available, and we have public health tools that we know work well.”

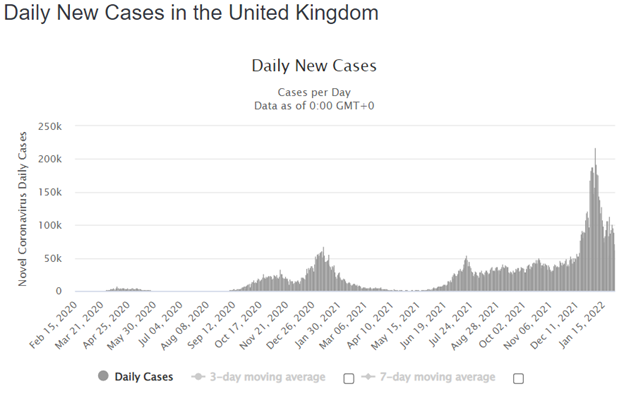

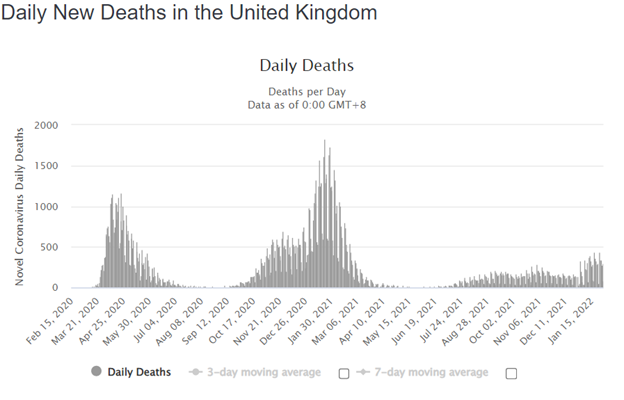

Having observed the two hotspots of Omicron, the UK and South Africa, we can see that although the surge in Omicron was nothing like we’ve ever seen, the deaths and severe illnesses have been relatively low which certainly is fueling some of the global rallies and demonstrations against pandemic restrictions. Below we can clearly see a lesser correlation between the number of cases and deaths both in the UK and South Africa (Source: worldometer).

Caerus Wealth Portfolio

January proved to be a volatile month and for right reasons. Inflation has been a focal point for investors as they calculate the trajectory of the economy and the stock market. With Inflation running high on both sides of the border, measures need to be implemented to combat further increases and to avoid having to go back to the 70’s or 80’s when inflation measures were in the low to mid-teens. We are undoubtedly going to see rate hikes on both sides of the border starting as early as March 2022 and this has created a reset of the valuation of stocks resulting in some volatile trading days in January. Having said that, we think this reset was necessary to fairly account for the state of the economy as we move towards a full recovery and expansion. With the earnings season starting out strong, and hints of a transition from a pandemic to an endemic, the stock market retains its potential with sizable upside in the coming months.

Our ADAPT Investment Strategy grants us the ability to remain objective and disciplined. Our research is focused on companies with increasing profitability and supporting trends. In 2022, we think that we will continue to benefit from allocating to stocks in sectors thriving in the post-pandemic era such as e-commerce, semi-conductors, automation, transports, and financials, as well as maintaining allocations to high-earning tech giants that continue to prove their resilience.

Terry Fay, Director, Private Client Group, Portfolio Manager

Kian Ghanei, Director, Private Client Group, Portfolio Manager

Caerus Private Wealth – iA Private Wealth

700 – 609 Granville Street, Vancouver BC V7Y 1G5

T: 604.895.3316 | TF: 1800.665.2030 | F: 604.682.0529

terry@caeruswealth.ca | kian@caeruswealth.ca

iaprivatewealth.ca | caeruswealth.ca

This information has been prepared by Kian Ghanei who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.