What a year! From extreme weather conditions causing forest fires and floods in BC to having to deal with new pandemic waves and restrictions, 2021 proved to be challenging and certainly kept us on our toes. Despite all of the suspense we have had to endure, we can’t help but to feel a sense of gratitude and a sense of hope heading into the new year. From an investment standpoint, we had an incredible year generating returns above our respective benchmarks. Much of our success lies with our ADAPT Investment Strategy which again proved to be instrumental in guiding our decision throughout a year filled with uncertainly. Most significant, from a public health standpoint, we are relieved to find that the omicron variant is proving to be less dangerous to our health than originally thought. This is not to suggest that Omicron won’t cause disruptions to our lives and our society over the next few weeks but the new data coming from South African, and other parts of the world, are encouraging and painting a far more optimistic road for us in 2022.

The two important themes playing out in 2022 will be inflation and pandemic. Specifically, how will the pandemic playout and will it turn to an endemic, and will the Fed be able to combat inflation through tightening policy without disrupting the markets?

The Pandemic

There is no doubt that the pandemic will continue to make headline news and shape the world we live in. How will the surge in cases impact our lives/society over the coming weeks? Will there be other variants that will pose new risks? Will the Omicron lead to herd immunity and eventually be classified as an endemic? These questions are yet to be answered but recent studies suggest that we have more reason to be optimistic than pessimistic. A new study from South Africa, suggests that people infected with the Omicron variant may have increased immune protection against the Delta variant. Consequently, Omicron could displace Delta variant over the coming months. “These results are consistent with Omicron displacing the Delta variant, since it can elicit immunity which neutralizes Delta making re-infection with Delta less likely,” the team of scientists, led by Khadija Khan at the Africa Health Research Institute, wrote in their findings. Furthermore, if omicron displaces delta and proves more mild than past variants, “the incidence of Covid-19 severe disease would be reduced and the infection may shift to become less disruptive to individuals and society,” according to the scientists’ findings.

Here in Canada, a new study conducted in Ontario suggests the Omicron variant is less likely to cause hospitalization or death than the Delta variant but could still significantly impact health-care systems due to its high transmissibility. The study by Public Health Ontario comes as the province has set several records for daily COVID-19 infections. It found that after adjusting for vaccination status and region, the risk of hospitalization or death was 54 per cent lower in Omicron cases than Delta cases. The most important takeaway is that “Omicron appears to be the first dominant variant to demonstrate a decline in disease severity,” the study said.

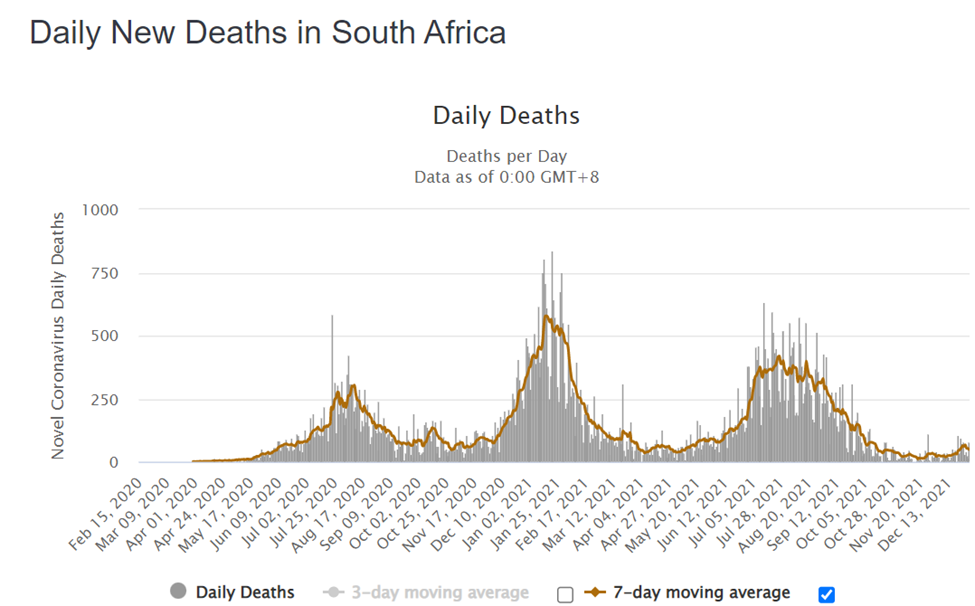

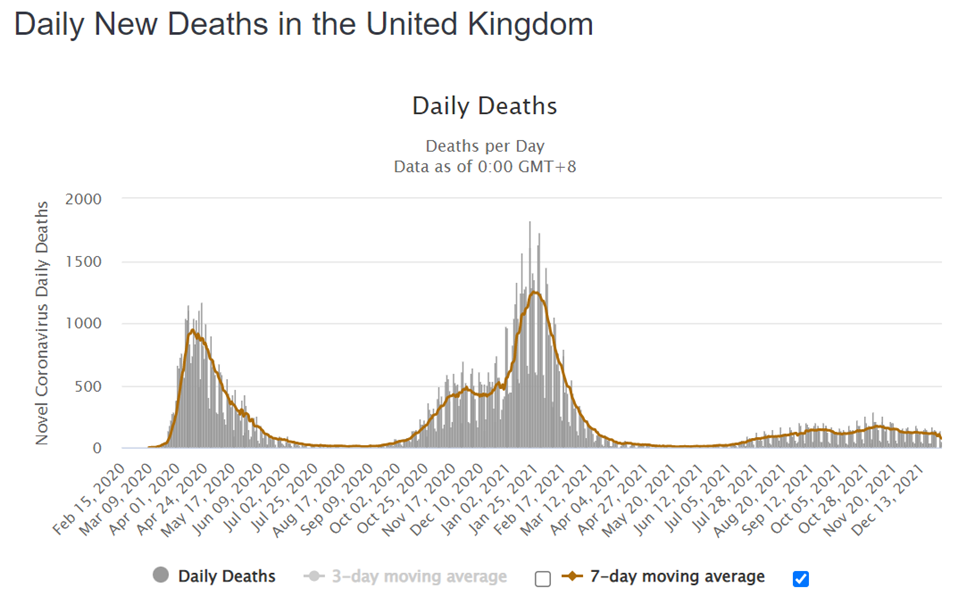

Let’s look at the UK and South Africa. Lately, the UK has been under the spotlight for all the wrong reasons. The growth in the number of new cases been ballooning due to Omicron variant and that trajectory is showing up here in Canada, US, and in the rest of the world. We must assume that the number of new cases reported is massively underreported but the one thing that we should all be paying attention to is the trajectory of the number of new deaths corresponding to the growing number of cases. Let’s look at the number of new death chart in both the UK and in South Africa for a glimpse into what we may experience in a few weeks here in Canada. Considering these numbers, we do think that the Omicron has a bigger bark than bite, and given the limited data collected so far, that’s very encouraging.

The Federal Reserve

The Federal Reserve ended its two-day meeting on Dec 15th where they made some notable changes to their monetary policy for the coming months. These changes were widely expected as inflation and employment numbers continue to pressure the Fed into a less accommodating policy shift which they have now confirmed will happen in the first few months of 2022. These changes will include a quicker reduction in the bond purchase to be followed by three interest rate increases starting in May 2022. Given the rise in the 2-year Treasuries over the last several weeks, many anticipated this announcement, and in response, the market reacted to the Fed’s comments in a positive way and has rallied into the year-end with an impressive rise to wrap up the year. But how much of this rally is attributed to strength of the market and how much of it is attributed to the Santa Clause rally? We believe that the answer lies somewhere in the middle.

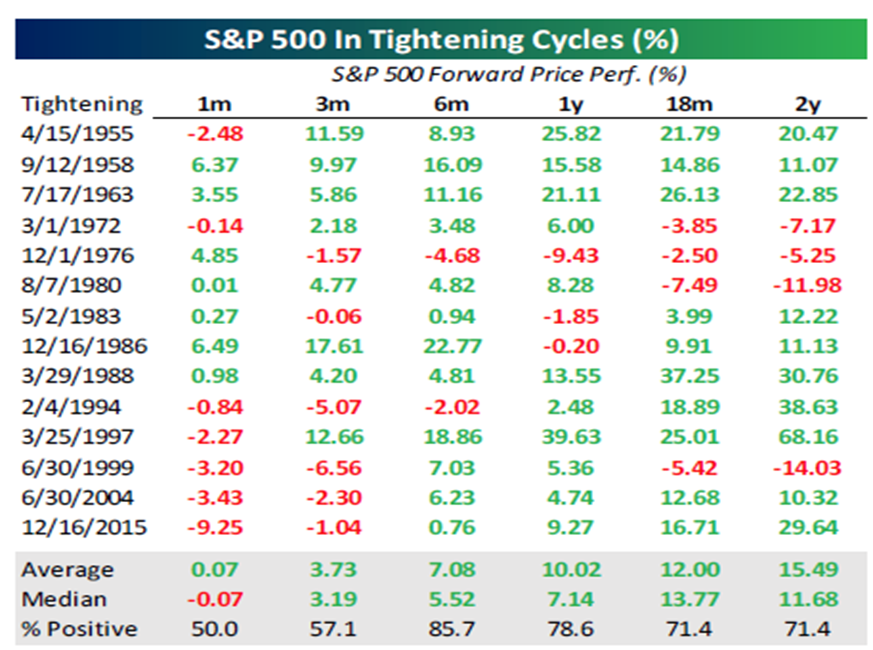

Many see a tightening policy shift as cause for volatility in the coming months but according to data going back as far as 1950, in tightening cycles, the markets ended the year in a strong position. Why? Well perhaps its because a tightening policy is typically during a time of expansion and growth, and earnings will continue to play a big part in that. Now, we’re not making any predictions, but we think its important to look at the data around prior tightening cycles to give us a better understanding of the possible outcomes in the coming months and years. (Source: Bloomberg)

Takeaway of 2021 – Facts over Fiction

Looking back to the year we had, there were several times when we had to adhere strictly to our data induced process and not allow for media induced speculation to drive our investment decisions. Our Facts over Fiction approach to investment management has proved yet again to be a valuable doctrine for us. As your portfolio managers, we believe that to have a pleasant investment experience, one must adopt a well-designed investment process that manages risk as well as return while adapting to changing market conditions. To do that, it is vital to have a process that includes both technical analysis while having the ability to overlay fundamental data in support of the price-action. Failure to do both, is more disposed to times of underperformance. Although 2021 was a great year for the markets overall, the truth is that it was probably very frustrating to those that couldn’t align themselves with winning investments.

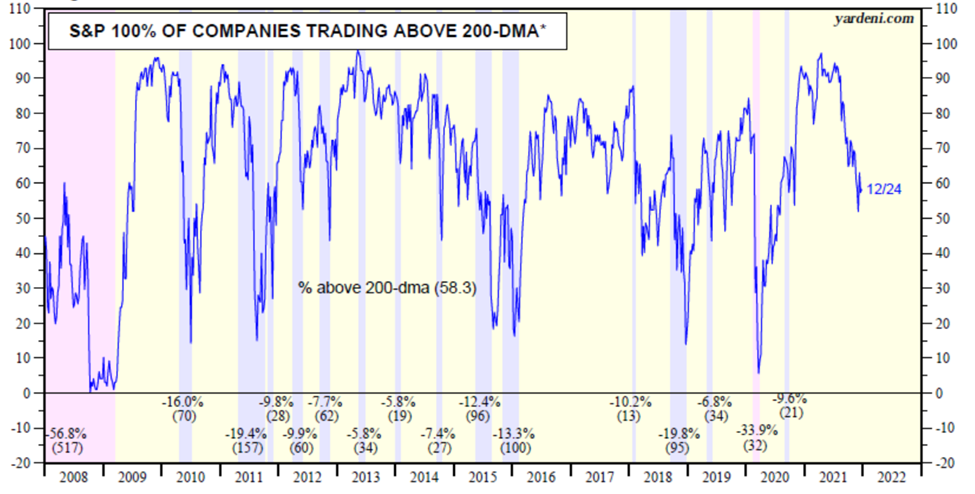

In 2021, the S&P 100 has performed well as a US stock index, however, when you take a look under the hood and examine its breadth, you can see a wide discrepancy amongst the performances of the underlying companies. For instance, of the 100 largest publicly traded companies in the US, less than 60% are trading above their 200-day moving average. This means that over 40% of the companies on the index are trading below their 200 day moving averages and therefore generating less than average returns. This would make investment selection a lot more difficult than if the index’s underlying companies performed at similar levels, and if you’re picking investments, you have a 40% chance of choosing under-performing stocks. At the start of the year, it may have been a lot easier to choose investments that yielded attractive returns, but over the last 6-8 months, it has become more and more difficult. Our point is this, if you are not paying attention to the price action/movements of stocks and their technical data, it’ll be more and more challenging to generate results. Often, we see investors make investment decisions based purely on fundamental analysis alone without paying any attention to the technical side. The conviction needs to be on both sides of the trade! Overall, we feel extremely proud of our accomplishments in 2021 and grateful to be able to utilize our ADAPT Investment Strategy to maneuver through changing market conditions and delivering results to you and your family!

Caerus Wealth Portfolio

There is some uncertainty surrounding Omicron and its impact on global recovery. However, recent data suggests that although Omicron will prove to cause some short-term pain, its bark is louder than its bite. We still think that the biggest challenge for investors and policy makers is to help loosen the supply-chain bottlenecks as we head into the new year and deal with the possibility of a more sustained inflationary environment while shifting to a tightening policy.

Our ADAPT Investment Strategy grants us the ability to remain objective and disciplined. Our research is focused on companies with increasing profitability and supporting trends. In 2022, we think that we will continue to benefit from allocating to stocks in sectors thriving in the post-pandemic era such as e-commerce, semi-conductors, automation, transports, and financials, as well as maintaining allocations to high-earning tech giants that continue to prove their resilience.

From our families to yours, we wish you a Happy New Year filled with Health, Joy, and Prosperity!

Terry Fay, Director, Private Client Group, Portfolio Manager

Kian Ghanei, Director, Private Client Group, Portfolio Manager

Caerus Private Wealth – iA Private Wealth

700 – 609 Granville Street, Vancouver BC V7Y 1G5

T: 604.895.3316 | TF: 1800.665.2030 | F: 604.682.0529

terry@caeruswealth.ca | kian@caeruswealth.ca

iaprivatewealth.ca | caeruswealth.ca

This information has been prepared by Kian Ghanei who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.