Caerus Private Wealth, iA Private Wealth – October Commentary

Coming off a volatile month of September, October has proved to be much more optimistic about the financial markets and the pandemic recovery. In fact, we saw the TSX climb to a new all-time high in 14 consecutive days which marked a new record for the broad Canadian index. On the south side of the border, we also saw the S&P500 climb to a fresh all-time high erasing its losses from the month before. Although there are several reasons to remain optimistic and hopeful about the future, there are some post-pandemic ‘kinks’ that are causing some pain around the globe for businesses, consumers, and policy makers. Let’s look on how these issues are impacting us.

Stagflation

Lately, you may have encountered the concept of stagflation floating around in a conversation or in an article. This term hasn’t been used much since the 70’s but it is something that we should all be mindful of heading into 2022. What is stagflation, where does it stem from, and what harm can it cause?

As the name suggests, stagflation is the combination of two concepts, stagnation, and inflation. Stagnation refers to an economic period with low activity, growth, and development. Inflation on the other hand refers to the rate at which prices of goods increase over a period. Inflation can be caused by both heighted economic activity (increase in demand and spending) or it can be cause during a period of supply shortage and/or the weakening comparative advantage of ones purchasing power (currency devaluation) whereby higher prices of goods are passed on to consumers. Stagflation occurs when declining productivity and GDP growth coincides with ‘sustained’ higher prices limiting the ability for policy makers to implement monetary and fiscal policies as a mechanism to control a sustained and worsening inflationary economic environment.

In a normal economic setting, when inflation expectations are elevated, policy makers will want to tighten their monetary policies to avoid higher prices. This typically will occur by increasing interest rates and reducing the money supply in an attempt to ‘cool off’ the economy. Currently the target range for Bank of Canada is set to 1-3% with an ideal level of inflation to be around 2%. Under this setting, the economic output of the country is typically positive with GDP growth indicative of an expansion. But what happens if economic expansion slows and retreats while prices of good continue to inch higher? How could policy makers balance the two and implement policies to avoid escalating prices while boosting the economy?

The United States economy grew at a much slower rate in the last three months ending in Sept. This was directly because of a heightened wave of the Delta variant, supply chain disruptions, and surging inflation lead by higher energy costs. The US GDP grew by 2% versus a consensus expectation of 7% lead by a significant slowdown in consumer spending habits which account for nearly two thirds of US’s economic growth. The period of pandemic relief has ended, and many consumers are becoming less willing to spend as freely as before while experiencing higher prices in just about every corner of their lives.

Labour Shortage

The situation we’re in is unlike any other period. It is important to remind ourselves that we have been dealing with a global event that continues to wreak havoc across many borders. The shortages in raw materials and labour have had businesses delay delivery and/or pass on higher costs to consumers. Furthermore, low interest rates have sparked a surge in housing prices and rents which again are leaving a large group of Americans and Canadians strapped for discretionary income.

Adding fuel to the fire, some workers seem to be uninterested in participating in traditional jobs. In the US, a record of 4.3 million Americans left their jobs in August and there are currently 10.4 million vacant jobs available for those wanting to find employment. (Source: Labor Department of US) According to the National Federal of Independent Businesses, 51% of small business owners said that they had job openings that they could not fill. This, of course, has led into business owners paying higher wages to attract and retain staffing.

The current labour shortage is a major issue for policy makers. On one hand, we have a rampant inflationary environment and on the other hand we have fewer people looking for jobs. On Thursday, Amazon’s new CEO Andy Jassy said during their earnings call that “in the fourth quarter, we expect to incur several billion dollars of additional costs in our Consumer business as we manage through labor supply shortages, increased wage costs, global supply chain issues, and increased freight and shipping costs—all while doing whatever it takes to minimize the impact on customers and selling partners this holiday season”. This is a good example of the current environment we’re in. Last year, Amazon had reported a net income of $6.3 billion in Q3 of 2020. This year in Q3, Amazon reported a net income of $3.2 billion which is nearly half of what they earned last year.

In a similar fashion, Apple sales missed expectations last week as the company’s CEO Tim Cook blamed a $6 billion opportunity cost and saying, “the supply constraints were driven by the industry wide chip shortages that have been talked about a lot, and Covid-related manufacturing disruptions in Southeast Asia”. Corporate profits are part of the domestic income calculation when accounting for GDP growth so here we clearly see a situation of lowered profits accompanied by higher prices.

Upward and Onward

Although we are dealing with some unsettling times, we remain focused on the road to recovery. After all, the North American markets are maintaining their resiliency and continue to offer attractive opportunities for investors. It appears that the Bank of Canada shares a similar view as we do in their take on the future.

Last week, The Bank of Canada held its target for the overnight rate at 0.25%. The Bank is ending its quantitative easing (QE) program by limiting the amount of government bonds it purchases and therefore limiting the amount of liquidity in the market. The reason for this is that the bank feel that Canada has turned a corner and no longer needs the financial liquidity to maintain its GDP growth and overall employment levels.

In its press release, the Bank of Canada said it “now forecasts Canada’s economy will grow by 5 percent this year before moderating to 4¼ percent in 2022 and 3¾ percent in 2023. Demand is expected to be supported by strong consumption and business investment, and a rebound in exports as the US economy continues to recover. Housing activity has moderated but is expected to remain elevated. On the supply side, shortages of manufacturing inputs, transportation bottlenecks, and difficulties in matching jobs to workers are limiting the economy’s productive capacity. Although the impact and persistence of these supply factors are hard to quantify, the output gap is likely to be narrower than the Bank had forecast in July”. (Source: Bank of Canada)

Q3 Earnings

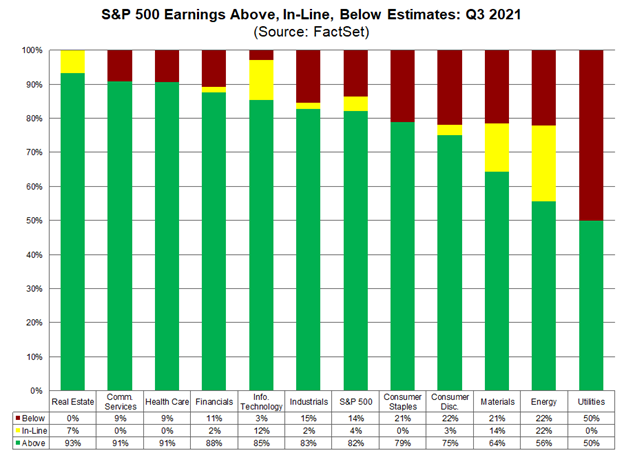

Despite the recent struggles of the technology giants Amazon and Apple, more S&P 500 companies are beating Earnings (EPS) estimates for the third quarter than average and beating EPS estimates by a wider margin than average. In fact, the index has so far reported the third highest (year-over-year) growth in earnings since Q3 2010. As of Friday October 29th, 56% of the companies of the S&P 500 have reported actual results for Q3 2021, and of these companies, 82% have reported actual earnings above estimates. (Source: FactSet)

Covid and The Delta Variant

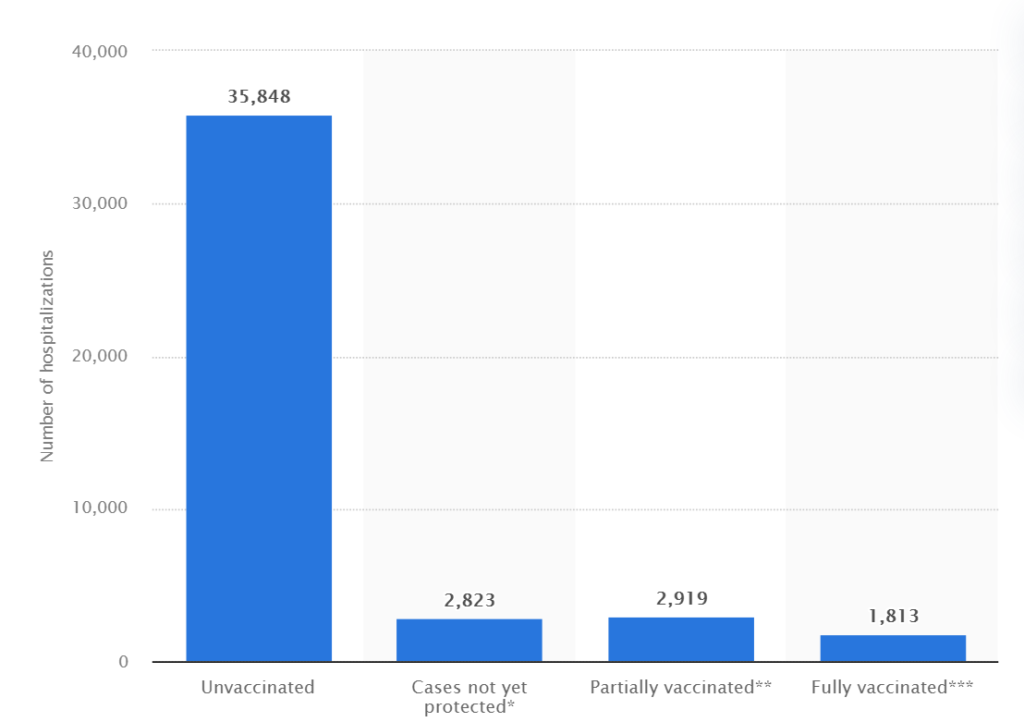

It has been nearly 2 years since Covid-19 was first reported in China, and as of today, we have recorded 5 million death globally related to the pandemic. Fortunately, we are beginning to learn some important things about its resiliency and tendencies. In a year-long study published last Thursday in the Lancet Infectious Diseases medical journal, vaccinated people are just as likely to spread the delta variant as those who haven’t had their inoculation. This may not be surprising as the cases in Canada, and partly in the US, have been somewhat elevated despite our high vaccination rates. Having said that, we seem to have turned the corner so far as hospitalizations and deaths across the country. The study also showed that those vaccinated had an easier time clearing the virus with milder symptoms than those without the shots. As reported across many news outlets, unvaccinated household members were more likely to suffer from severe disease and hospitalization.

In Canada, there is a significant amount data showing the effectiveness of the vaccine in keeping Canadian out of the hospital. Since the start of the vaccination program in Canada in December 2020, around 35,848 unvaccinated Canadians have been hospitalized with a COVID-19 infection, compared to 1,813 fully vaccinated Canadians. This statistic illustrates the number of confirmed COVID-19 cases hospitalized in Canada from December 14, 2020 to October 2, 2021, by vaccination status. (Source: Statista)

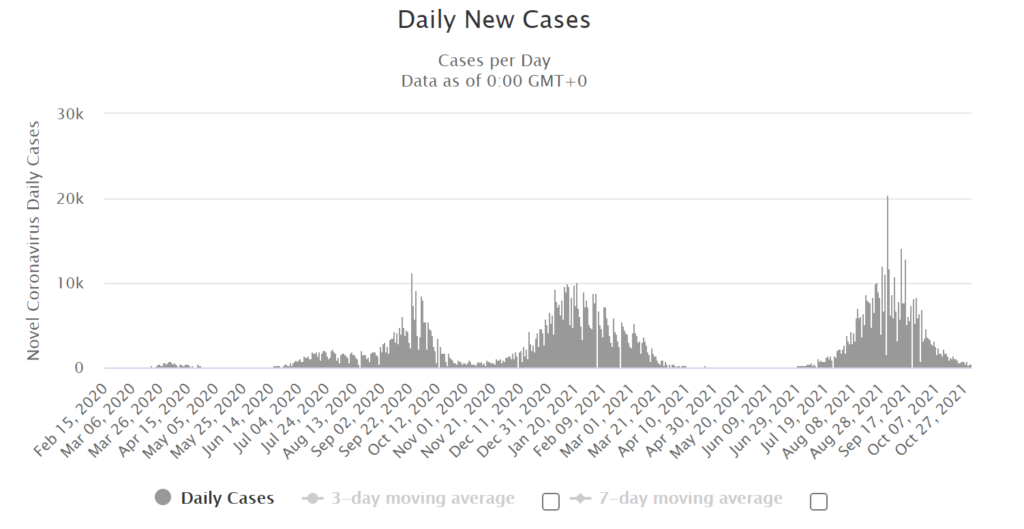

According to the data, we anticipate more people choosing to get vaccinated in the coming months as we await our booster shots scheduled for April/May 2022. Similarly, in the US, although much more politicized, hospitalizations and serious illnesses associated with Covid should continue to track downwards as the inoculation rates go up. Looking at the cases in Israel again as a benchmark of what to expect in the coming months, we see that since the administration of their booster shots, they have encountered a declining number of new cases as well as seeing their number of daily deaths go to single digits. This is reassuring and hopefully a sign of things to come here in Canada and the US.

Caerus Wealth Portfolio

The current economic landscape is a head-scratcher for policy makers across the globe. There are many questions that will need to be addressed in the coming months. When will inflationary pressures subside? How soon will the missing workforce get back to the labour force? How will the world adjust to current supply-chain gridlock? We remain confident that these issues will be addressed in the coming months as we continue moving up along the recovery ladder. We think that in almost all the issues mentioned above, supply will catch up to demand and we will see a more moderate level of inflation, a normalized level of employment, as well as a more efficient global supply-chain system. We mustn’t forget that the causation to the mentioned issues is the pandemic and it appears that we are making strides in the right direction.

We continue to see two very different types of broad trades leading markets at different times. They include a “work-from-home” trade characterized by strength among growth-style oriented stocks. At other times, we’ve seen a “reopening trade,” where the cyclically oriented value-style stocks have led. The Caerus Private Wealth portfolios are diversified across several asset classes and service sectors presenting the best chance of success in a recovery stage of the business cycle. Our ADAPT Investment Strategy grants us the ability to remain objective and disciplined. Our research is focused on companies with increasing profitability and supporting trends. So far in 2021, we continue to benefit from allocating to stocks in sectors thriving in the post-pandemic era such as e-commerce, semi-conductors, automation, transports, and financials, as well as maintaining allocations to high-earning tech giants that continue to prove their resilience.

As your trusted Portfolio Managers, Terry and Kian, and the Caerus Private Wealth team is available to address any questions you may have. Stay safe!

Terry Fay, Director, Private Client Group, Portfolio Manager

Kian Ghanei, Director, Private Client Group, Portfolio Manager

Caerus Private Wealth – iA Private Wealth

700 – 609 Granville Street, Vancouver BC V7Y 1G5

T: 604.895.3316 | TF: 1800.665.2030 | F: 604.682.0529

terry@caeruswealth.ca | kian@caeruswealth.ca

iaprivatewealth.ca | caeruswealth.ca

This information has been prepared by Terry Fay & Kian Ghanei who are Portfolio Managers for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.