February 2025 Commentary

If you’re feeling overwhelmed by the current state of the world, you are not alone. Whether it’s politics, tariffs, war, or technological advancements, compartmentalizing our thoughts and staying present has become increasingly difficult. Adding to the challenge is the sheer volume of information we consume daily, making it harder to separate fact from fiction—or even distinguish reality from AI-generated content. We get it, and we can relate!

Five years ago, the pandemic changed our lives, leaving behind a period that now feels surreal, almost like a distant dream. Personally, I recall those months—or years—as some of the most unnerving and bizarre of my life. Yet, we managed to push through. The key takeaway? We are far more resilient than we often give ourselves credit for, capable of adapting to abrupt and rapid changes. Financially, we navigated the turmoil of the pandemic, and I believe we will once again find our way through whatever challenges come next. Now, more than ever, it is crucial to rely on facts and avoid making emotionally driven financial decisions. Here are some of the key factors shaping today’s financial landscape.

Tariffs

Let’s address the elephant in the room. The proposed tariffs are causing significant anxiety for Canadians. It is important to be clear – tariffs will not benefit Canadians. The country faces a challenging path ahead, with economists warning that an extended trade war could push both the U.S. and Canadian economies into recession. But let’s pause for a second. We all know who is driving this push for tariffs, and while Trump appears to be on an unstoppable mission to disrupt the status quo, he has notable weaknesses.

Two of his biggest vulnerabilities are the stock market and gas prices (or inflation). Trump has long used the stock market as a measure of success, meaning any significant downturn could force him to reconsider his approach. For example, U.S. markets declined on February 3—the original tariff deadline—only to rebound when he delayed implementation by a month. “It’s no coincidence that Canada and Mexico received a 30-day extension on the 25% tariff shortly after stocks reacted negatively,” noted Benjamin Tal, Deputy Chief Economist at CIBC World Markets. Since then, the market has remained stable—not because investors believe tariffs are beneficial, but because they anticipate Trump will avoid actions that might shake investor confidence.

Another critical weak spot? Gas prices. Trump has consistently emphasized his commitment to keeping fuel costs low, advocating for U.S. energy independence with his “drill, baby, drill” mindset. However, a 10% tariff on Canadian crude—one of his latest threats—would cause an immediate spike in gas prices at the pump, with no easy alternative in place. While the trade battle appears intense, these pressure points could force Trump to reconsider his stance. Inflation control was one of his campaign promises, and the Yale study below suggests that the average American will face higher costs if tariffs persist.

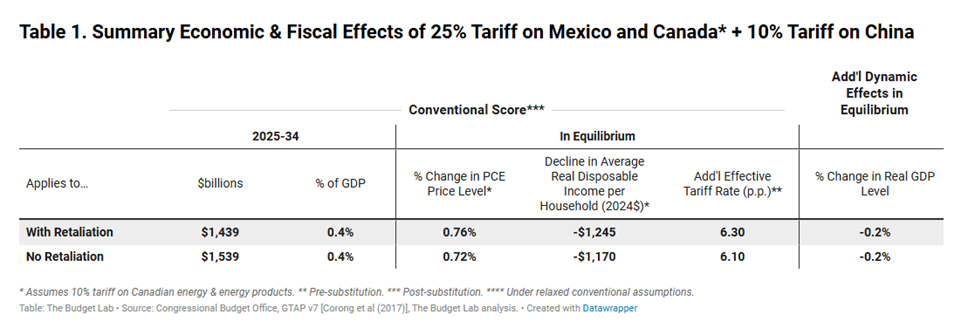

The Yale ‘Tariffs’ Study

A recent study from Yale suggests that Canadians have less to worry about than their Asian and European counterparts. The university’s Budget Lab analyzed the potential impact of tariffs and found that Canada would experience the smallest increase in tariff rates—just 4.59 percentage points, the lowest among the 20 countries examined. (Source: budgetlab.yale.edu)

Other G7 nations would not be as fortunate. Japan would see tariffs rise by 10.9 percentage points, while France, Germany, and Great Britain would face increases of 18.9, 19, and 19.9 percentage points, respectively. Italy would be the hardest hit, with tariffs spiking by 23.2 percentage points. Mexico, Canada’s partner in the U.S.-Mexico-Canada Agreement (USMCA), would also feel the impact, with tariffs expected to climb by 16.3 percentage points.

The study further indicates that the average disposable income of Americans is projected to decline by $1,245 if retaliatory measures are implemented, or by $1,170 if they are not. Given the current inflationary environment, the Trump tariffs may struggle to gain support if they ultimately cost the average American more than they currently pay.

U.S. Inflation – Heading The Wrong Way

Prices are once again rising across a broad range of goods, from housing to everyday essentials like eggs. This renewed inflationary pressure is largely driven by the same supply-and-demand imbalances and labor market constraints that initially fueled price surges during the pandemic. Adding to these concerns, proposed tariffs from former President Donald Trump are stoking fears of further cost increases in the months ahead.

Reports highlighting rising costs—including input materials, wage growth, and inflation expectations—underscore the Federal Reserve’s cautious stance on interest rates. Policymakers are closely monitoring inflation trends, and their preferred measure of underlying price pressures likely accelerated in January, ahead of key economic data set for release on Friday. According to Lauren Saidel-Baker, an economist at ITR Economics, inflation appears to be rebounding sooner than anticipated. “Our forecast has been for inflation to pick up in the second half of the year, but signs of renewed pressure are already emerging,” she noted, adding that trade and immigration policies will likely contribute to inflationary risks. (Source: ITR Economics)

What Are the Likely Scenarios?

Scenario 1 – Trump realizes the inflationary impact tariffs could have on the U.S. consumer and ultimately reverses course to avoid an all-out trade war. This would be the best-case scenario, allowing for a more predictable market trajectory and easing uncertainty.

Scenario 2 – Trump moves forward with tariffs regardless of their economic consequences. This would be the worst-case scenario, forcing the Federal Reserve to tighten monetary policy by raising interest rates in response to higher prices. As seen in 2022, financial markets typically do not react well to rising interest rates, and such a move could trigger another wave of market volatility.

Financial markets currently suggest that investors expect a compromise, with a resolution somewhere between these two extremes. Negotiations are likely to continue over the coming weeks and months, potentially leading to an outcome that mitigates some of the economic risks associated with scenario 2.

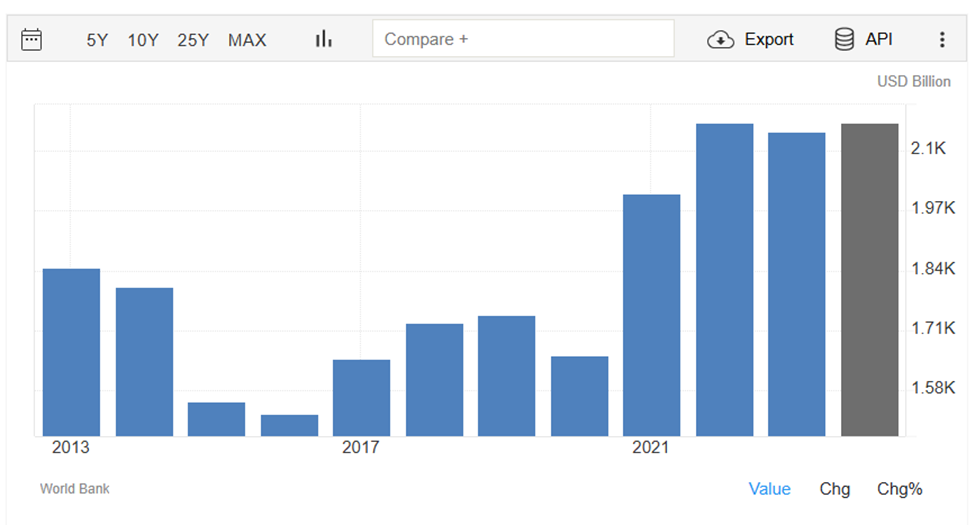

Canada’s GDP – Big Surprise!

Canada’s economy expanded by 2.6% in the final quarter of 2024, significantly outperforming expectations, according to data released by Statistics Canada on Friday. The stronger-than-anticipated growth was driven by increased consumer spending, rising business investment, and a boost in exports. (Source: Trending Economics)

Revised figures also showed that third-quarter growth was higher than previously estimated, reinforcing economic momentum heading into 2025. However, economists caution that ongoing uncertainty surrounding tariffs could influence the Bank of Canada’s upcoming interest rate decision on March 12.

“The Canadian economy showed signs of resilience in late 2024, benefiting from lower interest rates and a temporary sales tax reduction,” CIBC economist Avery Shenfeld noted in a research report. “But that momentum could be short-lived if a wave of tariffs disrupts trade in 2025.”

Preliminary estimates suggest GDP grew by 0.3% in January, Shenfeld added, emphasizing that without the looming tariff concerns, the outlook for 2025 would be much more optimistic. In such a scenario, the Bank of Canada might even consider pausing rate cuts. On the other hand, tariff concerns would likely force the BoC to continue its monetary easing, which could be beneficial for Canadian borrowers and overall economic activity.

Canada’s Inflation

In January, Canada’s annual inflation rate rose slightly to 1.9% from 1.8% in December, primarily driven by a 5.3% increase in energy prices. This uptick partially offset the downward pressure exerted by the federal GST/HST holiday, which began in mid-December and temporarily lowered the cost of certain goods and services. Despite this headline increase, core inflation metrics continue to show more stability.

The Bank of Canada’s preferred core inflation measures, CPI median and CPI trim, both of which exclude the impact of indirect taxes, rose slightly to an average of 2.7% year-over-year, up from 2.5% in December. However, on a month-over-month basis, these core measures grew at a more moderate 0.2% pace, aligning more closely with the BoC’s inflation target. (Source: RBC Inflationary Watch)

Mortgage interest costs remain a significant contributor to inflation, accounting for approximately 30% of total year-over-year CPI growth. However, this impact is expected to decline as earlier interest rate cuts gradually reduce borrowing costs. This is one area where a gradual decrease in rates could help slow inflation driven by borrowing expenses.

Corporate Earnings – U.S.

Corporate earnings continue to be a dominant force in shaping the stock market’s trajectory. The good news is that with 97% of S&P 500 companies having reported their Q4 2024 earnings, 75% have surpassed earnings-per-share (EPS) expectations, while 63% have exceeded revenue forecasts. The blended year-over-year earnings growth rate for the index stands at 18.2%, marking the strongest quarterly earnings expansion since Q4 2021. This performance highlights corporate resilience despite economic uncertainties.

However, the bad news is that growing concerns over inflation and tariffs have led analysts to revise their earnings-per-share (EPS) estimates for Q1 2025 at a steeper-than-usual rate. Between January and February, the Q1 bottom-up EPS estimate—which aggregates the median EPS forecasts for all S&P 500 companies—declined by 3.5%, falling from $62.89 to $60.66. This drop surpassed the typical downward revisions seen in the early months of a quarter.

Every sector of the S&P 500 saw a downward revision in Q1 earnings estimates from December 31 to February 27. The steepest declines occurred in the Materials sector (-16.2%) and the Consumer Discretionary sector (-8.8%). Meanwhile, estimates for full-year 2025 EPS also declined, though to a lesser extent, falling by 1.0% from $274.12 to $271.28 during the same period.

Despite these lowered earnings expectations, the stock market has remained relatively stable since the beginning of the year, showing no significant negative repercussions. This resilience in market performance, even amid looming tariff threats, underscores the underlying strength of the market.

In Summary

As we navigate an increasingly complex economic landscape, it is evident that inflation, tariffs, and interest rate policies remain at the forefront of financial market concerns. The interplay between these factors will shape economic conditions in the months ahead, affecting everything from consumer spending to corporate earnings. While tariffs present a significant risk—particularly for Canada—key vulnerabilities, such as stock market performance and fuel prices, could limit their long-term impact. Ongoing negotiations will play a critical role in determining whether a full-blown trade war can be avoided. This is what the market is telling us at the moment and this might be the most likely scenario.

Despite renewed inflationary pressures, corporate earnings have shown resilience, with S&P 500 companies reporting strong results for Q4 2024. However, downward revisions in future earnings estimates suggest caution is warranted. Analysts have been more aggressive in adjusting forecasts, particularly in sectors most vulnerable to tariffs and rising costs. While these revisions have been factored into market performance, continued progress in trade negotiations could support further market expansion.

For investors, the key takeaway is to stay informed and base decisions on data rather than emotion. In times like these, it is essential to adhere strictly to our ADAPT Investment Process, ensuring a clear, objective approach to financial decision-making. We will continue monitoring market developments and remain prepared to take defensive positions if necessary.

We thank you for your continued trust and we welcome you to reach out to us with any questions you may have.

This information has been prepared by Kian Ghanei and Terry Fay who are Portfolio Managers for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The [Investment Advisor/Portfolio Manager] can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.