November 2024 Commentary

With the US behind us, all focus has shifted to the implications of a Trump presidency in 2025. Naturally, some people feel nervous about his style of leadership and the economic fallout of his hardline policies around tariffs and immigration. However, with so much still unknown, it’s important to keep a neutral stance and allow time for things to play out. We should focus on the data that will ultimately drive the markets towards the end of the year and into 2025.

Canada’s Economy!

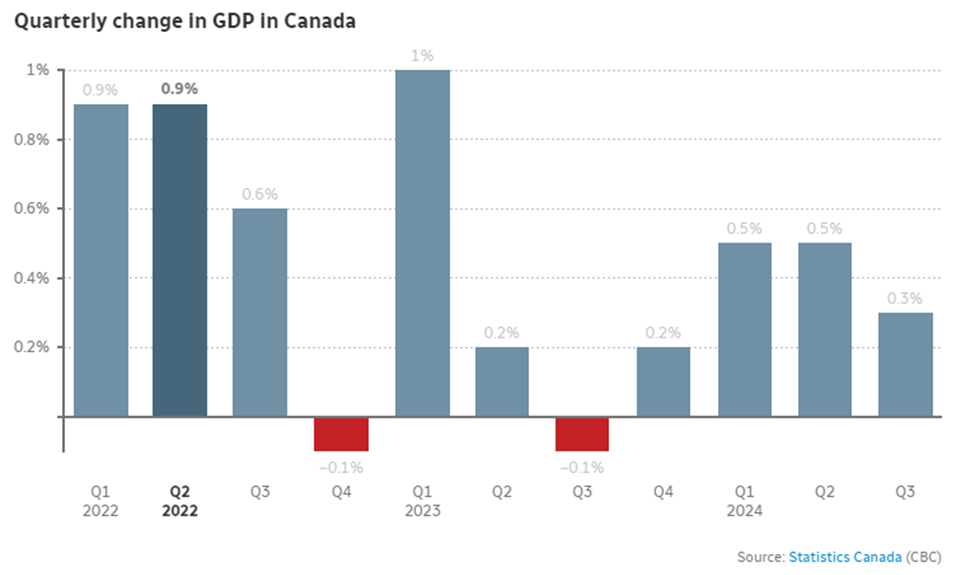

The reality is that most of the force behind the financial markets initiates from the US, but the Canadian market remains relevant to us and important to touch on. Canada’s economy expanded at an annualized rate of 1% in the third quarter, driven by increased household and government spending, Statistics Canada reported on Friday.

While the growth aligned with economists’ forecasts, it fell short of the Bank of Canada’s projection of 1.5% for the quarter. The gains were tempered by a decline in business investment, particularly reduced spending on machinery, including aircraft, and a drop in exports, which fell more sharply than imports, according to the agency’s data. (Source: Statistics Canada)

The employment report will serve as the last significant economic indicator before the central bank’s monetary policy announcement on Dec 11th. These numbers suggest a 50 basis-point rate cut is likely at the December meeting, though next week’s employment data will probably carry greater weight in the final decision.

US 10-Year Treasury Yields

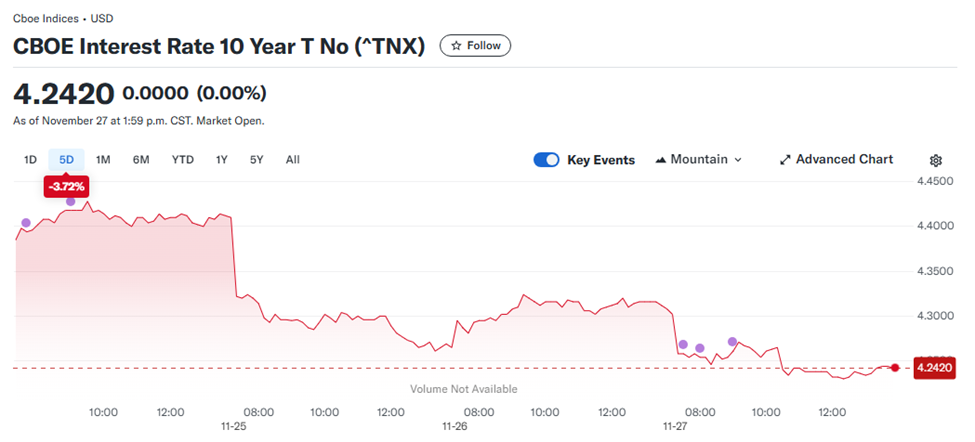

Many are calling for an ‘inflationary’ Trump era, especially since his intensions have surfaced around tariffs, deregulation, and tax cuts. Given that inflation has been a major point of interest for many over the last 2 years, there were some initial jitters causing some concerns especially surrounding elevated interest rates. Despite the narrative, 10 Year US Treasury yield has levelled off since it’s initial rise shortly after the election. Over the last week, the 10-year has come down 3.72% to its pre-election result level which tells us that there are competing forces at play and perhaps not everyone thinks Trump will have an inflationary effect in the US. (Source: Bloomberg)

The US Dollar’s Momentum

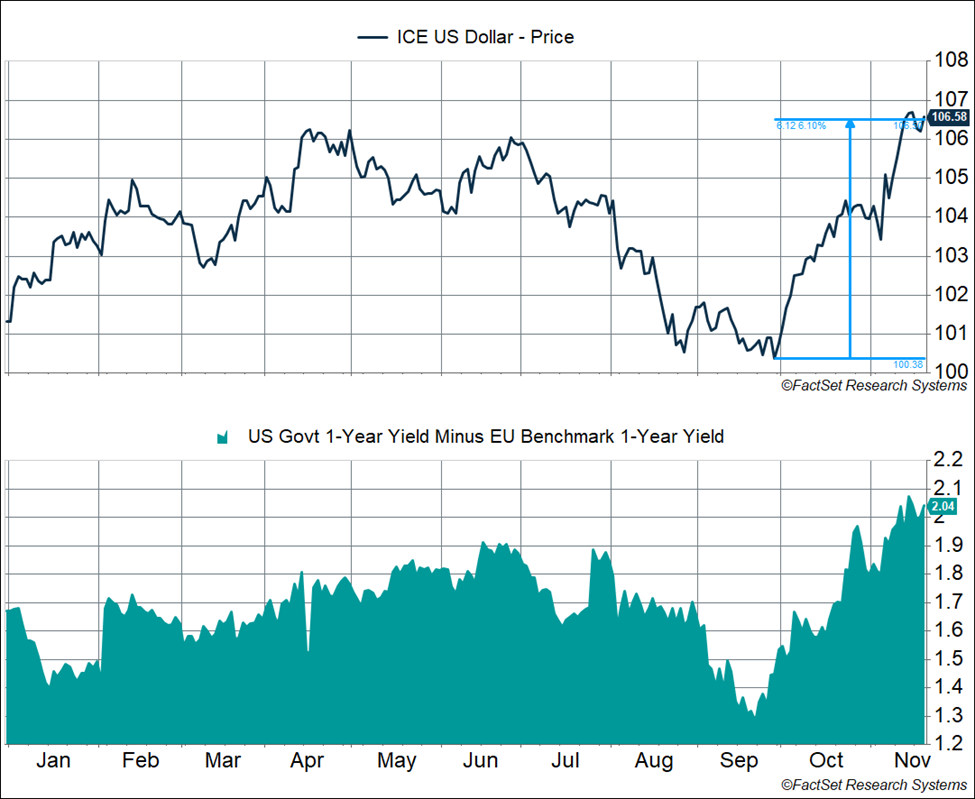

An underappreciated development right now is the rise of the US dollar, which has gained over 6% since late September. The dollar’s movement is largely influenced by relative growth rates between the US and other economies. This means the dollar’s trajectory hinges on how the US economy performs compared to the rest of the world. Stronger economic growth in the US typically suggests that interest rates will remain elevated, with the Federal Reserve likely maintaining higher policy rates relative to other central banks. Higher interest rate differentials favor the US dollar because capital tends to flow toward countries offering higher returns, boosting their currency. (Source: Factset Research Systems)

Since late September, US economic data has been notably strong, significantly reducing recession risks. This has tempered expectations for rate cuts and pushed longer-term yields higher. Meanwhile, growth outside the US remains sluggish, and foreign central banks are expected to pursue more aggressive rate cuts. These dynamics have widened the interest rate differentials between the US and other countries, further supporting the dollar’s appreciation. Interestingly, the CAD dollar has shown signs of strengthening over the last week like the recent downward trend of the 10 Year Treasury suggesting a calmer consensus.

Some argue that a strong US dollar can have negative implications for the US economy. For instance, a persistent strong dollar could hurt US manufacturing and make American goods more expensive to foreigners which will dampen the GDP numbers. Similarly, 40% of revenues generated by S&P 500 companies come from outside of the US which could play a heavy burden on profits. That may be the case but on the flip side, the US is a net importing country which means it imports more goods than it exports. A stronger US dollar allows for more goods at lower prices.

Tariffs: Risks and Opportunities

While everyone in Canada is fixated on the proposed 25% tariff on Canadian good sold in the US, some policy makers argue that the tariffs on Chinese goods which are rumored to be 60%, will have a surprisingly positive impact on global prices of goods. This might seem like wishful thinking but what if the tariffs cause a shift in buying patterns and decrease the overall demand for goods made in China? With China being the largest exporter to the global market, if tariffs are imposed, would mean they would have to fill the lowered demand by reducing costs across all spectrums.

Swati Dhingra, a senior policy makers of the Bank of England said the likely impact of the world’s largest goods importer imposing such a large tariff on products from the world’s biggest exporter would be for global goods prices to fall.

Chinese firms would respond to tougher trade barriers by attempting to find buyers in alternative markets, which could lead them to lower their prices to sell similar volumes, including in the UK, she said.

“It takes a massive amount of demand out of the world market. The way exporters, say in China, would respond to that would be to respond with prices, world prices, as they don’t want to lose market share,” she said. (Source: The Guardian)

There is a worst-case scenario here at play which would be for countries to get into a tit for tat situation and economic posturing which could end up in an all-out tariff war. This outcome, although unrealistic, could have major long-lasting implications.

Re-Emergence of Crypto

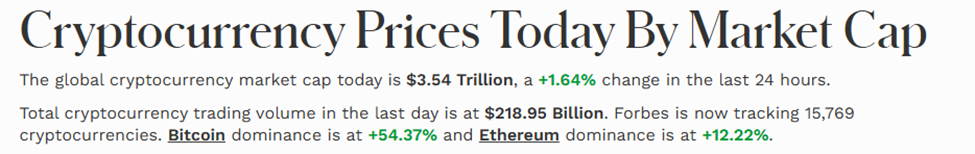

Whether we like it or not, there is an emergence of acceptance towards the Crypto category and it’s coming from the top of the food chain. Donald Trump has selected Scott Bessent, a well-known pro-crypto hedge fund manager, as his nominee for Treasury Secretary. Bessent, who previously served as chief investment officer for billionaire George Soros and later founded Key Square Capital Management, is a vocal supporter of blockchain technology and digital assets.

His nomination represents a significant shift from the Biden administration’s cautious regulatory approach to cryptocurrency under Treasury Secretary Janet Yellen. If confirmed, Bessent could provide greater regulatory clarity and pursue policies more favorable to the crypto industry, potentially advancing the integration of digital assets into the broader financial system.

If Bessent assumes leadership of the Treasury, he will face the complex task of balancing the promotion of innovation with the enforcement of regulation.

On one side, he has highlighted blockchain’s potential to transform the financial sector, envisioning its integration into mainstream systems to boost efficiency. On the other, the role of Treasury Secretary requires tackling legitimate regulatory challenges to ensure stability and security. (Source: Forbes)

Reasons to Remain Optimistic

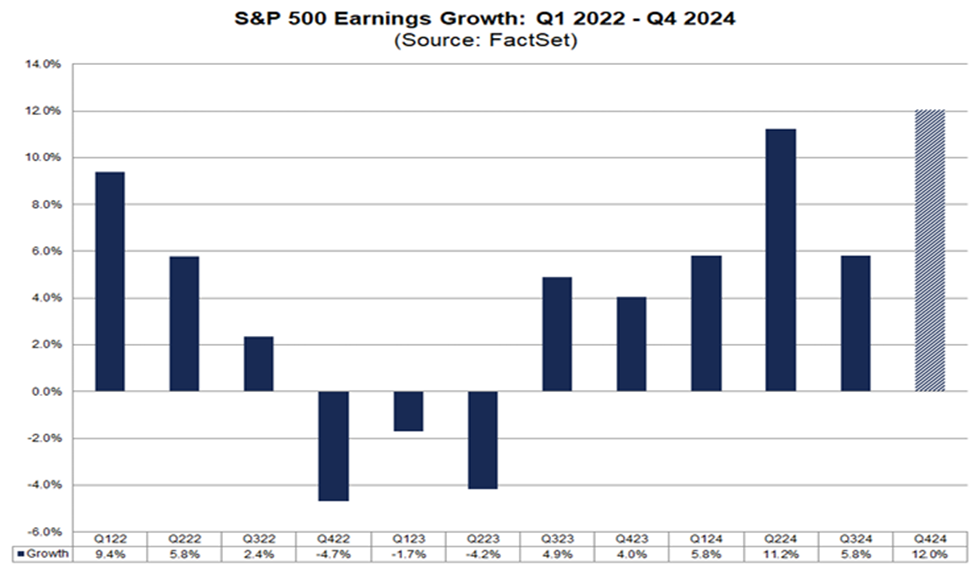

The S&P 500 reported earnings growth of 5.8% for Q3 2024, but earnings growth is projected to accelerate significantly in Q4 2024, with an estimated growth rate of 12.0%. If achieved, this would be the highest year-over-year growth rate since Q4 2021, when the index posted a 31.4% increase.

What is driving this anticipated surge in Q4 earnings growth? At the sector level, eight of the eleven sectors are expected to post year-over-year earnings growth, with six sectors projected to achieve double-digit gains:

Financials: 38.9%

Communication Services: 20.7%

Information Technology: 13.9%

Utilities: 12.9%

Health Care: 12.6%

Consumer Discretionary: 12.5%

At the industry level, five key industries are projected to be the largest contributors to this growth Banks, Semiconductors & Semiconductor Equipment, Pharmaceuticals, Interactive Media & Services, and Broadline Retail.

Without these five industries, the estimated earnings growth rate for the S&P 500 in Q4 2024 would drop from 12.0% to just 1.6%, underscoring their outsized impact on the overall growth projection.

Bull Markets Resilience

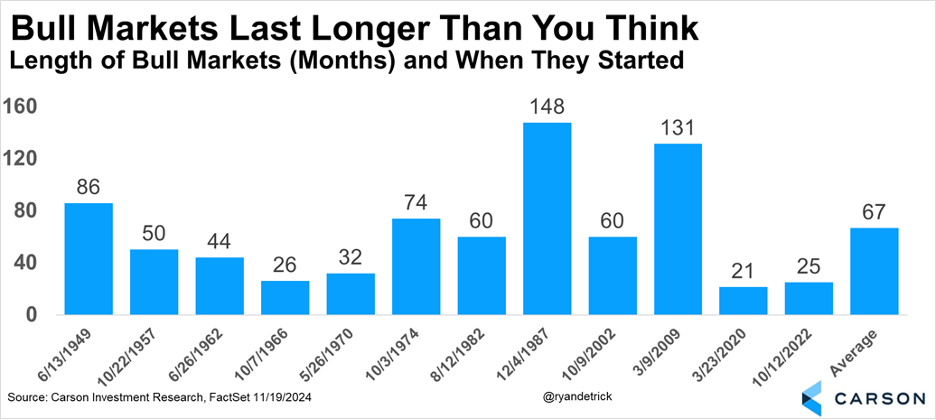

The current bull market started in the latter part of 2022, but how long can this last? The answer lies in several economic assessments including strong economic growth, continued profitability of companies, and a friendly monetary landscape. We are now in our 25th month of the bull market and if we consider the three factors mentioned above, we still have some ways to go. For instance, the US economy remain strong, corporate earnings remain high, and there is a political figure taking office that tends to be pro business and pro monetary easing. We don’t have a crystal ball as to what’s in store in 2025, but we do remain bullish in our outlook that the current bull market still has legs and can continue well into 2025. According to Carson Research, dating back to 1950, the average bull market lasts 67 months and we are currently in the 25th month. (Source: Carson Research)

In Summary

There was a lot to digest in the month of November. With the Trump victory, many seems to be scrambling and preparing for what’s to come. The most controversial of changes may be surrounding tariffs on foreign goods even from longstanding trade partners such as Canada and Mexico. The truth is no one can predict what’s going to unfold. Not even the bond or currency markets. Instead, we continue to focus on trending sectors and companies that continue to exhibit growth without getting distracted by the headlines. Our stance is validated by the economic and fundamental data coming from both sides of the border, and we believe that this trend will continue until some of the key underlying factors are tested. These include the strength of the US economy and the profitability of companies on the back of monetary easing.

We are confident in our ADAPT Investment Strategy, which we believe will successfully guide us through the next presidential term. This approach will continue to help us capitalize on opportunities in the markets while navigating through uncertainties, keeping us away from extreme volatility and well-positioned for continued success.

We thank you for your continued trust and we welcome you to reach out to us with any questions you may have.

This information has been prepared by Kian Ghanei and Terry Fay who are Portfolio Managers for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The [Investment Advisor/Portfolio Manager] can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.