October 2024 Commentary

With less than a week until the U.S. elections, more and more investors are wondering how the results will impact the markets for the remainder of 2024 and into 2025. After all, there has never been a more contentious and anticipated presidential election in modern history. There is a lot on the line, especially regarding major domestic and international policies, but from a financial standpoint, this may not significantly impact the economic trajectory as there are other factors that play a bigger role in how the financial markets will perform over the next few years.

Interestingly, Canada’s federal political landscape has its own challenges to address before October 2025. But for now, all eyes are on the U.S. elections, and rightfully so. Let’s look at some of the factors that will most likely shape the balance of this year and much of 2025.

Interest Rates Remain Key!

On November 7, the Federal Open Market Committee (FOMC) is anticipated to lower interest rates again, following an initial reduction on September 18. Current market expectations suggest a 0.25% rate cut, bringing the federal funds rate to a range of 4.5% to 4.75%. However, a more substantial cut of 0.5% remains possible, depending on upcoming economic data. Why is this important to the markets? Lower interest rates generally benefit markets because they make borrowing cheaper, encourage consumer spending, and boost corporate profits. The US consumer has been somewhat protected from higher rates due to the structure of US mortgages, but that tune is changing, and more and more business are feeling the pinch and eager for some further monetary easing. The FOMC appears to be easing its restrictive monetary policy as inflation approaches the 2% target and unemployment has trended upward over the past year, though it remains historically low. The Personal Consumption Expenditures (PCE) Price Index reported an annual inflation rate of 2.2% as of August 2024, or 2.7% when excluding food and energy, significantly down from the 7% peak in mid-2022, which had spurred aggressive rate hikes. Historically, the FOMC has faced challenges in maintaining inflation precisely at 2%, with typical fluctuations of around 1%. (Source: Federalreserve.gov)

The unemployment rate rose to 4.2% in August 2024, up from approximately 3.5% last year. While still low by historical standards, this increase suggests a more balanced labor market rather than the onset of ongoing weakness. However, even modest increases in unemployment have often signaled impending recessions, which supports our earlier call for further rate cuts.

Inflation Is Cooling!

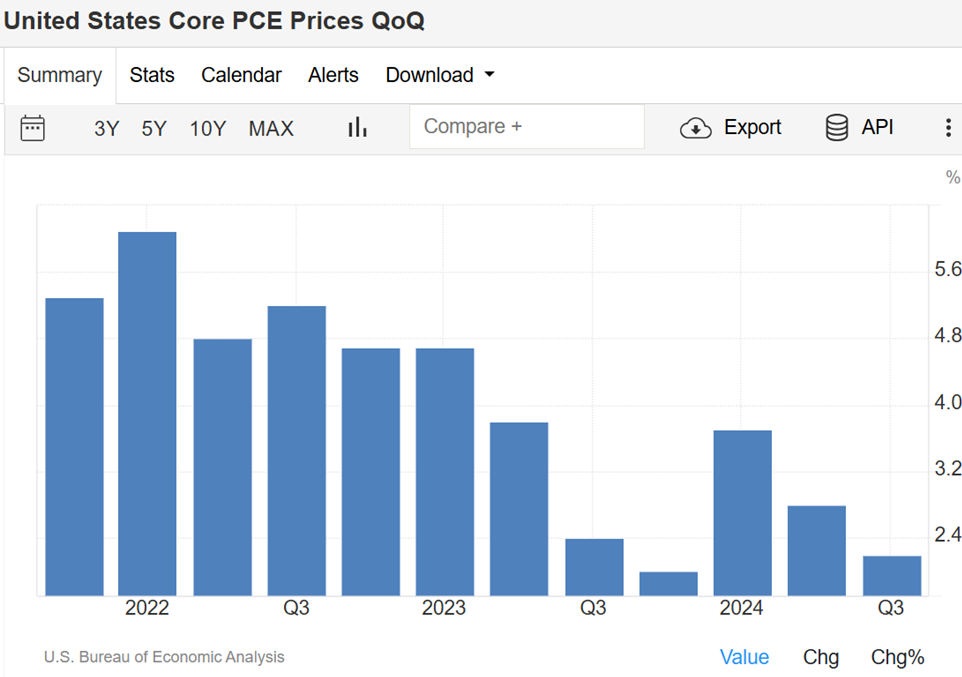

As of October 31, 2024, inflation in the United States has significantly moderated, approaching the Federal Reserve’s 2% target. The Personal Consumption Expenditures (PCE) price index, the Fed’s preferred inflation gauge, rose by 2.1% in September compared to the previous year, marking the lowest annual increase since early 2021. This decline reflects a steady reduction from the peak inflation rates experienced in mid-2022.

Core inflation, which excludes volatile food and energy prices, increased by 2.7% over the same period, indicating a gradual easing of

underlying price pressures. The Consumer Price Index (CPI) also showed a 2.4% annual rise in September, down from 2.5% in August, further illustrating the cooling trend. (Source: Trading Economics)

Canada’s Inflation Trending Lower

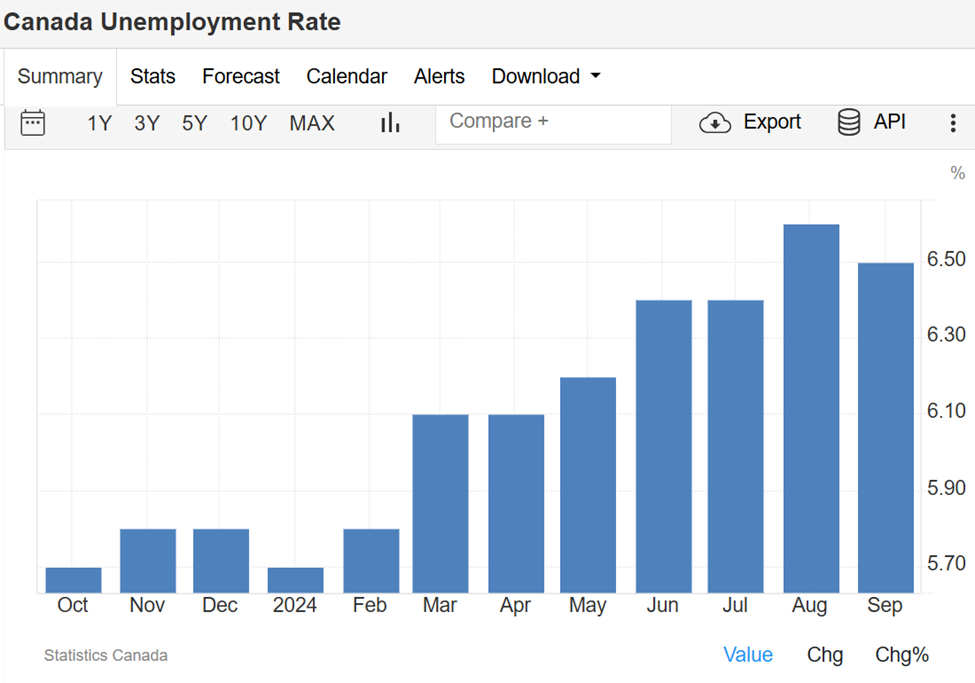

On October 23, 2024, the Bank of Canada reduced its policy interest rate by 50 basis points, bringing it to 3.75%. This marked the fourth consecutive rate cut and the largest since 2009, excluding pandemic-related adjustments. The decision was influenced by a significant decline in inflation, which fell to 1.6% in September, below the central bank’s 2% target. Additionally, the unemployment rate rose to 6.5%, indicating a softening labor market. This rate cut aims to stimulate economic growth by lowering borrowing costs for consumers and businesses. Governor Tiff Macklem indicated that further rate reductions are possible if economic conditions align with forecasts.

Strong Earnings

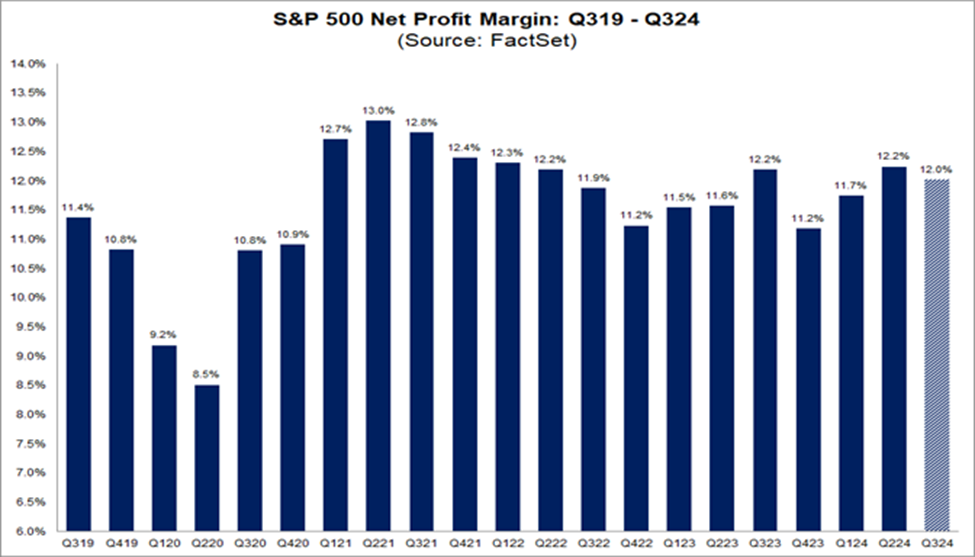

Another important indicator of a prolonged bull market is the strong earnings across several sectors, particularly in the U.S. The S&P 500 is maintaining solid profitability with a blended net profit margin of 12.0% for Q3 2024. Although slightly down from recent quarters, it remains above the 5-year average of 11.5%. This quarter marks the second consecutive period with a net profit margin at or above 12%, a level not consistently achieved since early 2022, signaling resilience among U.S. companies even in a dynamic economic landscape.

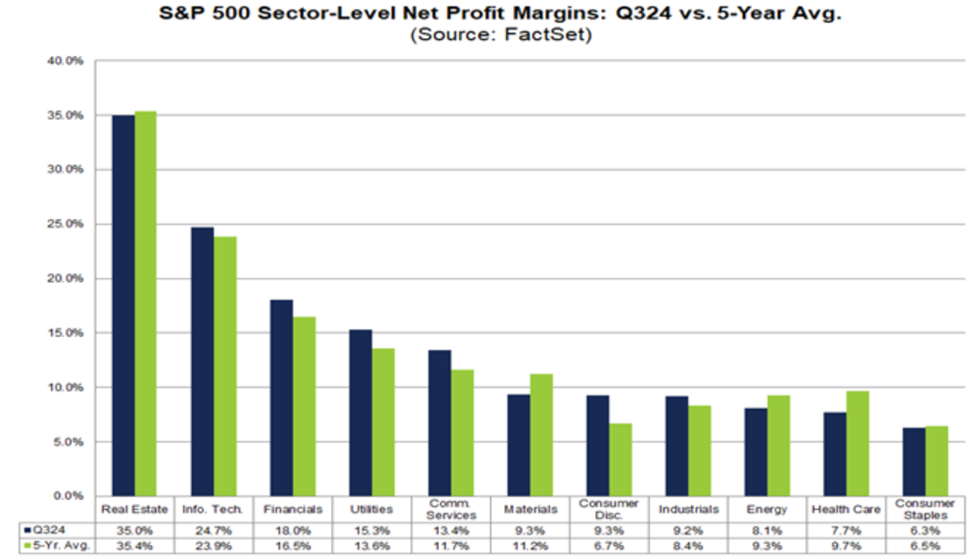

Several sectors stand out, particularly Information Technology, which saw a year-over-year increase in profit margins to 24.7%. Communication Services and Utilities also reported impressive quarter-over-quarter gains, with Communication Services margins rising from 11.5% to 13.4% and Utilities from 13.6% to 15.3%. These results demonstrate how specific sectors are adapting well, finding efficiencies, and maintaining solid growth, positioning them for continued strength in the coming quarters.

Looking ahead, analysts expect S&P 500 profit margins to hold above 12% over the next three quarters, with projected margins rising to 12.1% in Q4 2024, 12.6% in Q1 2025, and 13.1% in Q2 2025. This optimism suggests confidence in these companies’ ability to manage costs and sustain profitability amid economic pressures. With six sectors showing margins above their 5-year averages, the S&P 500 is well-positioned for steady, profitable growth in the near term. (Source: Factset)

Past Bull Markets

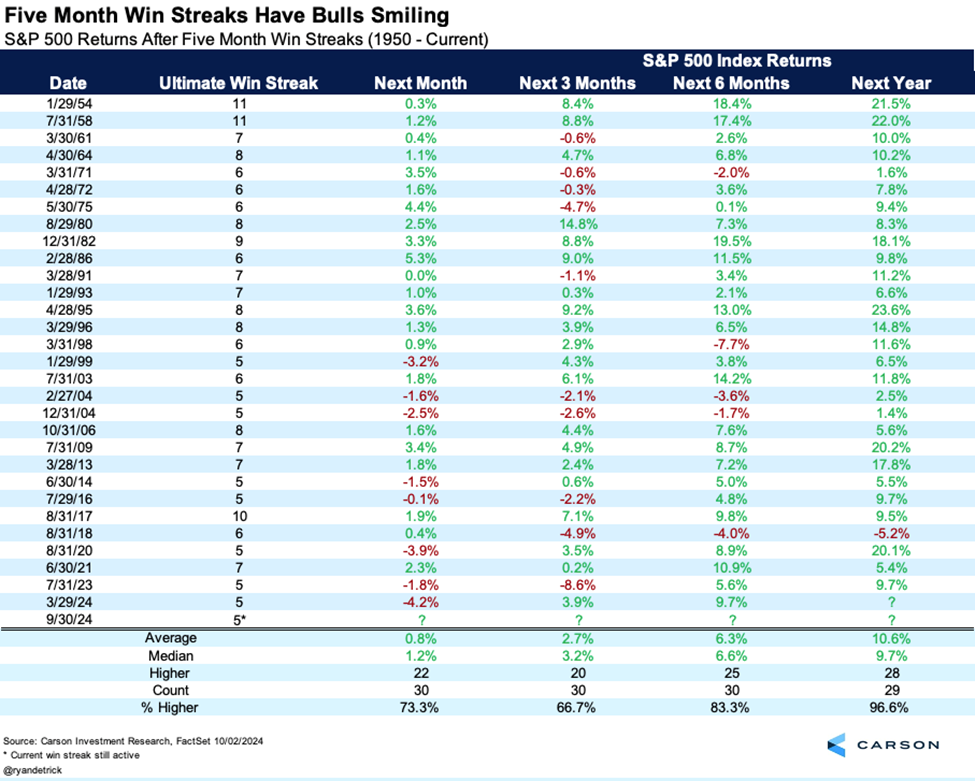

Despite the volatility on the last day of October, the S&P 500 experienced five consecutive months of expansion from May to September, which typically bodes well for equities. When stocks gain five months in a row, they tend to be higher a year later, 28 out of 29 times, with an average gain of over 10%. Moreover, when stocks gain ten of eleven months (as now), they are typically higher a year later, nine out of ten times, with nearly a 15% gain on average. This recent strength may be a reason to stay optimistic as we head into 2025. (Source: Factset & Carson Research)

Election Year Cycle

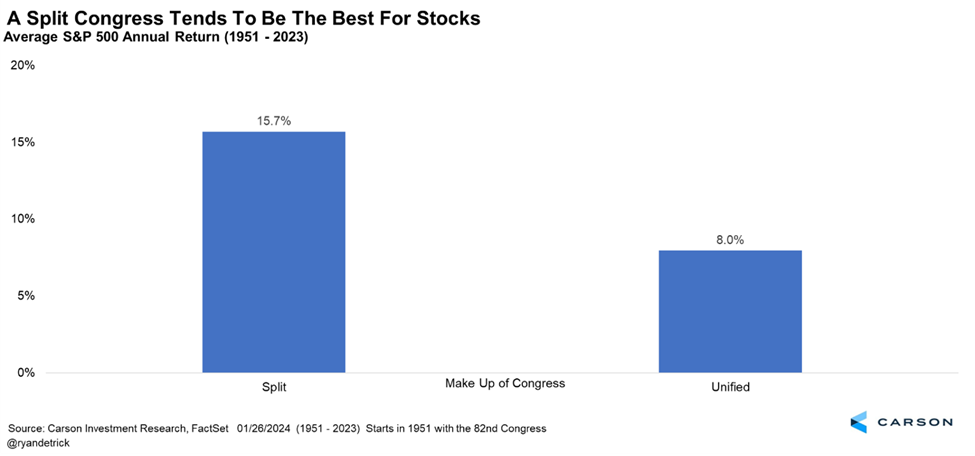

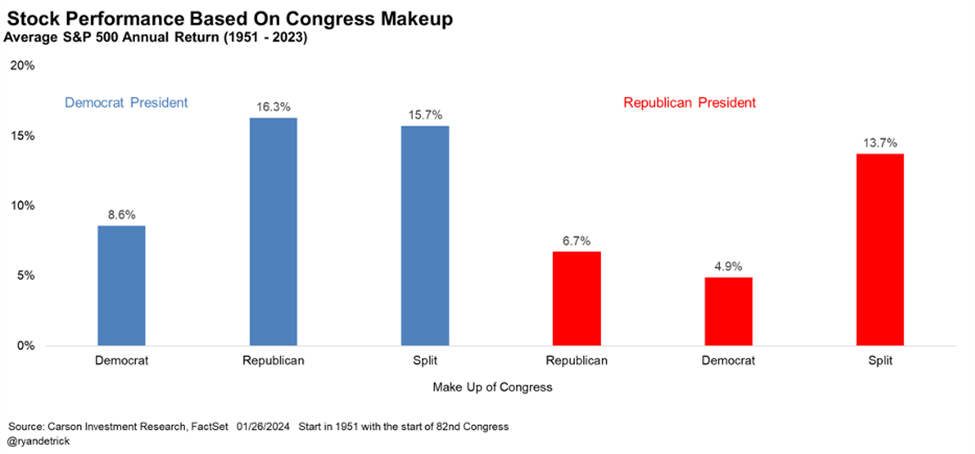

While the presidential race may significantly impact policy, it often has less bearing on markets than the makeup of Congress. A split Congress, where one party controls the House and the other the Senate, is generally favorable for the stock market. This balance reduces the likelihood of sweeping legislative changes, creating a stable environment for businesses to plan without major policy shifts. Historically, a divided Congress has led to less regulatory and tax upheaval, which can support investment and growth.

In such scenarios, policies impacting the economy and corporations often face gridlock, resulting in a “status quo” effect. With fewer dramatic changes in fiscal policy, businesses can better anticipate costs, tax structures, and regulations, fostering a steady environment for profitability. Investors typically respond positively to this stability, as it reduces uncertainty and the risk of abrupt legislative moves that could impact corporate earnings. Furthermore, a split Congress encourages bipartisan compromise, often leading to more moderate policies beneficial for stocks.

Historically, Democratic presidents have shown stronger stock market performances than Republicans, although opinions may vary. More objectively, a split Congress has consistently favored market performance. This dynamic should ease concerns about the financial fallout of either presidential candidate winning. (Source: Factset and Carson Research)

In Summary

With just a week remaining, we’ll soon know who the next U.S. president will be. While some may feel anxious, we do not expect this result to negatively impact the equity markets overall. However, we are closely monitoring the congressional elections, as the makeup of Congress will likely have a greater influence on financial markets’ trajectory in the coming years. Historically, markets have performed better under a split Congress, and we anticipate this trend will hold true again.

This year has been marked by a resilient bull market that we believe will continue well into 2025. With both Canada and the U.S. easing monetary policies, highlighted by interest rate cuts, strong GDP growth, and modest unemployment, we see an extended runway for this bull market, possibly even longer than expected. Our technical indicators consistently point to equities as the leading asset class, and we remain committed to an active approach by adding growth-oriented positions while managing potential downside.

We are confident in our ADAPT Investment Strategy, which we believe will skillfully guide us through the next presidential term. This approach will help us capitalize on market growth while effectively navigating any uncertainties, keeping us well-positioned for continued success.

We thank you for your continued trust and we welcome you to reach out to us with any questions you may have.

This information has been prepared by Kian Ghanei and Terry Fay who are Portfolio Managers for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The [Investment Advisor/Portfolio Manager] can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.