May 2024 Commentary

There are numerous headline news items that are causing concern and seem to be adding various risk factors globally. Our task becomes most engaging when we sift through the confusion and reach past the distractions that might divert us from the macro trends happening in the financial markets. On closer inspection, there seems to be more stabilization in the markets’ foundation than it initially appears, and we would like to highlight some of these trends both in Canada and the US.

A good example of this was on Friday when the U.S. stock market bounced back ferociously after an earlier session decline driven by multiple factors. This begs the question as to what the markets are looking for and gives us the opportunity to pause and look at a few factors.

At first glance, it appears that inflation expectations may have played a big part in this Fridays surge. The April Personal Consumption Expenditures (PCE) deflator, which tracks changes in the prices of goods and services, showed increases aligning with expectations. This calmed investors’ concerns about inflation, reducing fears of aggressive monetary policy tightening by the Federal Reserve. Additionally, the personal income and spending reports for April revealed modest growth, indicating that consumer spending, a crucial economic driver, remains robust. The market also benefited from revised first-quarter GDP and core PCE Price Index figures, which were slightly lowered but still above the Fed’s target. This adjustment, though modest, may have bolstered a more positive outlook among investors.

In addition to better expectations around inflation, we’re just coming off a positive earnings season and continued appetite of the US consumer which are both fundamentally playing nicely to investor confidence. Lastly, we can take a look at some Canadian factors are causing Canadians to hold their breath as they look for any signs of a rate cut in Canada in the coming month or two.

S&P 500 Earnings

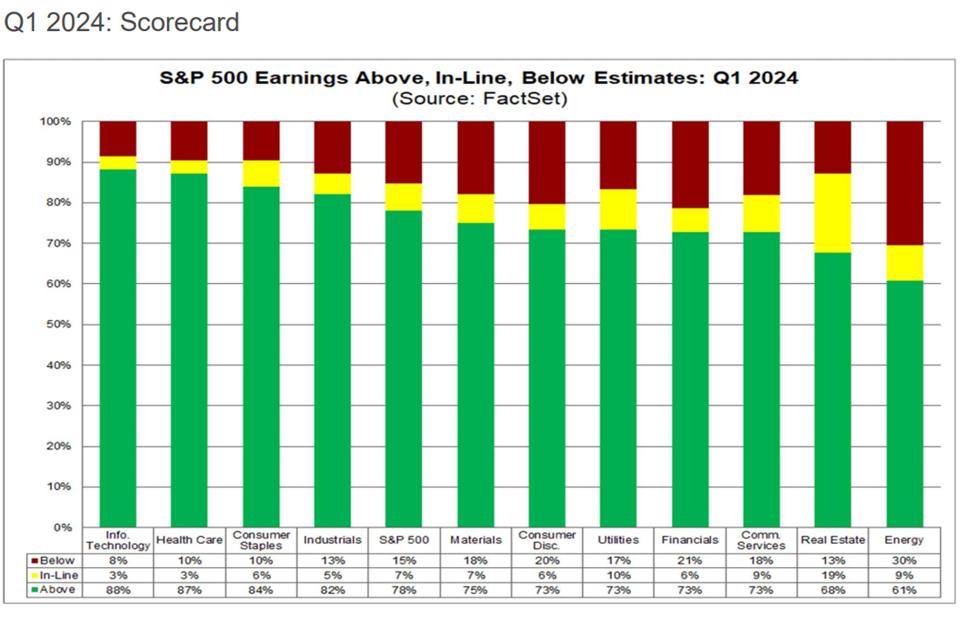

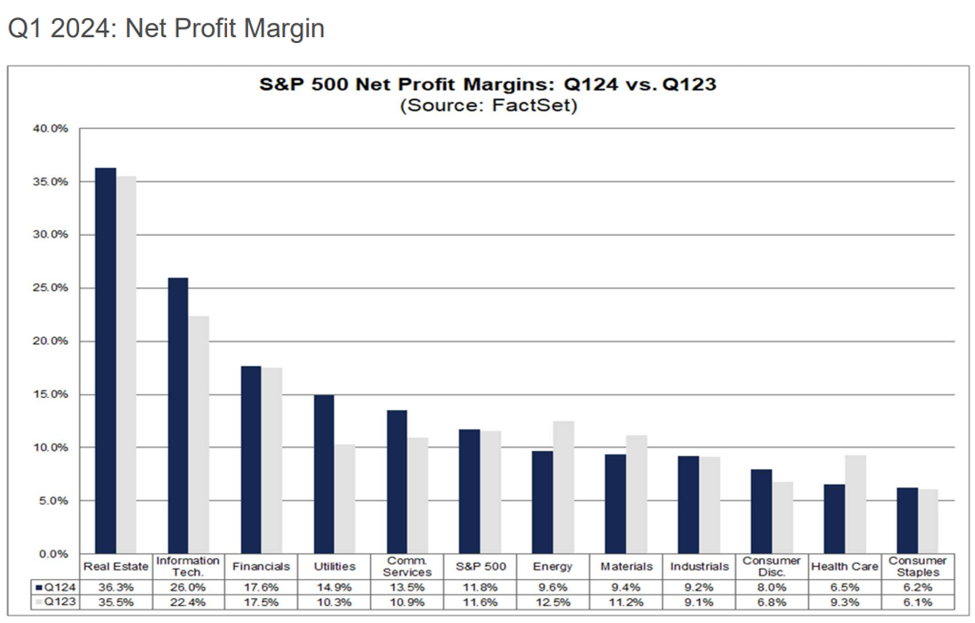

In May 2024, S&P 500 companies had a strong earnings season, continuing positive trends from earlier in the year. Here’s a summary of the key points: (Source: Factset)

Earnings Performance:

- About 80% of the S&P 500 companies reported their Q1 2024 earnings, with 77% exceeding earnings per share (EPS) estimates, matching the five-year average and surpassing the ten-year average.

- The blended earnings growth rate for Q1 2024 was 5.0%, up from 3.5% the previous week, marking the highest year-over-year earnings growth since Q2 2022.

- Aggregate earnings were 7.5% above analyst estimates, slightly below the five-year average but still above the ten-year average.

Sector Performance:

- Health Care and Consumer Discretionary sectors contributed significantly to positive earnings surprises. Other sectors such as Communication Services, Financials, Industrials, and Information Technology also performed well.

- Eight out of eleven sectors reported year-over-year earnings growth, with Communication Services, Utilities, Consumer Discretionary, and Information Technology leading. Conversely, Energy, Health Care, and Materials sectors experienced declines.

Future Outlook:

- Analysts are optimistic about future quarters, predicting year-over-year earnings growth rates of 9.6%, 8.4%, and 17.1% for Q2, Q3, and Q4 of 2024, respectively. An 11.0% growth rate is expected for the entire calendar year 2024.

Overall, the S&P 500’s performance in May 2024 was robust, characterized by strong earnings and steady revenue growth across most sectors, reflecting continued economic recovery and resilience of U.S. companies.

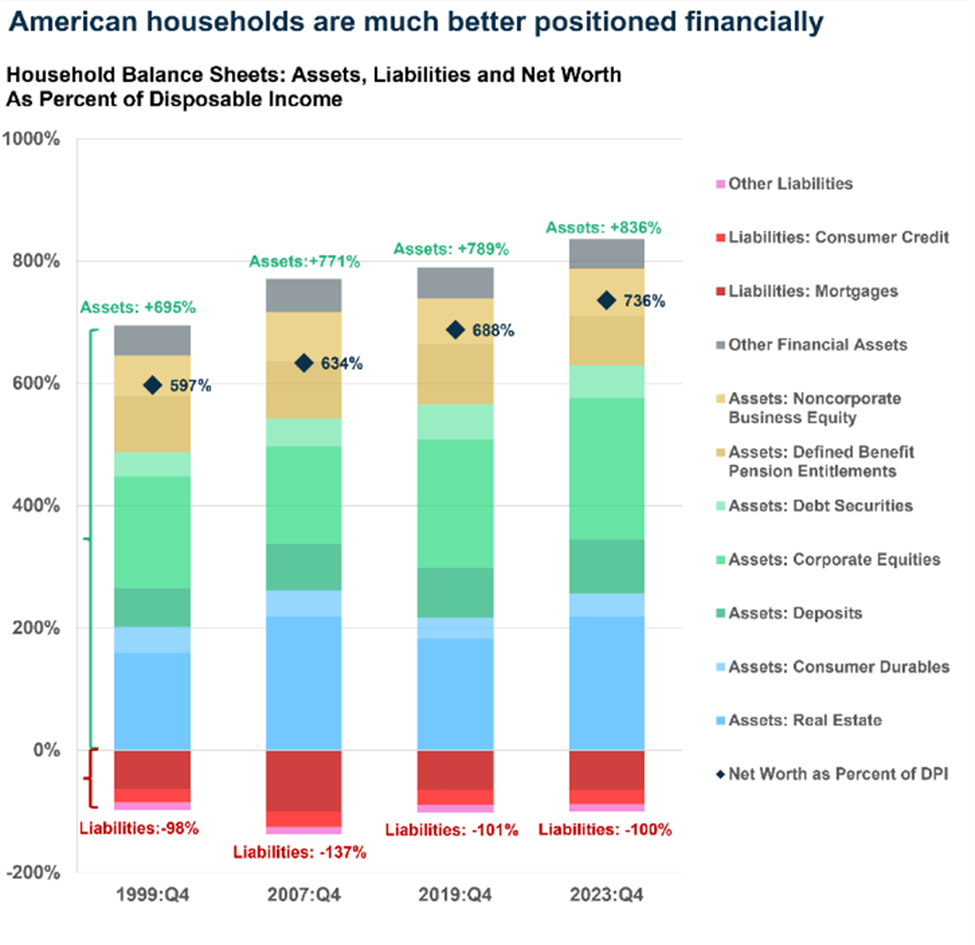

The ‘Driver’ – Consumers

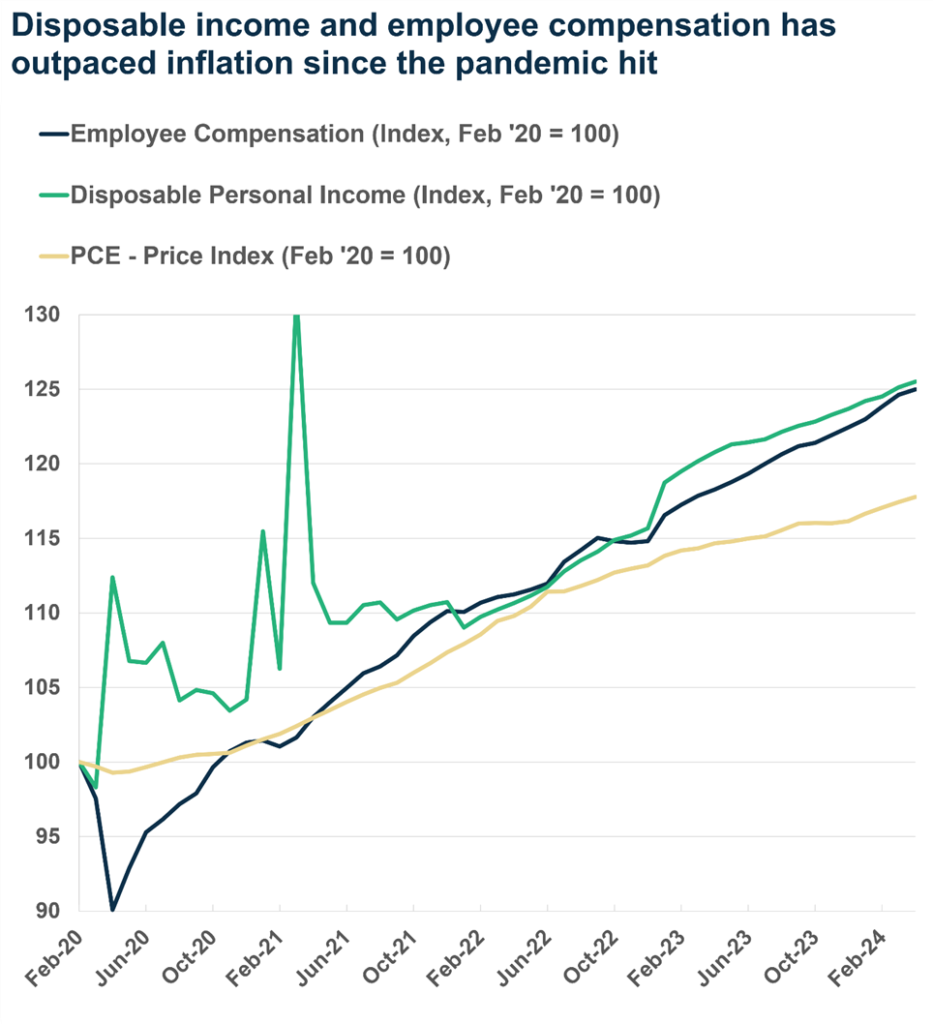

Adding to strength of the US economy, a key driver has continued to be the appetite of consumers and overall spending which has kept up with inflation. Home and stock prices have reached record levels, and consumer balance sheets are in good condition. Despite recent high inflation and low consumer sentiment, there’s a shift in the perception of “inflation,” now often understood as “high prices.” For instance, the inflation rate for full-service meals is currently 3.4%, down from 9% a year and a half ago, indicating a significant reduction but still reflecting overall rising prices.

However, disposable income has risen by over 25% since February 2020, keeping pace with inflation. This increase includes various income sources such as wages, social security, and business income. Over the past year, disposable income rose by 3.9%, and employee compensation increased by 5.7%, outpacing the 2.7% rise in headline PCE inflation, resulting in real income gains. This helps explain why consumer spending remains robust. Income growth has benefited all income groups, with lower-income households seeing significant improvements. The Congressional Budget Office’s research indicates that from 2019 to 2023, incomes for all quintiles grew more than inflation, even after accounting for government transfers and taxes. For the lowest income quintile, the share of income required to purchase a 2019 consumption bundle fell by 2%, showing that incomes have risen sufficiently to keep up with or surpass inflation, benefiting even lower-income households.

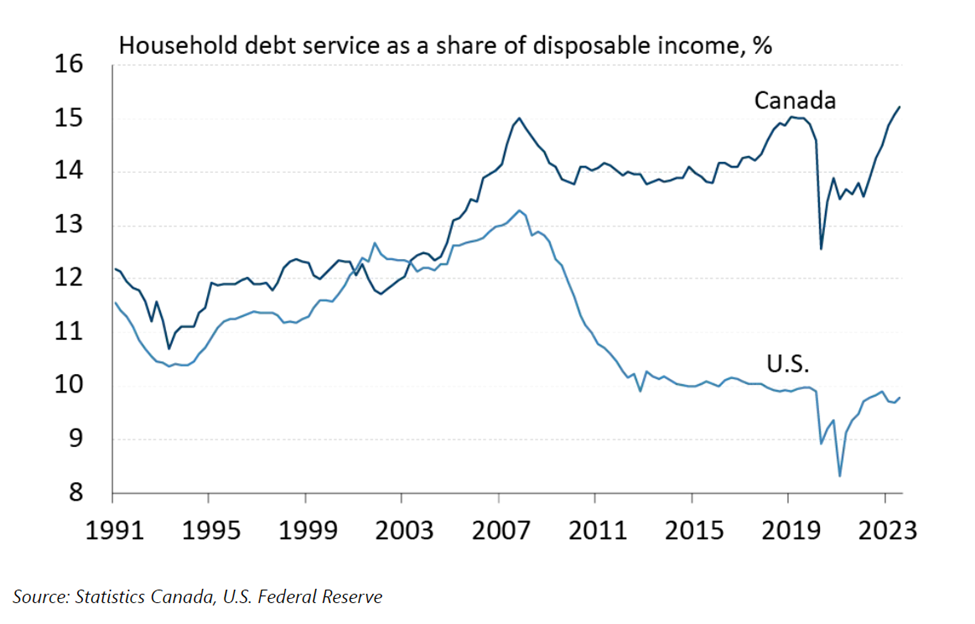

There is a notion in Canada and many Canadians are having financial constraints caused by higher shelter and borrowing costs. The fact of the matter is that Canadians are feeling the ‘pinch’ much more than their US counterparts and as such the next two months can be critical for some as the bank of Canada decides on a direction around their monetary policy. Let’s start by taking a look at the household debts between the average Canadian and the American.

Canada’s Household Debt vs. The U.S.

Canada’s household debt levels are significantly

higher compared to those in the United States. As of 2023, Canada has the

highest household debt among the G7 countries, with a large portion tied up in

mortgages. Canadian household debt has been steadily increasing over the past

decade, surpassing the size of the country’s GDP, reaching 107.5% of GDP in

early 2024. In contrast, U.S. household debt has decreased since the 2008

financial crisis, falling from 100% of GDP in 2008 to about 75% in 2021. (Source:

Carson Research)

As mentioned above, the rising debt levels in Canada are attributed to high housing costs, which have outpaced income growth, leading Canadians to take on more debt to afford homes. In comparison, the U.S. has seen relative stabilization in housing costs and a decrease in debt levels, partly due to stricter lending standards implemented after the 2008 financial crisis. This disparity indicates that Canadian households are more financially leveraged than their U.S. counterparts, posing higher risks in the event of economic downturns or rising interest rates. (Sources: Statistics Canada and The Federal Reserve)

Should we expect a rate cut in Canada?

As the Bank of Canada (BoC) prepares for its interest rate decision on June 5, 2024, market expectations lean towards a rate cut. Recent data shows that while inflation has moderated from its peak, it remains a concern. Core inflation measures have stabilized, with some analysts noting that inflation has returned to pre-pandemic levels in certain sectors. Despite this progress, overall inflationary pressures persist, so don’t be surprised if the BoC prefers to wait for more consistent evidence of inflation moving closer to its 2% target before adjusting rates.

Overall, the predominant view is that the BoC will cut interest rates on June 5, 2024, or at least provide a clear hint as to a timeline. There is no doubt, they will do what they feel is the right thing to do despite popular opinion to ensure a measured response to inflation and economic growth trends, even if it means buying more time in allowing for additional data to inform future policy decisions.

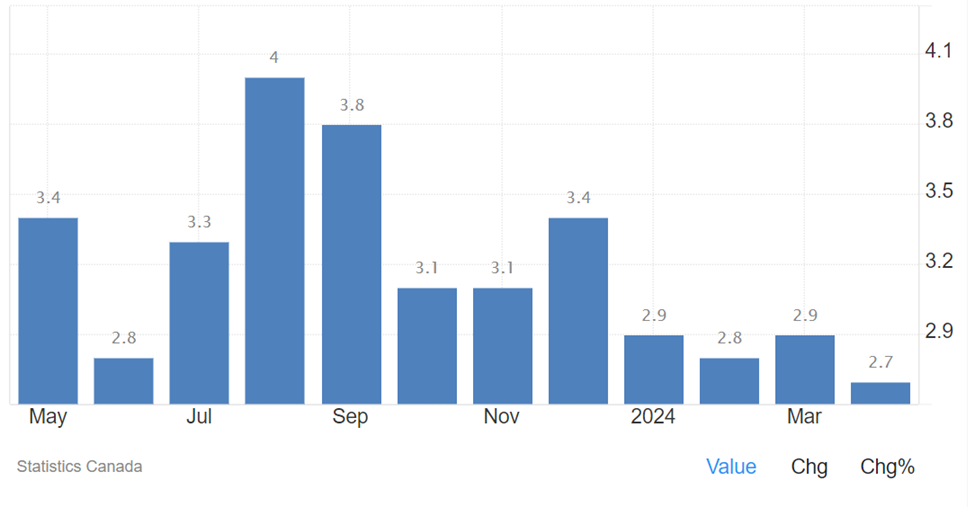

Canada’s Inflation Trend

As of May 2024, Canada’s inflation is trending downward, indicating a cooling in price increases across various sectors. The headline Consumer Price Index (CPI) inflation rate edged lower to 2.7% year-over-year in April 2024, consistent with expectations. This deceleration was driven by a broad-based slowdown in food prices, services, and durable goods. Specifically, food inflation dropped to 2.3% from its peak of 10% last year, and durable goods experienced deflation, down 0.8% year-over-year. However, gasoline prices increased by 6.1% year-over-year due to higher oil prices and seasonal factors. (Source: Statistics Canada)

The Bank of Canada’s preferred measures of core inflation also showed improvement, moving closer to the target range. The average of the Bank’s median and trim measures of core inflation fell to 2.8% in April from 3.1% in March. Additionally, the three- and six-month annualized paces of core inflation are trending lower, indicating potential for further easing in price growth. Shelter costs, particularly rent and mortgage interest, remain elevated, but other components like homeowner’s replacement costs have seen a decline.

Canada’s GDP Trend

As of mid-2024, Canada’s GDP growth has been modest, showing resilience but struggling with various economic challenges. In the first quarter of 2024, the GDP grew by 3.1% year-over-year, slightly better than expected. However, the forecast for the rest of the year indicates a slowdown, with GDP growth expected to be around 1.2% for the year. This slow pace is influenced by high household debt levels, rising mortgage rates, and sluggish productivity, which weigh heavily on the economy.

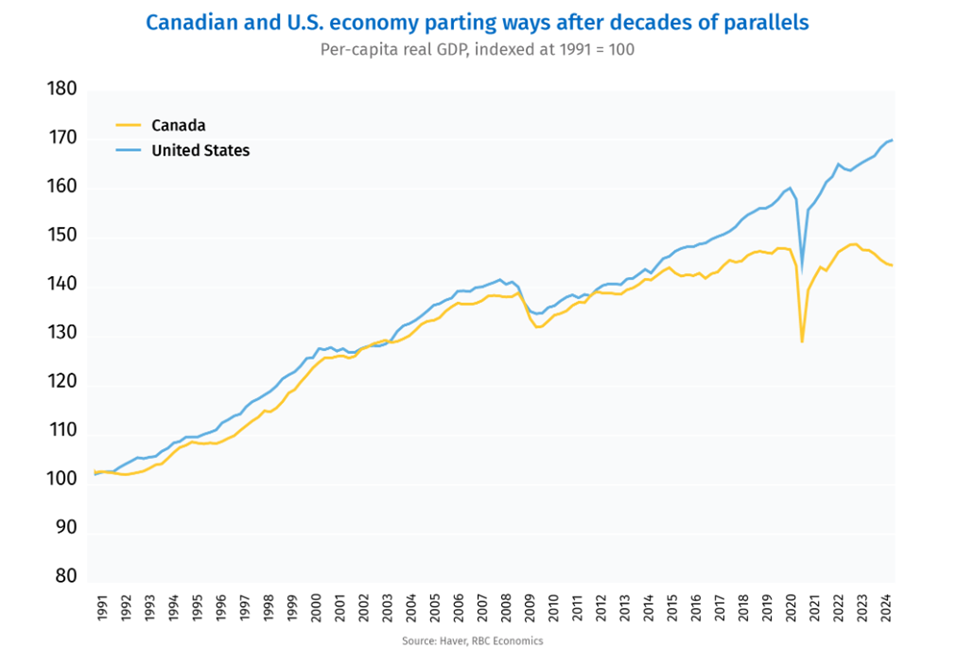

Canada GDP versus the US

Historically, the economic performance of Canada and the United States has been closely aligned due to their strong relationship and similar inflation trends. However, recently, the Canadian economy has been underperforming significantly and persistently. As of Q1 this year, Canadian per-capita real GDP is 10% lower than that of the U.S., marking the largest gap since at least 1965. Inflation trends have also started to diverge, with the U.S. headline consumer price index growing at an annualized rate of 4.3% from December to April, compared to just 1.3% in Canada. (Source: RBC Economics and Haver)

In sectors with strong trade ties, such as manufacturing, conditions remain broadly aligned between Canada and the U.S. In 2019, over 40% of Canadian manufacturing GDP catered to U.S. demand, making the sector highly sensitive to international market conditions. Recently, manufacturing output has stagnated in both countries due to a global decrease in demand for goods following a surge during the pandemic lockdowns. Despite this slowdown in manufacturing, the U.S. economy has demonstrated resilience, bolstered by strong consumer spending on services and government purchases, which have contributed to 70% of GDP growth on average over the past year.

A positive aspect for Canada is that its underperforming economy is exerting downward pressure on inflation, bringing it lower than in the U.S. This trend positions the Bank of Canada to potentially cut interest rates earlier than the U.S. Federal Reserve this year.

In Summary

Despite facing a myriad of global and local obstacles, the financial markets exhibit signs of resilience and stabilization. Economic indicators in the U.S. reflect controlled inflation and consistent consumer expenditure, complemented by robust earnings and revenue growth among S&P 500 companies. Conversely, Canadian households grapple with substantial debt burdens, prompting expectations for an interest rate reduction by the Bank of Canada on June 5th. Should this adjustment fail to materialize, many anticipate forthcoming rate cuts, offering potential relief to Canadian consumers and supporting capital assets. While we anticipate continued upward movement in equities, volatility remains a factor. Our ADAPT Investment Strategy enables us to adeptly navigate opportunities and risks, facilitating necessary adjustments across asset classes and sectors as we enter the summer months amidst a pivotal U.S. election year.

We thank you for your continued trust and we welcome you to reach out to us with any questions you may have.

This information has been prepared by Kian Ghanei and Terry Fay who are Portfolio Managers for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The [Investment Advisor/Portfolio Manager] can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.