The significance of the U.S. consumer and the adoption rate of artificial intelligence (AI) was noteworthy in the recent month, manifesting during Nvidia’s earnings release and the disclosure of US/Canada Q4 GDP figures. Both the S&P 500 and the TSX observed an uptick in February, and despite some struggles surrounding Canada’s economy, this market rally holds positive implications for equities for the remainder of the year.

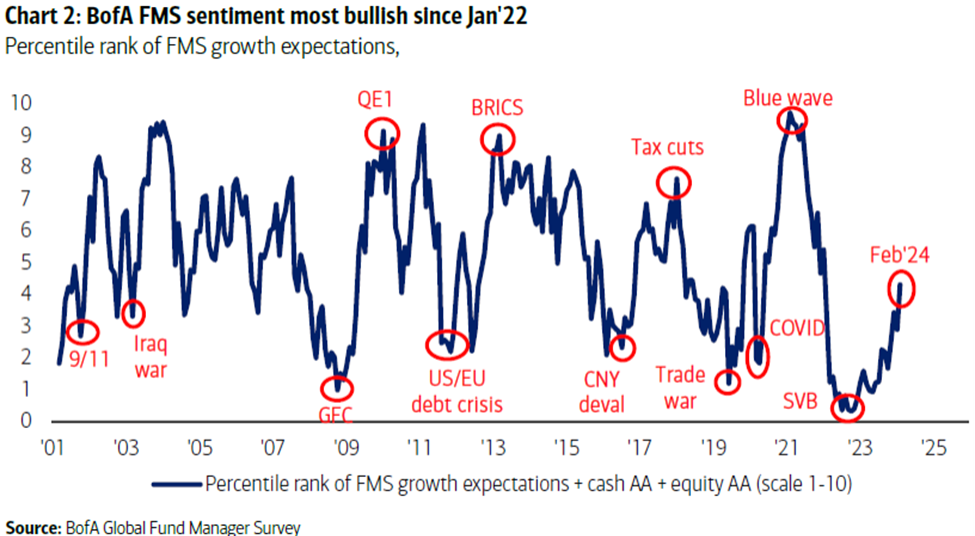

The Bull Market maintains its upward momentum, drawing in more participants as concerns about a recession recede. Several sentiment polls reveal significant boosts in optimism with one being the Bank of America Global Fund Manager Survey (GFS) which recently reported overall sentiment reaching its highest level in two years. While not reaching previous peaks, this surge in optimism indicates there is still room for growth before reaching the ultimate peak, making it noteworthy.

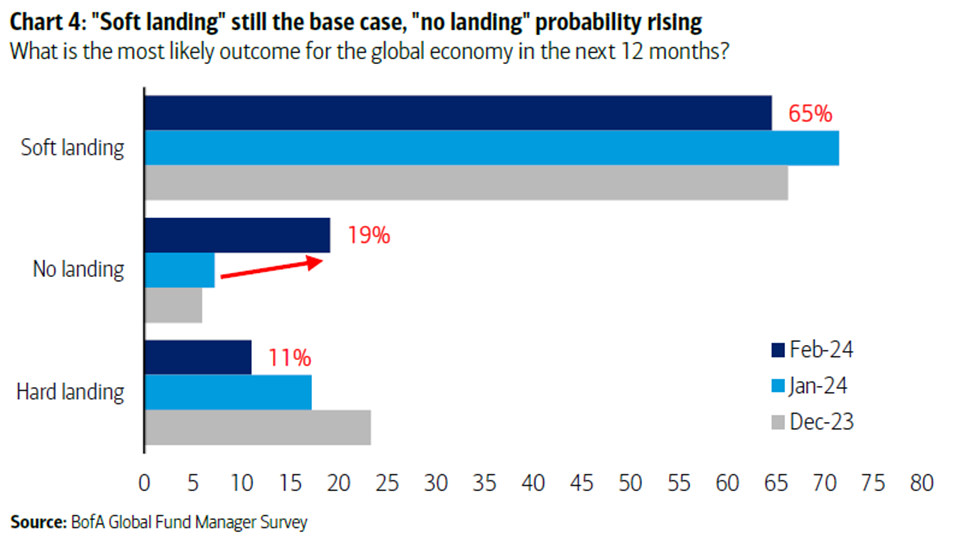

Furthermore, there are an increasingly number of money managers now believing in a scenario where the US avoids a recession completely. Although most still believe in a soft landing (aka small recession), the sentiment is changing quickly compared to just a few months ago.

The Case for US Equities – Earnings and Revenues!

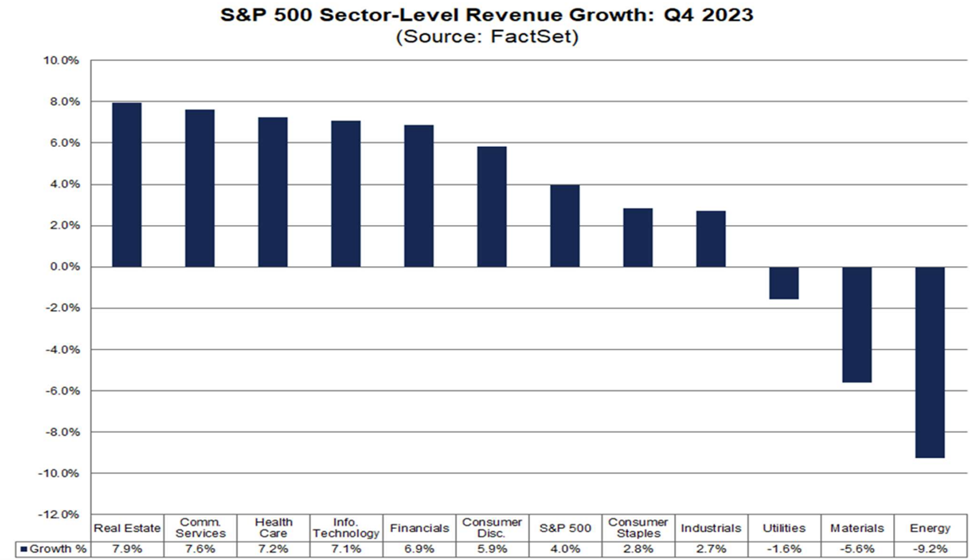

Earnings and revenues are still one of the biggest contributors to growth. According to Factset, the projected earnings growth rate for the S&P 500 in Q4 2023 is 3.2%. Achieving this growth rate would signify the index’s second consecutive quarter of year-over-year earnings growth. On the revenue front, the anticipated growth rate for the S&P 500 in Q4 2023 is 4.0%. While this falls below the 10-year average, attaining a 4.0% actual revenue growth rate for the quarter would mark the 13th consecutive quarter of revenue growth for the index. This streak would be the second-longest period of consecutive (year-over-year) revenue growth for the S&P 500 since FactSet began tracking this metric in 2008. The current record for the S&P 500 since 2008 is 15 straight quarters of revenue growth, spanning from Q3 2016 to Q1 2020.

To gain a better understanding of where the earnings are coming from, here is a visual look at the sectors and their respective revenue growth over the Q4 2023.

AI’s Impact and Utilization

There are high expectations surrounding artificial intelligence (AI), and prominent companies are taking the lead by meeting investor expectations. They are achieving this by balancing efficiency in the present while simultaneously making investments for the future. This positive trend benefits not only individual businesses but also the overall economy, with the potential to boost productivity—an important focus in our forward-looking 2024 Outlook.

The increasing ubiquity of AI is evident, with its adoption occurring at a rapid pace. NVIDIA’s fourth-quarter earnings report stands out as impressive on all fronts. Sales exhibited remarkable growth, exceeding triple the figures from a year ago, reaching $22.1 billion compared to $6.2 billion in the fourth quarter of 2022—an 8% beat against the consensus expectation of $20.41 billion. Each segment reported sales that surpassed expectations, with robust demand for NVIDIA’s graphic processing units (GPUs), crucial for AI training. Notably, revenue guidance exceeded expectations, showcasing the company’s resilience and success in the face of challenges.

The Ripple Effect

NVIDIA’s report provided reassurance to investors that the widespread influence of AI continues to expand without any signs of slowing down. This sentiment is echoed by numerous other companies. UnitedHealth Group highlighted its use of AI to enhance both customer service and employee productivity. Bank of New York Mellon employs AI for handling mundane and repetitive tasks. NVIDIA emphasized the global prevalence of AI in nearly every automotive company, focusing on design and efficiency, with many also venturing into autonomous driving capabilities. Quest Diagnostics utilizes AI to elevate quality, and JPMorgan incorporates it for enhanced fraud detection. The impact of AI extends beyond NVIDIA or the so-called Magnificent Seven; it is already making a significant impact on companies worldwide. As validated by NVIDIA’s earnings, the investment in AI shows no signs of slowing down in the foreseeable future, bringing positive implications for the company’s stock and the broader stock market. (Source: Bloomberg)

US Inflation – Muted!

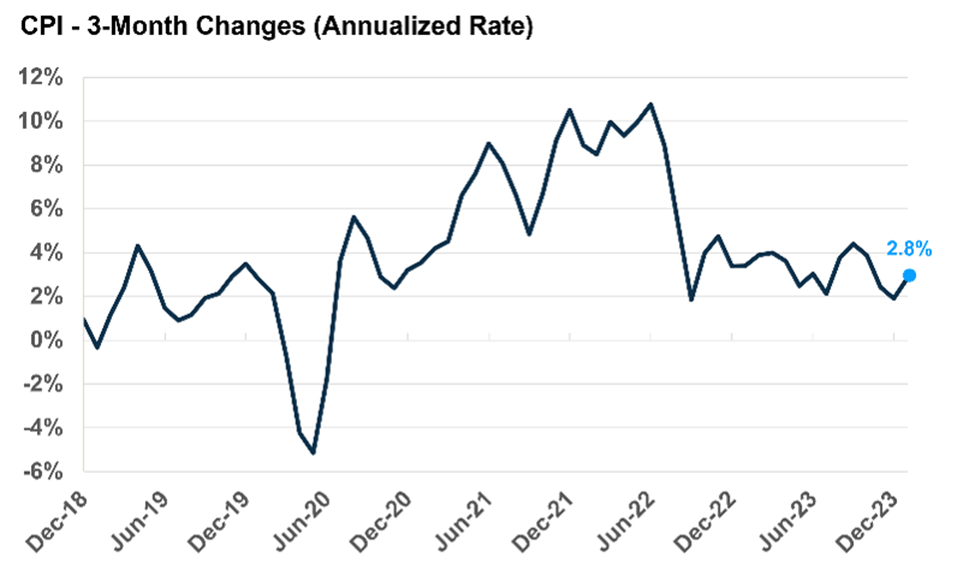

The Consumer Price Index (CPI) headline registered a 0.3% month-over-month increase in January, surpassing the anticipated 0.2% rise. The Core CPI, which excludes the volatile food and energy components, saw a 0.4% increase, exceeding expectations for a 0.3% uptick. Over the past three months, the annualized rate of headline inflation has been at 2.8%, while core inflation stands at 4.0%, significantly surpassing the Federal Reserve’s target of 2%.

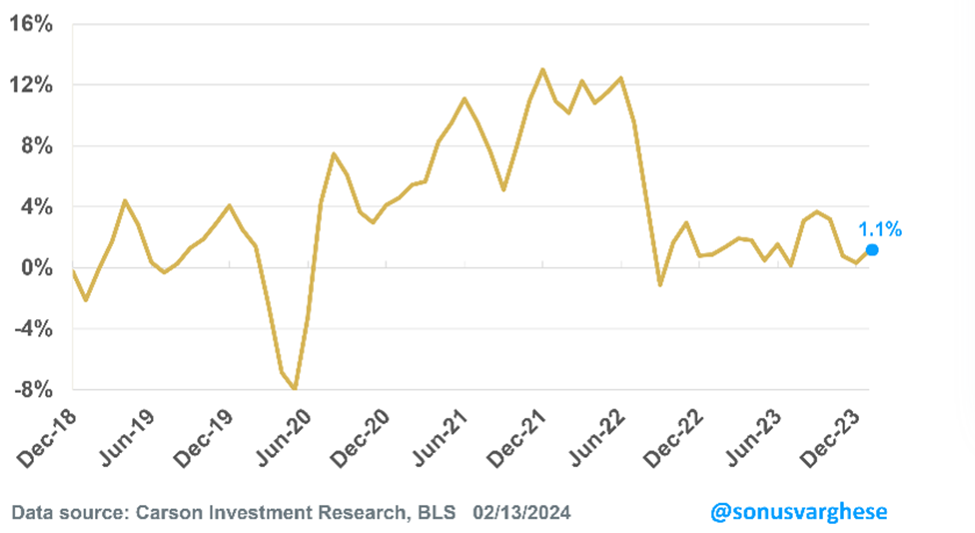

It seems that the current surge in inflation is primarily attributed to elevated shelter (housing) inflation. When excluding shelter costs, the headline inflation only increased by 0.1% in January. Over the last three months, this non-shelter inflation has been at an annualized pace of 1.1%, and over the last six months, it stands at 2.1%. Looking at the past year, the Consumer Price Index (CPI) excluding shelter has risen by just 1.6%. (Source: Carson Research)

Reported on Thursday by the US Bureau of Economic Analysis (BEA), the PCE Inflation in the US, gauged by the change in the Personal Consumption Expenditures (PCE) Price Index, decreased to 2.4% on a yearly basis in January. This figure followed the 2.6% increase noted in December and aligned with market expectations. On a monthly basis, the PCE Price Index saw a 0.3% rise, consistent with forecasts. The Core PCE Price Index, excluding the influence of volatile food and energy prices, recorded a 2.8% yearly increase, matching analysts’ predictions. This further indicates a subdued or stable inflation, currently influenced primarily by shelter costs.

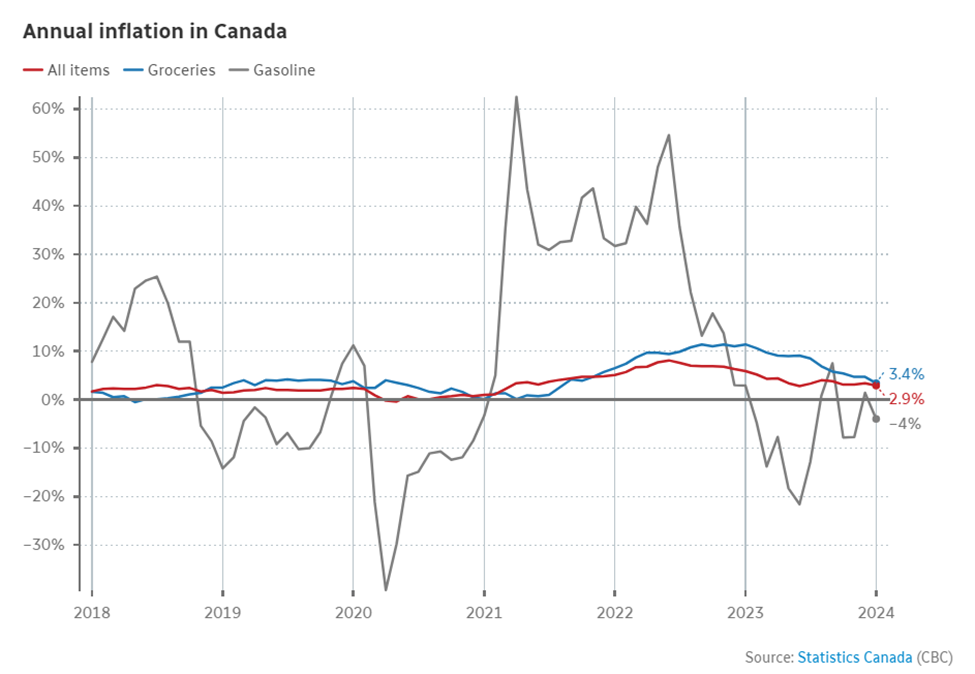

Canada Inflation

Statistics Canada reported on Tuesday that Canada’s annual inflation rate eased to 2.9% in January, primarily attributed to a slowdown in gas prices. Economists had anticipated a rate of 3.3%. Mirroring the situation in the US, mortgage interest costs remained the primary driver of inflation, with a year-over-year increase of 27.4%, while rent prices showed an uptick at 7.9%.

The persistent housing crunch and affordability challenges in Canada are expected to persist, regardless of future interest rate adjustments. This issue fundamentally stems from a supply-demand imbalance, with increasing demand exacerbating the situation.

Canada Q4 GDP

The Canadian economy experienced a rebound at the close of the previous year, buoyed by robust oil exports, affording the Bank of Canada additional time to evaluate inflation trends before contemplating rate cuts. In the fourth quarter, the economy expanded at an annualized pace of 1%, surpassing both the consensus estimate of 0.8% and the Bank of Canada’s projected zero growth. This marks a recovery from an upwardly revised 0.5% contraction in the period between July and September.

While population growth continues to outpace the increase in household spending, per-capita consumption expenditures have declined for the third consecutive quarter. Notable declines in business and housing investments were among the significant drawbacks, making the second half of 2023 the weakest half-year for business investment since 2016, excluding the pandemic.

However, many argue that the US demand for oil and oil exports is the real driver behind the better-than-expected GDP numbers in Canada. This might very well be true when you consider that per capita consumption expenditure in Canada is falling with an uptick in the unemployment rate.

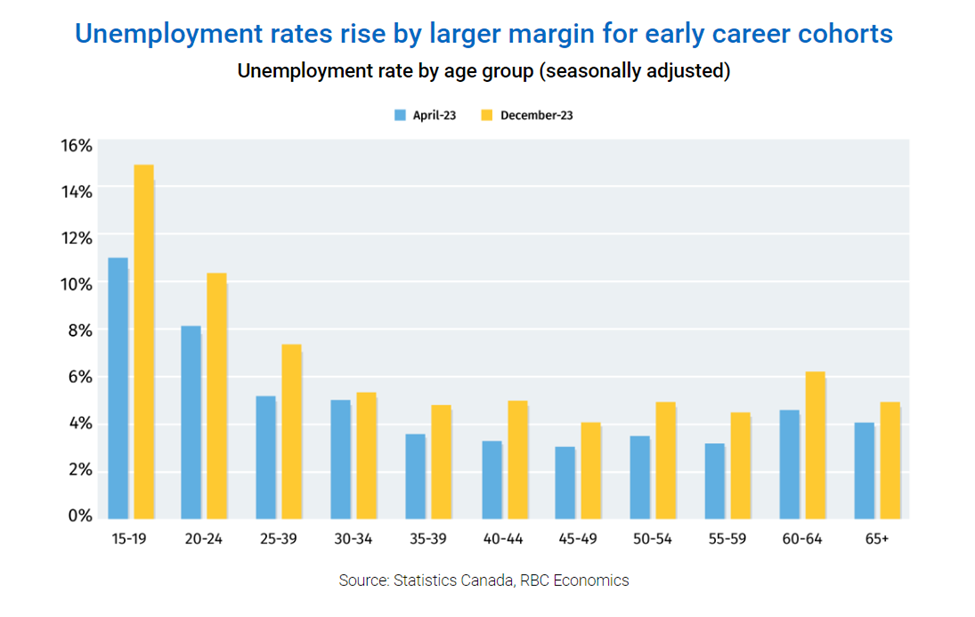

Since April, Canada’s unemployment rate has increased by 0.8 percentage points, a level of rise typically associated with a recession. However, the ascent in the unemployment rate aligns with the milder side of historical downturns. Anticipating a second consecutive modest decline in GDP for Q4 2023, per-capita output has already seen a downturn for five consecutive quarters through Q3 of the previous year.

Despite a notable surge in population growth, the heightened unemployment is predominantly a consequence of reduced hiring rather than an uptick in terminations. Individuals, particularly younger and recent graduates, are facing increased challenges in securing full-time positions. Although national employment figures continue to climb, the pace is no longer swift enough to accommodate the influx of new entrants into the labor market. This situation might exacerbate before showing signs of improvement, especially as Canada maintains its immigration policy unchanged.

In Summary

The resilience of the US economy has surpassed expectations, with the likelihood of a severe recession diminishing. Many investors who were on the sidelines are now compelled to ride the ongoing bullish wave. Despite the significant impact of inflation on rates and fiscal policy, the current trend in artificial intelligence (AI) is gaining momentum, experiencing increased adoption and utilization in commercial settings. Nvidia’s recent data serves as an indicator of the growing demand for efficiency optimization. For these reasons, we maintain our confidence in investing in US equities and anticipate the rally to persist into 2025.

Canada’s economy is holding steady and is capitalizing on the US demand for energy. However, challenges persist in the form of housing and shelter costs, exerting a substantial influence on overall inflation figures and reducing consumption on a per capita basis. This issue is also evident in the US but to a lesser degree. With the weakness observed in Canada, we anticipate that Canada will be the first to implement rate cuts, followed by a gradual reduction campaign on both sides of the border. This shift is expected to alleviate some pressure on Canadian borrowers and lenders as conditions begin to normalize.

We thank you for your continued trust and we welcome you to reach out to us with any questions you may have.

This information has been prepared by Kian Ghanei and Terry Fay who are Portfolio Managers for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The [Investment Advisor/Portfolio Manager] can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.