Rational Inattention

Earlier this month, there were some signs of easing inflation in the US indicating that perhaps inflation had peaked in June. Investors became somewhat optimistic about the financial markets suggesting that perhaps there would be a pause or a reduction in interest rate hikes in the coming months. This began a rally in the equity markets that showed signs of strength and an improving inflationary condition. However, this optimism was short-lived. In a speech given last week by the Fed Chair Jerome Powell, he expressed his concerns over the elevated inflation rate and used a very ‘direct’ tone to describe the interest rate policy over the coming months. Investors could not ignore the core message and subsequently a selloff began pricing in higher interest rates in the near future. There were several instances where he gave a clear indication of the Feds resolve in controlling and combatting inflation. Her are a few examples taken from his speech.

“Restoring price stability will likely require maintaining a restrictive policy stance for some time”

“Our responsibility to deliver price stability is unconditional.”

“Our aim is to avoid that outcome by acting with resolve now.”

“Use our tools forcefully”

Furthermore, Powell referred to an economic concept called ‘rational inattention’ and said that “the longer the current bout of high inflation continues, the greater the chance that expectations of higher inflation will become entrenched.” In other words, if inflation keeps being the talk of town, the perception of higher inflation can drive higher inflation. This can particularly be true with expectations of higher wages among employees and high rents implemented by landlords. It’s imperative to implement policies that will ensure the public that inflation will get under control.

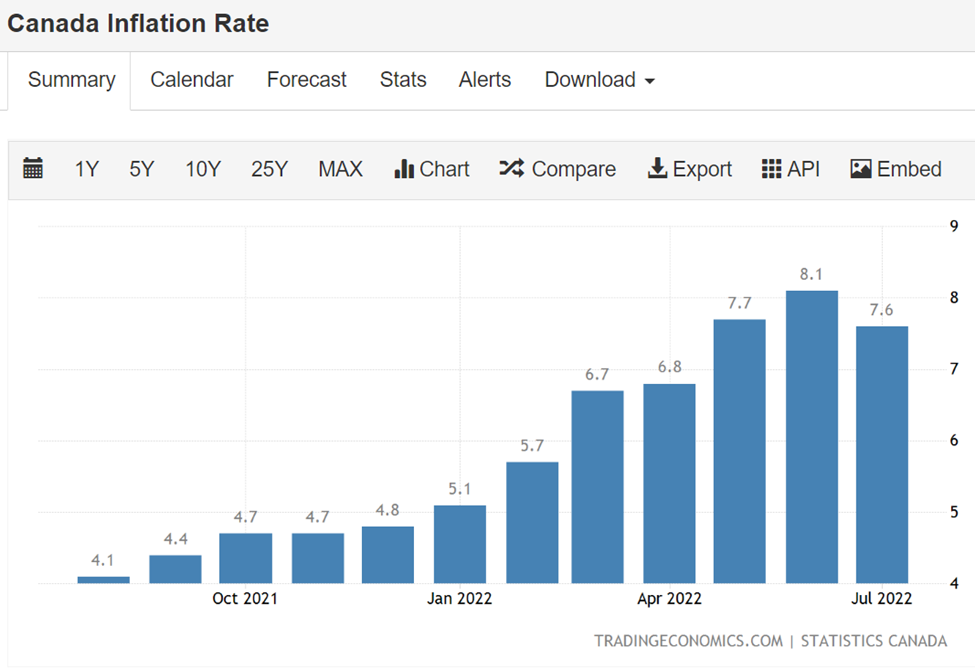

Given his short but very direct speech, the equity and bond markets have reacted accordingly. We are now expecting an above average rate hike in September with potentially more rate hikes into 2023. There are signs of price reduction in certain commodities and pockets, but both the US Consumer Price Index and Canada’s Consumer Price Index remain elevated.

The Double Edged Sword – Labour Market & Consumer Spending

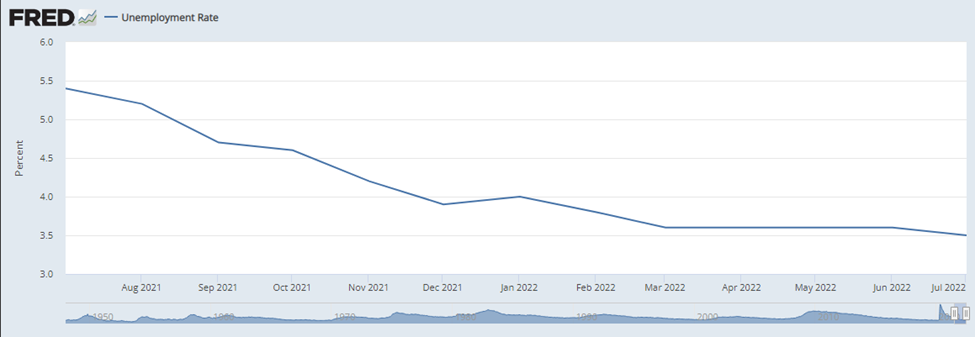

Making the situation more difficult for the Fed, the recent job opening data that came from the US pointed to a hotter than expected job market which only adds fuel to an out-of-control inflation. The July unemployment rate dropped to 3.5% from 3.6% which surprised many economic and policy makers during a period of policy tightening.

Similarly, consumer spending rose in the month of July from a month earlier but at a slower pace. In a normal economic expansion, one would view elevated consumer spending as a sign of a healthy economy, but at this point, strong economic data will most likely drive interest rates higher in the months to come making a recession inevitable.

Bond Spreads – A Leading Indicator?

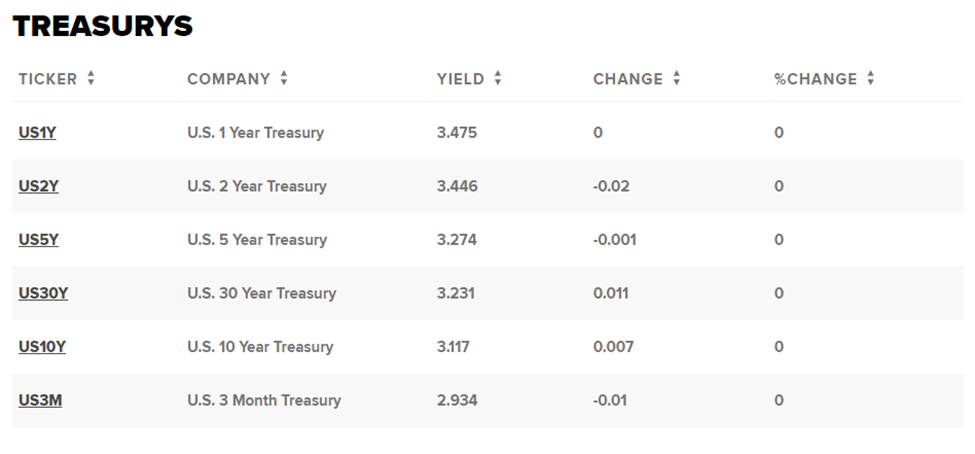

The 2-Year Treasury yield hit the highest level since 2007 with a continued inversion of the 2-yr/10-yr spread. This inversion is now at the deepest level since 2008 and typically inverted yield curves are a sign of challenging economic situations such those highlighted below. (St. Louise Federal Reserve)

A normal yield curve should indicate higher interest rates at longer term bands. An inversion is a sign of higher short-term yields in comparison to those in the latter years. This is due to either a higher expected rate of inflation in the near term or a low interest rate policy (typically after a recessionary environment) in the later years. As a note, the inversion has occurred over the last several weeks, but its spread has only widened since Chairman Powell’s speech last week suggesting high rates this fall and winter. (Source: Tradingeconomics.com)

Europe – Energy Crisis

With much of the focus on the US rate policy, some investors are concerned about the issues surrounding Europe as the Russian-Ukraine conflict continues to disrupt energy channels and supplies vital to Europe’s economic health. Here in North America, so far, we have been sheltered from the dire energy situation in Europe. To put things in perspective, the price of natural gas has risen by over 233% over the last 12 months and many are arguing that this is to be blamed on Russia as they have weaponized natural gas to retaliate against the West. (Source: Y-Charts and New York Times)

Why is this important? About 25% of the EU’s energy consumption comes from natural gas, according to the Directorate-General for Energy for the EU. Oil and petroleum (32%), renewable energy and biofuels (18%), and solid fossil fuels (11%) make up the rest. That dependence on natural gas means a dependence on Russia. Today, the EU is the largest importer of natural gas in the world, with the largest share of its gas coming from Russia (41%), Norway (24%) and Algeria (11%). The EU has been focusing on its buildout of renewable sources. But the buildout isn’t happening fast enough to eliminate that foreign dependence. (Source: CNBC)

The higher energy costs and the recent drought in Europe have led to inflation increasing in July to 9.1% leading to some power cuts for manufacturers and potentially homes in the weeks ahead. Furthermore, the Euro has lost some ground to the US dollars which has made imported good more costly, particularly oil, which is priced in US dollars. (Source: Bloomberg)

In the UK, inflation rose to 10.1% in July, a faster rate than the US and Europe. This is the highest increase in over 40 years in the UK. The Bank of England said, “soaring natural gas prices are likely to drive consumer prices to 13.3% in October and that could potentially push Britain into a recession that is expected to last through 2023”.

Adding to the pain, German’s inflation accelerated to the most since the euro was introduced on soaring energy prices, bolstering calls for a jumbo interest-rate increase when the European Central Bank meets next week. In Europe’s largest economy, inflation jumped 8.8% from a year ago in August. (Source: Bloomberg)

Summary

Earlier in August, we became optimistic as we saw some signs of improvement in inflation with some better-than-expected Q2 earnings season results. The short-lived market rally was indicative of an improving environment and there were rumours that Fed was going to loosen the tightening we’ve seen so far this year. The speech by Jerome Powell made last week painted a much clearer picture of their goals and intention in managing inflation. It was made clear that the Fed isn’t going to let inflation be the talking point in the years to come and that they would need to act now before it becomes entrenched in the behaviour of consumers and business owners. They emphasized that they do not want this to be a repeat of the 70s/80s Great Inflation era and that they would act accordingly without mincing words. Let’s be clear, the economy isn’t in a bad place but if things continue at this pace, the future economic conditions will become unstable as seen in many other countries with high levels of inflation. The Fed will continue to tighten aggressively until they see an ease in the labor market and consumer spending which would dampen the aggregate costs of goods and services. This is going to be a challenging undertaking by the central banks knowing very well that a recession might be the only way to restore price certainty. To add to their challenges, we are witnessing an energy crisis in Europe and parts of the US not seen since the Iranian Revolution. Lastly, there are calls for the Chinese government to ease their zero Covid policy and allow for suffering businesses and a fragile economy to remain operational. With the second largest economy in the world China participates to 15% of the global trades. Continued closures and disruptions are surely going to be felt around the world.

In conclusion, we sold the stocks and index ETFs inside our models. We decided that the current environment is not suited for risk-on assets such as stocks as we foresee more aggressive tightening policies from central banks in North America and around the globe. As Fed Powell said, there might be some short-term pain and we’d like to remain on the sideline until things become clearer from a policy standpoint and continue to look for better opportunities as they make themselves available.

As your portfolio managers, we thank you for your continued trust and we welcome you to reach out to us with any questions you may have.

This information has been prepared by Kian Ghanei and Terry Fay who are Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The [Investment Advisor/Portfolio Manager] can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.