For many investors a retraction in the market isn’t something new. We have experienced periods of high inflation, rising interest rates, and high unemployment. As described by Terry Fay, he recalls the early part of the 80’s to be economically challenging especially for many graduates looking for a career. “My introduction to the business was in 1981. Fresh out of Business school I was looking for a career in sales with a company that provided a base salary, car expense reimbursement, a pension etc. Such companies like Johnson and Johnson, Xerox were prime targets. At that time, we were in a recession. Inflation was high, interest rates were in the teens. Finding a suitable position was difficult to say the least because there was an abundance of experienced and more qualified people to fill those positions.”

Today, the backdrop certainly looks familiar. High inflation, interest rates rising to lower inflation, and potentially a spike in unemployment in the months ahead. Many of us have similar stories and can recall those periods of our lives. However, to those that are in their 40’s or younger, the current landscape may be somewhat of a surprise or shock as prices continue to rise and tighter policies take hold.

The future is uncertain and there are so many questions unanswered. Will the feds be able to get inflation under control? How long will that take? How long will interest rates rise for and by how much? Is a recession a certainty? Will the Ukraine war get worse? These questions are impossible to predict with accuracy but when we look at the current environment, we must proceed with caution and have a strategy that accounts for the possibility of further retraction and market correction.

Our Defensive Stance – the ADAPT Investment Strategy

Since the beginning of the year, we have been slowly reducing our equity exposure and building up cash. Today, our exposure to equities (With the exception of our BMO Bank Notes which by design have significant downside protection over the next 3-5 years) is at nearly 0%. These bank notes have a weighting of approx. 14% of the aggregate portfolio, and due to their unique structure, will continue to add value for Caerus clients over the next 3-5 years until maturity.

As many of you are aware, our ADAPT Investment Strategy is designed to help steer us into profitable trends but also provide us with the ability to manage stock market volatility during extended corrections or bear markets. Our decision to exit equities doesn’t come without much contemplation and consideration. As mentioned earlier, the future is uncertain, and as your portfolio managers, we rely on available data to make the best decision possible. Our strategy isn’t an exact science, and in fact, it comes with its own sets of unknowns or risks. There are risks to our tactical decision as there are with other strategies such as the buy-hold strategy. These decisions are important and weights heavy on us and we believe its important to offer rationale to our tactical approach. Our tactical approach to limiting downside exposure comes with the risk of missing potential gains should the markets rebound and move higher. Essentially, we could exit stocks only to see them climb higher the next day or in days. This is a risk that we are taking on in exchange to preserve client capital during periods of uncertainty. The buy-and-hold strategy will not have such risk as you’re never out of the market but it does pose extreme downside risk that we are not looking at participating in.

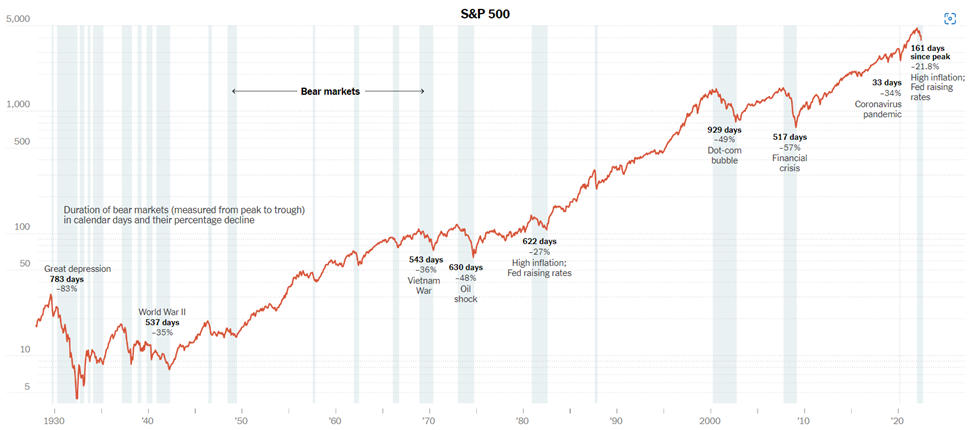

It’s critical that we have an understanding of some past periods of contraction, and assess the similarities and differences as they compare to today. They say history never repeats itself, but it often rhymes. A review of these recessionary periods (in the US) should offer some useful insight into what may lie ahead.

Recessions – 1970 to Present (U.S.)

1970 Recession

This recession was relatively mild, lasting 11 months—from December 1969 to November 1970. Unemployment peaked at 6.1% in December 1970. (Source: Bureau of Labor Statistics)

1973-75 Recession

This recession lasted 16 months, from November 1973 to March 1975. The OPEC oil embargo is blamed for quadrupling oil prices, but actions taken by President Richard Nixon were partly blamed. (Source: National Bureau of Economic Research)

First, Nixon instituted wage-price controls. They kept prices too high, reducing demand. Wage controls made salaries too high and forced businesses to lay off workers. Second, Nixon took the United States off the gold standard in response to a run on the gold held at Fort Knox, which led to inflation. The price of gold skyrocketed while the dollar’s value plummeted. (Source: PBS: Nixon, Price Controls and the Gold Standard)

The result was stagflation and five quarters of negative GDP growth.

1980-82 Recession

The economy suffered two recessions in this period. There was one during the first six months of 1980. The second lasted 16 months, from July 1981 to November 1982. The Fed caused this recession by raising interest rates to combat inflation. That reduced business spending. The Iranian oil embargo aggravated economic conditions by reducing U.S. oil supplies, which drove prices up. (Federal Reserve History, National Bureau of Economic Research)

GDP was negative for six of the 12 quarters. Unemployment rose to 10.8% in November and December 1982. It was above 10% for 10 months. (Source: Federal Reserve Bank of St. Louis)

1990-91 Recession

This recession ran for nine months, from July 1990 to March 1991. It was caused by the 1989 savings and loan crisis, higher interest rates, and Iraq’s invasion of Kuwait. GDP was -3.6% in Q4 1990 and -1.9% in Q1 1991. Unemployment peaked at 7.8% in June 1992. (National Bureau of Economic Research)

2001 Recession

The 21st century experienced three recessions. Each was worse than the one before it, but for different reasons.

The 2001 recession lasted eight months, from March to November. It was caused by a boom and subsequent bust in dot-com businesses. The Y2K scare had partially created the boom in 2000. The 9/11 attack worsened the recession. The economy contracted in two quarters. (Source: Stanford University)

2008–09 Recession

The Great Recession lasted from December 2007 to June 2009, the longest contraction since the Great Depression. The subprime mortgage crisis triggered a global bank credit crisis in 2007. By 2008, the damage had spread to the general economy through the widespread use of derivatives.

GDP in 2008 shrank in three quarters, including an 8.5% drop in Q4. The unemployment rate rose to 10% in October 2009, lagging the recession that caused it.

The recession ended in Q3 2009, when GDP turned positive, thanks to the American Recovery and Reinvestment Act. (Source: National Bureau of Economic Research)

2020 Recession

The 2020 recession was the worst since the Great Depression. The U.S. economy contracted a record 31.2% in the second quarter after falling 5.1% in the previous quarter. (Source: Federal Reserve Bank of St. Louis)

2022 – A Potential Recession

The US economy shrank at a slightly faster rate than previously estimated during the first quarter of 2022, the Bureau of Economic Analysis said Wednesday.With one quarter of negative economic growth in the books, the data adds to fears that a recession may be looming.

Real gross domestic product declined at an annualized rate of 1.6% from January to March. according to the BEA’s third and final revisions for the quarter. The advance estimate for second-quarter GDP performance is scheduled for release on July 28.

Recessions and Bear Markets – There is often a pattern!

Now that we have reviewed the past recessions since 1970, the below chart illustrates the coinciding bear markets that subsequently pursued.

The above chart illustrates the S&P 500 performance during recessionary periods in the US. Since 1970, the average drawdown of the S&P 500 during a recessionary period was 38.8% as measured from peak to trough. Although the long-term patterns of the S&P 500 are increasing over time, the average recovery could take ask long as a decade which most investors won’t be able to tolerate as most simply don’t have that time to spare. (1970’s and 2000’s). It is this drawdown during bear market that we attempt to avoid for our clients, and furthermore, therefore we find it reasonable to take on the risk of exiting stocks during these periods.

Summary

We believe that considerable risks lie ahead that could create more volatility in the stock market. We are officially not in a recession, but with elevated inflation and rising interest rates we could very well fall into a recession 2022. Markets typically don’t respond well to the earlier stages of a recession as it often coincides with low consumer spending, low capital expenditures by companies, a rising unemployment. We will hold our defensive stance until there is a reversal in the equity markets led by improving economic conditions surrounding inflation and interest rates. Once that happens, we will enter the markets strategically from a position of strength and take part in a period of expansion that always follows post a contraction. As your portfolio managers, we thank you for your continued trust and we welcome you to reach out to us with any questions you may have.

This information has been prepared by Kian Ghanei and Terry Fay who are Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The [Investment Advisor/Portfolio Manager] can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.