It’s hard to believe that December is upon us. If you live on the west coast, you probably haven’t seen much of the sun for the last several weeks and you’re probably looking forward to the holiday season. We certainly are! From the market’s standpoint, November tends to be one of the strongest months of the year for investing and this November was off to a great start. In the last few weeks, several encouraging economic metrics helped push the markets to another all-time high on both sides of the border. However, there has been some volatility over the last few days due to the resurgence of a new Covid-19 variant, called the Omicron. In fact, the news about this new variant has erased the positive momentum the month of November had build during its first three weeks. Is this a sign of things to come? Or are investors overly anxious when it comes down to the pandemic and its potential risks? Let’s look at this development as well as some of the market drivers setting the tone for 2022.

New Pandemic Concerns

Last Friday, the day after the US Thanksgiving holiday, The World Health Organization released a statement outlining a new Variant of Concern, called the Omicron. The Omicron, originally thought to have first been detected in South Africa, has now been detected in Europe, North America and Asia and is considered by the WHO to be extremely contagious and possibly more resilient against the current MRNA vaccine as suggested by the CEO of Moderna on Wednesday. Yesterday, the chief scientist at Pfizer, Mikael Dolsten, said that Pfizer is already working on a ‘worst case scenario’ plan to develop a shot dealing with the new variant but admitted that they simply don’t have enough information to assess the variant’s risks. The WHO has also mentioned in a related technical document that there are still considerable uncertainties around this variant. The main uncertainties are (1) how transmissible the variant is and whether any increases are related to immune escape, intrinsic increased transmissibility, or both; (2) how well vaccines protect against infection, transmission, clinical disease of different degrees of severity and death; and (3) does the variant present with a different severity profile. Public health advice is based on current information and will be tailored as more evidence emerges around those key questions. (Source: World Health Organization).

Omicron, by the sound of its name, sounds a bit fictional like it belongs in a Transformers movie. It turns out that it is simply the fifteenth letter of the Greek alphabet (O) and sequentially a logical name to assign to a Covid-19 variant. Based on the current data available, it is difficult to assess the risks associated with this variant and we must continue to be rational in dealing with this sort of news and look at the facts surrounding the markets. We are not saying that this variant isn’t something to be concerned with. We are simply saying that we need to remain rational and wait for more data to come in before making an accurate assertion. Having said that, we need to be cautious and do all that we can to limit it’s spread before more data is made available about its seriousness. Canada announced on Tuesday that incoming air travellers, regardless of their vaccination status, from all countries except the US will be required to take Covid-19 tests when arriving to Canada and must self-isolate until their results are available. Other countries are rightfully applying similar travel restriction until more data is made available.

The Broad Markets

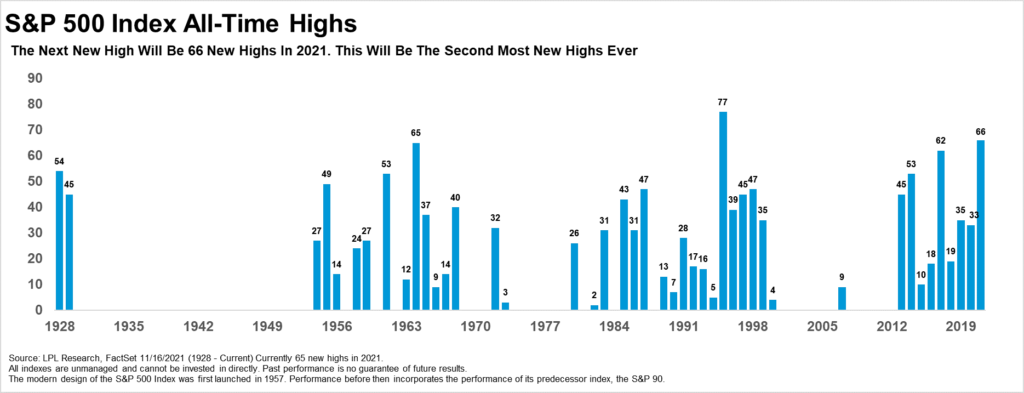

So far in 2021, the S&P 500 has set 66 new all-time records. This isn’t to say that every sector or stock has performed well during this period, but as an aggregate, the broad markets have performed very well so far this year. The graph below illustrates that 2021 marks the second highest number of days of reaching an all-time high since 1928 beating out 1964 so far by 1.(Source: LPL Research, Factset 11/16/2021 (1928 – Current) Currently 65 new highs in 2021)

But why is this relevant? This is relevant because during times when you can’t see the forest for the trees or during times of uncertainty and concerning developments, we must take a step back and objectively examine the real data impacting the trajectory of the economy and the markets. From our view, the two important themes this year have been a significant rebound in earnings as well as jobs growth compared to a year ago. These two factors cannot be ignored.

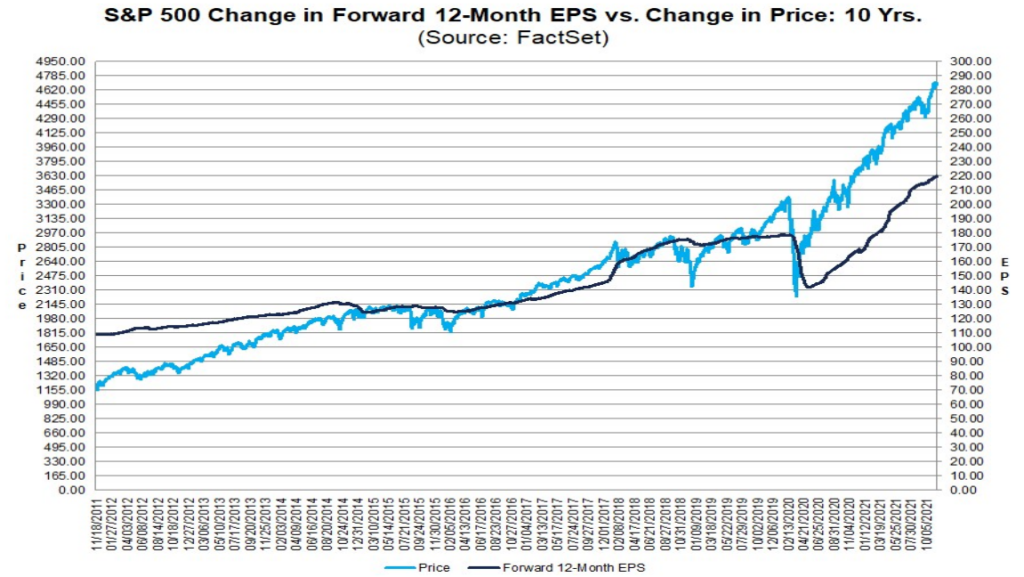

Earnings

We typically use the S&P 500 as a benchmark to examine the performance of the aggregate stock market. For that reason, it’s important to continue to monitor the profitability of the underlying stocks in the index as indication of their overall health.

At this point in time, more S&P 500 companies have beaten EPS estimates for the third quarter than average and have beaten EPS estimates by a wider margin than average. Due to these positive surprises, the index is reporting higher earnings for the third quarter today relative to the end of the quarter. The index is now reporting the third highest (year-over-year) growth in earnings since Q2 2010. Analysts also expect earnings growth of more than 20% for the fourth quarter and earnings growth of more than 40% for the full year. These above-average growth rates are due to a combination of higher earnings for 2021 and an easier comparison to weaker earnings in 2020 due to the negative impact of COVID-19 on several industries. Overall, 95% of the companies in the S&P 500 have reported actual results for Q3 2021 to date. Of these companies, 82% have reported actual EPS above estimates, which is above the 5-year average of 76%. If 82% is the final percentage for the quarter, it will mark the fourth-highest percentage of S&P 500 companies reporting a positive earnings surprise since FactSet began tracking this metric in 2008. In aggregate, companies are reporting earnings that are 10.0% above estimates, which is also above the 5-year average of 8.4%. (Source: Factset)

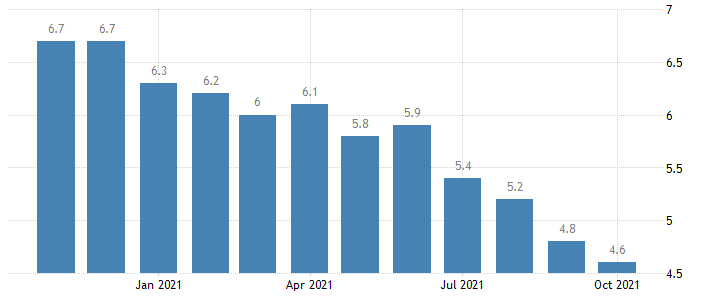

Unemployment and Jobless Claims

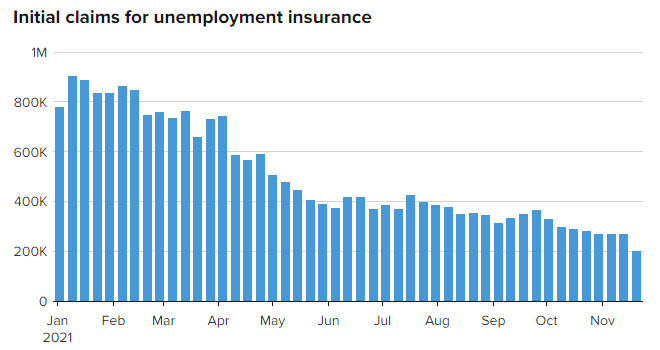

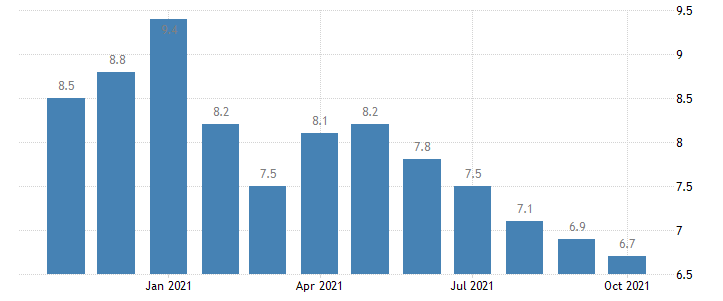

The US unemployment rate fell to 4.6 percent in October 2021, the lowest since March 2020. November data won’t come out until next week, but this is a promising trend. The number of unemployed people declined by 255 thousand to 7.4 million in October, while employment levels rose by 359 thousand to 154.0 million. Still, the unemployment rate remained well above the pre-crisis level of about 3.5 percent, amid reports of persistent worker shortages but we are confident we’re heading in the right direction. (Source: U.S. Bureau of Labor Statistics)

Furthermore, the number of those submitting jobless claims in the US dramatically declined last week as reported by the US Labor Department. Last week’s filings which totalled $199,000 is the lowest weekly claim since 1969. This supports the declining unemployment rate and it again points to a continued road to recovery.(Source: Statistics Canada)

The unemployment rate in Canada declined for the fifth straight month to 6.7% in October of 2021 from 6.9% in September, below market expectations of 6.8%, as the implementation of proof-of-vaccination requirements expanded through workplaces across more provinces, which allowed for non-essential venues to reopen more safely. That was the lowest jobless rate since the onset of the pandemic in February of last year and within 1 percentage point from the 5.7% recorded in February 2020. (Source: Statistics Canada)

Leading Economic Indicator

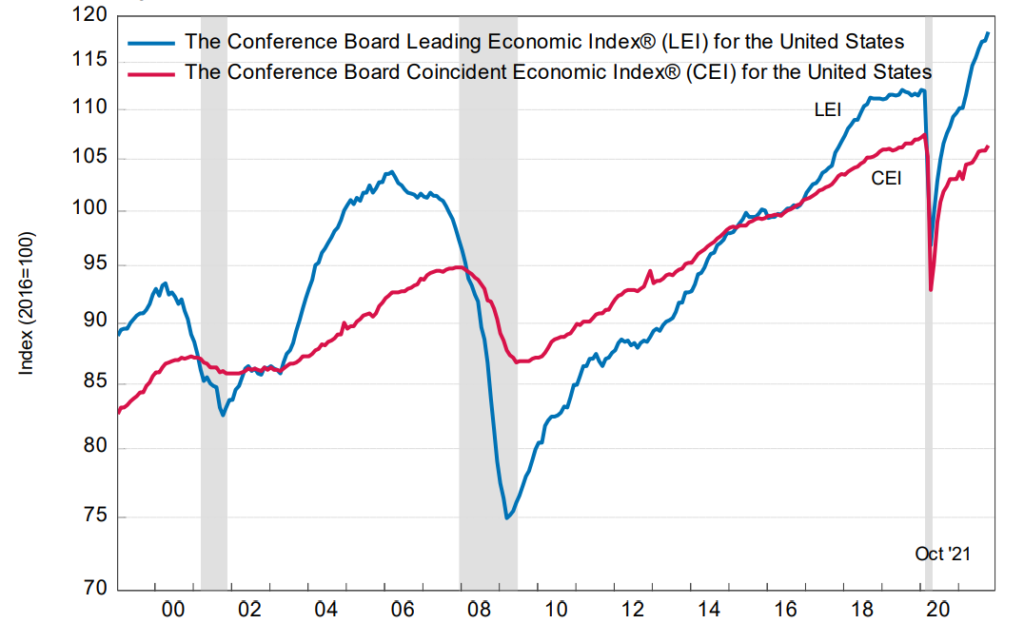

On Nov 18th, the Conference Board released the October U.S. Leading Indicator Index data report detailing the latest reading for the Leading Economic Index (LEI), a composite of ten data series that tend to lead changes in economic activity.

The ten components of The Conference Board Leading Economic Index® for the U.S. include:

- Average weekly hours, Manufacturing

- Average weekly initial claims for unemployment insurance

- Manufacturers’ new orders, consumer goods and materials

- ISM® Index of New Orders

- Manufacturers’ new orders, nondefense capital goods excluding aircraft orders

- Building permits, new private housing units

- Stock prices, 500 common stocks

- Leading Credit Index™

- Interest rate spread, 10-year Treasury bonds less federal funds

- Average consumer expectations for business conditions

Eight of the ten components of the index rose in October except for weekly manufacturing hours and consumer expectations for business conditions. The LEI for the U.S. increased by 0.9 percent in October to 118.3 (2016 = 100), following a 0.1 percent increase in September and a 0.7 percent increase in August.(Source: The Conference Board Org.)

“The U.S. LEI rose sharply in October suggesting the current economic expansion will continue into 2022 and may even gain some momentum in the final months of this year,” said Ataman Ozyildirim, Senior Director of Economic Research at The Conference Board.

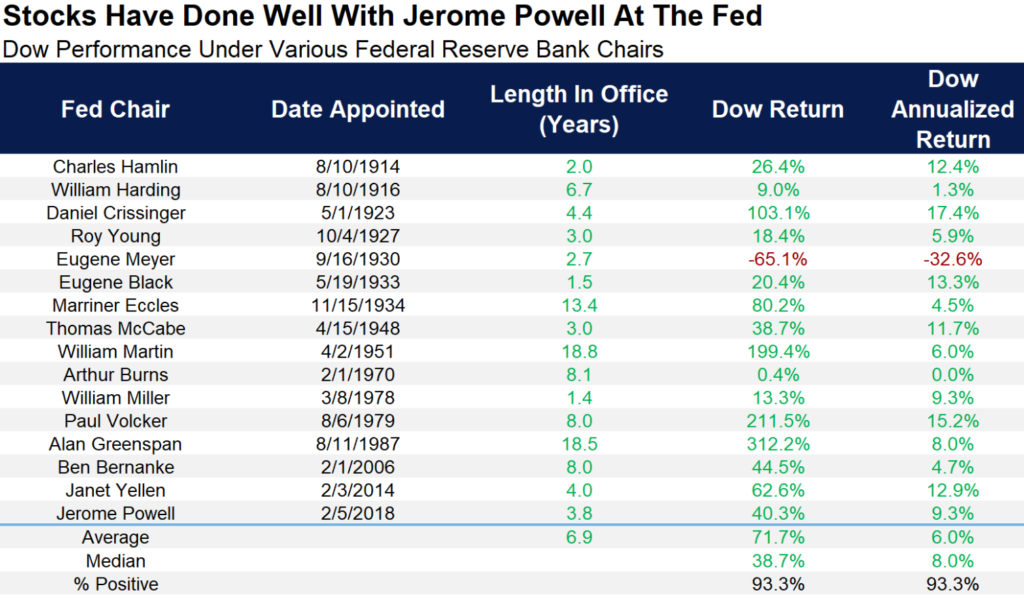

Jerome Powell – A Renewed Term

It is not a secret that the Federal Reserve Chair, Jerome Powell, has been very accommodative to the stock market and economic recovery seen in the US. Last week, President Biden nominated the current Fed Chair to another 4-year term, opting for continuity in the US economic policy despite some pushback from some Democrats and Republicans who are asking for someone tougher and less accommodative on policy. The roll of the Fed Chair is extremely important to maintaining order during a period of uncertainty and inflation. So far, here is how he compares to some Fed Chairs of the past as measured by the annualized growth in the Dow Jones Industrial Average Index. With another 4 years ahead of him, he might be able to beat out his predecessors Janet Yellen. (Source LPL Research)

Sustained Inflation – What does that imply?

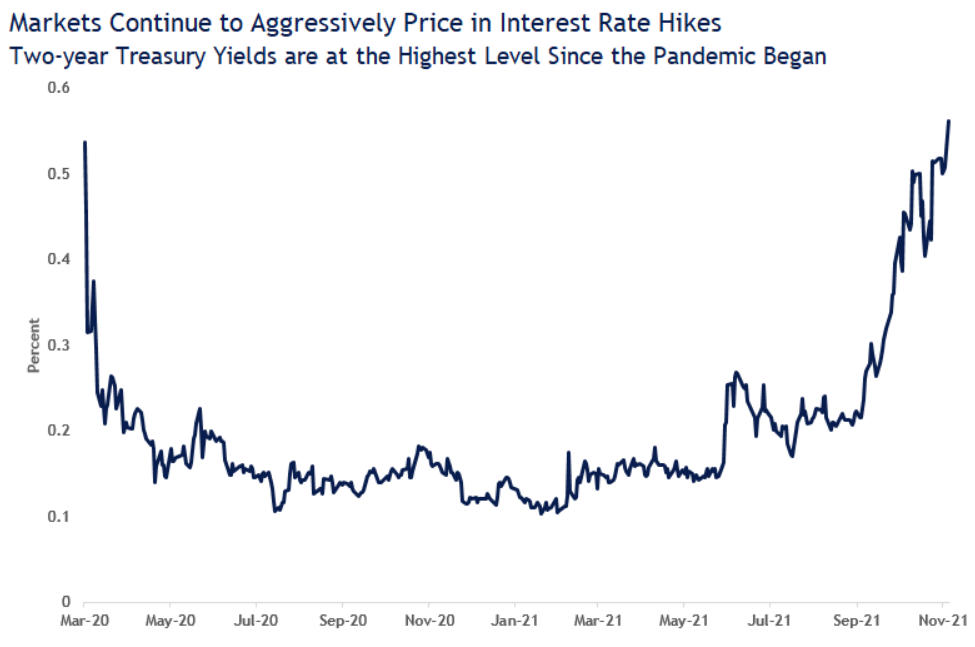

It’s clear that inflation isn’t going away any time soon. Yesterday, The Fed Chairman Jerome Powell warned it is important to take action to ensure higher inflation “does not become entrenched”. He said on Wednesday that “the economy is very strong and inflationary pressures are high, and it is therefore appropriate in my view to consider wrapping up the taper of our asset purchases, which we actually announced at the November meeting, perhaps a few months sooner”. Looking at the two-year US treasuries or government bonds as a leading indicator of interest rates moves in the future, it’s can be seen that the markets are certainly pricing in 2 or 3 interest rate hikes in 2022 to begin in June.(Source: US Department of the Treasury)

The Federal Reserve will be meeting this month to discuss the ramp up efforts of tapering and interest rate hikes in 2022. We are in the recovery phase of this post-pandemic expansion and given that we’re probably at the midway point of the cycle, we are expecting echoes of tightening or less-accommodative policies as we have here in Canada and around the world. This tightening, however, will most likely be offset by significant economic expansion characterized by a normalized GDP growth, lowering unemployment rates, and healthy corporate earnings. At the end, a less-accommodative stance from central banks will most likely point to a more robust economy.

Caerus Wealth Portfolio

There is some uncertainty surrounding Omicron and its impact on global recovery. There is not enough information that would prompt us to revaluate our current investment strategy or outlook. We will remain focused on data coming with respect to corporate earnings, unemployment, inflation, and GDP to help us with our future decisions. We still think that the biggest challenge for investors and policy makers is to help loosen the supply-chain bottlenecks as we head into the new year and deal with the possibility of a more sustained inflationary environment. Having said that, we remain confident that these issues will be addressed in the coming months as we continue moving up along the recovery ladder. We will undoubtedly keep a watchful eye on Omicron as more data is released and examined.

Our ADAPT Investment Strategy grants us the ability to remain objective and disciplined. Our research is focused on companies with increasing profitability and supporting trends. So far in 2021, we continue to benefit from allocating to stocks in sectors thriving in the post-pandemic era such as e-commerce, semi-conductors, automation, transports, and financials, as well as maintaining allocations to high-earning tech giants that continue to prove their resilience.

As your trusted Portfolio Managers, Terry and Kian, and the Caerus Private Wealth team is available to address any questions you may have. Stay safe!

Terry Fay, Director, Private Client Group, Portfolio Manager

Kian Ghanei, Director, Private Client Group, Portfolio Manager

Caerus Private Wealth – iA Private Wealth

700 – 609 Granville Street, Vancouver BC V7Y 1G5

T: 604.895.3316 | TF: 1800.665.2030 | F: 604.682.0529

terry@caeruswealth.ca | kian@caeruswealth.ca

iaprivatewealth.ca | caeruswealth.ca

This information has been prepared by Kian Ghanei who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.