Caerus Private Wealth, iA Private Wealth – August Commentary

As we wrap up the month of August and head into the Labour Day weekend, there is a sense of complacency in the market as investors unravel data surrounding several themes that could serve to impact the short-term state of the markets, particularly with its readily changing nature. After all, the markets have cooperated for most of 2021 and it is only natural for investors to begin questioning the future.

Having said that, we would like to step back and have a closer look at some of the themes shaping the current landscape.

Tapering by the Fed

There seems to be a safety net in place for the US economy and financial markets created by the Federal Reserve’s continuous bond purchases designed to create additional liquidity in the financial markets. Having said that, many fear that when the Fed announces a pullback or tapering on this measure, the markets will react adversely. Most of the Fed’s decision on the timing of the tapering will be induced by the job report set to be released this week. According to FactSet, economists estimate US employers have added just over 750,000 jobs in August, which would be a slowdown from the 943,000 added in July. Since the pandemic started, over 16.5 million jobs have been returned in the US, however, that is about 75% of the pre-pandemic levels. Given the current state of the Delta variant, some members of the Fed Reserve believe that employment numbers still require time to recuperate.

Gross Domestic Product – US & Canada

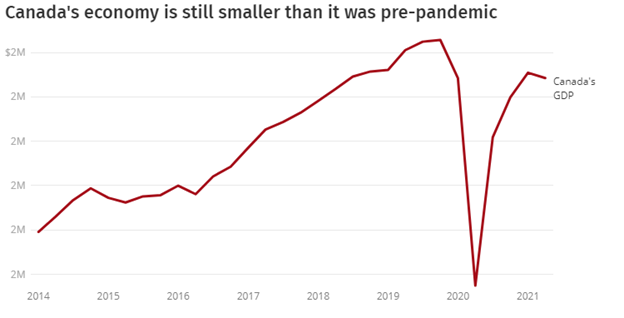

The GDP Numbers have been released this week in Canada and estimates have been updated in the US. In Canada, our economy remains smaller than it was pre-pandemic. In the second quarter of 2021, our economy shrank by 0.3% from April to June as the pandemic’s new surge caused less spending amongst consumers and businesses. Although export numbers fell, a big factor in the decline was the slowing housing market, specifically with respect to the volume of sales impacting service-related areas including real estate agent fees and other costs associated with home transfer.

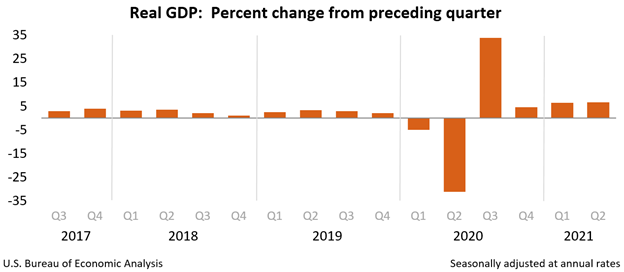

In the US, the second quarter GDP estimates were revised this week by the Bureau of Economic Analysis indicating that the Real GDP annual rate is 6.6% in the second quarter. The increase in second quarter GDP reflects the continued economic recovery, reopening of establishments, and government assistance related to the pandemic.

Consumer Behaviour – Some US data

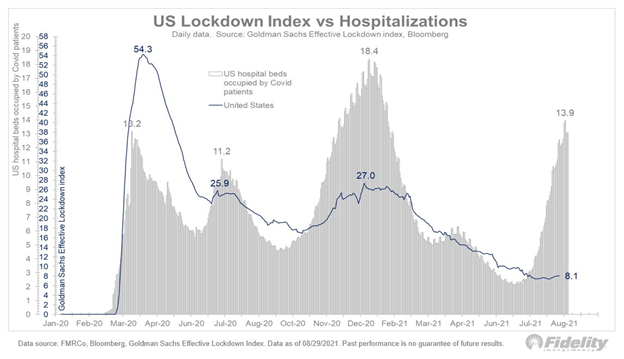

The Delta variant has undoubtedly impacted and slowed economic recovery on both sides of the border, but the question is, to what degree? Even with a surge in new cases and hospitalizations, consumers and businesses are finding ways to function through this pandemic, compared to the previous lockdown measures instated at the onset of the pandemic. The Goldman Sachs Effective Lockdown Index which measures the financial impact of a lockdown remains near lows, even though the percentage of US hospital beds occupied by Covid patients has surged to 13.9% from June’s 2.2%.

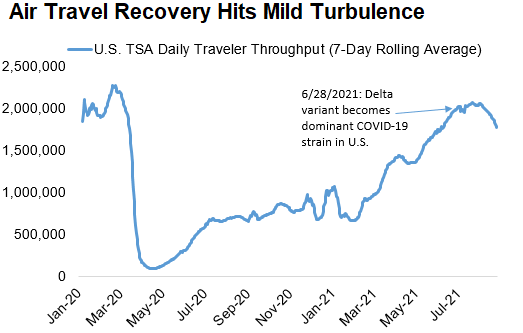

Adding to the consumer behavior and spending patterns in the US, we are seeing similar resiliency amongst US citizens in their flying patterns and their restaurant bookings. As per the graph below, although there has been a slight decline in flight travelling, Americans are still choosing to fly and are proceeding with their business or travel plans. (Source: Transportation Security Administration).

We see this pattern across restaurant bookings as well with restaurant bookings near pre-pandemic levels (Source: OpenTable).

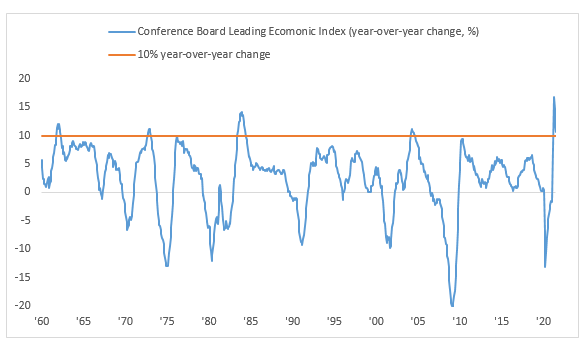

This information is important because with increased concerns about the Delta variant, it can be easy to forget that we are part of an economic recovery. Additionally, we can get a better sense of the recovery by looking at the Leading Economic Indicators (LEI) presented by the Conference Board in August showing a rise of 0.9% month over month where all 10 components contributing to the gains signalling the likelihood that economic momentum will likely persist.

Corporate Earnings

So far in 2021, we have had an extraordinary increase in profitability in Corporate America. Of the 500 companies that make up the S&P 500, over 85% have surpassed Q2 expectations with an 90% earnings growth (Source: Factset). Some firms are calling for an extension of the increased earnings right into 2022 with the mindset that the Fed will remain accommodative for a while longer. David Lefkowitz, head of American Equities at UBS adds that “despite some investor concerns about rising costs, revenue growth has been so robust at 25% in Q2 that it is overwhelming the cost pressures.” Echoing that sentiment, Credit Suisse believes that although the bulk of the gains associated with S&P500 have come in 2021, they see this extending into 2022. On the other hand, Mike Wilson of Morgan Stanley believes that S&P500 could drop by 10% should tapering measures come sooner than expected and corporate taxes eat into the forecasted earnings of companies (Source: Reuters). Having looked at both sides, one thing is clear: tapering and the rate at which it is implemented will impact the trajectory of the markets.

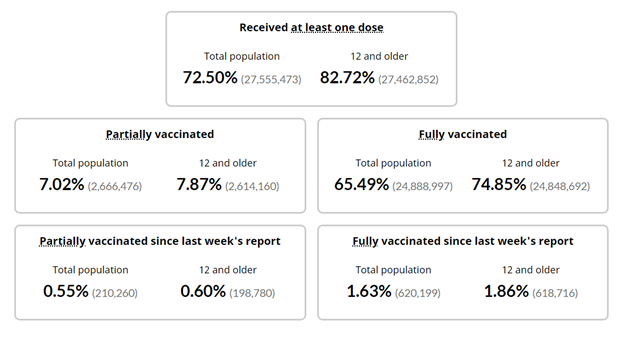

Vaccinated Stats Canada & US

Although we find ourselves dealing with yet another wave, there is a sense of ease with the effectiveness of the current covid vaccines as more people are getting their second round of shots. The news surrounding the third booster shot was welcomed in the US with nearly 1 million shots administered so far with more looking to get their 3rd shot (Source: CNN). Here in Canada, we have approx. 65% of our population fully vaccinated and 72.5% with at least one dose.

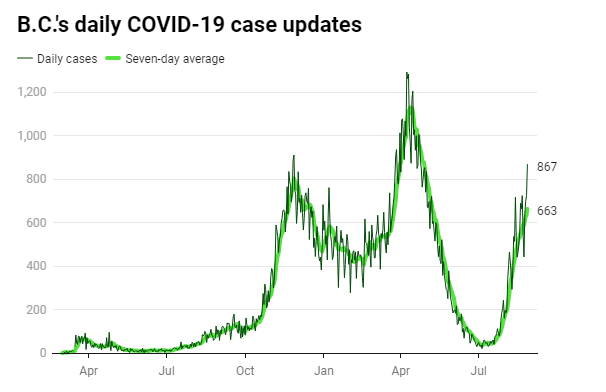

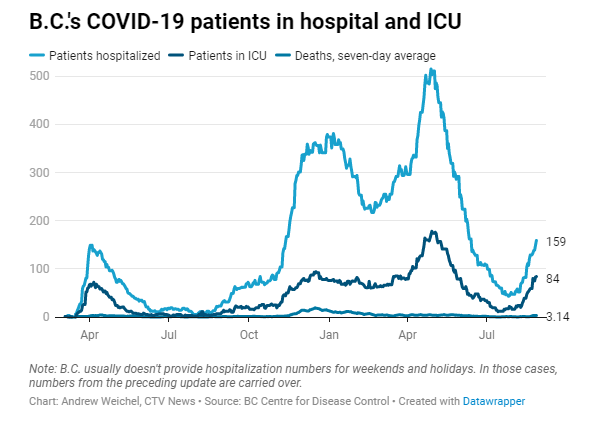

It appears that the new orders and restrictions implemented by our province and throughout the private sector are encouraging more people to get vaccinated, which we believe will benefit everyone in the months to come. A new study from the UK suggests that the Delta variant doubles the risk of covid hospitalization rates for unvaccinated and partially vaccinated people compared to the Alpha variant. The study examined 4,000 cases in England and in this study only 1.8% of covid cases had received both doses of the vaccine, 74% of the cases were unvaccinated and 24% were partially vaccinated (Source: The Lancet Infectious Diseases Journal). But are the vaccines working?

We can see the effectiveness of the vaccines by looking at the number of new cases versus the rate of hospitalized patients. In the past, the number of hospitalized patients were closely correlated to the number of new cases, but in the context of the newest Delta variant, that correlation has decreased significantly.

In the US, the rate at which people are getting vaccinated is slower than that of Canada’s but nonetheless 50% of the population is currently fully vaccinated and over 60% of individuals have at least one shot. We think more and more people will succumb to being vaccinated as public and private covid guidelines and orders become more restrictive.

Caerus Wealth Portfolio

In the prior months, we had suspected that the Delta variant would hamper the road to full recovery. It has certainly caused the recovery to slow but it has not derailed its path. We continue to see further recovery ahead, but it will not be without a cost. The Federal Reserve’s tapering plans may rattle the markets if introduced prematurely or without a significant runway. Economist and investors remain divided as to its timing or its velocity but the one thing that is clear to us is that the employment growth in the US has not yet warranted a measured tapering by the Fed. More data will be released this week as to the job growth but until then, it is all speculation. As for the pandemic, it is becoming increasingly clear that the vaccines are reducing hospitalization rates and the implementation of annual booster shots will be necessary to maintain our lifestyles. For many of us who have been getting regular flu shots, this is not much of a change and will not impact our lives. We certainly welcome regular booster shots to continue living normal lives.

The Caerus Private Wealth portfolios are diversified across several asset classes and service sectors presenting the best chance of success in a recovery stage of the business cycle. Our ADAPT Investment Strategy grants us the ability to remain objective and disciplined. Our research is focused on companies with increasing profitability and supporting trends. So far in 2021, we continue to benefit from allocating to cyclical stocks in sectors such as commodities, transports, and financials, as well as maintaining allocations to high-earning tech giants that continue to prove their resilience.

As your trusted Portfolio Managers, Terry and Kian, and the Caerus Private Wealth team is available to address any questions you may have. Stay safe!

Terry Fay, Director, Private Client Group, Portfolio Manager

Kian Ghanei, Director, Private Client Group, Portfolio Manager

Caerus Private Wealth – iA Private Wealth

700 – 609 Granville Street, Vancouver BC V7Y 1G5

T: 604.895.3316 | TF: 1800.665.2030 | F: 604.682.0529

terry@caeruswealth.ca | kian@caeruswealth.ca

iaprivatewealth.ca | caeruswealth.ca

This information has been prepared by Terry Fay & Kian Ghanei who are Portfolio Managers for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.