Caerus Private Wealth, iA Private Wealth – July Commentary

The month of July has been bitter-sweet in many ways. If you live in the Greater Vancouver area, you are most likely enjoying what seems to be one of the most sunshine-filled July’s recorded since the 1950s. Having said that, the warm weather comes at a cost and we feel terrible for what’s happening across our beautiful province with respect to the 250+ forest fires currently burning.

Furthermore, there seems to be a sense of rejoice since the restrictions were lifted last month as more and more Canadians are becoming fully vaccinated and beginning to gain their social footing. People are getting caught up to life, and not surprisingly, we are experiencing more social gatherings including weddings, bachelor/bachelorette parties, birthday parties and so on. Beneath the celebrations, we are constantly reminded of the Delta variant, and like the Tokyo 2020 Olympics, we are doing our best to live our lives despite the persistency of this pandemic.

The Delta Variant

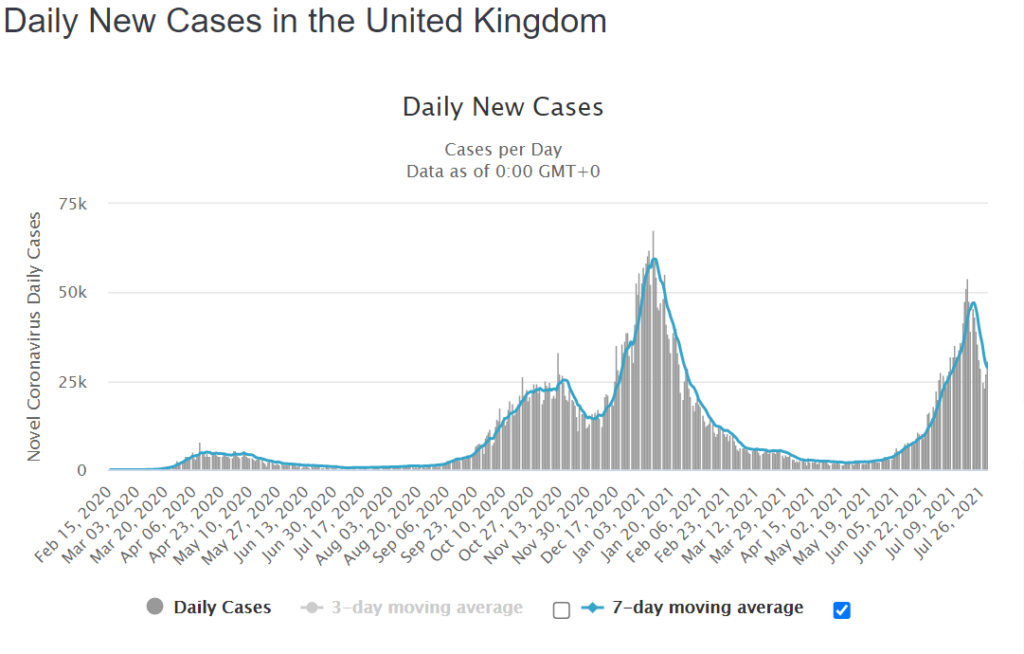

Cases and hospitalizations are heading higher and although the vaccine is proving effective against serious illness, those vaccinated remain at risk which could possibly add to the problem as we lower our guards against the pandemic. The Delta variant naturally presents a risk to the outlook and we must be mindful of this in the coming months.

The CDC has released statements comparing the delta variant’s contagiousness to chickenpox which is notably more contagious than SARS, MERS, Ebola, and smallpox. Having said that, we see strong reason to remain optimistic. The U.S. is lagging the U.K. in its exposure to the Delta variant, we expect to see a peak in cases in the coming weeks. In fact, the U.K. is already on a strong path to recovery despite doomsday headlines.

In the US, cases are spiking in areas with the lowest vaccination rates. However, there is evidence that these are also the states experiencing the highest uptick in new vaccinations, which should help self-correct the trends. (Source: CNN)

Yesterday, Pfizer released a statement saying that it is already rushing to produce and distribute a highly effective third vaccine to boost our response to the new variant. They understand the gravity of the situation and what it may mean for us and the globe moving forward. Israel, which has seen a steady rise in cases of the Delta variant is already administering the 3rd Pfizer booster shots to those over the age of 60. This will undoubtedly find its way to North America and Canada.

A recent study from the New England Journal of Medicine found that effectiveness of the Pfizer or Moderna vaccines are 30% for the delta variant after one shot versus 88% after two shots. The AstraZeneca vaccine, however, was found to be less effective against the delta variant at 67% when two shots were administered. Both vaccines seem to be providing great protection against serious illness but our guess is that an annual booster shot will be something normal for everyone and will most likely replace the seasonal influenza vaccines. (Source: The New England Journal of Medicine)

Market Drivers and Indicators

As investors, we need to look past today’s news and look at indicators to help us navigate through the headlines. The following data will most likely play a big part in the coming weeks and months. Let’s have a look.

Gross Domestic Product

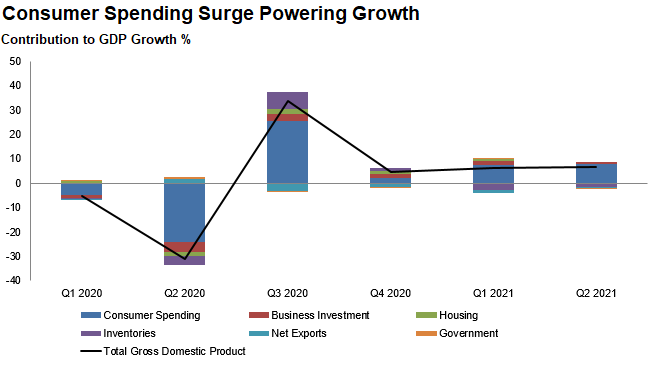

This week the US GDP numbers were in for the second quarter and the lofty expectations for second quarter US gross domestic product (GDP) growth fell short of expectations. The Bureau of Economic Analysis released its preliminary estimate for second quarter GDP showing the U.S. economy grew at a 6.5% annualized pace against the Bloomberg median forecast for 8.4%. Although this number created a mild disappointment, there were some compelling and positive figures surrounding the in-person consumption of services. This indicates confidence by consumers to reengage with the parts of the economy beaten down most by COVID, and continued momentum here will be key if we are to see the consumer continue to power overall growth. (Bureau of Economic Analysis – US)

In addition, business fixed investment came in healthy signaling business’ attempts to increase output to meet surging demand. Looking forward, we expect continued growth in the third quarter but with a different composition which we think would be lead by net exports and business investments which could be big boost to the US GDP.

Here in Canada, our GDP declined in May during the restrictions but saw a bounce back in June in line with the reopening. Some economists are calling for a 6% annualized growth in both Q3 and Q4 on reopening. (Yahoo Finance)

Central Banks – The Fed and the Bank of Canada

The Federal Reserve met this week to discuss its ongoing support for the U.S. economy. During its regularly scheduled two-day meeting, the nineteen-member committee is expected to discuss when the Fed should start to remove the emergency level monetary accommodation that it has provided since the beginning of last year’s COVID-19 shutdowns. Last month’s meeting sparked some market volatility as some of the comments, along with the data releases, were interpreted as a shift in tone to be slightly less accommodative. Notably, the committee downgraded the COVID-19 risk last month. However, the committee may reinsert that language given the uptick in cases due to the Delta variant. An acknowledgement would likely indicate that the committee’s hawkish shift last month may have been premature.

The Fed currently purchases $120 billion of debt securities every month ($80 billion of Treasury and $40 billion of agency mortgage securities) to help provide liquidity and to support financial markets. In previous meetings, Fed Chair Jerome Powell has said that it’s too early to talk about reducing that support. Although we don’t think that any announcements will surface regarding plans to scale back bond purchases, we do think that the language they use in the coming months will be important in averting volatility and it’ll most likely be subtle specially in the face of an uptick in recent cases. In Canada, however, policy makers decided to keep up with the growth momentum the country is experiencing by reducing their weekly bond purchasing from $3 billion to $2 billion to better reflect their confidence in the strength of the Canadian economy. (Source: Financial Post)

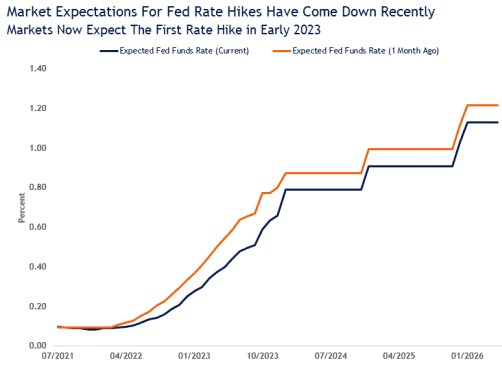

Furthermore, The Fed has said that it would like to reduce its bond buying programs before it starts to increase interest rates. At the end of the day, the market is more concerned about rising interest rates than the tapering of bond purchases. Historically, when the Fed starts to raise interest rates, economic growth tends to slow. The market will be looking for any hint of when that process will start. Markets don’t expect that to take place for another year or so any suggestions otherwise will likely increase market volatility. In fact, market expectations for when the Fed will start to raise short-term interest rates have changed over the past month. Largely due to the expected slowdown in economic growth due to the COVID-19 delta variant, the market now thinks the Fed will wait until the first part of 2023 to hike rates. (Source: Bloomberg)

In Canada, The Bank of Canada plans to let inflation run faster than its two-per-cent target through 2023, reinforcing governor Tiff Macklem’s pledge to orchestrate a “complete” recovery from the COVID-19 recession. Furthermore, Canada’s central bank released a new forecast predicting the country is on the verge of an impressive burst of economic growth that will offset a disappointing start to the year.

Leading Economic Index (LEI)

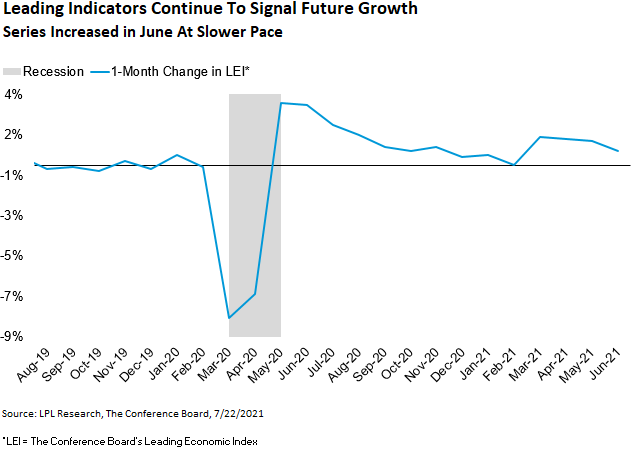

On Thursday, July 22, the Conference Board released its June 2021 report detailing the latest reading for the Leading Economic Index (LEI), a composite of ten data series that tend to lead changes in economic activity. Many economic data points are backward looking, but we pay special attention to the LEI, as it has a forward-looking tilt to it and spans many segments of the economy. The index grew 0.7% month over month, a bit slower than the previous three months but still squarely in positive territory.

“The market’s upward momentum is contending with a few bearish narratives at the moment, one of which is second derivative economic growth concerns, and while June’s LEI growth certainly did come in below the elevated levels of the past few months, we continue to see plenty of strong economic growth ahead of us.” said LPL Financial Chief Investment Strategist Ryan Detrick.

The LEI’s growth rate came off its hot run rate from the last three months, but it is still growing at a healthy clip by historical standards. Eight of the ten components grew in June, while two fell. Average weekly initial claims for unemployment insurance, the Institute for Supply Management (ISM) New Orders Index, and the Leading Credit Index represented the three largest positive contributors. Building permits and average weekly manufacturing hours detracted from the overall index’s performance.

Caerus Wealth Portfolio

Last month we touched on two factors that will create market headwinds in the coming months, specifically inflation and the delta variant. The latter is becoming the most significant factor in determining and projecting the rate of recovery and growth. We continue to remain optimistic in light of the uptick in new cases as we think that an accelerated vaccination rate will offset the recent uptick while keeping the number of deaths and hospitalizations at modest levels. We expect additional modest gains for stocks in the second half of the year although those additional gains are likely to come with some volatility lead by the Delta variant and its impact on the recovery and growth. We expect global demand for commodities, materials, consumer goods and technology to continue to pick up and drive earnings and share prices, but we remain mindful of the persisting covid landscape that could stall this expansion. We will continue to follow our ADAPT Investment Strategy in keeping up with an evolving economic landscape and will continue to make timely decision to protect and growth our portfolios.

The Caerus Private Wealth portfolios are diversified across several asset classes and service sectors presenting the best chance of success in a recovery stage of the business cycle. Our ADAPT Investment Strategy grants us the ability to remain objective and disciplined. Our research is focused on companies with increasing profitability and supporting trends. So far in 2021, we continue to benefit from allocating to cyclical stocks in sectors such as commodities, transports, and financials, as well as maintaining allocations to high-earning tech giants that continue to prove their resilience.

As your trusted Portfolio Managers, Terry and Kian, and the Caerus Private Wealth team is available to address any questions you may have. Stay safe!

Terry Fay, Director, Private Client Group, Portfolio Manager

Kian Ghanei, Director, Private Client Group, Portfolio Manager

Caerus Private Wealth – iA Private Wealth

700 – 609 Granville Street, Vancouver BC V7Y 1G5

T: 604.895.3316 | TF: 1800.665.2030 | F: 604.682.0529

terry@caeruswealth.ca | kian@caeruswealth.ca

iaprivatewealth.ca | caeruswealth.ca

This information has been prepared by Terry Fay & Kian Ghanei who are Portfolio Managers for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.