Caerus Private Wealth, iA Private Wealth – May Commentary

It is healthy to be optimistic. Thing are not perfect and maybe will never be, but we have endured an extremely unnerving crisis over the last 15 months testing our resilience, resolve, and our patience. The recent relaxing of British Columbia’s restrictions have given us a newfound appreciation for the small things in life which include inviting family over for dinner, booking a reservation at a restaurant and even going as far as laying a hug on someone. It is going to take some time for things to get normal again, but we can almost sense some relief in recognizing that we might be only months away from finding some normalcy. Afterall, we hear less and less about vaccine shortages and more and more about declining new cases as people around us are getting their first or even second round of vaccines. It is a marvelous feeling and one that should be embraced and celebrated. This is not to say that there won’t be hiccups along the way, but at this point in time, it is healthy to be optimistic.

Why Optimistic?

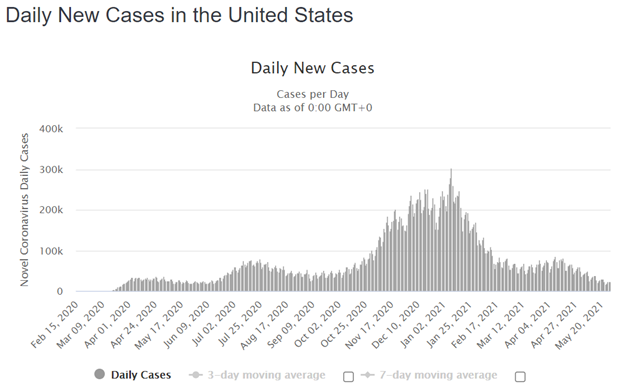

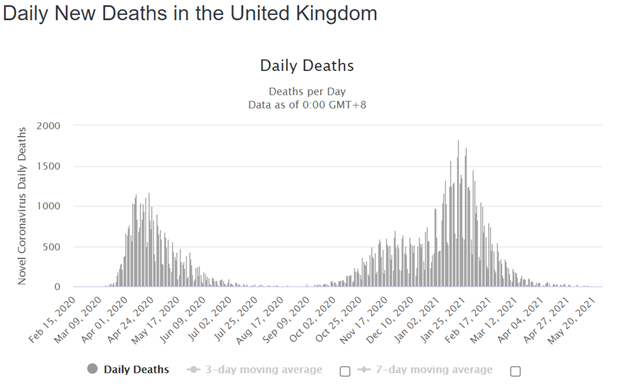

It was only back in April when we felt anxiety or a sense of desperation. Politicians were criticizing our vaccine efforts, we were pointing the blame at the younger generation, and there was an endless number of conspiracy theories surfacing in our newsfeeds. Meanwhile, the US was seeing major milestones in vaccination rates and declines in new cases. As mentioned in our March and April commentaries, we were paying close attention to countries that had aggressively rolled out their vaccine programs including Israel and the UK looking for signs of the effectiveness of the vaccines.

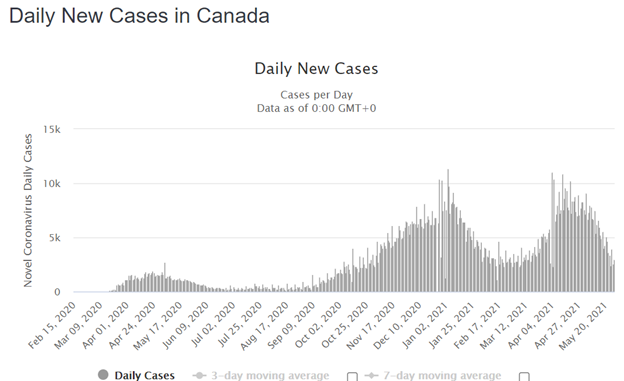

Weeks later, COVID is beginning to fade from the landscape. We are witnessing the effects of the vaccines across many parts of the world none closer than Canada. We still have some issues to deal with in some regions in our Country, especially in Manitoba, but we are confident that we will overcome those challenges as we have here in BC and Ontario. Although the majority of our population is vaccinating, there are some that reserve some apprehension surrounding the mRNA vaccines or those offered by JNJ and AstraZeneca but with time and more data, we hope that number narrows as people digest the compelling data pointing to the effectiveness of the vaccines.

Let’s look at the daily new cases here in Canada, US and the UK for a visual depiction of the effectiveness of the vaccines.

The Global Re-Build Phase

This is an exciting time for sports fans except for anyone who’s a Leafs fan (sorry). We have the playoffs in both the NHL and the NBA and for the first time in months we are seeing glimpses of the world we used to live in where fans would literally shake stadiums or hockey arenas through their chats and cheers. I watched in amazement as the Las Vegas Golden Knights fans erupted in excitement as their team won yet another game 7. It was quite the scene and it was a sweet indication that the US economy is in full re-build phase and fueled with an incredible amount of pent up demand. The same goes with other parts of the world including Canada and Europe. We imagine a pickup in everyday activity including leisure and hospitality within the next few months. Perhaps we may be overshooting our enthusiasm but I’m sure we all miss our sandy vacations or our European getaways and eager to participate in some travelling as soon as we feel it’s safe enough to do so.

Earnings, Earnings, and Earnings

Here in Canada, over the last few trading days, we noticed that Canada’s biggest banks saw their profits nearly double and in some cases more than double last quarter. This is a great sign that perhaps the harmful economic effects of the Covid-19 may be behind us.

“The banks are somewhat of a canary in Canada’s economic coal mine in that if the consumers and businesses they lend money to are having problems paying their bills, those woes will show up on the banks’ books. But this week’s profit bonanza suggests that in the aggregate at least, consumers and businesses are not exactly struggling.” (Source: CBC)

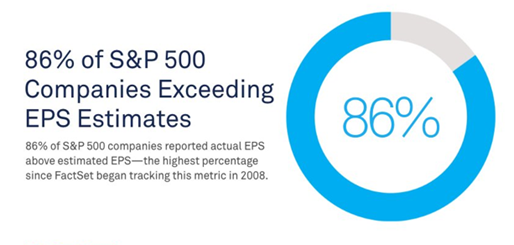

In the US, we are seeing a massive surge in earnings amongst some of the biggest companies in the world. In fact, the S&P 500 reported 52% of its composite showcasing an increase in earnings which is at the highest number since 2010. Of those 500 companies, 59 reported positive guidance for the remainder of 2021 which is at the highest level since 2006. Finally, 86% of companies listed on the S&P 500 reported actual earnings above estimated earnings (EPS) which is the highest since 2010. The latter is very compelling sign of a bull market as it showcases strong breadth amongst most of the 11 sectors. (Source: FactSet)

Inflation expectations and interest rates keep drifting higher, but WHEN?

U.S. consumer prices surged in April, with a measure of underlying inflation blowing past the Federal Reserve’s 2% target and posting its largest annual gain since 1992, because of pent-up demand and supply constraints as the economy reopens. The Federal Reserve has repeatedly shrugged off any concern around inflation and have repeatedly emphasized their interests in getting employment back on track.

The main event this week will be US payrolls on Thursday which is forecasted to show an addition of 650,000 new jobs but many are skeptical following April’s unexpectedly weak gain of 266,000. (Source: bls.gov). As for the stock market, a very strong jobs report may shake things up a little as it will increase the chances of a tightening policy rather than a prolonged accommodative policy. Having said that, a weaker than expect jobs report may be bullish for the stock market as it ensures more stimulus throughout the year and possibly beyond. We recognize that inflation will continue to make headlines over the next few weeks and months.

Treading Lightly

1. History Doesn’t Repeat Itself, But It Often Rhymes

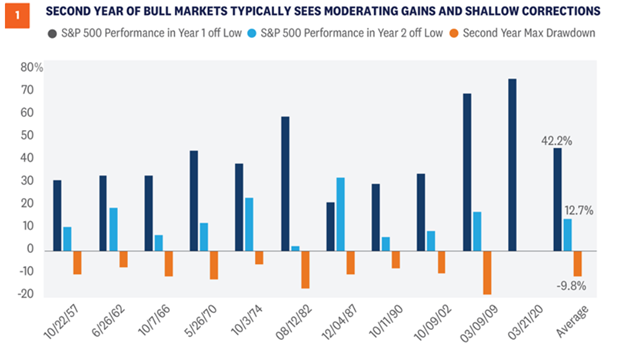

As optimistic as we are, and for good reason, we can’t get too ahead of ourselves. After one of the best starts to a bull market, the rally may start to show signs of fatigue. A strong economic recovery lies ahead as the reopening continues, bolstering a very strong earnings outlook that is helping stocks grow into elevated valuations. However, in the second half of the year, as inflationary pressure builds, interest rates potentially rise further, and this bull market gets a little older, the pace of stock market gains will likely slow and create volatility. In fact, the second year of a bull market typically sees modest results but with shallow corrections. Here is a great chart from LPL Research:

2. Earnings Headwinds

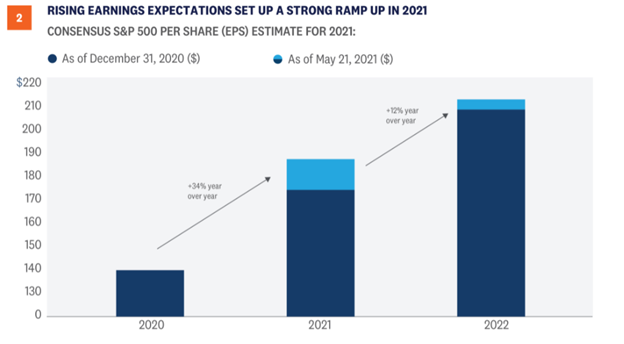

We are coming off a very strong first-quarter earnings season that saw results well ahead of the best-case scenario for nearly all analysts. As shown below, not only are earnings expected to ramp up significantly over the remainder of 2021 as the economic rebound continues, but estimates have risen significantly since the start of the year and they could be challenged over the coming months.

A significant pickup in inflation could present risk to corporate profit margins. Supply shortages, higher commodity prices, higher possible wages and rising borrowing costs may also erode profitability of U.S. companies. U.S. businesses are also closely monitoring policy developments, as a potential increase in the corporate tax rate would have an immediate impact on their bottom lines. (Source: LPL Research)

Caerus Wealth Portfolios

We expect additional gains for stocks in the second half of the year although they are likely to be more modest than the gains we have seen so far, and those additional gains are likely to come with more volatility. Amid a backdrop of an improving economy, massive levels of fiscal and monetary stimulus, and rising vaccination rates, we would not expect pullbacks to last very long and any potential corrections are likely to be shallow. So far this year, we have experienced a significant rotation away It’sfrom US based companies to Canadian based companies in the energy, commodities, and financials sectors. We expect global demand for these sectors to continue to drive earnings and share prices. We will continue to follow our ADAPT Investment Strategy in keeping up with an ever-changing economic landscape and will continue to walk away from challenged businesses.

The Caerus Private Wealth portfolios are diversified across several asset classes and service sectors presenting the best chance of success in a recovery stage of the business cycle. Our ADAPT Investment Strategy grants us the ability to remain objective and disciplined. Our research is focused on companies with increasing profitability and supporting trends. So far in 2021, we continue to benefit from allocating to cyclical stocks in sectors such as energy, transport, and base materials, as well as maintaining allocations to high-earning tech giants that continue to prove their resilience.

As your trusted Portfolio Managers, Terry and Kian, and the Caerus Private Wealth team is available to address any questions you may have. Stay safe!

Terry Fay, Director, Private Client Group, Portfolio Manager

Kian Ghanei, Director, Private Client Group, Portfolio Manager

Caerus Private Wealth – iA Private Wealth

700 – 609 Granville Street, Vancouver BC V7Y 1G5

T: 604.895.3316 | TF: 1800.665.2030 | F: 604.682.0529

terry@caeruswealth.ca | kian@caeruswealth.ca

iaprivatewealth.ca | caeruswealth.ca

This information has been prepared by Kian Ghanei who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.