Caerus Wealth December Commentary

2020 has been, undoubtedly, the most unnerving year in the last few decades. Some of us have been successful at adapting to this new normal while others have had to endure difficult and painful consequences. It is fitting for us to want to turn the page on this difficult year but before we do, it would be wise for us to reflect on a few important takeaways. For us, there are four very important takeaways and as we embark on a new year filled with hope, and we hope that our experiences in 2020 will make us better as people but also as Portfolio Managers.

Four Important Takeaways

The first 2020 takeaway, although a bit of a ‘cliché’, is to truly appreciate the small but important things in life. For us, these things include our ability to freely gather with family and friends, travelling, dining out, going to concerts, etc. Although the fight with the pandemic isn’t over, we hope this sense of appreciation can bring us closer and ultimately bring us more happiness.

The second takeaway of 2020 is that it has taught us that we cannot outsmart the market. The market is a construct of countless variables and we are limited in our ability to successfully predict or time the market. It is important for us to realize this important fact and build an investment process that is adaptable and data driven as opposed to an investment thesis built on prediction and a false sense of certainty.

The third takeaway of 2020 is that the market is not the economy. In the last 9 months, we have experienced extreme economic lows while achieving all-time market highs. We have never experienced this magnitude of divergence before and as an investor and as a student of the trade, this has probably been the most ‘academic’ lesson of 2020 which will be discussed and studied for years to come.

The fourth takeaway of 2020 is that to be successful as an investor, it would be wise to incorporate technical analysis together along with fundamental analysis to help you navigate through the most challenging of times. Many brilliant fundamental investors have found 2020 to be a very humbling experience in the sense that they were unable to accurately call the market direction. For instance, Ray Dalio’s Bridgewater Associates (the largest hedge fund manager in the world) has experienced a drop of nearly 18% so far this year in its flagship portfolio as a result of some difficult investment decisions.

The ADAPT Investment Strategy

At Caerus, we pride ourselves in our desire to continue to learn, adapt and implement new tools to help sharpen our skills as Portfolio Managers. We are especially proud of our achievements in the last 12 months as we welcome the new year. Our ADAPT Investment Strategy has helped us maneuver through some difficult times and has been instrumental in equipping us with the information required to make some very difficult decisions during an unprecedented economic landscape. In late February, we used our technical data indicators to begin selling some of our equity positions. This trend continued in the following two weeks and by March 11th, we managed to liquidate and convert all of our equity positions to cash to protect against a significant period of unknown and volatility. Over the next few weeks, we saw the markets continue to slide down resulting in US and Canada’s major indices to decline 19% and 22% year-to-date respectively while our portfolios experienced a decline of 5% on average.

During this period, we experienced a global shutdown, double digit unemployment and negative oil prices. We witnessed an unprecedented level of government support which included zero interest rates, relentless bond purchases and stimulus relief that began an equity bounce back that many didn’t see coming. In May, we noticed compelling technical data showing a significant resurgence of equities and we strategically began to allocate back into equities starting with Canadian banks and eventually purchasing resilient tech companies and healthcare stocks poised to help the recovery phase. Our ADAPT Investment Strategy’s ability to use technical data coupled with fundamental data has proved to be successful differentiator and has enabled us to outperform our portfolio benchmarks with far less volatility and downside potential. With 2021 upon us, we will remain objective and use our tools to navigate through possibly another challenging year.

Market Drivers and Themes in 2021

While we are prepared for anything the markets throw at us, there are several market drivers and themes to lookout for in 2021. With the US Elections and Brexit now officially behind us, we now look to a less tumultuous foreign affairs relations with countries outside of North America, most notably, China. We believe that many tariffs, if not all, will be removed and hence paving the way for constructive multilateral dialogue between the nations. In fact, The European Union and China agreed on Wednesday to an investment deal that will give European companies greater access to Chinese markets and help redress what Europe sees as unbalanced economic ties. European firms will gain permission to operate in China in electric cars, telecom cloud services and certain activities linked to air and maritime transport, such as ground handling. (Source: Reuters)

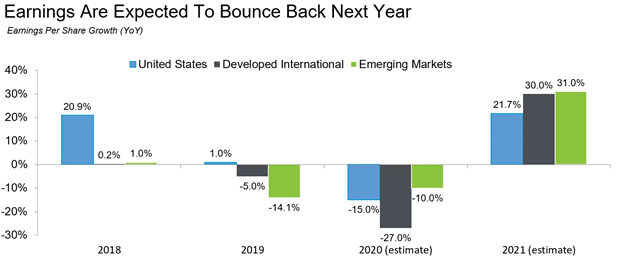

Strong Earnings Rebound

With the fourth quarter wrapping up, analysts are expecting earnings to continue their upward trend into 2021. Goldman Sachs contends the S&P 500 can hit 4300 by the end of 2021 as new vaccines are rolled out and we see a declining trend in hospitalizations and cases over the upcoming months. (CNBC and FactSet)

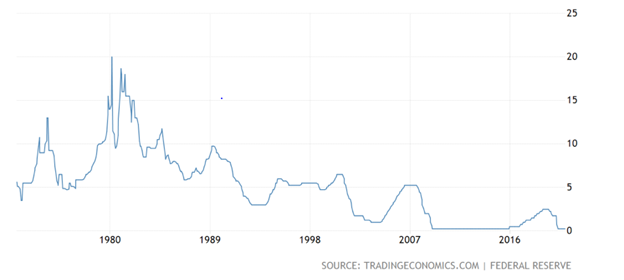

Interest Rates to Remain Low

Despite the rises in Covid-19 cases, all major US indexes closed at all-time highs as investors welcome a successful vaccine, mainstream politics and the potential of another round of stimulus. Congress comes back to Washington this week to discuss two major issues. One, they require to pass a spending bill before Dec 11th to avoid a shutdown. Two, they must get back to negotiating on whether they will move forward with another round of coronavirus relief bill as twenty-one states recorded records of hospitalizations over the US Thanksgiving weekend. An expansion of unemployment benefits, moratorium on federal student loan payments and some protections from eviction will expire at the end of the year. Millions of Americans are already struggling to cover costs. (Source CNBC)

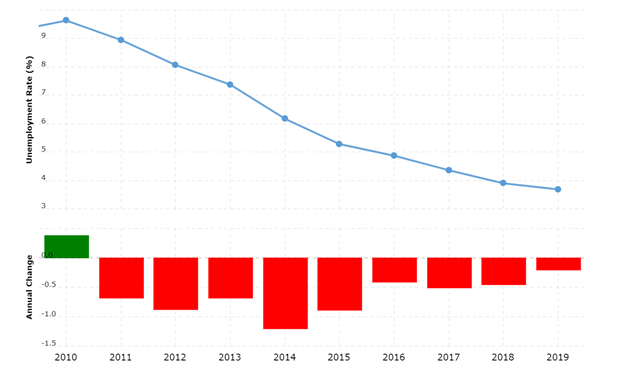

Unemployment on a Downward Trend

With the US unemployment inching lower to 6.7%, we see a continued decline heading into 2021. Although we can not accurately predict at what rate, we do anticipate this number to continue to decline over the next several quarters as we did post 2008 market correction. In Canada, although the pace is slowing, the rate of unemployment continues to fall as we are currently sitting at 8.5%. Like the US, we anticipate this to continue to drop over the coming quarters.

The below graph shows unemployment rate in the US from 2010 through to the end of 2019. This resembles a similar picture to where we are today and where we may end up with some aggressive economic fiscal and monetary policies.

Caerus Wealth Portfolios

The Caerus Wealth portfolios are diversified across several asset classes and service sectors presenting the best chance of success in a fragile environment. Although we are very hopeful of the vaccine outlook and its economic implications, we are mindful of its challenges around covid-19 variants, vaccine distribution delays, and unemployment. Our ADAPT Investment Strategy grants us the ability to remain objective and disciplined as we head into possibly another challenging year. Our research is focused on companies with increasing profitability and supporting trends and we continue to see a great deal of upside broadly in technology and healthcare. As we welcome the new year, we are finding opportunities in certain growing trends and we will continue to monitor them closely. Some of these trends are in biotech companies developing advanced medicine, cloud infrastructure and cryptocurrency resurgence.

From all of us here at Caerus Private Wealth, we wish you and your family a Healthy and Happy New Year filled with joy and laughter!

Terry Fay, Director, Private Client Group, Portfolio Manager

Kian Ghanei, Director, Private Client Group, Portfolio Manager

Caerus Private Wealth – HollisWealth, a division of Industrial Alliance Securities Inc.

700 – 609 Granville Street, Vancouver BC V7Y 1G5

T: 604.895.3316 | TF: 1800.665.2030 | F: 604.682.0529

terry@caeruswealth.ca | kian@caeruswealth.ca

holliswealth.com | caeruswealth.ca

This information has been prepared by Terry Fay and Kian Ghanei who are Portfolio Managers for HollisWealth® and does not necessarily reflect the opinion of HollisWealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. Terry Fay and Kian Ghanei can open accounts only in provinces in which they are registered. HollisWealth® is a division of Industrial Alliance Securities Inc., a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada.